How To Start A Real Estate Business In Australia [2025]

Learn how to start a real estate business in Australia, including key setup steps, licensing requirements, and tips to thrive in the property market.

The Australian real estate industry was estimated to be worth $136.5 billion in 2024, owing to high demand in the residential sector, particularly in cities such as Sydney, Brisbane, and Perth.

So, if you came up with the idea to start your own business and are thinking about real estate, that is a very good idea.

In this article, you will learn how to recreate that idea from the very beginning to the very end, and all that with the help of one tool.

Let's see what steps are needed to start your real estate business in Australia!

What Are the Benefits of Starting a Real Estate Business In Australia?

Here are a few benefits of starting a real estate business in Australia:

⭕ The Australian real estate industry is known for its profitability, assuming you have the necessary experience, resources, and a strong business plan. The industry offers a diverse range of opportunities, from residential and commercial to industrial properties, and has consistently contributed considerably to the nation's economy.

⭕ Australia's property market is known for its long-term capital growth and stability, making it appealing to both domestic and international investors.

⭕ Starting your own agency allows you the opportunity to create your own brand, business plan, and goals.

⭕ There is no set salary cap. Your earnings are directly proportional to your performance, clientele, and business savvy. Successful real estate professionals can generate significant income, especially in high-demand regions.

How To Start A Real Estate Business In Australia?

Here are 5 steps to make it easy for you to start a real estate business!

1. Get the Necessary Licences and Certifications

Before you can officially establish your real estate business, you must first obtain all necessary licenses. Real estate is a regulated sector in Australia, and the specific rules differ based on the state or territory you're in, so consult your local regulator.

Here's what's normally included:

⭕ Complete the authorised training - Most states require that you get a nationally recognised certification, such as the Certificate IV in Real Estate Practice (CPP41419) or the earlier CPP40307 Certificate in Property Services. These courses focus on the legal, ethical, and practical aspects of owning a real estate business.

⭕ Meet the experience and exam criteria - Some jurisdictions may require you to get real-world experience under the supervision of a licensed agent before applying for a full license. Exams are frequently used to check compliance with applicable laws and duties.

⭕ Apply for a real estate license - After meeting the education and experience requirements, you can apply for an individual or corporate license (if you're starting a business). Keep in mind this:

- At least one firm director or nominated officer must possess a valid real estate license.

- This person is in charge of managing the agency's operations and maintaining compliance.

2. Choose and Register Your Business Structure

When you're ready to start your business, you'll have to decide on a structure. This decision influences how you operate, how you are taxed, and your legal obligations.

Your goals and risk management strategy determine the structure you choose, and whether you are going alone or with a team.

Here are the main options:

⭕ Simplest and cheapest to set up.

⭕ You manage your own firm and are taxed as an individual.

⭕ You are personally liable for any bills or legal concerns.

⭕ A good decision if you're planning to do business with someone else.

⭕ Profits and obligations are divided among partners.

⭕ Partners, like lone traders, are personally liable (unless they are in a limited partnership).

Company:

⭕ A distinct legal organisation can reduce your personal liability.

⭕ More difficult setup and higher administrative expenditures.

⭕ Must comply with ASIC's continuous reporting and governance regulations.

How to Register a Business?

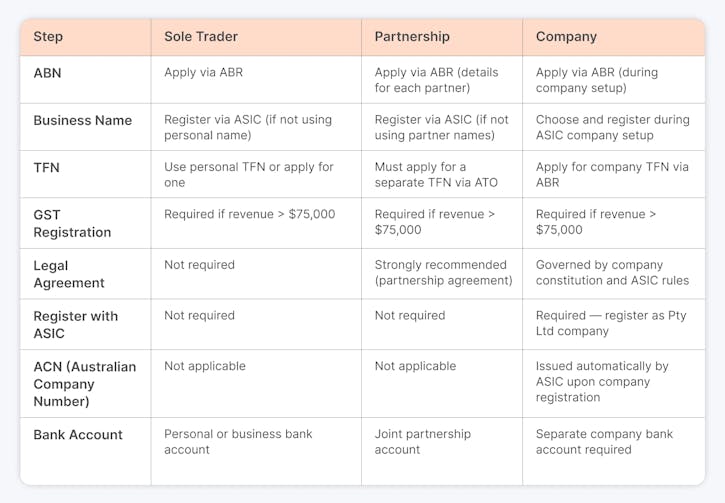

Follow these steps to register your business depending on your choice of business structure:

✅ Registering As a Sole Trader:

⭕ Apply for an Australian Business Number (ABN) - To apply online, go to the Australian Business Register. You'll need to give your personal information and describe your business activity.

⭕ Register a Business Name - Only if you don’t use your personal name. If you don’t want to use your personal name, check the ASIC Business Name Register for availability and then register.

⭕ Obtain a Tax File Number (TFN) - As a sole trader, you can use your personal TFN, but you can also register for another one.

⭕ Registering For the GST - If your annual revenue exceeds $75,000, this is required. You can do this when you apply for an ABN.

✅ Registering As a Partnership:

⭕ Apply for an ABN For the Partnership - You can apply via the Australian Government site. You'll need information for each partner.

⭕ Register a Business Name - As for a sole trader structure, you will need to register your business name via ASIC if you are not using your personal name.

⭕ Apply for a TFN - You can’t use your own TFN for any other structure except for sole trader, so you will need to obtain a separate TFN. You can apply through the ATO.

⭕ Create a Collaboration Agreement - This is not legally essential, but having a clear agreement helps to avoid problems. It should address profit sharing, decision-making, and what happens if someone leaves the business.

⭕ Register for GST - If your turnover is estimated to be $75,000 or higher.

✅ Registering a Company:

⭕ Decide On Your Company's Structure - Most small real estate businesses are registered as proprietary limited companies (Pty Ltd).

⭕ Register Your Company With ASIC - Visit the ASIC website and follow the instructions to register online. You must designate at least one director, decide on officeholders, and choose a company name.

⭕ Get your ACN (Australian Company Number) - ASIC will issue this once your company has been registered.

⭕ Apply for an ABN and TFN - This can be done on the ABR website as part of your company setup.

⭕ Register for GST - Required once your annual income reaches $75,000.

⭕ Set up a Company Bank Account - Since a company is a separate entity, you must maintain its own financial records.

💡ProTip

With ANNA Money, you can easily register your company! All you have to do is:

✅ Choose a company name

✅ Choose additional features, such as a virtual office address, to keep your home address off the records

✅ Share some details about your business

✅ We will notify you once your application is completed

3. Set Up Operations

Once the business has been legally registered, it is time to begin operations.

✅ Secure a physical office - Most states and territories require real estate agencies to operate from a registered physical office, which cannot be a P.O. Box or a virtual address:

⭕ Your workplace must be adequately configured for business and open to the public during typical trading hours.

⭕ It is also where your agency's records, trust accounts, and official documents should be housed.

⭕ Make sure the office address you select matches the one on your license and business registrations.

✅ Meet your legal obligations - Running a real estate business requires compliance with a wide range of regulations and industry standards. This includes:

⭕ Client Protection Laws - Client protection regulations require you to deal with clients fairly and honestly, disclose important information, and prevent misleading or deceptive behaviour. The Australian Consumer Law (ACL) applies on a national level.

⭕ State-Based Property Laws - Property laws vary by state, with particular legislation governing trust account management, property promotion, and lease agreements.

⭕ Codes of Conduct - If you're a member of an industry organisation like REIA or your state's Real Estate Institute, you must follow their professional standards.

⭕ Privacy Restrictions - Because you will be gathering personal information from clients and tenants, ensure your company conforms with the Privacy Act 1988.

4. Build Your Team and Network

It doesn't matter if you're beginning small or big, surrounding yourself with the proper people, both inside your agency and in the larger industry, may make a significant difference.

✅ Hire the Right Team

Begin by determining the responsibilities your company requires to run smoothly and effectively. At a minimum, you'll probably need:

⭕ Licensed Real Estate Agents - Depending on your state's laws, agents must have a certificate or license to sell, lease, or manage property.

⭕ Administrative Staff - The administrative team keep the office operating, handles paperwork, communicates with clients, and assists your sales or property management team.

⭕ Marketing Specialists - In a competitive market, a strong marketing presence (particularly online) is required. To begin, consider hiring an in-house marketing or a freelancer.

✅ Expand Your Network

In real estate, relationships are everything. Begin developing your network early by:

⭕ Joining Industry Bodies - Membership in organisations such as the Real Estate Institute of Australia (REIA) or your state-based institute (REIV, REIQ, REINSW, etc.) provides access to training, legal updates, events, and a strong support network.

⭕ Connecting With Other Professions - Develop contacts with mortgage brokers, real estate lawyers, builders, conveyancers, photographers, and interior designers. These connections can lead to referrals, allowing you to provide greater value to your clients.

⭕ Attending Local Business - Attending local business events and community gatherings increases your visibility in your town and positions you as a trusted local authority.

5. Develop a Marketing and Branding Strategy

Either you're selling, leasing, or managing properties, a great marketing approach will help you stand out

🎯 Create a Clear Brand Identity

Your brand is more than simply your logo; it's how customers view your company. Begin by defining:

⭕ Your Target Audience - Are you targeting first-time home purchasers, investors, luxury properties, or rental management?

⭕ Your Tone and Style - Professional and polished, or approachable and community-oriented?

⭕ Your Unique Selling Points (USPs) – What differentiates you from other local agents?

🎯 Create a Strong Online Presence

These days, the majority of property research begins online, so here's everything you'll need:

⭕ A professional website.

⭕ Promote your listings, team, and services.

⭕ Include customer testimonials, contact forms, and easy navigation.

⭕ Optimise for mobile and local SEO to help clients find you more easily.

⭕ Facebook, Instagram, and LinkedIn are ideal for posting new listings, market information, team updates, and behind-the-scenes content.

⭕ Create an email list and send newsletters, new listing alerts, and local property updates.

⭕ Property platforms.

⭕ List your homes on major portals to maximise reach.

Conclusion

As you can see, it's easier than you think. If you follow all the steps from this article, you will surely start a business much easier than you thought possible. With all that, if you use the ANNA Money feature, everything will be even easier.

How ANNA Money Can Help You Start Your Real Estate Business In Australia?

Although the focus of this tool is the opening of a company, with all its other features, you will surely manage your business more easily.

🚀 Business documents - Keep receipts, invoices, and company records all in one location. We'll match transactions, extract important details, and make everything easy to find and share.

🚀 Business account - Credit cards, virtual cards, Apple Pay, Google Pay, and employee expense cards. Easily check your balance and handle all of your payments.

🚀 Registered Office Service - Keep your personal address off the public record with same-day automated mail scanning and handling (compliant with ASIC, ATO, and other governmental authorities).

🚀 Matching receipts - Automated receipt matching and spending categorization to ensure you obtain the proper tax relief

🚀 Personalised tax calendar - Never miss another tax date, and assure timely compliance with all of your tax requirements.

🚀 Support from Tax Experts - Our polite support team will address any questions you might have.

🚀 Bookkeeping Score - Stay on top of your bookkeeping and receive simple strategies to keep your books neat.

🚀 Invoices that are paid sooner - In seconds, we can generate professional-looking invoices and immediately chase any unpaid invoices on your behalf.

🚀 Payroll - File payroll for yourself and your staff.

🚀 Goods and services tax (GST) - In only a few clicks, your GST is automatically calculated and reported to the ATO.

🚀 Annual Accounts and Company Tax Returns - File your annual accounts with ASIC and your company tax returns with the ATO straight through ANNA.

Sign up today and simplify starting your business!