Top 4 Reckon One Alternatives to Consider in 2025

Explore the best Reckon One alternatives with powerful features to simplify accounting, boost efficiency, and support your business growth.

While Reckon One provides certain advantages like customisation options in reporting, users seeking more intuitive interfaces, advanced automation features, and better scalability options at competitive pricing levels might explore these alternatives based on their unique business requirements.

Below, we’ll take a closer look at a few standout solutions that address varying operational needs, helping you find the ideal fit for your accounting and financial management.

1. ANNA – Everything You Need to Grow Happy Business

ANNA is more than just an accounting platform. It is a full-service business solution built specifically for Australian entrepreneurs and small business owners.

With a streamlined approach for everything from initial registration to ongoing tax support, ANNA takes the complexity out of setting up, managing, and growing a business.

Key Features

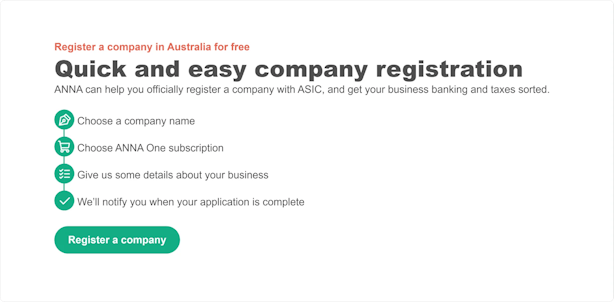

ANNA handles the entire legal groundwork required to establish a company in Australia – from obtaining an Australian Company Number (ACN) and Australian Business Number (ABN) to registering a business name.

After the setup stage, ANNA’s integrated platform automates tasks such as invoicing, bookkeeping, GST management, and BAS (Business Activity Statement) lodgement, saving you hours of manual administration:

⚡ Company Registration: Get your ACN and essential ASIC documents delivered to your inbox within hours.

⚡ ABN & Business Name Registration: Secure your ABN, whether you’re operating as a company or sole trader, and legally register your business name.

⚡ Tax Management – Automate GST calculations, monitor crucial tax dates with a custom tax calendar and streamline BAS submissions.

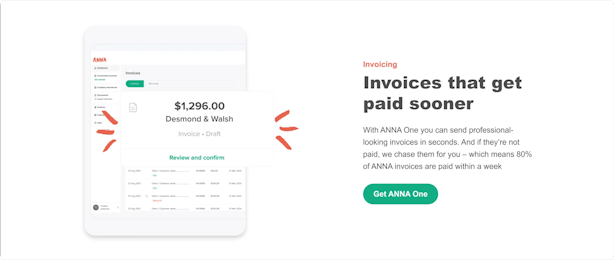

⚡ Bookkeeping & Invoicing – Access professional invoice templates, send automatic follow-ups and maintain real-time bookkeeping accuracy.

⚡ Document Storage – Keep receipts, invoices, and essential records in a secure hub for easy access and organisation.

⚡ Virtual Office Address – Protect your privacy with a professional address for official correspondence.

⚡ Boost Your Business with an ANNA Card: Open an ANNA business account and get everything you need to manage expenses effortlessly: a debit card, virtual cards, Apple Pay, Google Pay, and expense cards for your team.

⚡ Expert Support – Get reliable assistance from knowledgeable accountants and a friendly support team whenever challenges arise.

ANNA is perfect for startups, entrepreneurs, and small business owners in Australia who want an all-in-one platform to handle business registration, bookkeeping, and tax management. Its integrated approach removes barriers to entry, allowing you to focus on growth rather than administrative tasks.

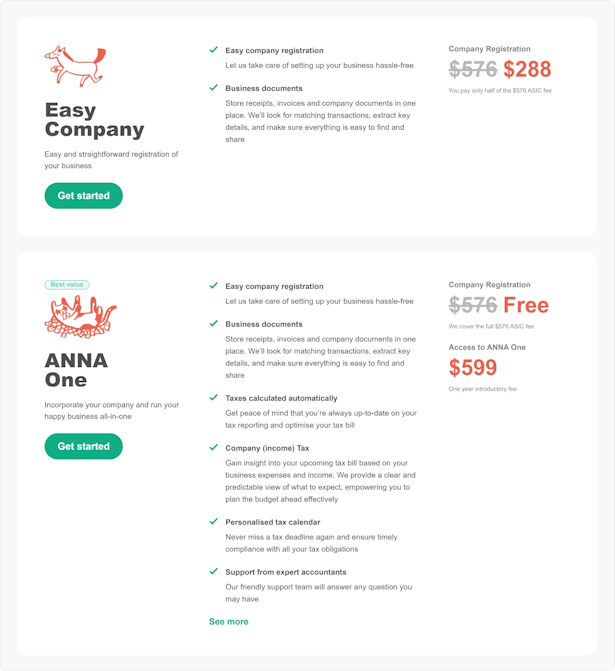

Pricing

ANNA provides two cost-effective packages that include ASIC fees, making it an accessible choice for new businesses.

Both packages cover the essentials to help you get up and running without breaking the bank.

2. Payroller – Payroll software with all your payroll needs

Payroller is a cloud-based payroll software designed specifically for Australian businesses.

It focuses on simplifying payroll management by automating wage calculations, leaves, and superannuation contributions, making it function like a truly scalable enterprise payroll platform that grows with your business.

It’s also worth noting that The Australian Tax Office (ATO) approves the platform for Single Touch Payroll (STP) reporting, ensuring compliance with ATO regulations.

Is your primary concern automated payroll solutions designed for Australia's regulatory environment without needing comprehensive accounting tools beyond that scope (like invoicing)?

Then Payroller could be an excellent choice due to its specialised features like STP Phase 2 support and integration with timesheets/rosters directly into pay runs.

Key Features

⚡ Automated Payroll Calculations: Automatically calculates wages, leaves, and superannuation to minimise errors.

⚡ STP Compliance: Approved by the ATO for STP reporting to ensure legal compliance.

⚡ Mobile and Web Access: Allows users to manage payroll from any device via a mobile app or web interface.

⚡ Timesheets & Rosters: Includes features for staff scheduling and time tracking with GPS logging options.

⚡ Leave Management: Manages employee leave balances efficiently.

⚡ Employee App: Provides employees access to their payslips, YTD earnings, leave balances through a dedicated app.

⚡ Integration with Xero: Offers integration with Xero accounting software for seamless financial management.

Pricing

⚡ Free Plan:

- Timesheets & Rosters

- Leave Management

- Employee App

- Payroll & STP on Mobile

⚡ Paid Plan ($2.99/month per employee):

All free plan features plus:

- Superannuation management

- Xero Integration

- Access to payroll on both mobile and web platforms

3. Kashoo – The World’s Simplest Accounting Software

Kashoo offers an intuitive, no-frills accounting platform for small business owners and freelancers who value simplicity without compromising on core functionalities.

Designed for a global audience, it remains a practical choice for Australian businesses seeking a streamlined approach to bookkeeping.

Key Features

⚡ User-Friendly Interface: Easily navigate Kashoo’s clean layout, even with minimal accounting experience.

⚡ Invoicing: Quickly create and send professional invoices to maintain positive client relationships.

⚡ Expense Tracking: Automate expense imports directly from your bank accounts, reducing manual data entry.

⚡ Real-Time Reporting: Generate up-to-date financial reports for timely insights and informed decisions.

⚡ Multi-Currency Support: Handle transactions in multiple currencies, making it ideal for businesses with international clients.

Using Kashoo in Australia

⚡ Currency & Localisation: Kashoo supports multi-currency functionality, including Australian dollars (AUD). Ensure that your local currency settings align with Australian accounting standards.

⚡ GST Compliance: While Kashoo doesn’t offer automatic GST calculations or BAS lodgement, you can set up GST tax codes manually. Be prepared for a bit of extra work to maintain accurate GST reporting.

⚡ Bank Integrations: Kashoo connects with numerous global financial institutions. Confirm compatibility with your Australian bank to streamline bank feed imports.

⚡ Invoicing & Reporting: Customise invoices and reports to align with Australian business requirements for a professional and compliant presentation.

4. Rounded – A Simple Invoicing and Tax App for Sole Traders

Rounded is a cloud-based accounting platform for Australian freelancers and sole traders.

By simplifying essential financial tasks such as invoicing, expense tracking, time management, and GST/BAS compliance, Rounded allows small business owners to focus on their work without getting lost in financial admin.

Key Features

⚡ Invoicing & Quoting:

- Create and send professional invoices with customisable templates.

- Generate and send quotes directly within the platform.

- Accept online payments via integrated payment gateways, including credit card transactions.

⚡ Expense Tracking:

- Automatically import expenses by connecting Australian bank accounts or credit cards.

- Digitally store and manage receipts using the mobile app for hassle-free expense tracking.

⚡ Time Tracking:

- Track billable hours and link them directly to client invoices for seamless invoicing.

⚡ Tax Management:

- Automate GST calculations and streamline BAS preparation, making tax compliance easier.

- Generate reports that simplify tax return filing for freelancers and sole traders.

⚡ Client Management:

- Maintain an organised client database with essential contact details and financial records.

⚡ Multi-Currency Support & Payment Gateways:

- Accept payments in multiple currencies for clients operating internationally.

- Secure online payment processing through integrated payment providers.

⚡ Mobile App & Reporting Tools

- Manage finances on the go with the iOS and Android mobile apps.

- Generate detailed financial reports, including income statements, expense summaries, and cash flow insights.

⚡ Collaboration Tools:

- Grant accountants secure access to financial data for simplified collaboration.

- Ensure compliance and financial accuracy with shared access for tax professionals.

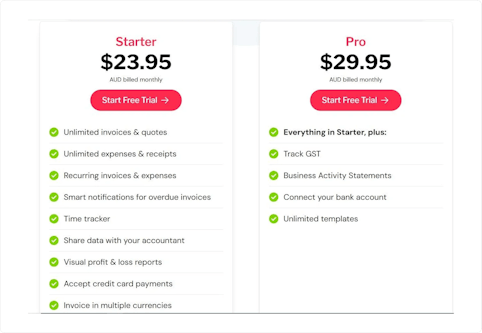

Pricing

Rounded’s pricing is straightforward per month regardless of the number of users (except multi-user access), whereas Reckon One often charges based on specific feature sets or user numbers depending on the plan chosen.

Rounded has two plans:

- Starter Plan ($23.95/month):

- Pro Plan ($29.95/month):

It adds all features from the Starter plan plus bank feed integration for automated transaction logging, GST tracking, and BAS.

How To Choose The Best Reckon One Alternative

Each of these platforms brings something unique to the table – Payroller is a strong choice for payroll automation, Kashoo keeps accounting simple, and Rounded caters to freelancers with intuitive tools.

For those looking beyond just accounting and payroll, ANNA is a complete solution that not only manages finances but also helps with business registration, compliance, and tax management – all in one place.

The right choice comes down to what your business needs most.

But, if you’re after a tool that does more than just track numbers and truly supports your business from the ground up, ANNA is the most well-rounded option.

Take the next step today and see how it can simplify your journey.