Sole Trader vs Company – Which One Should You Choose?

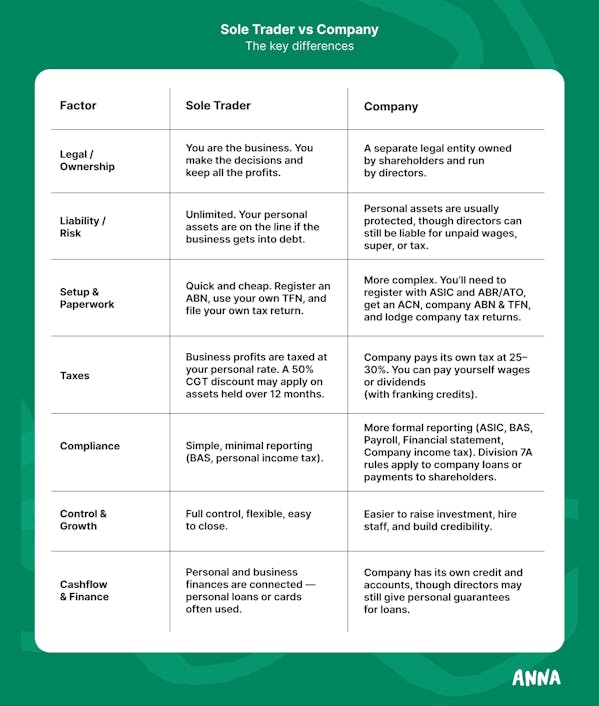

Starting a business can be exciting but confusing. This guide explains the key differences between a sole trader and a company in plain English, so you can choose the right structure for your goals.

Starting a business in Australia? One of the biggest decisions you’ll make early on is how to set it up. Should you keep things simple and go it alone as a sole trader, or register a company and give your business its own legal life?

Both options can work perfectly - it really depends on your goals, how much you’re earning, and how much risk you’re willing to take. Get it right from the start, and you’ll save yourself a lot of time, stress, and tax surprises later on.

Let’s break it down in plain English.

What’s a Sole Trader?

Being a sole trader means it’s just you - you run the show, keep the profits, and make all the decisions. It’s quick and affordable to set up, and perfect for freelancers, small side hustles, or anyone testing a business idea.

The flip side? You and the business are legally the same. So if your business owes money or gets into trouble, your personal assets (like your home or car) could be on the line. You’ll also report all business income and expenses on your personal tax return.

Best for:

- Solo operators and freelancers

- Low-cost, low-risk businesses

- Anyone starting out or testing an idea

What’s a Company?

A company is a separate legal entity. It’s like a totally different person in the eyes of the law. It has its own ABN, ACN, and TFN. That means it can earn money, own assets, sign contracts, and take on debts in its own name.

You (and any co-owners) become shareholders, and the company directors make the day-to-day decisions. The company files its own tax return and pays tax at the company rate — 25% for small businesses in 2025.

Because it’s separate, your personal liability is limited — so your house and savings are generally protected if something goes wrong.

Best for:

- Businesses planning to grow or hire staff

- Those wanting to attract investors or raise capital

- Companies holding valuable assets or operating in higher-risk industries

When Does It Make Sense to Switch from Sole Trader to Company?

A lot of small businesses start out as sole traders - it’s simple, flexible, easy to run. But as profits grow, a company structure often makes more sense.

You might think about switching if:

- Your taxable income consistently hits $130k–$150k+

- You want to protect your personal assets

- You plan to reinvest profits or bring in investors

- You’re hiring more employees or moving into a higher-risk industry

Meet Emma – A Real Life Example

Emma runs a catering business in Sydney.

As a sole trader:

- She earned about $140,000 profit in the 2025 financial year

- Paid tax at her personal rate (37% + Medicare levy)

- Worked mostly with contractors

- Kept things simple with GST on a cash basis

As her business grew, so did her profits (and her tax bill). She realised she could keep more of her earnings if her business paid the 25% company tax rate instead of her personal rate. She also wanted to hire permanent staff and protect her personal assets.

So, she made the switch.

*Rounded, simplified figures for example purposes

By forming a company, Emma could reinvest more of her profit, hire employees, and build credibility with clients and investors.

What Actually Changes When You Form a Company

- New business identity: Register with ANNA to get your company ABN, ACN, TFN, and business account in one go.

- Hiring more staff: Run payroll, make PAYG payments, report GST and PAYGW in your BAS.

- Company tax: Lodge a company tax return and pay 25% tax on profits.

- Paying yourself: Take money out as wages (taxed as salary) or dividends (with franking credits).

- Asset protection: Your personal assets are safer — though directors still have some responsibilities.

- Growth & investment: Easier to raise capital and attract investors.

- Branding boost: “Pty Ltd” adds credibility to your business name.

What About Transferring Assets (like a Car)?

Emma’s car is a depreciating asset, so it loses value over time. When she moves it from her sole trader business into her company, it triggers a 'balancing adjustment event'. In simple terms, any gain or loss from the car affects her personal taxable income.

That means any gain or loss may affect her personal taxable income - but there’s a possible small business restructure rollover (Subdivision 328‑G) that can help her avoid immediate tax, if she meet certain conditions.

In practice, most business cars lose value, so any gain or loss is usually small, and rollovers rarely provide a significant tax benefit.

Emma will also need to transfer the registration and pay stamp duty, so the company becomes the legal owner.

Before You Decide – Ask Yourself

- How much profit do I expect in the next few years?

- How much risk am I comfortable taking personally?

- Will I reinvest profits or distribute them?

- Am I planning to hire employees or attract investors?

- Do I need asset protection or extra credibility?

- Am I okay with more paperwork for better long-term benefits?

A Quick Note on Personal Services Income (PSI)

If most of your income comes from your personal skills or labour - like consulting or freelancing - PSI rules might apply. They can affect how you claim deductions and whether income-splitting through a company is allowed. We’ve got a separate blog explaining PSI in plain English.

The Bottom Line

Sole trader: simple, flexible, and low-cost - great for starting out.

Company: structured, protective, and scalable - great for growing.

Many Australian businesses begin as sole traders and move to a company when it’s time to level up.

Key takeaway: Pick the structure that fits your goals, income, and comfort with risk. And before you lock it in, have a quick chat with your accountant - or with us at ANNA Money - to make sure you’re set up the smart way.

Got questions? Reach out to us via app chat. You can also find more info about business structure on this website.