What Happens to my Money If My Account is Inactive?

Find out what happens to your money if your bank account becomes inactive, including fees, access restrictions, and how to reactivate your account.

Can you believe that there is around $2.3 billion in lost money to be claimed from bank accounts, shares, investments, and life insurance plans?

If you believe that your money is among these figures or you simply haven't used your account for a long time and suspect that it has become inactive, you are in the right place!

Here you will learn inactive bank account rules in Australia, what happens to your money in that case and how to get it back.

Let’s start!

What is an Inactive or Dormant Account?

According to inactive bank account rules in Australia, a bank account is considered inactive or dormant if you haven’t used it, such as making a deposit or withdrawal, for 7 years.

This means that you, as an account holder, have not made any deposits, withdrawals, or other transactions.

Simply earning interest or having fees deducted does not qualify as active use.

Banks often attempt to contact the account holder before the account is formally dormant, using the contact information on file. If there is no response and the account remains unchanged, it is marked as dormant.

At that point, the remainder may be transferred to the government for safekeeping under unclaimed money regulations.

Keep in mind that the account is not closed. The funds are simply shifted until the correct owner steps forward to claim them.

What Happens After 7 Years of Inactivity?

If your Australian bank account is dormant for seven years, the money in it does not just disappear, it gets relocated.

The Banking Act of 1959 requires financial institutions to report and transfer unclaimed money to the Australian Securities and Investments Commission (ASIC).

Once this happens, the balance is held by the government rather than the bank.

❗You will not lose your money, but you must go through a proper process to get it back.

ASIC retains the funds indefinitely, and they can be claimed at any time by the legitimate owner or legal agent.

Unclaimed funds received by ASIC are sent to the Commonwealth of Australia Consolidated Revenue Fund. ASIC maintains and publishes a database of unclaimed money records to assist people in locating and claiming lost funds.

How to Find Unclaimed Money?

If you believe you have unclaimed money from an inactive account, the process for checking and reclaiming it in Australia is simple and free. This is how you do it:

✅ Step 1: Visit the MoneySmart Website:

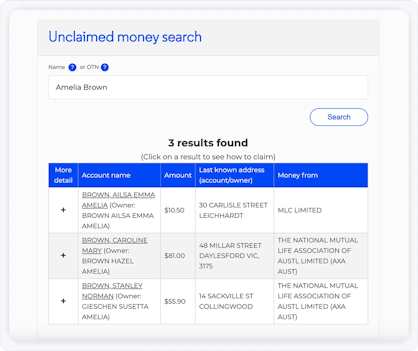

Visit MoneySmart.gov.au/find-unclaimed-money, a government-run platform operated by the Australian Securities and Investments Commission. This is Australia's official source for unclaimed money, which includes old bank accounts, life insurance, and shares.

✅ Step 2: Search for your name:

Enter your entire name or business name in the search bar. You do not have to create an account or log in. If your name appears in the results, it indicates that there may be unclaimed money for you.

✅ Step 3: Record the Original Transaction Number (OTN):

If you locate a match, make a note of the Original Transaction Number (OTN) printed next to the unclaimed item. This number is required to submit a claim to the financial institution that reported the money.

✅ Step 4: Contact the relevant institution:

Once you obtain the OTN, contact the bank, insurance, or company that initially held the money. They will verify your identity and walk you through the process of retrieving the funds.

✅ Step 5: Provide proof of identity:

To reclaim the funds, you will normally need to produce identification and maybe documentation that link you to the original account (such as previous statements or addresses).

➕Bonus Tip

If a private money search business approaches you and offers to find money for you for a fee, keep in mind that you can search for unclaimed money for free on the Moneysmart website.

What to Do If You Don’t Find Any Lost Money?

If you believe you have lost money, contact the institution where you believe you kept it. This list publicly displays all records received by ASIC. Various government websites allow you to look for various forms of unclaimed money:

➡️ Australian Taxation Office - Find lost superannuation by signing up for the Australian Taxation Office's online services on myGov.

➡️ State government - Locate lost funds from deceased estates, share dividends, salary and wages, checks, overpayments, sale proceeds, and more.

➡️ Services Australia – Check that your bank account information is up to date to ensure you receive the Medicare benefits to which you are entitled.

How to Prevent an Account From Going Inactive?

Here are a few tips to avoid the inactive bank account rule in Australia:

➕ Tip 1: Make regular transactions:

Making occasional transactions is the most effective strategy to keep your account active. Even a little investment or withdrawal will reset the inactivity period. You don't need to use the account on a regular basis, once or a few times a year is enough.

➕ Tip 2: Set up automatic payments:

Consider attaching the account to automatic payments such as a streaming service, subscription, or recurring transfer. These little, recurring transactions will keep your account active without you having to think about it.

➕ Tip 3: Update your contact information:

Your bank should always have your phone number, email address, and address on file. If they try to contact you about probable dormancy but are unable to reach you, the account will most likely become inactive without your knowledge.

➕ Tip 4: Consolidate old or unused accounts:

If you have several bank accounts but only use a few of them, think about shutting the ones you don't need. This lowers the likelihood of forgetting about them and losing access to your assets.

5 Common Reasons Why Bank Accounts Go Inactive in Australia

Here are 5 common reasons why bank accounts go inactive in Australia, often without people even realising it:

➡️ 1. You Simply Forgot About It

This is more common than you might think. People frequently open a savings account, use it for a short time, and then forget about it, especially if there is no debit card or internet banking associated with it.

➡️ 2. Life Changes

Major life events such as moving, changing employment, or switching banks can cause people to lose sight of their former accounts. If your contact information is not updated, the bank will be unable to notify you before the account becomes dormant.

➡️ 3. Accounts Opened for Children

Sometimes parents register accounts for their children but fail to make regular deposits and withdrawals. These accounts can lie undisturbed for years, eventually falling under inactive bank account rules in Australia.

➡️ 4. Redundant or Backup Accounts

Some people open accounts for specific reasons, such as travel, side jobs, or financial goals, but then stop using them after a while.

➡️ 5. Account Holders Who Are Elderly or Deceased

Accounts belonging to the elderly or those who have passed away may stay untouched. If the bank is not notified or if no one uses the account, it may be categorised as inactive.

How to Reactivate an Inactive Bank Account?

It is possible to reactivate an inactive bank account. However, the specific steps vary from bank to bank. You usually need to call the bank or visit a branch and provide proof that the account is really yours. Some banks also require an inquiry in written form.

Conclusion

If you have several bank accounts, it is difficult to keep track of each one and make regular payments to keep them active.

It is enough to have one or two personal bank accounts and another one for business, and you have a problem.

Fortunately, you see that even if you "lose" money on a forgotten account, you can get it back in a few steps, but why complicate things when you don't have to?

Luckily, there are tools like ANNA Money to help you make regular payments so that your account is always active.

How Can ANNA Money Help Your Bank Account Stay Active?

Although ANNA Money is not a bank but an all-in-one business tool, it can help you keep your account active.

How?

One of the features of this tool is scheduled and recurring payments!

With it, you can schedule all recurring payments, and in that way, you either keep an account in your life or organise your obligations so that you don't forget to pay something.

Other finance features include:

💸 Open Banking - Connect all your bank accounts to ANNA and see all your finances in one location.

💸 Instant Payment Notifications - As soon as money enters your account, or leaves it, we will let you know.

💸 Automated Invoice Matching - Automated invoice matching helps you stay organised and up to date. ANNA analyses payments in your account and compares them to invoices sent. Keep everything clean, organised, and ready for your accountant.

💸 Get Paid On Time - Never have to worry about chasing late invoices again. ANNA automatically sends kind reminder emails for missed payments, ensuring that you get paid on time.

💸 Instant Expense Capturing - Raise expenses on the move using only a photo. Snap, provide a few details, and ANNA will save all of your receipts in one secure location.

Sign up today and make sure your bank account is fully active and effective!

FAQ

Do Banks Charge Customers Who Have Inactive Accounts?

Some Australian banks charge fees for inactive or dormant accounts primarily to pay the costs of maintaining these accounts, even when there is no consumer activity.

These are known as inactivity or dormancy fees, and they are often charged to corporate accounts, while certain personal accounts may be affected depending on the bank's terms and conditions.

The following are some of the reasons why banks charge these fees:

- Maintenance Costs - Even if an account is not in use, banks spend administrative and compliance costs to keep it open and secure.

- Account Closure or Use - Charging inactivity fees encourages consumers to close unused accounts or reactivate them, allowing banks to better manage their resources.

- Regulatory Compliance - Banks must monitor inactive accounts for fraud and comply with government requirements on unclaimed money, which increases operational costs.

What Happens If I Send Money to an Inactive Account?

If you send money to an inactive bank account in Australia, the following occurs:

- If an account is inactive but still open, a deposit will reactivate it and reset the inactivity clock. This means that the account will no longer be classified as dormant or inactive because a deposit constitutes account activity.

- If an account has been dormant for 7 years or more, the bank will close it and transmit the proceeds to ASIC as unclaimed money.