Myob vs QuickBooks - Comparison & In-depth Review

Did you realise that you spend too much time on repetitive tasks and that it could be shortened with the right accounting tool?

If so, you are in the right place!

In this article, we will analyse MYOB and QuickBooks in detail, and by the end of the article, you will be able to conclude whether they actually meet your needs.

Plus, at the end of the article, there is another alternative waiting for you so that you have a greater choice when making a decision.

Let’s start!

3 Benefits Of Using MYOB and QuickBooks

▶️ Simpler Tax Compliance and Reporting - Both MYOB and QuickBooks offer complete capabilities for managing Australian tax duties, such as GST calculation, BAS preparation, and direct submission to the Australian Tax Office (ATO). They also provide Single Touch Payroll (STP) for real-time payroll reporting and automation of superannuation payments, helping you to stay compliant with tax rules and reduce errors.

▶️ Automation of routine accounting tasks - These solutions automate numerous laborious procedures, including bank feeds, transaction reconciliation, invoicing, and payroll calculations. QuickBooks, for example, employs AI-powered insights to identify late invoices and recommend tax deductions. MYOB automates payroll tax calculations and superannuation tracking. This decreases administrative workload and minimises human errors.

▶️ Effective invoicing and expense management - MYOB and QuickBooks allow businesses to effortlessly generate, send, and track bills using customised templates. Both include digital receipt capturing and spending monitoring, frequently connecting directly with bank accounts to keep records accurate and up to date.

Myob vs QuickBooks - Comparison & In-depth Review

Let’s check out MYOB and QuickBooks in depth and see their key features and who they are best for!

What is MYOB?

MYOB is an accounting software, short for "Mind Your Own Business," that businesses use to handle their finances, such as bookkeeping, invoicing, payroll, and tax reporting.

It's particularly popular among medium-sized businesses (SMEs) looking for effective financial management solutions.

Key Features

⭐ Snap ‘n Track Expenses - Snap a photo and upload your receipt to get it organised into a suitable category.

⭐ Invoicing - Create invoices in seconds, send them off, activate automated reminders, and watch the cash stream in.

⭐ Tap to Pay - Secure payments directly from your phone.

⭐ Online Payments - Allow your customers to choose the payment option that works for them: cards or digital wallets.

⭐ Cash Flow - Track your finances in one spot. See what's coming in and going out and gain a comprehensive understanding of your business income.

⭐ Bank Integration - Securely connect to up to two bank accounts to quickly track cash. Solo matches bank transactions with invoices and expenses.

⭐ Inventory Management - Keep track of what's in stock, identify your greatest sellers, and reorder them before they sell out.

⭐ Payroll - Create and send Single Touch Payroll (STP) reports from MYOB Business. Automatically determine payroll elements such as superannuation, tax, and annual leave within your workflow.

⭐ Integrated CRM - Take care of your leads, sales, and customer relationships.

⭐ Project Accounting - Keep client accounts and job sites arranged, so you can easily make recurring decisions.

Who Is It Best For?

✅ Small and Medium-sized Businesses (SMBs) - MYOB is ideal for small to medium-sized businesses that need to stick to strict local rules, particularly those imposed by the Australian Tax Office. Its features are designed to assist businesses with GST, BAS, payroll, and superannuation reporting, making it suitable for businesses that must stay on top of complex tax obligations. The platform provides various solutions for sole traders, small businesses, and big companies, allowing them to scale their accounting solution as they grow.

✅ Businesses With Complex Payroll or Inventory Needs - MYOB is ideal for businesses with particular payroll needs, such as those in industries with complex awards (e.g., healthcare, construction), or businesses with a large number of employees. Its inventory management capabilities, particularly in the AccountRight product, are strong and ideal for businesses that require multi-location tracking or broad stock control.

✅ Accountants and Bookkeepers - MYOB is popular among Australian accountants and bookkeepers. It offers in-depth financial control, and customisable tax reporting.

MYOB: Pros and Cons

Pros:

✔️ Powerful, accurate controls for accountants and complex tax scenarios in Australia and New Zealand.

✔️ Effective multi-location and precise inventory management.

✔️ Better payroll automation, fewer third-party integrations.

Cons:

❌ Setup can be hard and time-consuming.

❌ Limited app integrations compared to competitors. If you are looking for Myob alternative, check out our article 5 Myob Alternatives To Consider In 2025!

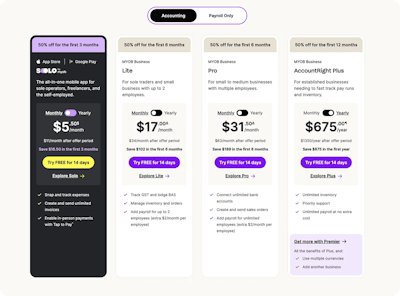

Pricing

The price of this software depends on what you use it for.

If you want to use accounting-related features, you can choose between several plans. If you want to use it only for payroll, then it's $9 for up to 4 employees for 24 months.

What is QuickBooks?

QuickBooks is an accounting software package designed by Intuit that helps small and medium-sized businesses manage their money.

It provides both cloud-based (QuickBooks Online) and on-premises (QuickBooks Desktop) solutions, including bookkeeping, invoicing, expense management, payroll, and other services.

Key Features

⭐ Auto-Track Every Transaction - Connect your bank accounts, and we'll track your income and expenses for you, allowing you to easily see where your money is going.

⭐ Snap and Store Receipts - They grab data directly from your receipts, correlate them to a transaction, and categorise them so you're always ready for tax time.

⭐ Auto Track - Automatically track your mileage and categorise it as business or personal. Every 1,000 kilometres equals $850 in tax deductions.

⭐ KPIs - The QuickBooks Performance Centre allows you to track your revenue and cash flow. Create custom charts and dashboards to track KPI performance across time, budget, and more to keep an eye on the business.

⭐ Custom Roles and Permissions - Limit who has access to sensitive information and transactions such as deposits, sales, expenses, inventory, or reports. Make sure that the proper information is in the right hands.

⭐ GST & BAS Tracking - Easily track your GST payments and charges. Prepare and submit your BAS, knowing exactly how much you owe and when to pay it.

⭐ Payroll - Manage your Single Touch Payroll, Superannuation, and other ATO obligations in one place.

⭐ Reports and Insights - Create quick and easy reports for key insights.

⭐ Cash Flow - Get personalised cash flow advice, real-time balances, and financial projections from your connected bank and credit card accounts.

Who Is It Best For?

✅ Small and Medium-Sized Businesses (SMBs) - QuickBooks is ideal for businesses that wish to streamline their financial administration and reduce administrative responsibilities. Its features are designed to help business owners efficiently manage invoicing, spending, payroll, and GST/BAS compliance, even when on the road.

✅ Freelancers, Contractors, and Microbusinesses - QuickBooks is a popular choice for freelancers, single traders, and micro-businesses because of its user-friendly interface, reasonable entry-level plans, and features like invoicing, cost tracking, and basic reporting.

QuickBooks: Pros and Cons

Pros:

✔️ User-friendly, easy to navigate.

✔️ Payroll available as an add-on, simpler for basic needs.

✔️ Affordable for freelancers and small businesses.

Cons:

❌ Some users report poor customer support.

❌ Limited for complex inventory management.

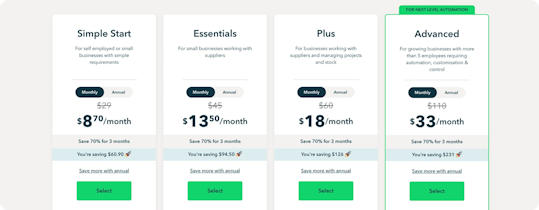

Pricing

You can choose between 4 paid plans:

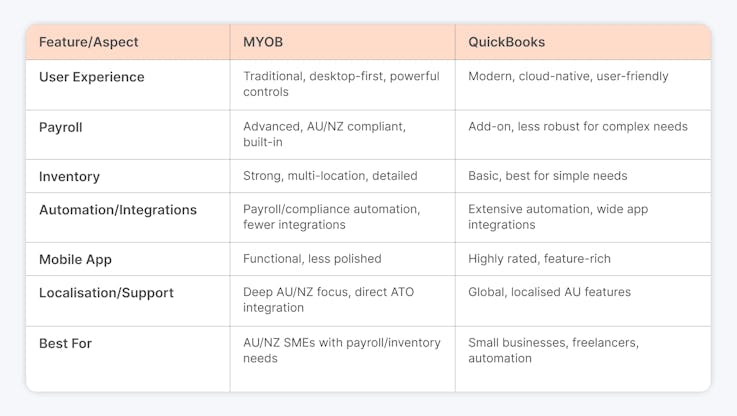

Who Is The Winner?

Which software you choose depends entirely on your needs and budget. MYOB is for more complex and detailed matters, suitable for both small businesses and larger companies.

On the other hand, QuickBooks is great for smaller businesses or freelancers with smaller needs.

But if you are looking for something more detailed than both tools with even more features for companies and solo traders, we have the right all-in-one business tool for you.

Meet ANNA Money!

ANNA Money - A Viable Alternative

What sets ANNA Money apart from both of these tools is that, in addition to accounting and bookkeeping features, you have the opportunity to open a company, get an ACN, ABN, and much more.

Let's see what you can get with this tool only:

🌟 Company Registration - Register your company for a $288 one-off fee, 50% off your ASIC fee to get started!

🌟 ABN Registration - It doesn't matter if you're a company or a sole trader, all you need to do for ABN is to verify your business information and submit your application through our website.

🌟 ACN Registration - As soon as you register your company, you will get your ACN number in minutes.

🌟 Register a Trademark - Get fast, trustworthy trademark protection without any hidden expenses.

🌟 Virtual Office Address - Improve your professional image with a virtual business address while working from anywhere you want.

🌟 Financial Management - Manage your accounts properly and keep up with your tax reporting.

🌟 ANNA +Taxes - Register for Corporation Tax, calculate what you owe, and make sure you fulfill all deadlines.

🌟 Pots - Set aside a portion of your money and save up for taxes.

🌟 AI Tax Bot - Ask ANNA's ChatGPT-powered tax bot for answers and links to relevant ATO documents.

🌟 Smart Receipt Scanner - Take a photo of a business receipt to instantly link it to a transaction in your account. It is then classified and used to calculate your taxes.

🌟 Business Account - Connect your bank accounts and view all of your finances in one location.

🌟 Scheduled Payments - Arrange scheduled and recurring payments, and we will alert you before they occur.

Sign up today and manage your business much easier and cut down on boring and repetitive tasks!