How to Write an Invoice in Australia? (Examples + Best Practices)

Learn how to write an invoice in Australia with this guide, including essential elements, examples, and best practices for accuracy and compliance.

Invoices are more than just paperwork. They represent the final step in a transaction and are an essential part of running a business in Australia. They ensure your work is recognised, compensated, and contribute to maintaining a professional relationship with your clients.

In addition to facilitating payments, invoices are critical for tax compliance and keeping your financial records in order.

Writing an invoice may seem simple at first glance, but there are important requirements and best practices every business owner should understand.

Why a Detailed and Accurate Invoice Matters

Invoices are more than payment requests. They’re also legal documents that serve as a record of transactions between you and your clients.

A well-constructed invoice can:

- Ensure timely payments by providing clear and complete information.

- Build trust with clients by demonstrating professionalism.

- Fulfil legal obligations under the Australian Taxation Office (ATO) regulations, especially if you’re GST-registered.

- Simplify your bookkeeping and tax reporting processes.

Invoicing isn’t just a task but an opportunity to enhance your business’s credibility. Let’s break down how to write an invoice step-by-step.

7 Essential Components of an Australian Invoice

For an invoice to be legally compliant and effective, it must include specific details. Here’s what every Australian invoice should have:

1. Your Business Information

Include all relevant details about your business to establish credibility and comply with tax regulations:

- Business Name: This should match the name on your business registration.

- ABN (Australian Business Number): Mandatory for taxation purposes. If you don’t provide an ABN, your clients may need to withhold 47% of the payment for tax purposes.

- Contact Details: Provide your full business address, phone number, and email for easy communication.

ABC Web Designs

ABN: 12 345 678 901

123 Main Street, Sydney NSW 2000

Phone: (02) 9876 5432

Email: info@abcwebdesigns.com.au

2. Customer Information

To make the invoice specific to the client:

- Include the customer’s name, business name, and address.

- For invoices over $1,000, include the customer’s ABN (if they’re a registered business).

Client: XYZ Marketing Pty Ltd

ABN: 98 765 432 109

456 High Street, Melbourne VIC 3000

3. Invoice Details

These details help with tracking and organisation:

- Invoice Number: Assign a unique number to every invoice. Use a consistent numbering format (e.g., INV-2024-001).

- Invoice Date: The date when the invoice is issued.

- Payment Due Date: Clearly state the deadline for payment (e.g., “Payment due within 14 days”).

Invoice Number: 2024-001

Invoice Date: 4 December 2024

Due Date: 18 December 2024

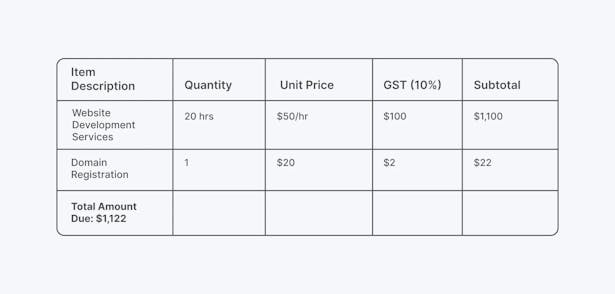

4. Itemised List of Goods or Services

Transparency is critical. Provide a detailed breakdown of what you’re charging for:

- Description: Clearly specify the goods or services provided.

- Quantity: State how many units or hours were provided.

- Unit Price: Include the cost per item or service unit.

- Subtotal: Total cost before taxes.

- GST Amount: If you’re GST-registered, show the GST amount or state that the price includes GST.

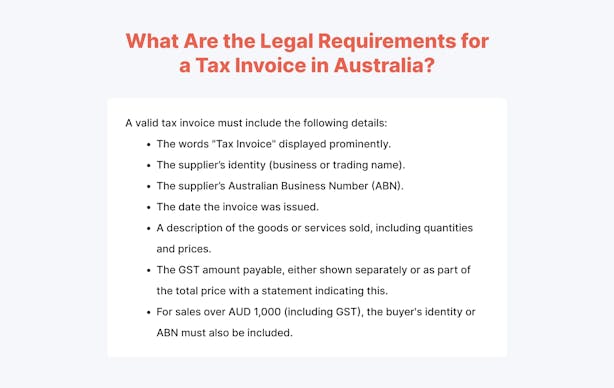

5. GST and Tax Compliance

If your business is registered for GST, your invoice must include:

- The words “Tax Invoice” displayed prominently at the top.

- GST details for each item or a statement like “Total price includes GST.”

- Your ABN.

6. Payment Information

Make it easy for clients to pay by including:

- Payment Terms: Specify when payment is due (e.g., "Net 30 days") and any penalties for late payments.

- Payment Methods: Include details for bank transfers (BSB, account number), PayPal, or credit card payments.

7. Optional but Useful Details

Add these to enhance clarity and professionalism:

- Purchase Order Number: Reference a purchase order if applicable.

- Notes or Instructions: Include details like “Thank you for your business” or special handling instructions.

- Job or Project References: Useful for tracking work tied to specific projects.

Best Practices for Writing Invoices

How you structure and present your invoices can impact your client’s experience. Here are some tips to ensure your invoices are clear, professional, and effective.

1. Brand Your Invoice

Add your business logo and use consistent branding (colours and fonts).

A professional design reflects positively on your business.

2. Use Clear and Concise Language

- Avoid jargon or overly technical terms.

- Ensure descriptions are specific and easy to understand.

❌ Instead of: “Consultation services”

✔️ Write: “5-hour strategic marketing consultation for product launch planning.”

3. Automate the Process

Use invoicing software to streamline your process:

- ANNA for small businesses, offering integrated bookkeeping and tax tools.

- Xero and QuickBooks for GST-compliant invoicing for larger businesses.

- Square or Zoho Invoice for simplicity and customisation.

Common Mistakes to Avoid When Writing an Invoice

Even with the best intentions, invoicing mistakes can disrupt the payment process, frustrate clients, and even cause compliance issues.

Let’s go over bad and good practices for further clarification:

1. Missing Key Information

As we mentioned many times, including all legally required and essential information is crucial. Missing details like your ABN, GST breakdown (if applicable), or even contact information can delay payments and create confusion.

❌ Bad Example

Invoice #123

John’s Cleaning Services

Date: 1 December 2024

Total: $500

This invoice is missing critical details such as the ABN, GST breakdown, and payment instructions. A client receiving this invoice might need to reach out for clarification, delaying the payment process.

✔️ Good Example

John’s Cleaning Services

ABN: 12 345 678 901

Invoice #123

Date: 1 December 2024

Total (including GST): $500

Payment Methods: Bank Transfer (BSB: 123-456, Account: 789123)

This example includes the ABN, GST information, and clear payment instructions, making it easier for the client to process the invoice.

2. Using Vague Descriptions

Vague descriptions can confuse clients and lead to disputes about the charges. A detailed breakdown builds trust and ensures transparency.

❌ Bad Example

Service: Consultation

Total: $1,000

This description lacks clarity about the nature of the consultation, what it entailed, or the time involved. A client might question the value or accuracy of the charge.

✔️ Good Example

Service: Strategic Marketing Consultation

Description: 10 hours of strategic consultation for the XYZ product launch, including a full market analysis and campaign planning.

Hourly Rate: $100

Total: $1,000

This example clearly outlines what the service included, how the rate was calculated, and the total amount, leaving no room for doubt.

3. Forgetting to Specify Payment Terms

Without clear payment terms, clients might delay payments or misunderstand the timeline. Payment terms also set expectations and provide a basis for follow-ups.

❌ Bad Example

Total Due: $1,500

This invoice does not indicate when the payment is due or any penalties for late payments, leaving the client to guess the deadline.

✔️ Good Example

Total Due: $1,500

Payment Terms: Payment is due within 14 days of the invoice date (by 15 December 2024). Late payments will incur a 5% monthly fee.

This example specifies the payment deadline and includes late payment penalties, creating a clear timeline and incentive for timely payments.

4. Reusing Invoice Numbers or Not Keeping Them Sequential

Invoice numbers are critical for tracking and record-keeping. Reusing numbers or failing to follow a sequential order can create confusion for both you and your clients.

❌ Bad Example

Invoice #001: Sent to Client A on 1 December 2024.

Invoice #001: Sent to Client B on 3 December 2024.

Reusing the same number can cause accounting errors and confusion during audits or reconciliations.

✔️ Good Example

Invoice #2024-001: Sent to Client A on 1 December 2024.

Invoice #2024-002: Sent to Client B on 3 December 2024.

This sequential numbering system avoids duplication and simplifies tracking and reporting.

5. Failing to Follow Up on Overdue Payments

Even the best invoices won’t always result in timely payments. Failing to follow up can harm cash flow and strain client relationships. Polite, consistent reminders are essential.

❌ Bad Example

No follow-up communication after an invoice due date passes.

This can lead to prolonged delays, leaving the client unaware of the missed payment or assuming it is not urgent.

✔️ Good Example

A polite reminder email sent shortly after the due date:

“Dear [Client Name],

This is a friendly reminder that Invoice #2024-001, issued on 1 December 2024, was due on 15 December 2024. Please let us know if there are any issues with processing this payment. If payment has already been made, kindly disregard this message.

Thank you,

[Your Name]”

This approach is professional, non-confrontational, and encourages prompt action.

📌 Important Note: Tax Invoice Deadlines and Compliance in Australia

Tax invoices must be issued within 28 days of a taxable sale exceeding AUD 82.50 (including GST).

If requested by the customer, you should provide the tax invoice sooner.

Failing to issue a tax invoice within the required timeframe can have consequences:

- Your customer may be unable to claim GST credits for the transaction.

- The ATO may scrutinise your compliance, potentially leading to penalties or fines.

You are not legally required to issue a tax invoice for transactions below AUD 82.50.

However, customers may still request one for their records, and providing one can enhance professionalism.

How to Write an Invoice for International Clients

When invoicing clients outside Australia:

- State the currency clearly (e.g., AUD, EUR, or USD).

- Exclude GST, as international transactions may not be subject to it.

- Use international payment methods like PayPal or Wise for convenience.

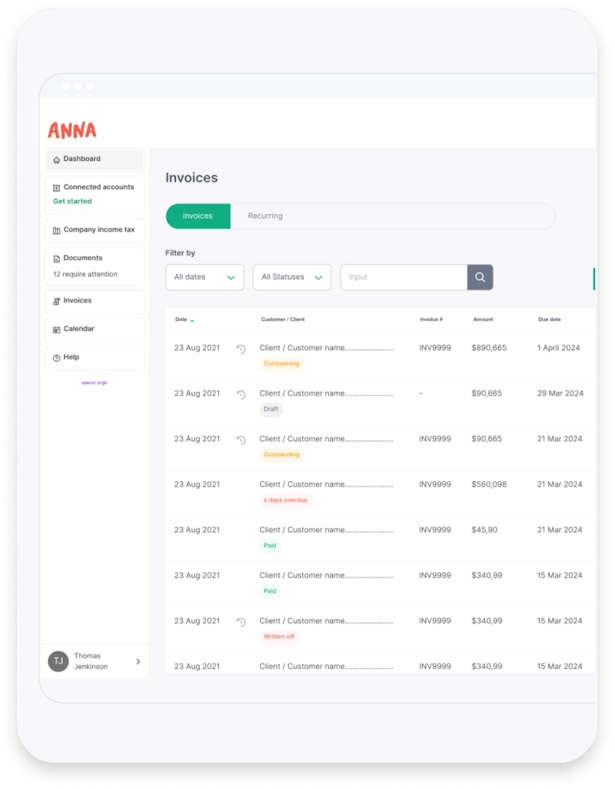

How ANNA One Simplifies Invoicing

With ANNA One, avoidance of common invoicing mistakes becomes effortless. This all-in-one solution ensures professional, error-free invoices and provides tools to optimise the process.

⚡ Professional Invoice Templates: ANNA One allows you to create professional, customisable invoices in seconds. Every invoice includes essential details such as ABN, GST, and payment terms, ensuring compliance and clarity.

⚡ Automatic GST Calculations: Registered for GST? ANNA One automatically calculates the GST and includes it on your invoices, saving you time and eliminating errors.

⚡ Send Invoices in Seconds: With ANNA One, you can send professional-looking invoices in just a few clicks, freeing up your time for more important tasks.

⚡ Follow-Up on Payments: One of the standout features of ANNA One is that it actively helps you chase unpaid invoices. If a client hasn’t paid, ANNA sends polite reminders on your behalf, significantly increasing the likelihood of timely payments. In fact, 80% of ANNA invoices are paid within a week.

⚡ Expense Tracking and Integration: ANNA automatically categorises expenses, matches them with invoices, and keeps all your financial data organised.

⚡ Tax Compliance Made Easy: All your tax obligations, including GST and income tax, are tracked and calculated. ANNA One ensures you stay on top of deadlines with automated reminders and an integrated tax calendar.

⚡ Seamless Bookkeeping: ANNA consolidates receipts, invoices, and financial records into one platform, making tax time stress-free and ensuring your books are always audit-ready.

Say goodbye to admin headaches and hello to smarter, faster business solutions.

Sign up with ANNA today and take the first step toward effortless business management.

FAQ

1. What Are Simplified Invoices?

Simplified invoices are permissible for sales under AUD 1,000. While they require less information than standard tax invoices, they must still include:

- Your business name and ABN.

- The date of issue.

- A description of the goods or services provided.

- Any applicable GST amounts.

2. What If My Supplier Does Not Have an ABN?

If a supplier does not have an ABN, they are required to complete a Statement by a Supplier form. This form is used to confirm the supplier's exemption from withholding tax. Without this statement, you may need to withhold tax on payments made to them.

3. How Long Should I Keep My Invoices?

You must retain copies of all invoices for at least five years from the date they are issued or the transaction is completed. Proper record-keeping is essential for tax compliance and auditing purposes.