How to Start a Small Business in Australia in 9 Steps

Discover how to start a small business in Australia with our step-by-step guide. Learn about registration, legal requirements, and tips for success.

Have you ever dreamed of starting your own small business in Australia but don't know where to begin?

Starting a small business involves navigating through various essential steps, each critical for laying a solid foundation for your venture.

Whether you're exploring profitable small business ideas or already have a concept in mind, the process can seem overwhelming, but you can turn your entrepreneurial vision into reality with the proper guidance.

This article will break down the process into 9 actionable steps, providing a clear and concise guide to help you successfully start your small business in Australia.

Ready to embark on your entrepreneurial journey?

Let's begin!

Launch Your Small Business in Australia This Year with These 9 Essential Steps

1. Dive into Market Research

Conducting market research is essential when starting a small business because it provides critical insights into:

📌 consumer needs,

📌 market trends, and

📌 competitive landscapes.

This step enables informed decision-making and strategic planning, regardless of your company size.

By conducting market research, you can minimize risks by validating your business concept and identifying potential challenges and opportunities in the market.

Key Steps to Conduct Market Research in Australia

To conduct market research successfully, you should focus on customers, competitors, location, industry, and market trends.

Here are some ideas on where to start:

👉 Utilize Existing Research: Sources like government statistics, industry reports, and trade associations can offer valuable data.

- Example: Use the Australian Bureau of Statistics (ABS) for demographic data.

👉 Interact Directly with Potential Customers: Use surveys, focus groups, or social media polls to gather feedback on your business idea.

- Example: Create a simple online survey to understand customer preferences and pain points.

👉 Search for Public Studies: Look for studies about your customer group and monitor social media and community groups for insights.

- Example: Join relevant Facebook groups or forums to see what your target audience is discussing and what their needs are.

These methods will help you gain a comprehensive understanding of your market, enabling you to make informed decisions and strategically plan your business.

2. Craft a Winning Business Plan

Crafting a winning business plan is your second crucial step when starting a small business in Australia.

This serves as a strategic roadmap, guiding decision-making and operations, and is instrumental in attracting investors and ensuring long-term viability.

Without a well-thought-out business plan, entrepreneurs can:

⛔ lose sight of their objectives,

⛔ struggle with potential challenges, and

⛔ lack control over the direction of their business.

Key Points to Consider When Crafting a Business Plan

👉 Establish Measurable Goals: Set specific, achievable targets and define your unique selling proposition (USP) to guide your business's direction. Using a business plan template can help structure these elements effectively.

- Example: "Increase online sales by 20% in the first year through targeted digital marketing campaigns."

👉 Create Detailed Financial Projections: Outline your revenue, expenses, cash flow, and profit margins to attract investors and secure financing.

- Example: "Forecast monthly revenue and expenses for the first three years, including a break-even analysis."

By focusing on key elements, your business plan can serve you as a guide for your operations while also enabling you to effectively communicate your vision to potential investors and stakeholders.

3. Select Your Business Structure

Selecting the appropriate business structure is a pivotal step for your businesses as it influences:

📌 legal liability,

📌 tax obligations, and

📌 the complexity of business operations.

This decision sets the foundation for how your business will be managed, the level of control you will have, and the potential for growth and investment.

Key Points to Consider

👉 Tax Implications: Different structures have varying tax responsibilities and benefits.

- Example: Sole traders report income as part of their personal tax return, while companies are subject to corporate tax rates.

👉 Legal Liability: The structure determines the extent of personal liability of the business owners.

- Example: In a sole trader setup, the owner is personally liable for business debts, whereas, in a limited liability company (LLC), liability is limited to the amount invested in the company.

👉 Operational Complexity: Each structure comes with its own set of administrative duties and costs, affecting the ease of business management.

- Example: Partnerships may require a formal partnership agreement and shared decision-making, while corporations need to comply with more rigorous reporting and governance requirements.

By carefully evaluating these factors, you can choose the business structure that best aligns with your goals, resources, and risk tolerance, ensuring a solid foundation for your business's success.

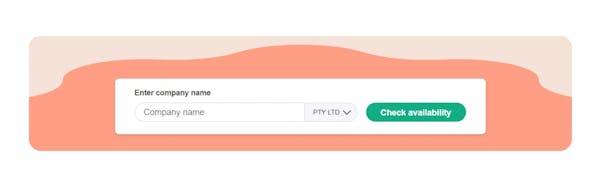

4. Secure Your Unique Business Name

By choosing and registering a unique business name with the Australian Securities and Investments Commission (ASIC), you are halfway there.

This step is vital as it establishes your brand's identity and legal presence in the market while protecting against potential infringement by others.

A unique business name is key to differentiating your business and ensuring that customers can easily identify and remember your brand.

Key Points to Consider

👉 Legal Protection: Registering your business name prevents others from using the same or a similar name, protecting you from legal disputes and trademark infringement.

- Example: Registering "EcoFriendly Solutions Pty Ltd" ensures that no other business can operate under a similar name in Australia.

👉 Brand Identity: A unique business name enhances your brand's recognition and reputation, making it easier for customers to find and engage with your business.

- Example: A memorable name like "GreenLeaf Gardening" helps customers recall and recommend your services.

👉 Market Positioning: A distinctive name sets your business apart in a crowded marketplace, aiding in marketing efforts and establishing a strong position within your industry.

- Example: A creative name like "TechSavvy Solutions" can attract tech-savvy clients and stand out in the tech industry.

By securing a unique business name, you lay the foundation for a strong brand identity, legal protection, and effective market positioning, all of which are crucial for the success of your small business.

Pro Tip

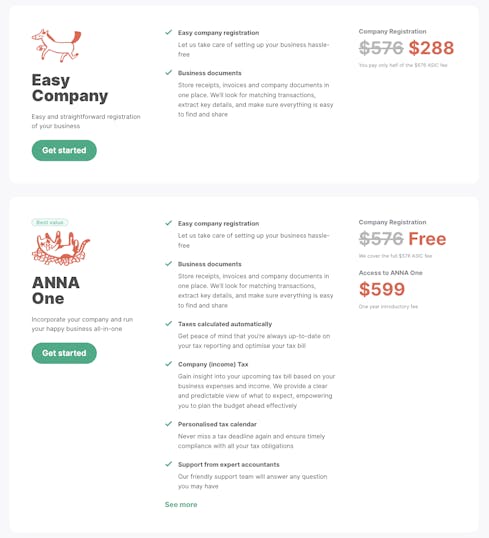

Did you know that with ANNA, you can register your small business in Australia from start to finish without spending a dime?

You can experience the convenience of ANNA One's streamlined process, which allows you to easily register your Australian company and open a business bank account.

All you need to do is to:

1. Use our search tool to check if your company name is available instantly.

2. Provide a registered office address in Australia.

3. Provide the director and shareholder's name, date, place of birth, and residential address.

5. Obtain an Australian Business Number (ABN)

An Australian Business Number (ABN) is an 11-digit business number critical for any business in Australia.

It serves as a unique identifier in dealings with the government and other businesses, and is necessary for tax purposes, claiming credits, and enhancing your business's credibility.

Key Points to Consider When Applying for an ABN

👉 Application Process: Apply online through the Australian Business Register (ABR).

Ensure you have all necessary documents and information about your business activities.

- Example: Prepare details about your business structure, activities, and location before starting the application.

👉 Eligibility: Not every enterprise requires an ABN. Check your eligibility on the ABR website to ensure you meet the criteria before applying.

- Example: Sole traders and partnerships conducting business in Australia generally need an ABN, but hobbyists do not.

👉 Immediate Use: Once obtained, you can use your ABN for various business activities, including invoicing, applying for an Australian domain name, and more.

- Example: Display your ABN on invoices to ensure compliance and facilitate credit claims.

Remember, the ABN application is free of charge and can typically be completed quickly if all required information is provided accurately.

6. Register for Taxes

Registering for taxes ensures compliance with tax laws and enables the business to operate legally.

This is a necessary step when starting a small business in Australia for:

📌 managing financial obligations,

📌 claiming tax credits, and

📌 facilitating smooth transactions with other businesses and the government.

Key Taxes for Small Businesses in Australia:

👉 Goods and Services Tax (GST): A 10% tax on most goods and services sold or consumed in Australia.

- Requirement: If your business has a GST turnover of $75,000 or more, you must register for GST.

- Example: A retail store with annual sales exceeding $75,000 must charge and remit GST.

👉 Pay As You Go (PAYG) Withholding: Businesses must withhold tax from payments to employees and certain contractors and remit these amounts to the Australian Taxation Office (ATO).

- Example: A consultancy firm deducts PAYG withholding from employee salaries and submits it to the ATO.

👉 Income Tax: The amount of income tax depends on the taxable income of the business, calculated from assessable income minus any deductions.

- Example: A cafe calculates its taxable income by subtracting business expenses from total revenue and pays income tax on the profit.

👉 Other Taxes That May Apply:

- Capital Gains Tax (CGT)

- Fringe Benefits Tax (FBT)

- Payroll Tax

- Land Tax

Eligibility for Lower Company Tax Rate

The full company tax rate of 30% applies to all companies not eligible for the lower rate.

👉 Lower Rate Eligibility: From the 2017–18 income year onwards, eligibility depends on whether you are a base rate entity.

By registering for the necessary taxes and understanding your tax obligations, you can ensure your business remains compliant with Australian tax laws.

7. Open a Dedicated Business Bank Account

Opening a dedicated business bank account ensures a clear separation between personal and business finances.

This step is important because it ensures accurate record-keeping and tax compliance. Additionally, it enhances the credibility of your business, making it easier to:

📌 manage finances,

📌 track performance, and

📌 establish a professional image with customers and suppliers.

Key Points to Consider

👉 Legal Compliance: For certain business structures like companies, trusts, or partnerships, it's a legal requirement to have a separate bank account.

- Example: An LLC must have a dedicated bank account to comply with regulatory standards.

👉 Financial Management: A dedicated account simplifies managing business-related income and expenses, aiding in better cash flow management.

- Example: Tracking payments and expenses from a single account helps maintain clear financial records.

👉 Tax Efficiency: It helps in identifying deductible business expenses, providing supporting documentation, and ensuring compliance with tax regulations.

- Example: Using a business account to pay for business-related expenses makes it easier to claim deductions at tax time.

By opening a dedicated business bank account, you ensure better financial management, enhance your business’s credibility, and comply with legal and tax obligations.

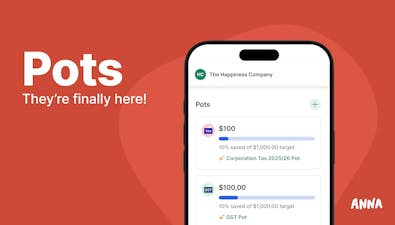

Pro Tip

When you open an ANNA business account, you can:

- Access a credit card, virtual cards, Apple Pay, Google Pay, and expense cards for employees.

- Store and manage receipts, invoices, and company documents in one place.

- Automate transaction matching, extract key details, and easily share documents.

- Stay up-to-date with tax reporting and optimize your tax bill.

- Gain clear insights into upcoming tax bills based on business expenses and income.

- Create professional-looking invoices quickly with automated follow-up on unpaid invoices.

- Monitor your bookkeeping with tips on maintaining tidy records.

- Benefit from automated receipt matching and categorization for optimal tax relief.

8. Obtain Required Licenses and Permits

Obtaining the required licenses and permits ensures that your small business is legally compliant with local, state, and federal regulations.

They also prevent the risk of fines, penalties, or business closure.

Additionally, obtaining licenses and permits establishes your business's legitimacy while building trust with customers, suppliers, and investors.

Common Licenses and Permits for Small Businesses in Australia

👉 Trade Licenses: Necessary for specific trades and professions to ensure practitioners meet industry standards.

- Example: A plumbing business requires a trade license to operate legally and assure customers of their qualifications.

👉 Building Permits: Required for construction-related activities to ensure compliance with building codes and safety regulations.

- Example: A construction company needs building permits to start new construction projects, ensuring all work meets safety standards.

👉 Environmental Permits: Needed for businesses that may impact the environment, to ensure adherence to environmental laws and regulations.

- Example: A manufacturing plant must obtain environmental permits to manage emissions and waste disposal legally.

By securing the necessary licenses and permits, you ensure that your business operates within the law, builds a strong reputation, and fosters trust with key stakeholders.

9. Implement Efficient Accounting and Record-Keeping Systems

Implementing efficient accounting and record-keeping systems ensures accurate financial tracking and compliance with regulatory requirements.

By utilizing these systems, you can facilitate informed business decisions and strategic planning.

Efficient systems also streamline tax preparation and reporting, helping to avoid penalties and optimize financial performance.

Key Points to Consider

👉 Accurate Financial Tracking: Maintain precise records of all financial transactions to ensure accuracy in financial statements.

- Example: Regularly update your accounting system with income and expenses to get a clear picture of your financial health.

👉 Compliance with Regulations: Ensure your accounting practices comply with Australian tax laws and regulations to avoid legal issues.

- Example: Use a system that supports GST reporting to meet ATO requirements.

👉 Streamlined Tax Preparation: Simplify the process of preparing and filing taxes, reducing the risk of errors and penalties.

- Example: An integrated accounting system can automatically generate reports needed for tax filing.

Example of Accounting and Record-Keeping System

ANNA provides a digital solution for invoicing, tax filing, and financial management, suitable for small businesses looking for an all-in-one platform.

- Example: Use ANNA to automate invoicing and track expenses, ensuring all financial data is in one place.

By implementing an efficient accounting and record-keeping system, you ensure accurate financial management, regulatory compliance, and optimized business performance.

Wrapping Up

As you can see, starting a small business in Australia requires careful planning and following a series of essential steps.

These steps range from conducting market research to obtaining necessary licenses and implementing efficient accounting systems.

And each step in our list is crucial for establishing a strong foundation for success of your business.

When it comes to managing your small business finances and operations, ANNA stands out as the best solution. Here’s why:

Key Benefits of Registering Your Small Business In Australia With ANNA One

🎯 Comprehensive Financial Management:

- ANNA provides a digital solution for invoicing, tax filing, and financial management, simplifying your business operations.

🎯 Expense Tracking and Receipt Management:

- Easily store and manage receipts, invoices, and company documents in one place with automated matching and categorization.

🎯 Automated Invoicing and Payment Follow-ups:

- Create professional invoices quickly and ensure prompt payment with automated follow-ups.

🎯 Tax Reporting and Optimization:

- Stay up-to-date with tax reporting, gain clear insights into upcoming tax bills, and optimize your tax bill based on business expenses and income.

🎯 Employee Expense Management:

- Access credit cards, virtual cards, Apple Pay, Google Pay, and expense cards for employees to streamline expense management.

By leveraging ANNA’s comprehensive suite of tools, you can focus on the expansion of your business while ensuring financial accuracy and compliance.

Ready to take the next step in your entrepreneurial journey?

Get started with ANNA today and experience seamless business management!