3 Best Rounded Alternatives to Consider for 2025

Explore the best Rounded alternatives, offering versatile features to streamline workflows, enhance productivity, and support business growth.

Do you find Rounded’s simplicity appealing but feel that it lacks key features you need for your business?

Perhaps you’re transitioning from freelancing to running a registered company and need tools to manage company structures, BAS submissions, or employee payroll.

Maybe you’re seeking more advanced invoicing options, like recurring billing, client portals, or integrations with payment gateways.

Or it could be that you need deeper insights into tax calculations, such as automated GST tracking or real-time forecasts for annual returns.

Anyhow, let’s look at some Rounded alternatives that could better align with your evolving requirements.

4 Rounded Alternatives to Try Out Now

1. ANNA One

Managing the administrative side of running a business can be a challenge. From registering a company to tracking expenses and lodging tax submissions, the list of tasks can quickly grow overwhelming.

But ANNA, a multifaceted platform, supports entrepreneurs and small business owners in Australia.

This Rounded alternative integrates essential business services into a single cohesive system, including company registration, tax management, business banking, and virtual office solutions.

Key Features

1. Company Registration

- ANNA simplifies the process of registering a proprietary company limited by shares with the Australian Securities and Investments Commission (ASIC).

- The $576 ASIC registration fee is included in the plan, along with essential documents such as ACN and ABN.

- The platform provides clear guidance throughout the process, ensuring that all legal requirements are met.

2. Business Banking

- A fully integrated business account helps manage finances with ease.

- Physical credit cards and virtual cards for secure transactions.

- Compatibility with Apple Pay and Google Pay for flexible payment options.

3. Real-time tracking of income and expenses

- Banking tools are seamlessly tied to the platform’s accounting features, reducing the need for separate systems.

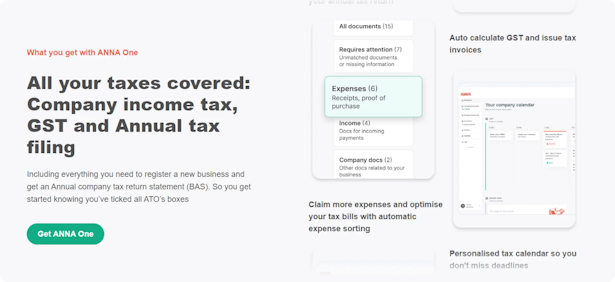

4. Tax and GST Management

- ANNA automates GST calculation and keeps track of tax obligations based on transaction data.

- Users can lodge GST and Business Activity Statements (BAS) directly with the Australian Taxation Office (ATO) from the platform.

- The system ensures compliance with Australian tax regulations and provides reminders for upcoming tax deadlines.

5. Invoicing Tools

The invoicing system allows businesses to:

- Create and send professional, branded invoices.

- Automate follow-ups for overdue payments to improve cash flow.

- Monitor payment statuses in real-time for better financial oversight.

6. Expense Tracking and Receipt Organisation

ANNA’s expense management tools allow users to:

- Upload receipts and invoices directly to the platform.

- Automatically extract and match details with transactions.

- Keep financial records well-organised and ready for tax submissions.

7. Virtual Office Services

Businesses can establish a professional image with ANNA’s virtual office solutions:

- A dedicated business address for correspondence, maintaining privacy for home-based operations.

- Mail forwarding services to ensure important documents reach you wherever you are.

- Support for e-commerce businesses needing a registered address.

8. E-Commerce Support

ANNA supports the setup and management of e-commerce ventures:

- Integration with online marketplaces and payment gateways.

- Automated tracking of sales, expenses, and GST from e-commerce platforms.

9. Automatic Financial Health Monitoring

- ANNA’s Bookkeeping Score evaluates the organisation of financial records.

- It provides actionable insights to improve tax efficiency and financial tracking.

- Tools such as cash flow forecasting and spending analysis give business owners a clearer understanding of their financial position.

10. Professional Support: Award-winning customer support with tax specialists available for any questions 24/7.

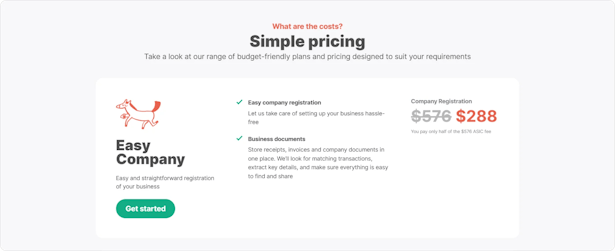

Pricing

ANNA offers 2 packages, each suited for different needs.

2. Erly (formerly Saasu)

Erly is a cloud-based platform developed in Australia that provides tools for accounting and workforce management.

It promises to help small businesses manage their financial operations and team collaboration in one place.

With features tailored to meet Australian compliance requirements, Erly integrates functions like invoicing, payroll, and rostering to reduce manual work and improve operational efficiency.

Key Features

1. Accounting Tools:

Invoicing and Quotes:

- Users can create and send invoices and quotes directly from the platform.

- Once quotes are approved, they can be easily converted into invoices.

Expense Tracking:

- The system allows users to log expenses and attach relevant documents for accurate financial tracking.

Automated Bank Feeds:

- Erly enables automatic import of transactions by connecting directly to bank accounts.

Payroll and Superannuation:

- The platform supports Single Touch Payroll (STP) submissions, meeting ATO compliance requirements.

- It also handles superannuation contributions through SuperStream.

Recurring Billing:

- Businesses can automate recurring credit card payments for clients, reducing manual invoicing efforts.

Customer Invoice Portal:

- A dedicated portal lets customers access their invoices and payment history, improving communication and payment transparency.

Financial Reports:

- Erly provides tools to generate reports such as profit and loss statements, balance sheets, and cash flow summaries.

Cashflow Forecasting:

- Users can create forecasts and budgets to manage future financial planning.

Inventory Management:

- The platform includes inventory tracking to monitor stock levels and prevent shortages or overstocking.

Multi-Currency Transactions:

- Erly supports transactions in various currencies, which is useful for businesses operating internationally.

2. Workforce Management Features:

In addition to accounting tools, Erly offers workforce management features through its associated WORKR app. These include:

- Rostering and Timesheets: Scheduling tools to manage shifts and track work hours.

- Staff Communication: Messaging functions for team collaboration.

- Recruitment and Onboarding: Tools to manage hiring and streamline employee onboarding.

Pricing

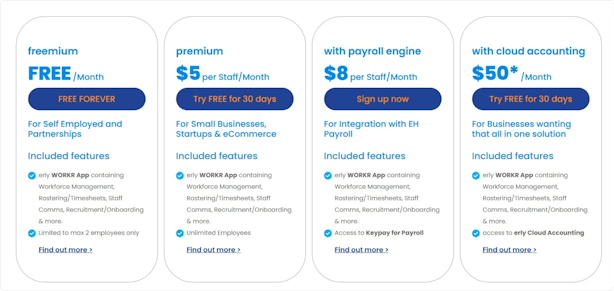

Erly offers free and 3 paid plans, each suitable for different business structures.

3. Reckon One

Reckon is an Australian accounting software solution for small businesses across various industries.

This Rounded alternative offers a comprehensive suite of tools for managing financial operations, invoicing, payroll, and compliance.

Designed to simplify day-to-day accounting tasks, Reckon empowers business owners to monitor cash flow, manage payroll, track expenses, and prepare for tax time.

Key Features

1. Accounting and Cash Flow Management

- Customisable dashboards provide real-time insights into your business performance.

- Tools for tracking income, expenses, and cash flow support informed decision-making.

- GST tracking and BAS preparation simplify compliance with ATO requirements.

2. Payroll Management

- Easy-to-use payroll software designed to stay compliant with ATO regulations.

- Manage pay runs, leave, superannuation, and Single Touch Payroll (STP) with precision.

3. Invoicing

- Create and send professional invoices with time-saving features like recurring invoices, payment reminders, and templates.

- Enable faster payments with a “Pay Now” button for online credit card payments.

- Unlimited invoicing ensures flexibility for businesses of all sizes.

4. Expense Tracking

- Track and store business expenses with options to attach receipts for tax purposes.

- Mark expenses as billable to pass on charges to clients directly.

- Provides visibility into spending patterns to support better financial decisions.

5. Bank Reconciliation

- Automates the reconciliation of transactions, saving time and improving accuracy.

- Ensures up-to-date records for seamless financial reporting.

6. Industry-Specific Support

- Reckon offers tailored features for industries like non-profits, retail, hospitality, farming, e-commerce, and more.

7. Additional Solutions

- Options to expand capabilities with add-ons like business loans, financial reporting, point-of-sale systems, and project management tools.

- Integration with third-party platforms supports tailored business needs.

Pricing

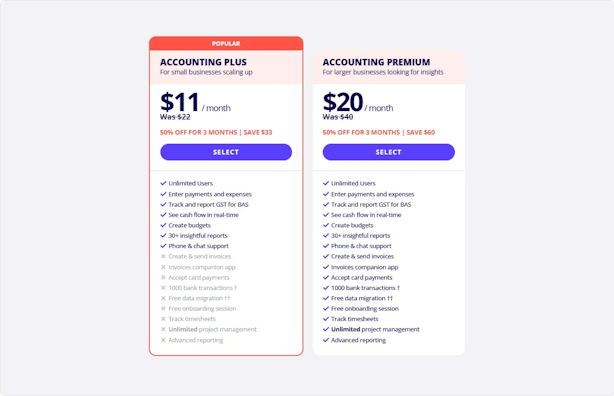

Reckon has two plans: Accounting Plus and Accounting Premium.

Final thoughts: What’s the Best Rounded Alternative?

Rounded is often seen as a straightforward option for freelancers, consultants, and sole traders, focusing on simplicity over extensive functionality.

While it offers useful tools like invoicing and time tracking, it does not function as a complete financial management platform.

Key features, such as automatic transaction categorisation, receipt reconciliation, and direct BAS lodgement to the ATO, are absent.

Additionally, users will still require a bookkeeper or accountant to handle more complex financial tasks, which can add time and cost to managing finances.

If you’re looking for a more comprehensive solution, ANNA stands out by combining multiple essential tools into one platform.

With ANNA, transactions are categorised automatically, receipts are reconciled effortlessly, and you can lodge your BAS directly with the ATO, removing the need for extra software or professional services.

ANNA also includes features like company registration, a business account with virtual cards, and bookkeeping insights, making it an all-in-one choice for small businesses and sole traders.

Choosing ANNA means simplifying your workflow and keeping everything from invoicing to tax compliance under one roof.

Ready to take control of your business needs? Join ANNA today and experience the ease of an all-in-one platform designed to streamline your operations and keep you focused on growth.