Get a detailed MYOB review that covers its top features, ease of use, and benefits for efficient accounting and compliance.

When it comes to business management and accounting software, MYOB (Mind Your Own Business) is a well-established solution for Australian and New Zealand small-to-medium enterprises (SMEs).

With a reputation for user satisfaction and powerful functionality, MYOB’s cloud-based software has earned Canstar Blue’s Most Satisfied Customers – Small Business Accounting Software Award in 2023-2024.

Let's explore MYOB's key features, benefits, pricing, and more to understand if this praised software is actually the right choice for you.

Why MYOB?

MYOB is a versatile solution that’s designed to grow with your business. The platform is renowned for its all-in-one approach to financial management, supporting functions from invoicing and payroll to reporting and inventory management.

Here’s a closer look at MYOB’s primary features and the advantages it brings to SMEs.

Key Features

MYOB offers a broad feature set tailored for businesses of different sizes and needs:

1. Online Invoicing and Billing

- Customisable Invoices: MYOB allows you to create and send professional invoices with customisable templates, track their status, and even enable online payment options for faster transactions.

- "Pay Now" Button: Adding a “Pay Now” button on invoices lets clients pay directly online, which has helped businesses get paid up to three times faster.

2. Expense and Bill Management

- Snap and Upload Receipts: Use the mobile app to snap a picture of receipts, linking them to your accounts in real-time. This feature reduces the need for manual data entry, making expense tracking smooth and efficient.

3. Payroll Automation

- Single Touch Payroll (STP) Compliant: MYOB automatically sends payroll and tax data to the Australian Taxation Office (ATO) with each pay run, ensuring compliance and simplifying payroll processes for businesses with up to 50 employees.

4. Bank Reconciliation

- Automatic Bank Feeds: Link your bank accounts to MYOB to get real-time transaction data and perform bank reconciliations automatically, ensuring accuracy and saving hours on manual entry.

5. Inventory Management

- Real-Time Stock Tracking: For businesses with inventory, MYOB tracks stock levels, manages orders, and forecasts demand to help you maintain the right amount of stock on hand.

6. Mobile Accessibility

- On-the-Go Business Management: Access dashboards, send invoices, manage cash flow, and track expenses from any device. MYOB’s cloud-based software provides flexibility, allowing you to work anywhere.

MYOB App Integrations

MYOB connects with many other tools, organised into helpful categories like E-commerce (Shopify, BigCommerce), POS Systems (Square, Retail Express), CRM (Salesforce), Expense Management (ProSpend), Project Management (Autodesk, simPRO), and so much more.

Accounting & Financial Services Integrations

MYOB supports various tools that streamline document management, expense tracking, cybersecurity, accounts payable, and more.

Here’s a look at the top options:

1. Document Management and E-signatures

- Virtual Cabinet: Manages digital documents and supports electronic signatures, making document handling easy and secure.

- Acrobat Sign: MYOB’s preferred e-signature solution, offering trusted and seamless digital signing.

2. Expense and Accounts Payable Management

- ProSpend (Expense Manager): Automates expense management and claims processes, simplifying tracking and approvals.

- Accounts Payable Automation Solution for MYOB: Provided by Dataline, this platform digitises invoices and automates workflow approvals for easier AP management.

3. Cybersecurity

- Practice Protect: A cybersecurity platform designed for accountants, helping firms control access to client data, manage risk, and meet security obligations.

4. Investment and Tax Management

- Simple Invest 360: A full-featured accounting, investment, and tax tool for managing trusts, companies, and individuals.

5. CRM and Sales Management

- Tall Emu CRM: An end-to-end CRM that handles sales, customer management, inventory, orders, and fulfilment—all within one platform.

6. Business Performance Monitoring

- XBert: AI-driven auditing and task management tool, perfect for process automation and identifying anomalies.

- Jazoodle: Provides health scores and KPIs to monitor business performance continuously, with helpful trend reports.

7. Human Resources

- Happy HR: A comprehensive HR software that covers all aspects of employee management, from recruitment to performance tracking.

The Benefits and Drawbacks of Using MYOB Accounting Software

MYOB also offers various features to streamline financial operations and enhance business efficiency. However, like any software, it has its strengths and areas for improvement.

Below is an overview of the pros and cons of MYOB, as highlighted by user reviews on platforms such as Capterra and G2.

Pros:

✔️ Comprehensive Feature Set: MYOB provides a wide array of tools, including invoicing, expense tracking, payroll processing, bank reconciliation, inventory management, and reporting. This all-in-one approach allows businesses to manage various financial aspects within a single platform.

✔️ User-Friendly Interface: Many users appreciate MYOB's intuitive design, simplifying navigation and making it accessible even for those without extensive accounting knowledge.

✔️ Cloud Accessibility: Being cloud-based, MYOB enables users to access their financial data from anywhere, facilitating remote work and real-time collaboration.

✔️ Integration Capabilities: MYOB integrates with over 350 third-party applications, enhancing its functionality and allowing businesses to tailor the software to their needs.

✔️ ️Award Recognition: MYOB has been recognised for customer satisfaction, receiving Canstar Blue’s Most Satisfied Customers – Small Business Accounting Software award in 2023-2024.

Cons:

❌ Customer Support Challenges: Some users have reported long wait times and difficulties in reaching customer support, which can be frustrating during critical times.

❌ Complex Implementation: Certain features may require a steep learning curve, and initial setup can be time-consuming, especially for businesses transitioning from other platforms.

❌ Cost Considerations: While MYOB offers a range of pricing plans, some users find the costs higher compared to other accounting software options, particularly for advanced features.

❌ Performance Issues: A few users have experienced system slowdowns and delays in processing, which can hinder efficiency.

❌ Limited Customisation: Some users feel that the software lacks flexibility in certain areas, such as report customisation and integration with specific third-party applications. For businesses seeking a more tailored solution, exploring MYOB alternatives can provide insight into other platforms with more customization options.

Pricing Options

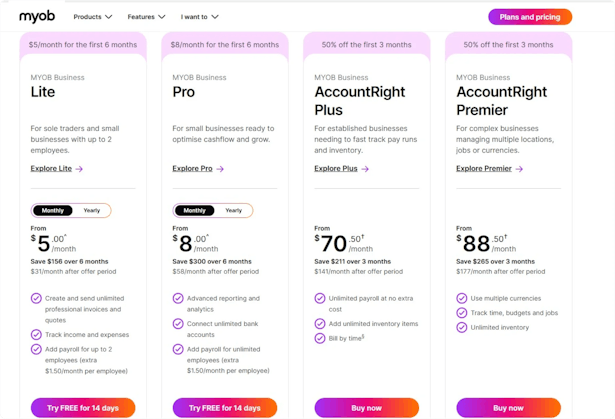

MYOB’s pricing plans are structured to cater to businesses of all sizes:

📌 The Lite plan, priced at $5/month (with an increase to $31/month after the offer period), provides essential features for small businesses. This plan includes income and expense tracking, unlimited invoices and quotes, the ability to accept payments, receipt scanning and storage, and GST tracking with BAS lodging.

However, the Lite plan is limited to connecting up to two bank accounts and has basic reporting capabilities. For payroll, it offers payroll reporting and employee benefits, but only for up to two employees at an additional cost of $1.50 per employee.

📌 The Pro plan, at $8/month (increasing to $58/month after the offer period), offers everything included in the Lite plan, with a few added benefits.

Pro removes the restriction on bank accounts, allows unlimited connections, and enhances reporting and analysis to an advanced level.

It also includes the same payroll feature as Lite but removes the employee limit, making it suitable for businesses with a larger workforce.

Inventory management is basic, covering order management, supplier management, and up to ten product attributes, and it requires an additional $22/month for unlimited inventory.

📌 The Plus plan, priced significantly higher at $70.50/month (increasing to $141/month after the offer period), is designed for businesses needing more advanced payroll and inventory management.

This plan automates payroll and offers employee benefits, making it ideal for larger teams.

Plus plan also includes advanced inventory features, like one warehouse location and unlimited product attributes, and has a built-in unlimited inventory option at no extra cost.

Reporting and analysis capabilities are upgraded to a professional level, which can support more detailed business insights.

📌 Finally, the Premier plan is the most comprehensive, costing $88.50/month (increasing to $177/month after the offer period).

Premier includes all the features of the Plus plan but extends inventory and warehouse capabilities with unlimited warehouse locations, making it suitable for businesses with complex inventory and distribution needs.

Payroll remains automated, and reporting and analysis are at the professional level, suitable for businesses requiring detailed financial insights.

Premier also includes additional features like billing by time, which is valuable for service-based businesses needing to track billable hours.

In summary:

- Lite and Pro are best for small businesses with straightforward accounting and basic inventory needs.

- Plus and Premier cater to larger or growing businesses with more extensive payroll, inventory, and reporting requirements, with Premier offering the highest level of inventory management and analysis.

Both Lite and Pro plans offer a 14-day free trial, allowing you to test MYOB’s features before committing.

Why ANNA One Outshines MYOB for New and Growing Businesses in Australia

When comparing MYOB and ANNA, each offers unique strengths tailored to business owners in Australia, but ANNA stands out for entrepreneurs who want a more streamlined, all-in-one experience from business registration to comprehensive financial management.

Ease of Business Registration

⚡ ANNA One is designed to simplify the startup process, offering free company registration with an Australian Company Number (ACN) and the necessary ASIC documents directly in your inbox. We also handle additional requirements like an Australian Business Number (ABN) for both companies and sole traders, making it a one-stop shop for all key registrations.

For new business owners, this means fewer steps and no added registration costs.

⭐ MYOB, while robust in accounting, MYOB accounting does not offer integrated registration services. Business owners need to handle this aspect independently, which can be cumbersome for startups.

All-in-One Financial and Tax Management

⚡ ANNA One uniquely combines bookkeeping, tax, invoicing, GST, and company tax management in one platform. It also features automatic GST calculation, tax reminders, a personalised tax calendar, and annual tax filing options. This allows business owners to manage their tax obligations with minimal hassle, offering peace of mind that they’re always compliant with Australian Taxation Office (ATO) requirements.

⭐ MYOB excels at providing comprehensive accounting features, such as payroll automation, invoicing, and bank reconciliation, but does not include the seamless tax filing and comprehensive tax services that ANNA One offers, making ANNA a more comprehensive choice for tax-focused solutions.

Cost Structure and Pricing

⚡ ANNA One offers transparent, cost-effective pricing with the registration process covered, so there are fewer hidden fees. Its pricing also bundles bookkeeping, invoicing, a business account, a credit card, and tax features without significant add-on costs.

ANNA’s all-in-one pricing model reduces the need for external services and provides value for growing businesses that need full financial and registration support.

⭐ MYOB offers a tiered structure for more flexibility, with specific plans catering to small or growing businesses. However, costs can escalate as features are added (like advanced inventory management or payroll for more employees). This could become costly for businesses looking to expand while maintaining budget control.

Time-Saving and Automation

⚡ ANNA One emphasises automation, particularly with automated invoicing and receipt management. You simply snap receipts, and ANNA will automatically categorise and match them, streamlining bookkeeping.

Additionally, ANNA’s automatic invoicing reminders ensure faster payments, with 80% of invoices reportedly paid within a week, offering cash flow benefits.

⭐ MYOB also provides powerful automation with bank reconciliation, payroll compliance, and inventory tracking, but its features are more segmented. ANNA’s unified automation for tax and invoicing makes it more accessible and streamlined for those who need rapid setup without extensive training.

Integration Capabilities and Customisation

⭐ MYOB supports over 350 third-party integrations with CRM systems, inventory management, and project management tools, offering flexibility for larger companies that need diverse systems connected.

⚡ ANNA One, though less customisable, focuses on core business needs (tax, invoices, and expense tracking) and is well-suited for business owners who prefer a simpler setup.

ANNA’s limited integrations are more curated, keeping the platform easier to manage without needing extensive customisation.

Customer Support and Usability

⚡ ANNA One provides dedicated support from accountants and tax experts, ensuring business owners have direct assistance with tax or financial questions, which is ideal for small business owners needing guidance in unfamiliar areas.

⭐ MYOB has a user-friendly interface with an intuitive design, but some users have reported challenges in reaching customer support, which could be a drawback for those needing quick help.

Ideal for

⚡ ANNA One is a better fit for startups and small businesses focused on hassle-free company setup, with integrated tax support and simplified accounting needs.

ANNA’s all-inclusive service allows entrepreneurs to register, manage, and grow their businesses without juggling multiple platforms.

⭐ MYOB suits businesses that already have their registration and tax structure in place and require a customizable accounting platform with robust, specialised integrations.

In summary, ANNA One stands out for new businesses or entrepreneurs in Australia needing straightforward registration and comprehensive financial management in one place, while MYOB remains a strong choice for businesses that prioritize deep accounting features and flexibility through integrations.

Do you want to know more about what ANNA has to offer?

Sign up and take control of your business finances effortlessly with ANNA One!