How to Start a Cleaning Business in Australia [4 Easy Steps]

Learn how to start a cleaning business in Australia, covering key steps, legal requirements, and essential tips for success in the industry.

- In this article

- What Are the Benefits of Starting a Cleaning Business in Australia?

- How to Start a Cleaning Business in Australia In 4 Steps

- Step 2. Create a Business Plan

- Step 3: Register Your Business

- Step 4: Get Insurance

- 3 Additional Tips to Boost Your Cleaning Business

- How ANNA Money Can Help You Start a Cleaning Business in Australia?

- FAQ

Thinking about becoming your own boss but not sure where to begin?

You're in the right place! In this guide, you'll learn how to start a cleaning business step-by-step. We'll walk you through the crucial documents you need, share tips and tools to make the whole process easier.

Let’s start!

What Are the Benefits of Starting a Cleaning Business in Australia?

Starting a cleaning business in Australia offers several benefits:

▶️ Low Start-Up Costs - Cleaning businesses require a lower initial investment. Key expenses include basic cleaning supplies, insurance, and registration fees, with no requirement for commercial property or heavy gear.

▶️ Recession-Proof Demand - Residential and commercial clients frequently require maintenance, repairs, and specialised services (e.g., end-of-lease cleaning), ensuring a consistent income.

▶️ Flexibility and Autonomy - You can work freely, set your own schedules, and choose your clientele. This flexibility allows you to balance work with personal responsibilities and gradually scale operations.

▶️ No Formal Qualifications Required - You need basic cleaning abilities to start the business. Even if you need specialised training (for example, eco-cleaning), you can obtain it through online classes or on-the-job experience.

▶️ Scalability and Growth Potential - You can easily grow your business by hiring more employees and broadening your services (for example, commercial cleaning and carpet care) or focusing on specific markets such as healthcare institutions.

Even though it is a physically demanding job, the benefits of low barriers to entry, stability, and growth make it a great option.

How to Start a Cleaning Business in Australia In 4 Steps

Now, let’s go through the steps and see how you can easily make it happen!

Step 1: Conduct Through Research on Industry

First things first.

You can't launch a business without first knowing what the industry is like – what the demand is, how pricing works, what exactly is needed, and where the demand comes from.

Here are a few questions you should have answers to before starting a cleaning business in Australia:

🔸 Do I want to provide my services in urban areas or suburban and rural areas?

The answer to this question is important so that you can make a decision on what type of cleaning business to engage in, and here's why:

- Due to the high concentration of commercial buildings in cities like Sydney, Melbourne, and Brisbane, there is a greater need for commercial cleaning services.

- Although the market size may be smaller than in metropolitan areas, suburban and rural areas may have a greater need for residential cleaning services.

🔸 Do I want to deal with residential, commercial or specialty cleaning?

Here are the differences:

- Household duties, including dusting, vacuuming, mopping, and disinfecting bathrooms and kitchens, are the main focus of residential cleaning.

- Commercial cleaning includes duties such as waste management, window cleaning, and floor upkeep for establishments such as offices, retail stores, and industrial buildings.

- Cleaning services such as post-construction cleaning, window cleaning, and carpet and upholstery cleaning are included in specialty cleaning.

🔸 How does billing work in this type of business?

- Hourly Rates: Depending on region and experience, house cleaning services in Australia usually charge $35 to $60 per hour.

- Flat Rates: Depending on the size of the property or the nature of the work, several services have flat rates. For instance, assuming 10 hours of labour, end-of-lease cleaning for a three-bedroom apartment may cost about $800.

- Type of Service: Because they need a lot of work, specialised services like deep cleaning and end-of-lease cleaning frequently have higher costs.

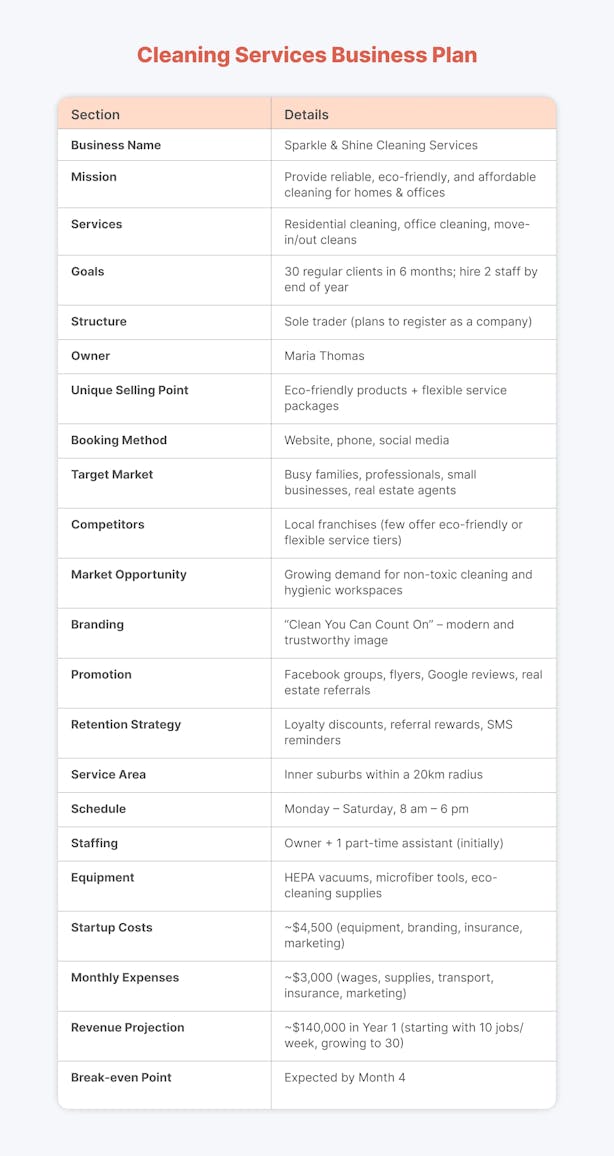

Step 2. Create a Business Plan

Everything becomes easier when you know what needs to be done and when to do it, right?

A clearly defined business plan helps you to:

⚡ Define Goals: Clearly state your company's objectives and the plans you'll need to reach them.

⚡ Understand the Market: Learn about competitors, target clients, and industry trends.

⚡ Handle Finances: Make plans for initial outlay, continuing costs, and anticipated income.

⚡ Attract Investors: Show lenders or investors that you have a well-thought-out business plan.

Step 3: Register Your Business

Follow these steps:

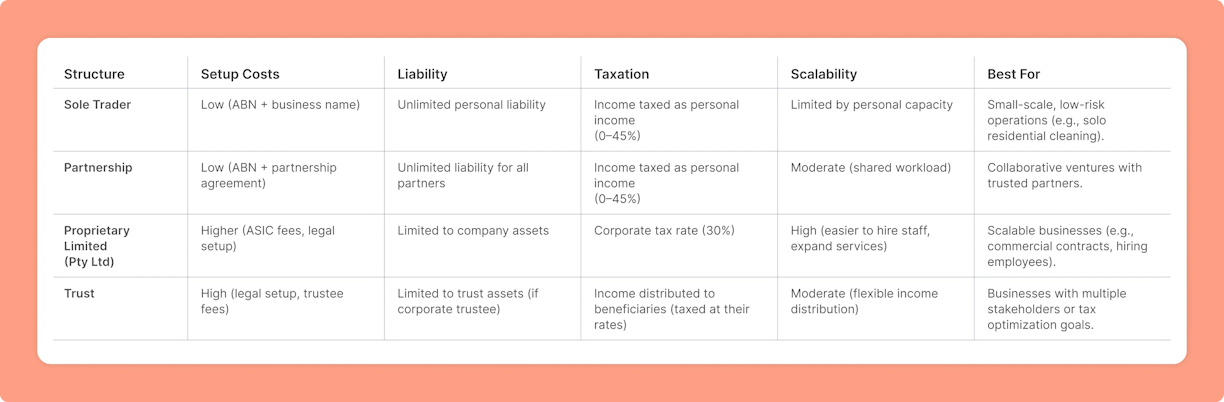

1. Choose a Business Structure:

Australia offers several business structures, although sole traders and proprietary limited companies (Pty Ltd) are the most frequent for cleaning businesses.

Below is a breakdown of key structures and recommendations:

1. Sole trader

✅ Pros: Simple setup, low cost, complete control, and minimum compliance.

❌ Cons: Unlimited personal liability for debts.

🟢 Ideal for: Small-scale, low-risk operations (e.g., single operators or partnerships with minimal assets).

2. Partnership

✅ Pros: Shared workload and costs, flexible decision-making.

❌ Cons: All partners are subject to unlimited liability, potential conflict

🟢 Ideal for: Collaborative ventures with trusted partners.

3. Proprietary Limited Company (PTY Ltd)

✅ Pros: Limited liability, tax efficiency, and scalability.

❌ Cons: High setup costs and difficult compliance (e.g., ASIC reporting).

🟢 Best suited for: Growing business looking to expand services or add employees.

4. Trust

✅ Pros: Asset protection and flexible income distribution.

❌ Cons: High start-up costs and administrative complexity.

🟢 Best suited for: Businesses with various stakeholders or tax optimisation objectives.

2. Check Name Availability

Now it’s time to choose a name for your business.

Once you’ve picked the right one, you’ll need to check if it’s available. If the name is already registered anywhere in Australia, you won’t be able to use it.

To check name availability, follow next steps:

1. Visit the ASIC Connect website and select the 'Check business name availability' option from the search tool.

2. Enter your preferred business name into the search bar. Results will show:

- Green: The name is available.

- Amber: The name deserves more evaluation.

- Red: The name is not available.

💡Pro Tip

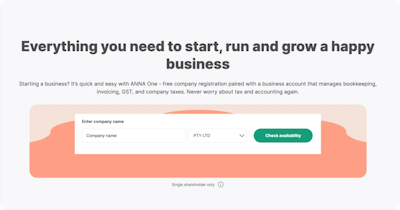

There’s an even easier way to check if your business name is available – use the ANNA Money tool!

Simply visit our page, and you’ll immediately see the “Check name availability” tab.

Enter your desired name, and within seconds, you’ll get the results.

3. Apply for an ABN

The ABN is a unique 11-digit number that identifies your company or organisation to the government and the community.

You may face prosecution or criminal penalties if you apply for an ABN, register for GST, and claim GST refunds when you are not entitled to them.

Here is a list of everything you need for the application:

▶️ Tax File Number (TFN): Yours and any associates (e.g., partners, directors, trustees).

▶️ Registered Agent Number: When utilising a tax or BAS agent.

▶️ Professional Adviser Number: If utilising an adviser with a licensing (e.g., AFS licence).

▶️ Previous ABN: If you had one before. ACN or ARBN: Required for companies and registered organisations (from ASIC).

▶️ Start day: The day you intend to start business activity (must be within six months).

▶️ Entity Legal Name: The official legal name of your company.

▶️ Authorised Contacts: People who can change information on your behalf (e.g., your agent).

▶️ Associates' Details: Varies depending on the business structure.

▶️ Business Contact Information: Include address, email (not generic like support@), and phone number.

▶️ Business Activity: Your primary source of revenue (e.g., cleaning, construction).

▶️ Business Locations: All premises are operated, unless they pose safety risks

If your application is successful, you will instantly receive your 11-digit ABN.

If your application is unsuccessful, you will get a refusal number.

Within 14 days, you will receive a letter confirming your refusal with an explanation and the options available to you.

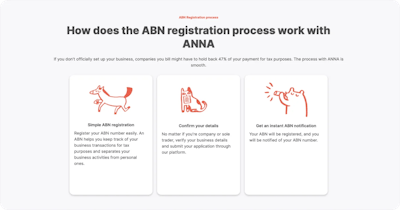

💡Pro Tip

With ANNA Money you can get your ABN easily. All you have to do is confirm your data and you will receive a notification about your registered ABN number!

4. Set Up Finances

Setting up separate finances for your cleaning business is strongly advised. Here's why:

▶️ Protect Personal Assets - Separating funds reduces personal liability and protects your assets from business-related risks.

▶️ Streamline Administration - Dedicated business accounts streamline financial management, making it easier to file taxes and handle costs.

▶️ Maximise Tax Benefits - Clear separation enables correct tax deductions and GST claims, optimising your company's financial performance.

How to do that?

✅ Register for an ABN - This is the first step in separating personal and business finances.

✅ Open a separate business bank account - Use it for all business transactions to keep accurate financial records.

✅ Pay Yourself a Salary - To preserve financial discipline, move your business salary to your personal account on a regular basis.

✅ Separate Receipts - Organise business receipts for easier expenses tracking and tax claims

💡Pro Tip

ANNA Money can simplify this step for you and you can easily boost your business with an ANNA card!

Open an ANNA business account and receive:

- Debit card

- Virtual cards

- Apple Pay

- Google Pay

- Employee expense cards

Step 4: Get Insurance

If you have insurance, you will protect yourself from many potential problems.

▶️ Risk Protection - Cleaning companies frequently work on third-party properties, which increases the likelihood of accidents or property damage. Insurance protects against financial damages resulting from events like this.

▶️ Client Requirements - Many commercial clients want confirmation of insurance before engaging in cleaning services, which can have an influence on business growth.

▶️ Professional Image - Having insurance displays reliability and competence to potential clients, improving your business reputation.

What Are the Most Common Types of Insurance for Cleaning Businesses in Australia?

✔️ Public Liability Insurance - Covers you if a client or member of the public is injured or their property is damaged because of your work.

✔️ Workers' Compensation Insurance - Legally required if you have employees. It covers medical costs and lost wages if they get injured or sick from work.

✔️ General Property Insurance - Protects your cleaning equipment and tools from theft, damage, or loss.

✔️ Personal Accident Insurance - Covers accidents or sickness for business owners and employees. Ensures income continuity and employee well-being.

✔️ Commercial Vehicle Insurance - Provides coverage for company vehicles used to transport staff or equipment. Required to protect against vehicle-related accidents or theft.

✔️ Cleaning Bonding Insurance (Janitorial Services Bond) - Covers theft or wrongdoing by staff on client premises.

3 Additional Tips to Boost Your Cleaning Business

Tip 1: Start With the Basics

When it comes to equipment and supplies, it is best to start with the basics and expand later.

In the beginning, it is enough to have a vacuum cleaner, mop, rags and cleaning products, but as your business grows, consider switching to eco-friendly variants.

Using eco-friendly products and practices can help you draw in eco-aware customers and lessen your environmental impact:

✅ Biodegradable Cleaning Agents - Make use of goods that decompose organically without causing environmental damage and lessen your environmental impact.

✅ Microfiber Cloths - They are reusable and a chemical-free cleaning solution.

✅ Energy-Efficient Equipment - Select equipment that meets sustainability objectives by using less energy.

Tip 2: Soft Launch Your Cleaning Business

A soft launch is a planned strategy for presenting your business to the market that avoids a full-scale rollout. Here's how to do it:

✅ Test Your Services - Provide free services to a small group of friends, family, or local companies to test your operations and collect feedback. Use feedback to improve service quality and efficiency before expanding.

✅ Offer Promotional Incentives - Offer introductory discounts or unique packages to attract new consumers and create a clientele. Set up a referral programme to encourage existing clients to refer friends and family.

Tip 3: Invest in an Online Presence

You must have an online presence and actively promote your services if you want to expand your cleaning business in Australia.

✅ Social Media Marketing: Create expert accounts on Facebook, Instagram, and LinkedIn to display before-and-after cleaning results, client endorsements, and behind-the-scenes content. ✅ Post frequently - Use reels, stories, and client reviews and reply promptly to messages and comments to establish credibility.

✅ Use Local Hashtags & Geo-tags - This increases visibility among local users who are actively seeking services. For instance, on Instagram, use hashtags like #SydneyCleaning, #MelbourneCleaners, or #EndOfLeaseCleaning.

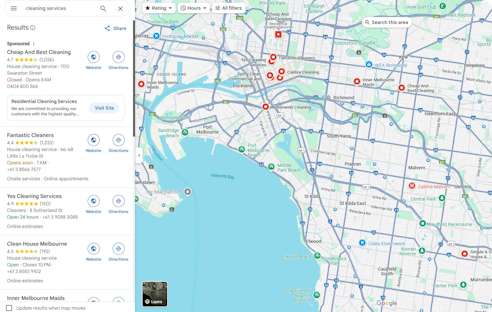

✅ Create a Google Business Profile - Helps your company show up on Google Maps and in local search results, particularly for "cleaners near me" queries.

How ANNA Money Can Help You Start a Cleaning Business in Australia?

ANNA Money is an all-in-one business tool designed to support you through every step of starting your cleaning business in Australia – from checking business name availability to managing payments and even handling payroll.

Let’s see what it can help you with:

🔥 Company Registration - Register your company easily for a $599 one-year introductory fee, the ASIC fee of $576 is on us.

🔥 Business Documents - Keep receipts, invoices, and company records in one location. We will check for matching transactions, extract crucial facts, and ensure that everything is easy to find and share.

🔥 Tax Calendar - Ensure timely compliance with all of your tax requirements.

🔥 Support From Expert Accountants - Get answers to all your questions.

🔥 Business Activity Statement (BAS) - Get automatic GST calculation, payroll, and direct lodging with the ATO.

🔥 Invoices - Receive professional invoices and immediately get any unpaid invoices.

🔥 Bookkeeping Score - Stay on top of your bookkeeping and receive simple strategies to keep your books neat.

🔥 Receipt matching - Get automated receipt matching and expense classification to provide you with the appropriate tax benefits

Sign up today with ANNA and simplify every aspect of your cleaning business!

FAQ

Should I Apply for GST?

Not necessarily.

If you expect to generate $75,000 or more in the first year, then yes, you have to apply for GST.

However, a lot of cleaning companies prefer to voluntarily register even if they fall below the criteria, this is the reason:

✔️ GST credits are available for company purchases, such as clothing, cleaning supplies, and equipment.

✔️ It might present your company in a more professional manner, particularly to business clients.

But, here are few things to think about:

✖️ You have to charge your services more if you do. Precisely 10%.

✖️ Depending on your setup, you must submit Business Activity Statements (BAS) either monthly or quarterly.

✖️ Because of that, you have more administrative work and fees to pay if you want to stay compliant

Do I Need ACN If I Have a Cleaning Business in Australia?

Unless you are registering your business as a company, you do not require an Australian Company Number (ACN) for a cleaning business.