Westpac vs Commonwealth - Comparison & In-depth Review

Compare Westpac and Commonwealth Bank to evaluate their features, fees, and services, helping you choose the best banking option for your needs.

- In this article

- Business Accounts: Which Bank Makes Day-to-Day Banking Easier?

- Cash Flow Management: Keeping Your Finances Smooth

- Lending Solutions: Which Bank Offers the Right Support?

- Merchant and Payment Services: Simplifying Transactions

- Business Credit Cards: Rewards and Flexibility

- Digital Banking: Managing Finances Anywhere

- Fees and Costs: Which Bank Is More Affordable?

- ANNA: The Modern Solution for Business Owners

As a business owner, choosing the right bank is one of those decisions you just can’t afford to get wrong.

Whether you’re looking for flexible cash flow solutions, simple transaction accounts, or tools to help you grow, Westpac and Commonwealth Bank (CommBank) are two top contenders.

So, let’s break it all down and figure out which one might be a better fit for your business.

Business Accounts: Which Bank Makes Day-to-Day Banking Easier?

When it comes to managing your business’s income and expenses, both Westpac and CommBank have some solid account options. Here’s how they compare:

Westpac

- Business One Transaction Account: A straightforward option for everyday banking, perfect for handling income and expenses.

- Business Savings Accounts: Earn interest on surplus funds while keeping them easily accessible.

- Not-for-Profit Accounts: Fee-free accounts specifically designed for non-profits, which is a rare find.

CommBank

- Transaction Accounts: These accounts come with unlimited electronic transactions and a Visa Debit Card, making them convenient for daily operations. You can also set up customisable alerts to stay on top of your spending.

- Savings and Term Deposit Accounts: Competitive interest rates and easy access to funds make these a great choice for businesses looking to grow their reserves.

- Specialised Accounts: Tailored for industries like real estate, legal, and not-for-profits, these accounts come with features that meet specific statutory and operational needs.

🔶 The Bottom Line:

If you’re running a non-profit, Westpac’s fee-free accounts are hard to beat.

But if you’re in a specialised industry like real estate or legal, CommBank’s tailored accounts might be a better fit.

Cash Flow Management: Keeping Your Finances Smooth

They say cash is the king, and both banks offer tools to help you manage it effectively.

Here’s what they bring to the table:

Westpac

- Flexible Payment Solutions: You can accept card and digital payments directly from your phone, which is great for on-the-go businesses.

- Cash Flow Management Tools: These tools help you stay on top of your finances and plan for the future.

CommBank

- Stream Working Capital: This tool connects to your cloud-based accounting software, unlocking funds tied up in unpaid invoices. If you’ve ever felt the pinch of waiting for clients to pay, this could be a game-changer.

- Business Overdraft: Need quick access to extra cash? CommBank’s overdraft gives you up to $250,000 with flexible repayment options.

- Cash Flow Management Course: Developed with UNSW Business School, this free course teaches you how to handle your business’s finances better.

🔶 The Bottom Line:

CommBank’s advanced tools, like Stream Working Capital, are perfect for businesses dealing with delayed payments.

If you’re just looking for basic payment solutions, Westpac’s offerings will do the job.

Lending Solutions: Which Bank Offers the Right Support?

At some point, most businesses need funding – whether it’s to manage day-to-day operations, invest in new equipment, or expand into new markets.

Let’s see how Westpac and CommBank compare:

Westpac

- Business Loans: Flexible options with redraw facilities, so you can pay ahead and still access funds later.

- Equipment Financing: Designed to help you acquire machinery or tools without upfront costs.

- Trade Finance Solutions: Ideal for businesses that operate internationally.

CommBank

- Small Business Loans: Fast and flexible funding, whether you need secured or unsecured options.

- Sustainable Finance: Loans for environmentally-friendly projects, showing CommBank’s commitment to sustainability.

- Industry-Specific Financing: Tailored solutions for sectors like healthcare, agriculture, and more.

🔶 The Bottom Line:

If sustainability or industry-specific solutions are important to you, CommBank has the edge.

For international trade or equipment financing, Westpac’s offerings stand out.

Merchant and Payment Services: Simplifying Transactions

Having reliable payment solutions is essential for any business. Here’s how the two banks stack up:

Westpac

- Payment Processing Solutions: Secure point-of-sale systems to handle transactions seamlessly.

- Dynamic Mobile Cards: Virtual cards that make online and in-store purchases easier.

CommBank

- EFTPOS Terminals: From portable options to integrated systems, CommBank has a range of EFTPOS solutions.

- eCommerce and Online Payments: Secure online payment systems that integrate with your existing platforms.

- Split-Bill Features: Perfect for restaurants or other businesses needing to divide payments.

🔶 The Bottom Line:

CommBank’s split-bill features and industry-specific payment solutions give it a slight edge for businesses in hospitality or retail.

Westpac’s dynamic mobile cards are a great option for businesses that operate on the go.

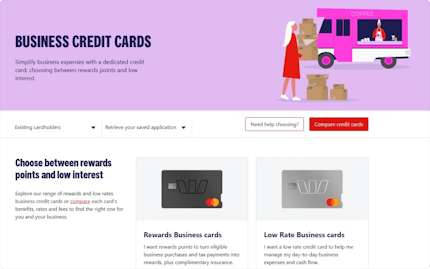

Business Credit Cards: Rewards and Flexibility

Credit cards can be a powerful tool for managing expenses and earning rewards. Here’s how the two banks compare:

Westpac

- Altitude Business Platinum Mastercard: Earn points on business purchases and get complimentary travel insurance.

- BusinessChoice Rewards Platinum Mastercard: A rewards structure tailored to business spending.

- BusinessChoice Everyday Mastercard: Flexible payment options and no introductory fee.

CommBank

- Low Rate Credit Cards: Competitive interest rates for businesses that carry a balance.

- Awards Credit Cards: Earn points redeemable for travel, merchandise, or gift cards.

- Corporate Charge Cards: Advanced expense tracking and security for larger organisations.

🔶 The Bottom Line:

Westpac’s cards are great if you’re looking for travel perks or rewards points. CommBank’s low-rate cards and corporate charge cards cater more to businesses focused on managing costs.

Digital Banking: Managing Finances Anywhere

Both banks offer robust digital tools to make banking more convenient:

Westpac

- Account management with biometric security.

- Budgeting tools and real-time notifications.

- Seamless switching between personal and business profiles.

CommBank

- Advanced transaction categorisation and financial tracking.

- Integration with NetBank for streamlined account management.

- Fraud protection with real-time alerts.

🔶 The Bottom Line:

Both apps are user-friendly and packed with features, but CommBank’s fraud protection and financial tracking make it the better choice for businesses looking to stay secure and organised.

Fees and Costs: Which Bank Is More Affordable?

Westpac

- Monthly Account Fees: AUD 0–AUD 10.

- Assisted Transactions: AUD 3 (first 25 free for Business One Plus).

- International Transaction Fees: 2.2% to 3%.

CommBank

- Transaction Fees: Unlimited electronic transactions for certain accounts.

- EFTPOS and Payment Solutions: Flat-rate or custom transaction fees.

- Overdraft Fees: Competitive rates for cash flow fluctuations.

🔶 The Bottom Line:

If your business processes a high volume of transactions, CommBank’s unlimited electronic transactions can save you money. Westpac’s fee-free assisted transactions (up to 25) might appeal to smaller businesses.

ANNA: The Modern Solution for Business Owners

If you’re looking for something a little different, ANNA might just be the answer.

Unlike traditional banks, ANNA offers an all-in-one business management platform designed for modern entrepreneurs.

While the Big Four focus on conventional banking products, ANNA integrates essential financial tools like bookkeeping, tax management, and invoicing into a seamless experience.

It eliminates the need to juggle multiple apps or services, offering a single, cohesive solution to handle your business’s financial needs.

What ANNA Brings to the Table:

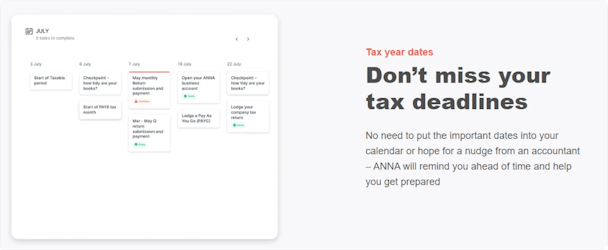

- Tax and Compliance Simplified: ANNA’s AI-driven tax tools automatically calculate GST, set aside tax funds, and file BAS and company tax returns. This saves time and ensures compliance without the stress.

- Automated Financial Insights: From tracking expenses with a smart receipt scanner to providing real-time financial overviews, ANNA empowers you to make data-driven decisions.

- Enhanced Payment Solutions: Virtual and physical debit cards make managing team expenses effortless, while automated invoicing and reminders ensure you get paid faster.

- Personalised Support: ANNA’s award-winning 24/7 customer support is there for you whenever you need it, offering a level of care that’s often hard to find elsewhere.

While Westpac and CommBank offer the reliability and scale of established institutions, ANNA represents the future of business banking. It’s a smarter, integrated approach that supports your business in ways traditional banks simply cannot.

If you’re ready to streamline your finances, automate tax responsibilities, and enjoy a banking experience tailored to your needs, ANNA might be the perfect fit.

Sign up today and experience the future of business banking!