How to Start a Food Business in Australia [2025]

Learn how to start a food business in Australia, including essential setup steps, licensing requirements, and tips to launch successfully.

Starting a food business in Australia is an exciting way to transform your passion for food into something real.

You may wish to open a café, run a food truck, or sell homemade goods – but whichever road you choose, careful preparation and an understanding of the rules are essential.

This article will help you through the five basic steps to getting started in 2025, from selecting a niche to registering your business and managing your records.

Let’s dive in!

4 Revenue Statistics about the Food Business in Australia

Let’s go over key revenue statistics about the food business in Australia and see why it is a good idea to start one!

1. In 2025, the revenue for the whole food market in Australia is predicted to be roughly US$96.59 billion, with an expected annual growth rate (CAGR) of around 4.82% between 2025 and 2030.

2. Another source predicts the Australian food and beverage market size at around USD 141.2 billion in 2024, anticipating growth at a CAGR of 4.60% through 2033, which corresponds to the 2025 revenue being close to this figure.

3. In Australian dollars, the food and beverage industry was valued at 139.24 billion in 2024 and is predicted to increase at a CAGR of 4.34% from 2025 to 2034, showing revenue in 2025 near this value.

4. Focusing specifically on the restaurant sector, industry revenue is predicted to reach around AUD 24.1 billion in 2025, rising at a CAGR of 6.6% over the previous five years.

5 Steps to Start a Food Business in Australia in 2025

Here are 5 steps to start your food business!

1. Choose Your Niche

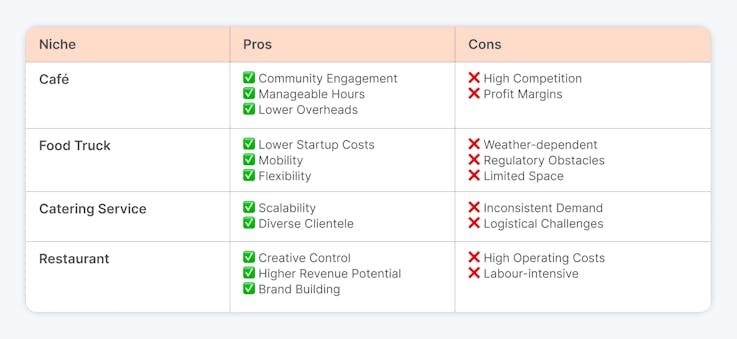

Before you start your food business in 2025, first, you need to think about your niche. There are many choices in this industry, and every one of them has its own pros and cons.

Let’s take a short overview:

1. Café:

Pros:

✅ Community Engagement - Cafés frequently become local hubs, establishing strong community bonds and returning customers.

✅ Manageable Hours - Typically operate during the day to provide a balanced work-life schedule.

✅ Lower Overheads - Compared to full-service restaurants, cafés typically have smaller menus and fewer employees.

Cons:

❌ High Competition - The Australian café market has been flooded, making it difficult to differentiate.

❌ Profit Margins - Profit margins can be narrow, especially if the cost of goods and rent rise.

2. Food Truck

Pros:

✅ Lower startup costs - It is more affordable than traditional businesses.

✅ Mobility - The ability to move to high-traffic areas or events and maximise exposure.

✅ Flexibility - The ability to try alternative markets and menus without long-term commitments.

Cons:

❌ Weather-dependent - Bad weather can have a substantial impact on sales.

❌ Regulatory Obstacles - Multiple permits are required, as is adherence to local council laws.

❌ Limited Space - Menu options may be limited due to space constraints in the kitchen.

3. Catering Service

Pros:

✅ Scalability - Start at home and expand as demand develops.

✅ Diverse Clientele - Customers are diverse, with opportunities ranging from corporate to private occasions.

Cons:

❌ Inconsistent Demand - Business may be seasonal or event-driven.

❌ Logistical Challenges - Organising events, transportation, and staffing can be difficult.

4. Restaurant

Pros:

✅ Creative Control - Complete power over the food, ambience, and branding.

✅ Higher Revenue Potential - The ability to provide a diverse range of services, such as dine-in, takeaway, and events.

✅ Brand Establishment - An opportunity to create a strong, recognisable brand.

Cons:

❌ High Operating Costs - High operating costs include significant spending for rent, utilities, and staffing.

❌ Labour-intensive - To maintain service quality, you need a big, well-trained crew.

2. Learn Food Regulations

The following are the essential regulatory requirements and processes:

➡️ 1. Food Standards Code Compliance - All food businesses must follow the Australia New Zealand Food Standards Code, which governs food safety, labelling, additives, hygiene, and microbiological limitations.

Chapter 3 of the Code focuses on food safety protocols and general regulations for food enterprises, such as employee training, food handling, storage, and cleanliness standards.

➡️ 2. State and Territorial Food Acts - Each state and territory has its own Food Act, such as the NSW Food Act 2003, the Victorian Food Act 1984, and the Queensland Food Act 2006. These acts require businesses to maintain food safety protocols, train employees, and conduct frequent inspections.

➡️ 3. Food Business Classification - Local councils categorise food enterprises according to risk (high-risk, low-risk), which dictates the precise standards you must follow, such as having a Food Safety Program or a Food Safety Supervisor. The business class influences the level of regulation, inspection frequency, and training requirements.

➡️ 4. Food Safety Supervisor and Training - Most states require at least one certified Food Safety Supervisor (FSS) in every business that received authorised food safety training. All employees who work with food must be knowledgeable of and trained in food safety and hygiene.

➡️ 5. Food Safety Program - High-risk food enterprises must create and implement a Food Safety Program based on HACCP principles, which documents how food safety hazards are addressed. This program must be available for review and updated on a regular basis.

➡️ 6. Premises and Equipment Standards - To maintain food safety, food premises must follow strict layout, equipment, ventilation, storage, and cleaning regulations. Any construction or renovation must be approved by the local council in order to meet zoning, building, and health codes.

➡️ 7. Ongoing Compliance and Inspection - Councils perform regular inspections to guarantee continuous compliance with the Food Act and Food Standards Code. You must renew your registrations annually and notify municipalities of any substantial changes.

➡️ 8. Special Considerations - If you intend to offer alcohol, you need a separate liquor license.

3. Find a Suitable Location

Choosing the ideal location for your food business is one of the most important decisions you'll make.

It influences your customer base, costs, legal approvals, and long-term profitability. The best location depends on your business model, whether it's a café, restaurant, or food truck.

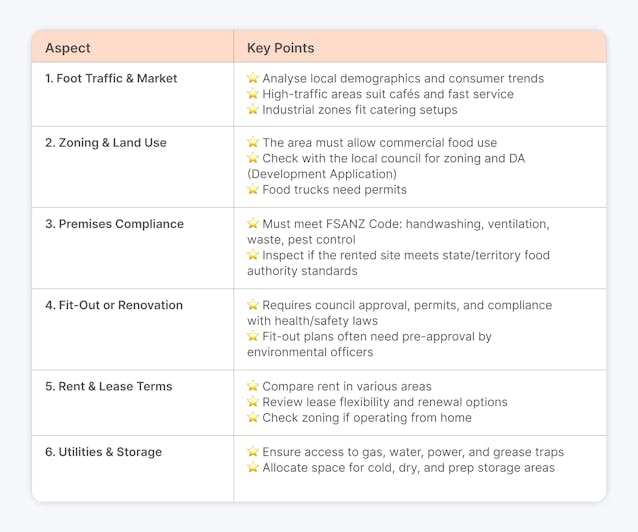

Key Considerations When Choosing a Location

Take into consideration the following factors:

1. Foot traffic and target market:

⭐ Examine local consumer trends and demographics.

⭐ Cafés and quick-service establishments do best in areas with plenty of foot traffic, including shopping malls, office buildings, areas close to schools, or transportation hubs.

⭐ As long as delivery and suppliers can reach them, catering kitchens and food preparation facilities can be located in industrial zones.

2. Approvals for Land Use and Zoning:

⭐ The area you have in mind needs to be approved for commercial food use.

⭐ To find out about zoning restrictions and whether a development application (DA) is required, get in touch with the planning department of the local council.

⭐ For certain trading zones and hours, food trucks will require council clearance.

3. Compliance with Premises & Layout:

The area needs to meet the standards of the Food Standards Australia New Zealand (FSANZ) Code:

⭐ Stations for hand washing

⭐ Appropriate ventilation

⭐ Facilities for disposing of waste

⭐ Methods of controlling pests

⭐ Verify that the current food facility you are renting satisfies the hygienic and structural requirements established by your state or territorial food authority.

4. Fit-out or Renovations:

⭐ When constructing or remodeling a kitchen or storefront, you will require:

⭐ Council consent

⭐ A building permit

⭐ Compliance with environmental health, fire safety, and accessibility (such as wheelchair access) laws

⭐ The local environmental health officer frequently needs to preapprove fit-out plans (kitchen layout, equipment placement, etc.).

5. Price and Lease Conditions:

⭐ Examine the differences in rent between inner-city, suburban, and industrial suburbs.

⭐ Examine the lease's long-term viability. Is it flexible? What conditions apply to the renewal? Could there be room for growth?

⭐ Determine whether operating from home conforms with residential zoning regulations and whether the kitchen may be licensed for home-based companies.

6. Storage and Utility Access:

⭐ Verify that necessary utilities such as gas, water, three-phase power, and grease traps are available.

⭐ Make sure there is enough room for areas designated for safe food processing, dry storage, and cold storage.

4. Register Your Business

Follow these easy steps:

Step 1: Select a Structure for Your Business

Choose the structure that best meets your company's requirements:

➡️ Sole Trader - The simplest type is a sole trader, in which you run and direct the company.

➡️ Partnership - A partnership is when two or more people or organizations work together to run a business.

➡️ Company - An independent legal body with its own responsibilities.

Your decision has an impact on your personal liabilities, tax requirements, and legal duties.

Step 2: Apply for an Australian Business Number (ABN)

ABN is a an 11-digit unique identification number for your business:

➡️ Go to the ABR, or Australian Business Register.

➡️ Make sure you have:

- Your TFN, or tax file number

- Information about your business partners and directors

➡️ Fill out the application online.

Step 3: Register Your Business Name

You must register a name if you intend to trade under one other than your own. Before you start your application, make sure you've applied for or already have an ABN.

➡️ Visit the Business Registration Service of ASIC.

➡️ Verify whether the business name you have in mind is available.

➡️ Fill out the registration form by supplying:

- Your ABN

- The suggested name for the company

- Details of the business name holder

- Business locations

➡️ Select between a one-year or three-year registration duration.

➡️ Pay the relevant fee.

Step 4: Register for the Goods and Services Tax (GST)

When do you need to apply for GST?

✅ If your company makes at least $75,000 in GST turnover (gross income less GST)

✅ If you offer ride-sharing or taxi services

✅ In order to be eligible for GST credits

Follow these steps:

➡️ Go to the Australian Taxation Office's (ATO) GST registration page after acquiring your ABN.

➡️Sign up using:

- Business internet services

- Over the phone at 13 28 66

- Through your BAS agent or registered tax agent

5. Keep Records

Besides simplified daily operations, keeping accurate and comprehensive records is required by law for Australian businesses in accordance with ATO (Australian Taxation Office) regulations.

Keeping records helps you to:

✅ Follow tax laws

✅ Claim deductions

✅ Get Business Activity Statements (BAS) ready

✅ Monitor earnings, expenses, and performance

✅ Be prepared for reviews or audits

You must keep records that explain:

➡️ Sales and Income - EFTPOS summaries, invoices, receipts, and sales reports from platforms or POS systems

➡️ Purchases and Expenses - Utility bills, bank statements, petty cash records, and supplier invoices

➡️ Employee Records - Timesheets, pay stubs, tax filing declarations, and superannuation payments are examples of employee records.

➡️ Tax Documents - BAS statements, income tax returns, GST data, and any applicable fringe benefits are examples of tax documents.

➡️ Legal and Business Documents - Loan agreements, insurance policies, licenses, and contracts.

➡️ Food safety logs - Temperature logs, cleaning schedules, staff training records (required for food businesses under FSANZ).

Conclusion

Starting a food business in Australia requires more than just a passion for cooking; it also requires planning, following the rules, and using the proper tools.

From deciding on a niche to registering your business and keeping proper documents, each step contributes to a solid and successful base.

ANNA Money can help you stay on top of your financial and administrative responsibilities, making the process go more smoothly.

Let’s see how it can help you start your food business more easily!

How ANNA Money Can Help You Start a Food Business in Australia?

If you decide on a company structure, ANNA Money can make your entire job a lot easier! If you decide on a different structure, this tool can still help you run your business and not worry about taxes.

Here's how:

🚀 Company Registration - Register your company for a $288 one-off fee

🚀 ABN Registration - No matter if you're a company or a sole trader, you can register your ABN in a few clicks

🚀 Centralised Financial Management - Use Open Banking to link all of your personal and business accounts to ANNA, giving you a comprehensive financial picture.

🚀 Instant Payment Notifications - Stay on top of your cash flow by getting immediate notifications anytime a payment comes into or goes out of your account.

🚀 Recurring and Scheduled Payments - Set up regular and planned payments, and ANNA will take care of the rest, informing you in advance of any changes.

🚀 Smart Receipt Scanner - When you snap a picture of a business receipt, it is immediately linked to a transaction in your company's account. After that, it is categorized and applied to determine your tax liability.

🚀 Pots - Set aside a part of your money and get ready for taxes.

🚀 Tax Calendar - To ensure you never miss a deadline, Anna will help you plan and remind you of important dates.

Sign up today and start your food business with ease!