10 Tips to Start Import or Export Business in Australia

Discover essential tips to start an import or export business in Australia, covering key requirements, regulations, and strategies for success.

- In this article

- 1. Grasp the Fundamentals of Global Trade

- 2. Narrow Your Focus Through Market Research

- 3. Register Your Business and Handle Legal Essentials

- 4. Navigate Australia’s Customs and Biosecurity Rules

- 5. Refine Your Marketing and Networking Approach

- 6. Streamline Logistics and Shipping

- 7. Get Comfortable with Pricing and Payment Methods

- 8. Prioritise Correct Labeling and Product Safety

- 9. Explore Government Grants and Incentive Programs

- 10. Stay Flexible and Nurture Long-Term Relationships

- How Can ANNA Help?

Global trade has never been more accessible. With advancements in eCommerce and logistics, it’s now possible for businesses – no matter their size – to source products from halfway across the planet and sell them to customers worldwide.

In Australia, a country known for both its robust domestic market and diverse export offerings, starting an import-export business can be a rewarding venture.

But how exactly do you get started?

Below are 10 essential tips on launching your own import-export operation in Australia.

We’ll talk about finding your niche, meeting local biosecurity rules, navigating customs requirements, and much more.

1. Grasp the Fundamentals of Global Trade

Before diving in headfirst, you must understand how cross-border trade functions in Australia and beyond.

At its heart, importing is when you bring goods into Australia from other nations, typically to fill a gap in the local market or introduce products that are underrepresented here.

Exporting, by contrast, involves sending Australian products overseas to capitalise on foreign demand.

🔸 Key Initial Considerations

1. Local and Global Regulations

Each country enforces unique tariffs, quotas, and product safety rules. Australia, for instance, demands strict biosecurity measures for incoming foodstuffs, agricultural items, or other high-risk products.

2. Terminology and Trade Structures

- Export Trading Company (ETC): Focuses on matching local suppliers with foreign buyers.

- Export Management Company (EMC): Operates as an agent for domestic manufacturers, arranging sales and logistics.

- Import-Export Merchant: Buys goods outright to resell, assuming greater risk but potentially higher returns.

3. Market Opportunities and Pitfalls

A typical household might contain electronics from China, shoes from Indonesia, and tapestries from India.

These items didn’t appear by accident ‘cause import-export businesses acted as conduits, handling everything from product selection and shipping to customs documentation.

However, if an importer fails to label items properly or pay the right duties, shipments can be stalled or penalised.

So, building a knowledge base is your first safeguard against such complications.

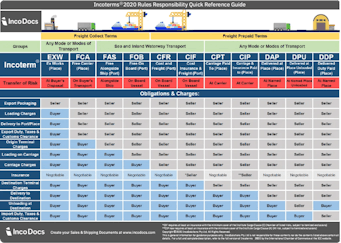

Familiarise yourself with the essentials of customs declarations, tariff codes, and logistical terms (e.g. Incoterms) to ensure your foundation is solid.

2. Narrow Your Focus Through Market Research

The global trade arena is vast. So, rather than stretch yourself across multiple product categories or countries, focus on a particular niche that aligns with your interests, skills, or existing networks.

How to Identify a Viable Niche:

1. Uncover Market Gaps

Look for categories in which local supply is low, but consumer demand runs high.

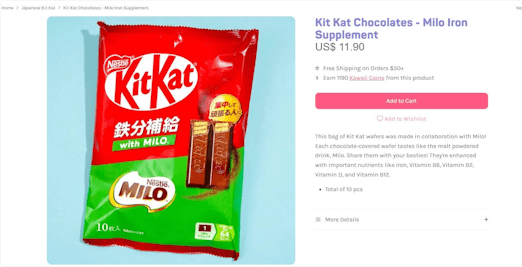

For instance, if certain exotic spices are scarce in Australian supermarkets, importing them could be lucrative.

Conversely, if specialty Australian honey or organic wool products are trending overseas, consider exporting them.

2. Use Data and Research Tools

- Google Trends and social media to assess current hype or stable interest.

- Australian Trade and Investment Commission (Austrade) to glean insights about emerging markets.

- GlobalEDGE’s Market Potential Index or the International Trade Administration reports to evaluate broad international demand.

3. Evaluate Competition

Research how many players are in your space and whether there’s room for a newcomer.

If you’re looking to export Australian seafood, is the market already saturated with major exporters who have decades of experience and established logistics?

4. Craft Your Business Plan

Your market research should feed into a detailed business plan, outlining target demographics, potential profit margins, shipping costs, and marketing tactics.

If you’re planning to distribute consumer goods in Australia, identify how you’ll differentiate from existing importers.

If you’re exporting, define which foreign markets show the most promise and which distribution channels you’ll tap into – online marketplaces, local distributors, or large-scale wholesalers.

3. Register Your Business and Handle Legal Essentials

After settling on a niche, it’s time to legitimise your operation. In Australia, you usually need an Australian Business Number (ABN) if you’re trading goods or services.

The business structure you select – sole trader, partnership, or company – will affect tax responsibilities, personal liability, and the perception of your enterprise among potential partners.

🔸 Additional Registrations and Licenses

- Importer of Record (IOR): For those regularly bringing goods into Australia, registering as an IOR might be mandatory, particularly for certain controlled items (e.g., pharmaceuticals or chemicals).

- Export Licenses: Depending on your product, you may need a license from the relevant department (like the Department of Agriculture, Fisheries and Forestry for food or agricultural exports).

- Foreign Qualifications: If you plan to store or re-route goods through another country, local laws in that jurisdiction may require additional corporate registrations.

When you handle these administrative steps promptly, you project professionalism to potential suppliers, buyers, and government agencies which also helps avoid last-minute compliance snags that derail shipments or invite fines.

4. Navigate Australia’s Customs and Biosecurity Rules

Australia’s quarantine laws are among the strictest in the world, designed to protect local ecosystems and agricultural industries.

Similarly, Australian customs requires correct valuations and payment of duties or taxes to clear goods.

🔸 Import Concerns

1. Clear Import Declarations

Goods over $1,000 typically need a formal import declaration. Under-declaring the shipment value to skirt taxes is illegal and can result in heavy penalties.

2. Biosecurity Screening

Some products like live plants, seeds, fresh produce, meat, or wooden objects may demand special permits or treatments. Consult the Biosecurity Import Conditions system (BICON) to see what’s allowed or restricted.

3. GST and Duties

Most imports are subject to the 10% Goods and Services Tax (GST). Alcohol and tobacco have higher excise rates. So, familiarise yourself with the tariff codes used to classify your goods, as they determine duty rates.

🔸 Export Concerns

1. Export Controls

Certain items, like defense materials, dual-use technologies, or culturally significant artifacts, require an export permit.

2. Free Trade Agreements (FTAs)

Australia has multiple FTAs with nations worldwide. Understanding these agreements can yield tariff reductions or exemptions, boosting the competitiveness of your exported goods.

5. Refine Your Marketing and Networking Approach

Import-export success hinges not only on having desirable goods but also on connecting with the right people. Building strong relationships is crucial if you're looking for local Australian retailers for your imports or international distributors for your exports.

🔸 How to Build Visibility

1. Professional Online Presence

A well-designed website that shows your offerings, origin stories, or unique selling points fosters credibility. But don’t forget to adapt your content for potential overseas buyers, you can consider including multiple language options if targeting non-English markets.

2. Trade Shows and Industry Events

Gatherings like Fine Food Australia or industry-specific expos let you meet manufacturers, sellers, and buyers in person. Face-to-face interactions can finalise deals far quicker than endless email threads.

3. Chambers of Commerce and Trade Associations

Local chambers or specialist trade groups often maintain international ties, introducing you to overseas partners or relevant grants and programs. Memberships can also bolster your reputation as a serious player in the field.

❗ Don’t forget!

Building trust is critical when transactions involve thousands or millions of dollars in merchandise.

So keep communication channels open, provide timely updates on shipments, and honor your contractual commitments. If you plan to work with US suppliers or customers, having a dedicated US phone number can make communication faster and more reliable.

Over time, strong rapport can lead to reduced prices, lenient payment terms, and referrals to new buyers or suppliers.

6. Streamline Logistics and Shipping

Efficient logistics (transportation, storage, freight forwarding, and customs clearing) are essential for a successful import-export business.

Securing high-quality products or lucrative overseas contracts won't matter if inadequate logistics management causes spoilage, delays, or additional costs that eat into profits.

🔸 Freight Forwarders and Brokers

Freight forwarders can manage cargo booking, packaging, and documentation, and occasionally offer consolidated shipping if your volume is small.

Licensed customs brokers, meanwhile, ensure your items are classified properly under the Harmonized System (HS) codes, handle import or export declarations, and address any unforeseen questions from customs officials.

❗ Don’t forget!

Selecting forwarders or brokers experienced in your product category is advantageous – someone familiar with cold-chain shipping for seafood or specialised packaging for fragile electronics can save you from major headaches.

🔸 Essential Shipping Documents

- Commercial Invoice: Outlines item descriptions, prices, and payment details.

- Packing List: Specifies volume, weight, item count, and packaging details.

- Bill of Lading (BOL) or Air Waybill: Contract between you and the carrier, detailing shipping responsibilities.

- Certificate of Origin: May enable lower tariffs if a Free Trade Agreement applies.

- Import/Export Licenses: Required for restricted products like firearms, chemicals, or some agricultural goods.

Make sure the information on these documents aligns perfectly because any discrepancy can raise customs suspicions and lead to cargo holds.

7. Get Comfortable with Pricing and Payment Methods

In addition to typical overhead and labor expenses, import-export businesses face various extra costs: insurance, freight, storage fees at ports, bank charges on international transfers, and more. It’s essential to:

1. Calculate the Total Landed Cost

Include all expenses (purchase price, shipping, insurance, duties, and GST) to determine your import break-even point or minimum viable export price. This figure guides how you set your margins when selling domestically or internationally.

2. Choose a Payment Method That Protects You

- Letters of Credit (LC): Bank-backed guarantee of payment if you meet shipping conditions. Secure but can be costly.

- Documentary Collections: Less secure than an LC but faster and cheaper, relying on banks to exchange documents for payment.

- Open Account: The buyer pays after receiving goods, which is riskier for the exporter but appeals to established clients.

- Cash in Advance: Great for the seller but often unpalatable to buyers, who must pay before seeing the goods.

- Consignment: You don’t get paid until products are sold by the buyer, suitable for penetrating new markets but risky if sales are low or delayed.

Balancing your desired level of security with what your market finds acceptable is often a dance of negotiation, especially if you’re new to a particular country or product category.

8. Prioritise Correct Labeling and Product Safety

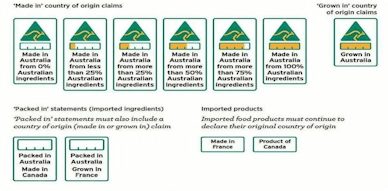

One of the most common pitfalls for new importers or exporters is labeling noncompliance.

In Australia, items like food, cosmetics, chemicals, and electronics have stringent labeling requirements.

The Australian Competition and Consumer Commission (ACCC) and Food Standards Australia New Zealand (FSANZ) both monitor product labeling closely to guard consumers against misleading or harmful products.

🔸 Common Labeling Concerns

- Country of Origin: Some food products must explicitly list the country of origin, especially if you claim “Made in Australia.” Exports might need details in the importer’s local language.

- Safety Warnings: Electrical goods might need a recognised safety mark, and cosmetics might require an ingredient list plus warnings about allergens. For instance, if you import children’s toys, check for any choking hazard labels needed under Australian law.

- Allergen Information: Food items containing peanuts, soy, gluten, or dairy must comply with allergen disclosure requirements. Missing or vague details can result in product recalls or border rejections.

9. Explore Government Grants and Incentive Programs

Australia actively encourages local businesses to venture into international markets. Various grants and incentives aim to ease the financial burden of marketing, product development, or export expansion.

1. Export Market Development Grants (EMDG)

This program provides partial reimbursements for costs like overseas trade show attendance, advertising, or marketing consultants. Ideal for smaller businesses testing new markets.

2. Duty Drawback or Tradex

If you import goods only to export them later (unchanged or further processed), you may reclaim the customs duties paid. The Tradex Scheme even defers GST and import duty on goods intended for re-export.

3. Export Finance Australia

Offers loans, guarantees, and other finance solutions for exporters needing capital to produce large orders or invest in expansion. This can be particularly useful if your overseas buyer requests open account terms, but you need funds to fulfill inventory upfront.

10. Stay Flexible and Nurture Long-Term Relationships

Global trade rarely remains static. Currency fluctuations, supply chain disruptions, and evolving consumer tastes can all upend your carefully laid plans.

🔸 How to Build Lasting Partnerships

1. Suppliers and Freight Partners

Over time, stable relationships with suppliers might earn you better payment terms or priority stock in high-demand seasons.

Likewise, a dependable freight forwarder can alert you early to port congestion or airline strikes, allowing you to pivot shipping routes.

2. Repeat Buyers

Loyal customers reduce your marketing costs and streamline your forecasting. By consistently delivering on time and offering competitive prices, you’ll turn one-off buyers into regular clients.

3. Industry Alliances

Collaboration with other exporters or importers, whether to co-sponsor a container shipment to split costs or to share booth space at an international trade show can open fresh revenue streams and reduce overhead.

Such alliances become valuable shock absorbers when market conditions turn volatile. A flexible mindset, underpinned by real-time monitoring of shipping routes and product trends, helps you maintain momentum in the long run.

How Can ANNA Help?

After you’ve tackled the groundwork – identifying your market, navigating regulations, setting up logistics – one of the biggest day-to-day challenges is managing your business's financial and administrative aspects.

ANNA offers a streamlined platform designed to address exactly that, helping you focus on scaling your import-export venture:

⚡ Business Registration

ANNA simplifies the company registration process, assisting you in filing for an ABN and ACN. This saves you from wrestling with multiple government portals and confusing paperwork.

⚡ Real-Time Bookkeeping

Import-export ventures often incur complex expenses: shipping insurance, customs duties, and supplier payments in multiple currencies. ANNA automatically categorises transactions, matches receipts to invoices, and maintains a digital record so you always know your cost breakdown and profitability.

⚡ GST and BAS Management

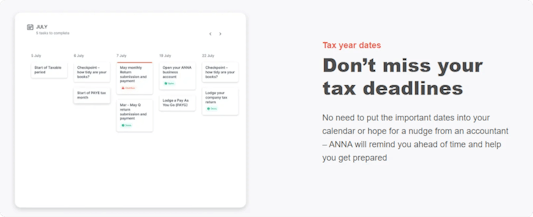

Correctly calculating GST, especially if you operate as both an importer and an exporter, can be tricky. ANNA’s built-in tax tools compute your GST amounts, prepare your Business Activity Statements (BAS), and remind you of deadlines to avoid late lodgment penalties.

⚡ Invoice Generation and Payment Tracking

A clear, professional invoice system is essential to building trust with clients, whether overseas or local. ANNA’s integrated invoicing feature helps ensure you’re paid promptly, while real-time tracking of outstanding bills keeps your cash flow healthy.

⚡ Compliance Alerts

Whether you’re dealing with quarterly BAS or annual company updates, ANNA offers timely reminders so you never miss critical deadlines. This mitigates the risk of fines and keeps your focus on expanding your trade network.

Sign up today and be freer to strategise, pursue new markets, and cultivate the partnerships that will carry your import-export business into the future.