NAB vs Commonwealth Bank - Which One to Choose?

Compare NAB and Commonwealth Bank to explore their features, fees, and services, helping you choose the best option for your banking needs.

Struggling to decide between NAB vs Commonwealth Bank for your business?

Each bank offers distinct features, from advanced online tools to practical solutions for managing finances.

But which one aligns better with your goals and daily operations? Let’s explore to help you make the right choice.

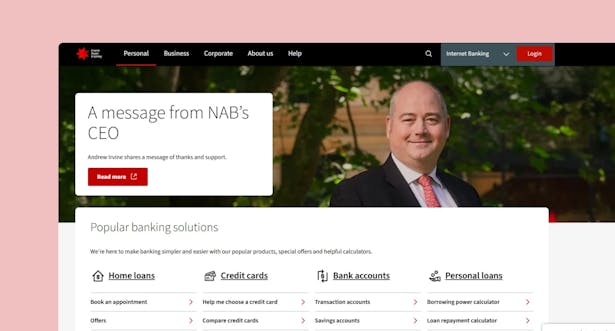

1.NAB – A Practical Choice for Business Banking

National Australia Bank (NAB) has been part of Australia’s financial framework since 1834, evolving into one of the nation’s leading banks after its merger in 1982.

With its headquarters in Docklands, Melbourne, NAB serves over 8.5 million customers globally, providing straightforward financial services for individuals, businesses, and corporations.

Personal Banking

NAB’s personal banking options focus on everyday functionality and financial growth:

1. Bank Accounts:

- NAB Classic Banking Account: A basic everyday account with no monthly fees if specific conditions are met.

- NAB iSaver: A savings account with competitive interest rates, designed to encourage regular deposits.

- Reward Saver: Provides bonus interest for consistent saving habits.

2. Loans:

NAB offers a range of home loan options, including fixed-rate and variable-rate products.

Personal loans are available for various needs, with unsecured options and flexible repayment terms.

3. Credit Cards:

NAB’s credit card range includes rewards cards, low-interest options, and the NAB StraightUp card, which charges a flat fee instead of interest.

📌 Note

Why mention personal banking here? As a business owner, your financial world doesn’t exist in isolation.

NAB’s personal banking options can complement your business needs, whether by providing flexibility through personal loans, savings tools to manage profits or rewards that benefit your lifestyle.

Now, let’s look at how NAB’s business banking services can help drive your operations forward.

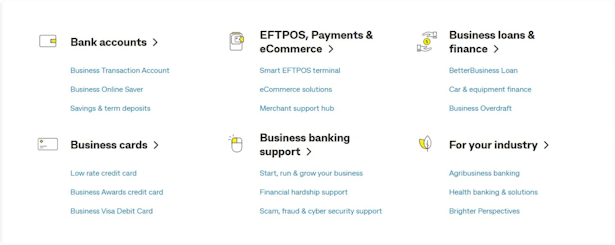

Business Banking

NAB supports businesses of all sizes with different accounts, financing options, and tools for managing transactions:

⚡ Business Accounts:

- Business Transaction Account: A fee-free account for managing everyday business transactions.

- Business Everyday Account: Suited to businesses handling a high volume of cash or cheque transactions, with a $10 monthly fee.

- Business Cash Maximiser: An online savings account to help manage surplus funds and taxes.

⚡ Financing:

- Business loans and overdrafts for day-to-day needs or larger investments.

- Equipment finance to help businesses acquire necessary tools without upfront costs.

⚡ Payment Solutions:

- Merchant services like EFTPOS machines and online payment gateways provide secure and flexible ways to accept payments.

Digital Tools

NAB’s digital banking services make managing finances efficient and accessible:

- NAB Connect: A comprehensive platform for businesses managing multiple users, high transaction volumes, or foreign exchange needs.

- Internet Banking for Business: Offers simpler management tools with integration for accounting software and payment limits of up to $100,000.

- Mobile App: Enables individuals and businesses to check balances, transfer money, and pay bills on the go.

Security and Support

NAB places a strong emphasis on protecting customers and providing accessible support:

- Fraud Prevention: NAB offers fraud alerts and resources to help customers safeguard their accounts.

- Customer Assistance: Support is available through online guides, in-branch services, and interpreter options for non-English speakers.

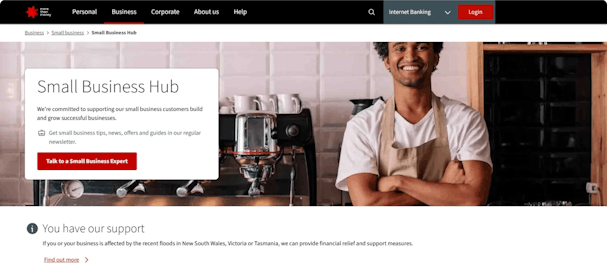

How NAB Supports Small Businesses

NAB offers various services to help small businesses manage their finances, navigate challenges, and achieve growth.

⚡ Industry-Specific Banking: Custom solutions for sectors like wholesale, retail, and trading to provide relevant support and insights.

⚡ Indigenous Business Banking: Dedicated services to promote financial inclusion and economic development for Indigenous businesses and community organisations.

⚡ Digital Tools:

- Small Biz Explorer: Consolidates products and services into one platform for easy access.

- NAB Connect: Advanced online banking for managing transactions and multiple users securely.

- Online Banking Tools: Includes calculators and resources to support budgeting and financial planning.

- Payment Solutions: Options like EFTPOS machines and online gateways make accepting payments secure and efficient.

⚡ Bookkeeping and Cost Management:

- NAB Bookkeeper: A tool that simplifies financial management, offered with a six-month free trial.

- Cost of Living Support: Resources to help small businesses manage rising costs.

- Financing Options: Business loans and equipment finance provide flexible funding to manage operations or invest in growth.

⚡ Resources and Support:

- Small Business Hub: Offers tools and information for tackling common challenges.

- Business Moments: Case studies and tips to guide businesses at every stage.

- Customer Support: Assistance through in-branch services, online guides, FAQs, and interpreter support.

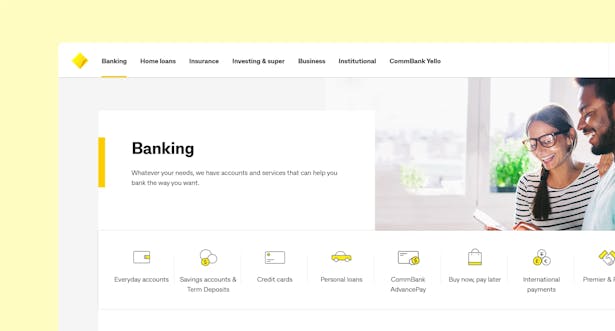

2. CommBank

The Commonwealth Bank of Australia (CommBank), founded in 1911 and headquartered in Sydney, has been a key player in Australia’s financial sector.

Serving millions of customers both locally and internationally, CommBank offers a broad range of financial services for individuals, businesses, and corporations.

Personal Banking

CommBank’s personal banking options facilitate everyday banking needs while promoting financial growth:

⚡ Bank Accounts:

- Everyday Account: A basic account with no monthly fees if certain conditions are met, such as maintaining a minimum balance or making a specified number of transactions.

- Goal Saver Account: A high-interest savings account that rewards customers with bonus interest for regular deposits and no withdrawals during the month.

- Youth Accounts: Designed for young customers (under 18) with no monthly fees and features that promote saving habits, including educational resources about money management.

⚡ Loans:

- Home Loans: Offers a variety of home loan options, including fixed-rate, variable-rate, and split loans. Customers can choose from different terms and repayment options to suit their financial situation.

- Personal Loans: Available for various purposes, including travel, education, or debt consolidation. Options include secured and unsecured loans with flexible repayment terms and competitive rates.

⚡ Credit Cards:

- Rewards Credit Cards: Earn points on everyday purchases that can be redeemed for travel, merchandise, or gift cards.

- Low Rate Credit Card: Offers a lower interest rate for those who may carry a balance month-to-month.

📌 Note

Once again, why mention personal banking here? For business owners, personal finances and business goals often intersect.

CommBank’s personal banking options, from savings accounts to flexible loans, can provide the financial stability and resources that support your broader aspirations.

Let’s now shift focus to how their business banking solutions can directly impact your operations.

Business Banking

CommBank supports businesses of all sizes with various accounts, financing options, and tools for managing transactions:

⚡ Business Accounts:

- Business Transaction Account: A fee-free account designed for everyday business transactions with easy access to funds.

- Business Online Saver Account: An online savings account that helps businesses manage surplus funds while earning interest.

⚡ Financing:

- Business Loans: Various loans available to support day-to-day operations or larger investments. Options include secured and unsecured loans with flexible repayment terms.

- Overdrafts: Provides businesses with access to additional funds as needed to manage cash flow effectively.

- Equipment Finance: Helps businesses acquire necessary tools or machinery without upfront costs.

⚡ Payment Solutions:

- Merchant Services: CommBank offers EFTPOS machines that enable secure card payments in-store and online payment gateways for e-commerce businesses.

⚡ Digital Tools

CommBank’s digital banking services make managing finances efficient and accessible:

- CommBank App: A user-friendly mobile application that allows individuals and businesses to check balances, transfer money, pay bills, and manage accounts on-the-go.

- NetBank: An online banking platform that provides tools for managing personal and business accounts. It includes features like transaction categorisation and budgeting tools.

Security and Support

CommBank places a strong emphasis on protecting customers and providing accessible support:

- Fraud Protection: Comprehensive fraud detection systems monitor transactions in real-time. Customers receive alerts about suspicious activities on their accounts.

- Customer Assistance: Support is available through online guides, in-branch services, phone support, and interpreter options for non-English speakers.

Community Initiatives

CommBank actively engages in projects that benefit the broader community:

- Financial Literacy Programs: CommBank runs initiatives aimed at educating Australians about managing their finances effectively through workshops and online resources.

- Sustainability Projects: The bank invests in sustainable practices and supports projects that promote environmental responsibility within communities.

How CommBank Supports Small Businesses

CommBank offers a suite of services specifically designed to help small businesses manage their finances, navigate challenges, and achieve growth:

⚡ Industry-Specific Banking Solutions:

Customised solutions for various sectors such as retail, hospitality, agriculture, and healthcare provide relevant support and insights specific to each industry’s needs.

⚡ Indigenous Business Banking:

Dedicated services aimed at promoting financial inclusion and economic development for Indigenous businesses through specialized products and support programs.

⚡ Digital Tools:

- Small Biz Explorer: A platform consolidating various products and services in one place for easy access by small business owners.

- Business Health Check Tool: An online tool that helps small business owners assess their financial health by analyzing key metrics.

⚡ Payment Solutions:

- Options like EFTPOS machines enable small businesses to accept secure payments easily. CommBank also provides online payment gateways for e-commerce operations.

⚡ Bookkeeping Support:

- Integration with accounting software simplifies financial management for small business owners.

⚡ Cost of Living Support:

- Resources aimed at helping small businesses manage rising costs effectively through budgeting tools and financial advice tailored to current economic conditions.

⚡ Financing Options:

- A range of business loans, overdrafts, and equipment finance solutions provide flexible funding options for operations or growth initiatives specifically for small businesses.

⚡ Resources and Support:

- The Small Business Hub offers tools, tips, articles, webinars, and resources to assist small business owners at every journey stage.

- Access to case studies through the Business Moments program helps guide decision-making based on real-world examples from other small businesses.

⚡ Customer Support Services:

- Dedicated small business bankers are available to provide personalised assistance based on individual business needs. This includes advice on cash flow management, financing options, and growth strategies.

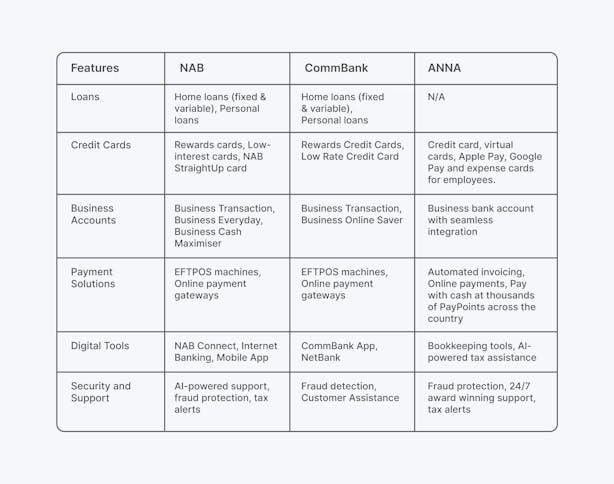

NAB vs Commonwealth Bank vs ANNA

When it comes to choosing between NAB, CommBank, and ANNA, the difference lies in their approach to meeting business needs.

NAB and CommBank offer traditional banking solutions that support various financial requirements, including business accounts, loans, and payment systems.

ANNA, however, takes it a step further.

With its all-in-one platform, ANNA is built specifically for business owners, streamlining company registration, banking, tax management, invoicing, bookkeeping, and expense tracking. For modern entrepreneurs seeking simplicity and efficiency, ANNA offers a solution that does more than just banking – it transforms how you run your business.

But what truly sets ANNA apart is what comes next:

⚡ Effortless Finances: ANNA’s smart receipt scanner tracks expenses automatically, while the Bookkeeping Score provides tax-saving tips to maximize your earnings.

⚡ Stress-Free Tax Management: ANNA handles GST calculations, sets aside tax funds, and files your BAS and company tax returns so you never miss a deadline.

⚡ Professional Invoicing Made Easy: Create sleek invoices in seconds, track payments, and reduce unpaid invoices with automated reminders.

⚡ Simplified Spending: Manage business payments with virtual and physical credit cards, perfect for team expenses or everyday transactions.

⚡ Integrated Insights: Connect all your bank accounts to ANNA for a complete financial overview, helping you stay on top of your business performance.

Beyond these core features, ANNA offers thoughtful extras like a virtual office address to protect your privacy and elevate your business’s image.

With a 24/7 support team and AI-powered tax assistance, help is always at your fingertips.

If you're a business owner seeking an innovative way to manage your finances, ANNA is the future of business banking.

Sign up for ANNA now and take control of your business’s financial future!