How to Start a Car Rental Business in Australia: Full Guide

Learn how to start a car rental business in Australia, including legal requirements, setup steps, and tips to launch and grow your venture.

Thinking of starting a car rental business in Australia?

It is a good idea since the rental business is expanding, and consumers are increasingly choosing flexibility over car ownership, raising the demand for rental vehicles.

In this guide, we'll go over everything you need to know, from selecting the right business structure and registering for GST to developing your fleet.

We'll also show how tools like ANNA Money can simplify the entire process, and save you time and money, along the way.

4 Statistics About the Car Rental Business in Australia

Let’s check out some statistics before we dive into how to start a car rental business in Australia!

⏩ The Australian car rental industry was estimated to be worth USD 2,717.8 million in 2024 and is expected to reach USD 4,476.0 million by 2033, growing at a compound annual growth rate (CAGR) of 5.7% between 2025 and 2033.

⏩ In 2024, the market reached USD 3.62 billion, according to another forecast. It should rise at a slower CAGR of 2.2% to reach USD 4.51 billion by 2034.

⏩ Nearly 23% of Australians say they would rather rent cars for road trips than drive their own cars, demonstrating the ease and flexibility of rental services.

⏩ There is potential for development in terms of making technology easier for consumers to use, as just 53% of users find the features and amenities in rental cars easy to use.

How to Start a Car Rental Business in Australia: Full Guide

1. Choose a Business Structure

First, you need to choose if you want to register a company, partnership, or as a sole trader structure. Liability protections and tax effects vary by structure.

1. Company

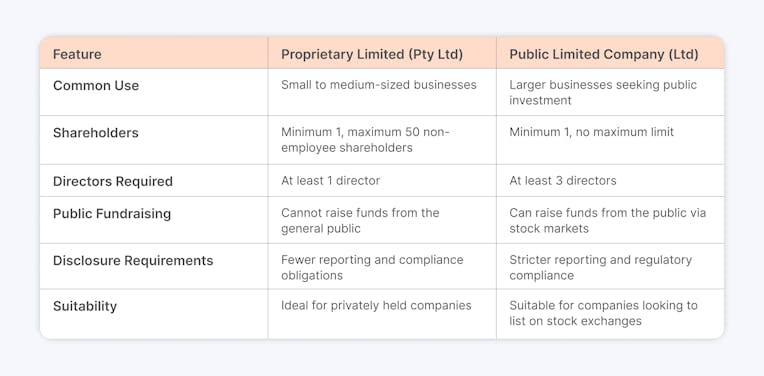

There are 2 types of companies in Australia:

🔶 Proprietary Limited (Pty Ltd) - This is the most common business structure in Australia, which is appropriate for small to medium-sized businesses. It needs a minimum of one director, and one shareholder and there can be no more than fifty non-employee stockholders.

🔶 Public Limited Company (Ltd) - This type of company is usually used by larger businesses looking to obtain money from the general public through stock markets. At least one shareholder and three directors are necessary.

What are the key features of a company?

🔶 Separate Legal Entity - A business can engage in agreements, own property, and face legal action on its own since it is a separate legal entity from its stockholders.

🔶 Limited Liability - Unless personal guarantees are provided, shareholders' personal assets are often shielded from company debts and liabilities.

🔶 Taxation - Depending on their turnover and eligibility requirements, companies are subject to either a 27.5% or 30% corporate rate of taxation.

🔶 Registration and Compliance - Companies need to have an Australian Company Number (ACN) and register with the Australian Securities and Investments Commission (ASIC). Higher compliance standards, such as yearly reporting and auditing requirements, apply to them.

🔶 Governance - Directors oversee the management of companies, making strategic choices and making sure that the law is followed.

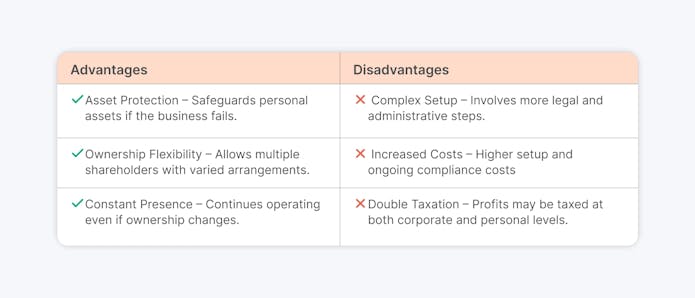

What are the advantages and disadvantages of a company?

Advantages:

✅ Asset Protection - Provides defence for private assets in the event that a corporation fails.

✅ Ownership Flexibility - Multiple shareholders enable a variety of ownership arrangements.

✅ Constant Presence - Remains in operation even in the event that stockholders change.

Disadvantages:

❌ Complex Setup - More documentation and legal procedures are needed than for partnerships or sole traders.

❌ Increased Costs - Contains increased setup and continuous compliance expenses.

❌ Double taxation - This occurs when profits are subject to corporate taxation and dividends paid to shareholders are subject to additional individual taxation.

2. Partnership

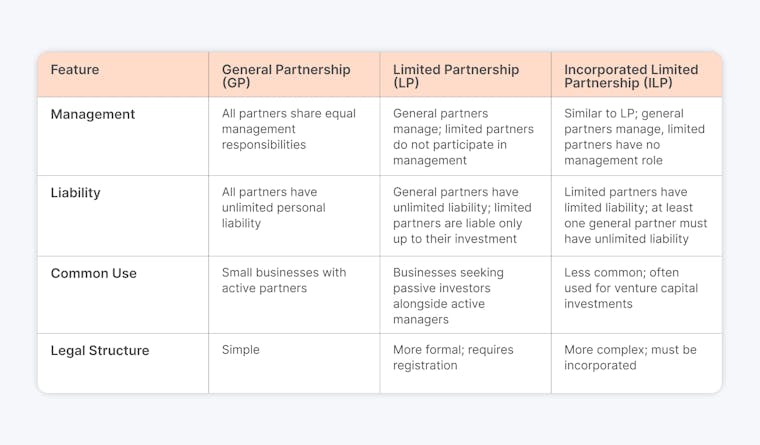

In Australia, a partnership is a type of business structure where two or more people jointly own and run a business, splitting profits and losses. There are 3 partnership types:

🔶 GP, or General Partnership - Each partner is personally liable for all corporate debts and has equal managerial obligations. This structure is typical for small businesses with active partners.

🔶 Limited Partnership (LP) - Consists of limited partners who provide capital but do not participate in management as well as general partners who have unlimited liability. The liability of limited partners is capped at their investment.

🔶 Incorporated Limited Partnership (ILP) - Although limited liability is provided to participants in an incorporated limited partnership (ILP), at least one general partner must have unlimited liability. Less frequent, this form is frequently utilised for venture capital investments.

What are the key features of a partnership?

🔶 Easy Setup - Forming a partnership is comparatively easy and affordable. Although it is not legally needed, a formal partnership agreement is advised.

🔶 Taxation - Each partner reports their portion of revenue on their personal tax return; partnerships are not taxed as distinct legal entities. The Australian Taxation Office (ATO) requires the partnership to submit an annual tax return.

🔶 Liability - If other partners are unable to pay, each partner may be held personally liable for all business debts due to their joint and several liability.

🔶 Management - Usually, partners divide management and control duties, which might cause conflict if not specified in a partnership agreement.

What are the advantages and disadvantages of a partnership?

Advantages:

✅ Benefits include variable profit distribution, shared responsibility, low compliance expenses, and ease of setup.

Disadvantages:

❌ Limitless personal liability, possible management disputes, and partnership dissolution in the event of a partner's departure are drawbacks.

3. Sole Trader

In Australia, the most basic type of business ownership is a sole trader business structure, in which just one person owns and runs the company.

What are the key features of a sole trader structure?

🔶 Easy Setup - There aren't many legal or tax requirements, and it's cheap and simple to set up.

🔶 Single Ownership - The sole trader is in complete control of the company and bears personal liability for all debts and liabilities.

🔶 Taxation - Using the individual's Tax File Number (TFN), the business income is taxed at their personal tax rate. For business operations, an Australian Business Number (ABN) is necessary.

🔶 Unlimited Liability - If the company accrues debts or liabilities, the owner's personal assets could be jeopardised.

What are the advantages and disadvantages of a sole trader structure?

Advantages:

✅ Low Costs - There aren't many setup or maintenance expenses.

✅ Total Authority - The solo proprietor has total authority over business choices.

✅ Privacy - Public disclosure of financial information is not required.

Disadvantages:

❌ Unlimited Liability - In the event that a business fails, personal assets could be at stake.

❌ Limited Expansion - It can be difficult to raise money for expansion.

❌ Taxation - Compared to corporations, tax rates may be higher.

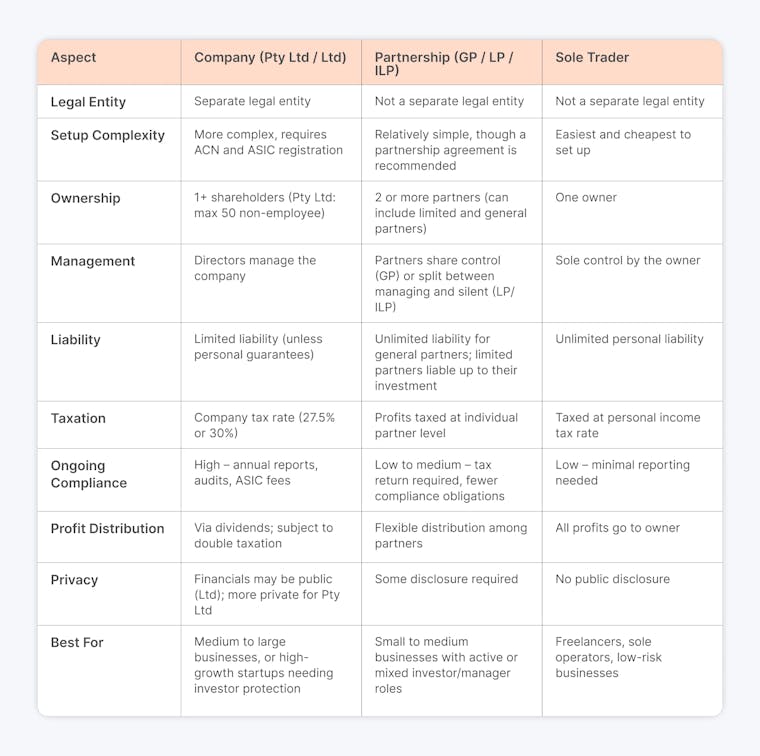

Which Structure To Choose?

Every business structure has its own pros and cons. Here is a table so you can compare features easily:

💡Pro Tip

ANNA Money can assist you with company registration for $288!

🖊️ Choose a company name

🖊️ Add extra features – like a virtual office address to keep your home address private

🖊️ Share a few details about your business

🖊️ We’ll notify you when your application is complete

The $576 ASIC fee is on us!

2. Register Your Business

If your yearly turnover reaches $75,000, you must register for Goods and Services Tax (GST) and obtain an Australian Business Number (ABN).

ABN

The Australian Business Register (ABR), run by the Australian Taxation Office (ATO), issues a unique 11-digit identification number known as an Australian Business Number (ABN).

You need an ABN to:

🔷 Avoid Pay As You Go (PAYG) withholding on payments and obtain Goods and Services Tax (GST) credits.

🔷 Register an Australian (.au) domain name; domain registration is necessary.

🔷 Confirm the identification of your company while placing orders and sending invoices.

How to register an ABN number?

Follow these steps to register:

✔️ Go to the Business Registration Service website of the Australian Government.

✔️ Apply online using the form.

✔️ Enter your personal information, including your full name, birthdate, home address, and phone number.

✔️ Give business information, such as the company's structure, start date, operations, and projected yearly revenue.

✔️ For sole traders, enter your personal tax file number (TFN); for other business structures, enter the TFN of the company.

GST

The Goods and Services Tax (GST) in Australia is a 10% value-added tax placed on most goods, services, and other items sold or consumed domestically.

How does the GST work?

🔷 Businesses include GST to the prices of taxable goods and services they sell.

🔷 They claim credit for GST paid on commercial purchases.

🔷 Businesses submit regular Business Activity Statements (BAS) to reflect the GST collected and paid.

✔️ Use either the Australian Government's Business Registration Service or the ATO Business Portal. To use online services, you must have a myGovID that is linked to your Australian Business Number.

✔️ Call the Australian Taxation Office (ATO) at 13 28 66 to register by phone.

✔️ Fill out the NAT 2954 form. You can obtain this form through the ATO's publication purchasing service.

✔️ Hire a registered tax or BAS agent to complete the registration process for you.

3. Acquire Vehicles

Choosing the correct vehicles for your rental fleet is critical, and they should match the demands and tastes of your target market. When building your fleet, consider the following:

🔶 Match Vehicles to the Target Audience:

- Tourist - Look for compact, fuel-efficient vehicles that are easy to drive and park.

- Corporate Clients - Choose sedans, premium SUVs, or luxury automobiles to satisfy business needs.

- Eco-conscious Renters - Provide electric or hybrid models to attract environmentally conscientious clients.

- Families or Groups - Get larger cars such as SUVs, minivans, or people movers for group travel.

🔶 Choose between purchasing or leasing - Purchasing grants you full ownership but incurs additional upfront expenditures. On the other side, leasing provides flexibility, lowers upfront costs, and facilitates fleet updates.

🔶 Register interest in the vehicles with the Personal Property Securities Register - This safeguards your ownership or lease rights in the event of customer disputes, unpaid rentals, or if the vehicle is involved in liquidation or repossession proceedings.

🔶 Get Add-Ons - Also, it is a good idea to have GPS systems, kid seats, and other add-ons that may boost revenue or customer pleasure.

4. Set Up Your Operations

Establishing smooth, customer-friendly procedures is essential for running a profitable car rental business. Here are the key components to consider:

Implement a cloud-based booking system and use rental management software for:

🔶 Accepting and managing online bookings in real-time.

🔶 Monitoring vehicle availability and maintenance schedules.

🔶 Managing consumer data and communication efficiently.

🔶 Reducing duplicate bookings and manual errors.

Offer flexible payment options:

🔶 Credit and debit cards (Visa, Mastercard, American Express)

🔶 Mobile wallets (Apple Pay and Google Pay)

🔶 Online payment gateways (e.g., PayPal, Stripe)

Draft clear rental agreements:

Clearly state the terms, circumstances, and duties.

🔶 Make sure they are compatible with the Australian Consumer Law (ACL).

🔶 Avoid unethical actions such as hidden fees or charging for pre-existing harm.

🔶 Include terms for late returns, fuel costs, and insurance coverage.

Include Customer Support Processes:

🔶 Offer several contact methods (phone, email, and chat).

🔶 Prepare consistent responses to typical questions and issues.

🔶 Establish an emergency procedure for vehicle breakdowns or accidents.

💡Pro Tip

With the ANNA One package, you can simplify your operations and get:

- Professional-looking invoices and overview of unpaid invoices

- Automated receipt matching and categorisation of expenses

- Bookkeeping Score

6. Establish Your Business Location

Most people do online research on where and how they can rent a car, but even so, it is important that your location is in a good place. Where do you think it could be?

🔶 Near airports, train stations, or major tourist areas - This is perhaps the best location you can think of. This would make it much easier for people to take over the car immediately upon arriving.

🔶 Close to major roads - Think about main roads and easily accessible places for convenient vehicle pickup and return, especially if your target group are tourists.

If it is not possible to find a location near the airport or main roads, you can offer to drive the rented car to a certain place or pick people up at their station.

💡Pro Tip

If you can't find a place big enough for the necessary offices, customer support or booking, for example, with ANNA Money, you can have a virtual office.

What are the benefits of virtual offices?

⚡ Better professional image

⚡ Your workers can work from anywhere

⚡ You can reach more clients

Conclusion

Starting a car rental business in Australia may appear to be a difficult task, but with the correct strategy, equipment, and industry knowledge, it is quite possible and profitable.

This industry is steadily expanding, with Australians increasingly adopting rentals for travel convenience.

Just remember that legal compliance (such as ABN, GST, and ACL) and cautious financial habits are essential. Your location, booking system, vehicle selection, and support process will all influence your customer experience and reputation.

How Can ANNA Money Help You to Start a Car Rental Business in Australia?

ANNA Money is a business tool that can help you start your car rental business in Australia, as well as manage all your taxes and finances!

The focus of this tool is on starting a company, but it also offers you a lot more:

⚡ Business documents - Keep receipts, invoices and company documents in one place.

⚡ Business account - Get a debit card, virtual cards, Apple Pay, Google Pay, and employee expense cards. Easily check your balance and manage all your payments.

⚡ Registered office service - Keep your personal address off the public record with same-day automated mail scanning and handling (compliant with ASIC, ATO, and other governmental authorities).

⚡ Personalised tax calendar - Get a tax calendar and ensure timely compliance with all of your tax responsibilities.

⚡ Payroll - File payroll for yourself and your staff.

⚡ Goods and Services Tax (GST) - Get automatically calculated GST and lodged with the ATO.

⚡ Annual Accounts and Company Tax Return - File your annual accounts with ASIC and your company tax returns with the ATO.

Sign up today and start a car rental business with ease!