St George vs Westpac - Comparison & In-depth Review

Compare St. George and Westpac to understand their key differences in services, fees, and features, helping you choose the right bank for your needs.

It is not easy to make a decision when you have two such banks standing in front of you.

In order to help you decide, in this article, you will see an in-depth review of St George and Westpac, as well as their comparisons.

On top of all that, there is another option waiting for you that, in some way, combines some features that these banks give you and offers something more for your business.

Read to the end and find out what it's all about!

How Secure Are St George and Westpac?

Both Westpac and its subsidiary, St George Bank, use strong security measures to safeguard consumers from scams and fraud, making them extremely secure institutions.

🔶 SafeBlock - A new feature that allows consumers to immediately block their accounts via the Westpac app or online banking if they detect fraudulent activity. This disables all new transactions, including card payments, transfers, and ATM withdrawals, preventing financial loss until the account becomes secure again.

🔶 Westpac SafeCall - Verified, branded calls made using the app to avoid fraudulent calls mimicking the bank.

🔶 Westpac SaferPay - An AI-powered system that prompts clients with targeted inquiries when a payment appears suspect, assisting in the detection of scams such as the common "Hey Mum" scam.

🔶 Westpac Verify - Notifies clients if the account name does not match the payee details when adding a new payee, preventing payment redirection scams. This functionality is also available to St George clients.

🔶 Dynamic CVC - The three-digit card security code for digital cards changes every 24 hours to improve card security.

🔶 Cryptocurrency and Merchant Blocks - To limit the danger of scams, payments to high-risk businesses and certain cryptocurrency exchanges are blocked.

🔶 Call Spoofing Prevention - 94,000 Westpac phone numbers have been added to a 'Do Not Originate' list to prevent scammers from spoofing them.

🔶 Inbound Payment Detection - Monitor incoming payments for scam indicators and retain funds if a scam is suspected.

🔶 Sophisticated Behavioural Detection - Complex behavioral detection: Advanced capabilities to combat remote access scams and other complex fraud.

As a Westpac subsidiary, St George benefits from several of these security developments, including Westpac Verify and Dynamic CVC, assuring a comparable high degree of safety for its customers.

St.George vs Westpac In-depth Review

Now that you are familiar with the security measures of these two banks, let's first see what they offer and then compare them!

What is St.George?

St.George Bank is a significant Australian retail and business bank based in Sydney. Established in 1937, it primarily serves customers in New South Wales and the Australian Capital Territory, with other locations in Queensland, South Australia, Western Australia, and through its subsidiary BankSA, South Australia and the Northern Territory.

St.George began as an independent entity before merging with the Westpac Group in 2008. Since then, it has functioned as a subsidiary and brand of Westpac. However, it ceased to be a standalone authorised deposit-taking institution in 2010.

Key Services

Here are key business services:

🌟 Bank Accounts - With the proper mix of commercial bank accounts, you can keep your personal and business finances separate.

🌟 Business Credit Card - Earn points for business spending, get up to 3 free extra cards, and pay no annual fee for the first year – plus up to 55 interest-free days on purchases.

🌟 BusinessVantage Credit Card - A low-rate business card with flexible limits, up to 99 extra cards, and a competitive 9.99% annual interest rate – ideal for managing day-to-day business spending.

🌟 Business Loans - Access business loans starting at $20,000 with loan-to-value ratios of up to 100%, depending on the security provided.

🌟 Commercial Overdraft - Flexible overdraft facility that allows you to access additional funds from your company account without a defined term—repay what you can, when you can, within your agreed-upon amount.

🌟 Business Loan For Startups - Startup loans ranging from $10,000 to $50,000 with periods of up to five years are excellent for new businesses with a good business plan looking to expand.

🌟 Bank Bill Business Loan - Market-linked term loans for medium to large businesses borrowing more than $250,000, backed by expert guidance from a dedicated relationship manager.

🌟 Insurance - Choose from a variety of adaptable business insurance solutions to meet the demands of your business.

🌟 Agribusiness - Build financial reserves in strong years with no account-keeping fees – deposit $1,000 to $800,000 and earn interest to help your farm.

🌟 International Payments - Send one-time international transfers in over 15 currencies—pay nothing for foreign currency payments, $20 for AUD transfers, and only $12 to receive overseas funds.

🌟 Foreign Currency Accounts - Hold and manage foreign cash with ease—transferring to your St.George AUD account incurs no account maintenance or conversion fees, and you have access to ten major currencies, including USD, GBP, and EUR.

St.George Bank is not only for businesses, it also provides a full range of banking products and services suited to individuals.

As a customer, you can open transaction and savings accounts, select from a variety of credit cards (including rewards and low-interest alternatives), and apply for personal loans to cover expenses such as car purchases or home improvements. The bank also offers home loans for purchasing or refinancing property, as well as insurance solutions to protect your home, contents, and investment.

What is Westpac?

Westpac Banking Corporation, or Westpac, is one of Australia's largest and oldest banks.

The Bank of New South Wales was established in 1817, making it Australia's earliest bank and oldest bank.

In 1982, it merged with the Commercial Bank of Australia and was renamed Westpac Banking Corporation, a name derived from "Western" and "Pacific," signifying the region it serves.

Westpac is one of the "Big Four" banks in Australia, along with Commonwealth Bank, ANZ, and NAB. Its headquarters are in Sydney, and it has a significant presence not only in Australia but also in New Zealand and throughout the Asia-Pacific region.

Key Services

🌟 Business Bank Accounts - Simplify your business banking by consolidating your checking and savings accounts into one spot.

🌟 Business Term Deposits - Invest surplus funds for a certain duration and enjoy the security of a guaranteed return.

🌟 Business Savings Accounts - Put your spare funds to work in the short or long term, generating interest in whatever way you want.

🌟 Business Credit Cards - Simplify business expenses with a dedicated credit card that offers both rewards points and low interest rates.

🌟 Business Foreign Currency Accounts - Make and receive payments in foreign currencies and decide when to convert them.

🌟 Business Debit Mastercard - A debit card linked to your business bank account allows you to track business purchases and cash withdrawals.

Just like St George, of course, Westpack is not only for businesses.

It offers a wide range of personal banking products, and you can open transaction, savings, or term deposit accounts, apply for credit cards with rewards, low interest rates, or minimal fees, and obtain personal loans for purposes such as automobile purchases or debt consolidation. Westpac also provides assistance with house loans, including property investments and access to repayment calculators.

In addition to banking, Westpac offers insurance, share trading, and foreign and travel services, making it a full financial partner for both personal and business needs.

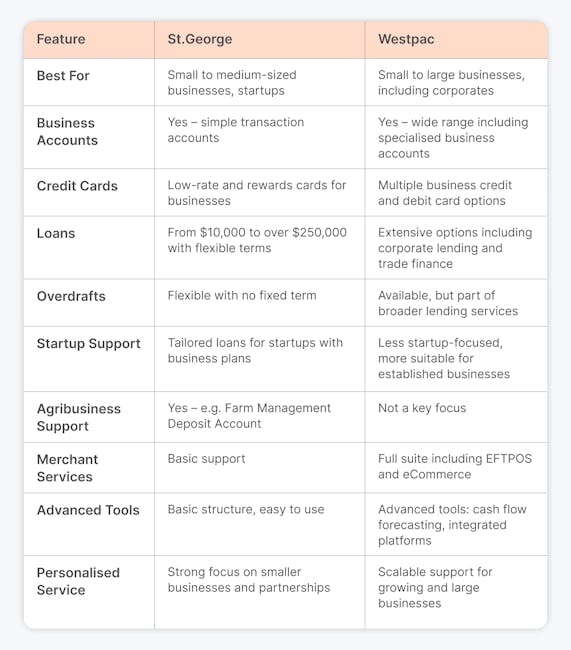

St.George vs Westpac - Comparison

Let’s see these two banks side by side:

1. St.George for Business

✅ St.George provides a targeted, uncomplicated approach to business banking that is ideal for small and medium-sized businesses.

✅ It offers important products like business transaction accounts, low-interest incentives, business credit cards, overdrafts, and a choice of loan alternatives ranging from $10,000 to more than $250,000.

✅ St.George also provides personalised financing and flexible repayment choices to startups, as well as specialised support for agribusiness through features such as the Farm Management Deposit Account.

✅ One of its key assets is personalised assistance for small enterprises and startups.

✅ Their overdraft and lending choices are well-structured and flexible, with reasonable costs and simple application processes.

✅ If you're a sole trader, partnership, or small business searching for easy banking and hands-on help, St.George is a good option.

2. Westpac for Business

✅ Westpac, one of Australia's "big four" banks, provides a more complete and expandable suite of corporate services.

✅ It's suitable for both small businesses and major corporations.

✅ They offer a broad range of business bank accounts, credit and debit card solutions, business loans, and merchant services such as EFTPOS and eCommerce.

✅ Westpac also includes advanced services, including cash flow forecasting, corporate lending, and international trade financing.

✅ Westpac provides solid grounds and support for businesses looking to expand or operate on a greater scale, as well as those in need of more advanced banking solutions.

✅ It's excellent if you require advanced financial solutions, integrated platforms, or comprehensive corporate banking services.

St.George provides a more personalised, cost-effective, and adaptable solution for small and developing businesses.

If you have a larger company or require enterprise-level assistance and digital capabilities, Westpac has the infrastructure and range of services to fulfil your demands.

Both banks are part of the same financial group, so you can anticipate stability and security from either, but your decision will be based on the size and complexity of your organisation.

Before you make a decision, let us present you with one more option - ANNA Money!

ANNA Money - Feasible Alternative to Both Solutions

Although ANNA Money isn’t a bank, it’s an all-in-one business tool designed to support you in starting, managing, and growing your business more efficiently.

Here’s what you can get from this tool:

✨ Business Account - You'll gain rapid access to your own business account for making and accepting payments, and you'll be able to start using our hassle-free business finance tools immediately.

✨ Open Banking - Connect all of your bank accounts to ANNA and see your finances in one spot.

✨ Instant Payment Notifications - We will notify you as soon as a payment leaves or enters your account.

✨ Scheduled and Recurring Payments - Set up periodic or recurring payments, and ANNA will handle it. We will even notify you before they occur.

✨ Company Registration - Start your company in 4 easy steps for a $288 one-off fee!

✨ ACN Registration - As soon as you register a company, you can get your ACN number. Just like with ASIC!

✨ ABN Registration - Register your ABN in a few minutes, and we will notify you as soon as the process is complete.

✨ Ecommerce Business Registration - Register your ecommerce business for free and set up a business account that is effortlessly connected with Shopify, WooCommerce, Etsy, eBay, and Amazon.

✨ Virtual Office Address - Improve your professional image with a trustworthy business address while working from anywhere you want.

✨ Smart Receipt Scanner - Snap a photo of a business receipt, and ANNA will automatically match it to the correct transaction in your account, categorise it, and use the data to help calculate your taxes.

✨ Pots - Pots automatically set aside a portion of your business income, helping you stay prepared for upcoming tax payments.

✨ Corporate Tax - ANNA +Taxes assists you in registering for Corporation Tax, calculates how much you owe, and keeps you on track with all your tax deadlines.

✨ Tax Calendar - ANNA reminds you of upcoming tax and filing deadlines and helps you get everything ready in advance.

Sign up today and get bank-like features, with all tax benefits and other features in one tool!

FAQ

Can St George’s Clients Withdraw Cash at Westpac?

Yes, St George clients can withdraw cash from Westpac ATMs, branches, and Australia Post Bank@Post. This is because Westpac, St. George, Bank SA, and Bank of Melbourne are all members of the Westpac Group and have access to each other's services.

Can I Deposit Into a St.George account at Westpack?

Yes, clients from St. George can make deposits into their accounts at Westpac ATMs and locations. This covers cash, coin, and check deposits.

Can I do St.George Banking at the Post Office?

Yes, you can do St. George banking at Australia Post offices using their "Bank@Post" service. You can use your St. George credit or debit card and PIN to make withdrawals and deposits and check your balance.

St. George Bank has teamed with Australia Post to provide this service at more than 3,400 Post Offices. To find a participating Post Office, go to auspost.com.au/banking or phone 13 33 30 (8 am-8 pm, Monday through Friday).