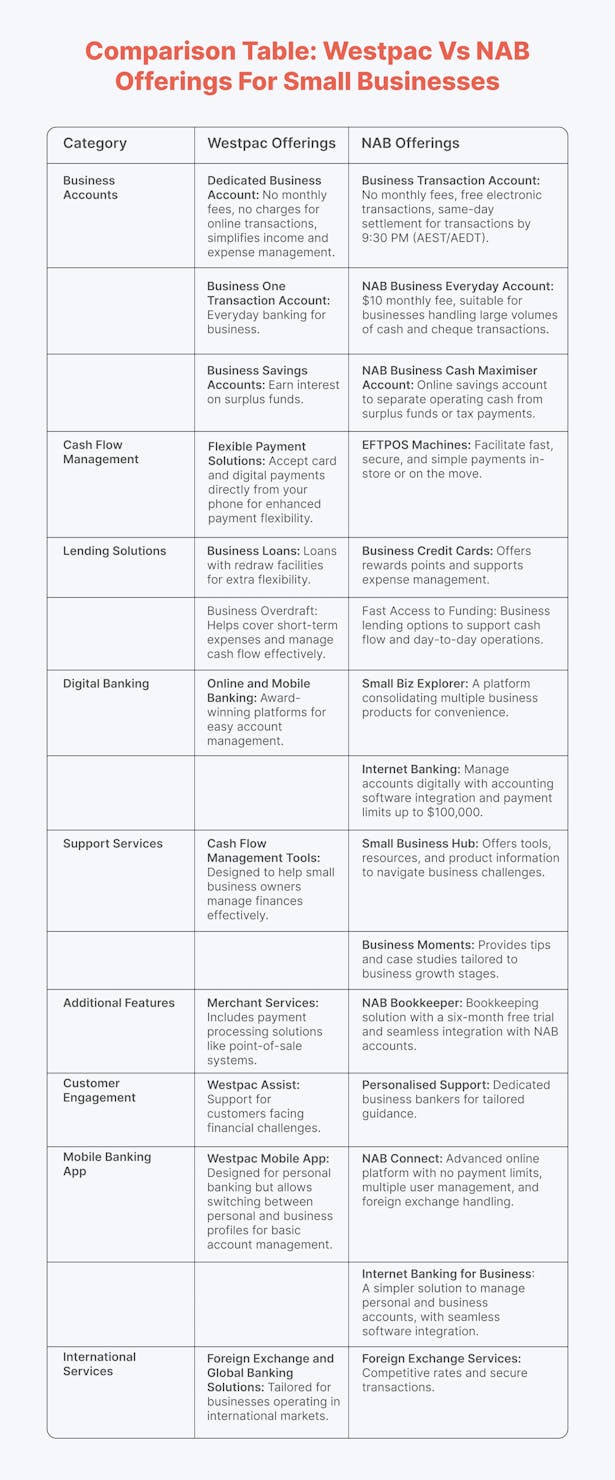

Compare Westpac and NAB to evaluate their features, fees, and services, helping you determine the best banking option for your financial goals.

Your business deserves more than just a bank – it needs a partner that understands your goals and helps you achieve them.

Westpac and NAB, two of Australia’s top contenders, each bring numerous offerings to the table.

In this guide, we’ll cut through the noise and explore how each bank delivers value so you can decide which one is the perfect match for your needs.

1. Westpac Overview

Westpac Banking Corporation, founded in 1817, holds the title of Australia's oldest bank, offering a wide array of banking and financial services.

Serving over 13 million customers, Westpac operates in Australia, New Zealand, and the Pacific, solidifying its position as one of Australia’s Big Four banks.

What Westpac Has To Offer?

Westpac Banking Corporation provides a rounded suite of financial services for individuals, businesses, and institutions. Below are the key offerings across various sectors:

1. Personal Banking

Westpac provides various personal banking options, including everyday accounts, savings plans, loans, and insurance.

From setting up a savings account for kids to managing shared finances with a joint account, their services have practical, everyday use.

For business owners, the focus shifts to managing operations effectively.

Let’s look at how these offerings can support your cash flow, streamline transactions, and drive growth.👇

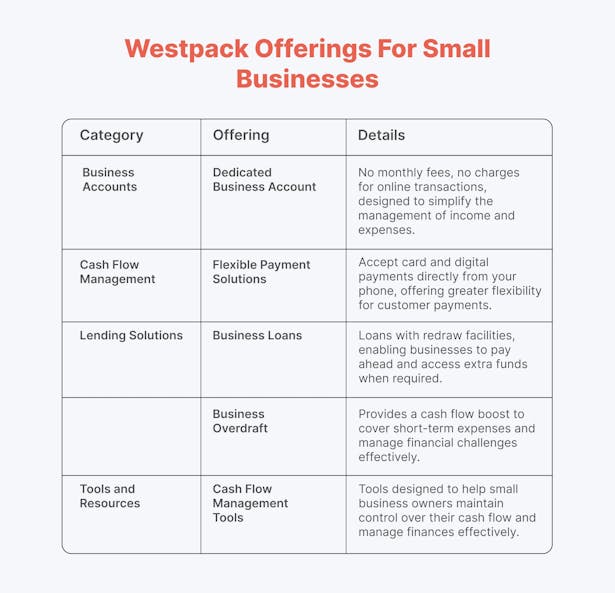

2. Business Banking

- Business One Transaction Account: An everyday banking account for managing business income and expenses.

- Business Savings Accounts: Designed for surplus funds with easy access while earning interest.

- Not-for-Profit Accounts: Tailored accounts for non-profit organizations with no transaction or monthly fees.

2. Loans and Financing: Business loans, equipment financing, trade finance solutions, and specialized financial advice.

3. Merchant Services: Payment processing solutions for businesses, including point-of-sale systems.

3. Institutional Banking

1. Corporate Finance: Services including debt capital markets, structured finance, and advisory for corporations and government clients.

2. Transaction Banking: Solutions for cash management, payments, and foreign exchange for institutional needs.

4. Wealth Management

1. Investment Solutions: Access to investment products, superannuation funds, and managed funds through BT Financial Group.

2. Retirement Planning: Comprehensive retirement planning services to help customers prepare for their future.

5. International Services

1. Foreign Exchange: Competitive rates for currency exchange and international payments.

2. Global Banking Solutions: Services designed for businesses operating in international markets.

Additional Features

- Customer Support Programs: Initiatives like Westpac Assist to help customers facing financial difficulties.

- Educational Resources: Tools aimed at improving financial literacy among customers.

- Accessibility Options: Extensive network of branches and ATMs across Australia and New Zealand, along with support for new migrants.

Business Credit Card Options

1. Altitude Business Platinum Mastercard

- Annual Fee: $0 for the first year, then $200.

- Interest Rate: Purchase rate of 20.24% p.a., balance transfer rate of 4.99% p.a. for the first year (increasing to 20.74% p.a. after 12 months).

- Rewards: Earn 1 Altitude Point per $1 spent on business purchases in Australia; 0.5 points per $1 on government payments.

- Points Transfer: Points can be transferred to major frequent flyer programs, including Qantas Frequent Flyer.

- Insurance Benefits: Includes complimentary travel insurance and purchase protection.

- Additional Features: Supports mobile payments (Apple Pay, Google Pay, Samsung Pay) and offers up to 55 interest-free days on purchases.

2. Altitude Business Gold Mastercard

- Annual Fee: $125.

- Interest Rate: Purchase rate of 14.25% p.a.

- Rewards: Earn points capped at 20,000 points per month.

- Additional Cardholders: Allows for up to 10 additional cardholders.

3. BusinessChoice Rewards Platinum Mastercard

- Annual Fee: $75 (waived if spending exceeds $15,000 annually).

- Interest Rate: Purchase rate of 14.25% p.a.

- Rewards: Similar rewards structure as the Altitude cards, with opportunities to earn points on business-related purchases.

4. BusinessChoice Everyday Mastercard

- Annual Fee: No introductory fee; $75 for additional cardholders.

- Interest Rate: Competitive purchase rates with flexible payment options.

Eligibility Criteria

To qualify for a Westpac business credit card, businesses typically need to meet certain criteria:

- Minimum annual income of $4 million.

- Expected annual credit transactions of approximately $250,000.

- At least 15 card users within the organization.

- The business should have been operating for at least two years and cannot be a sole proprietorship.

Additional Features

- Expense Management: Westpac provides tools that simplify bookkeeping by allowing users to download monthly statements compatible with accounting software.

- Dynamic Mobile Cards: For corporate clients, Westpac offers virtual cards that can be created on-the-go, allowing for online and in-store transactions without the need for physical cards.

- Comprehensive Reporting: Businesses can access detailed reporting on spending, enhancing visibility and control over expenses.

Fees Overview

- Annual fees vary by card type but can be waived under specific conditions (e.g., spending thresholds).

- Interest rates are competitive but vary based on the specific card and its features.

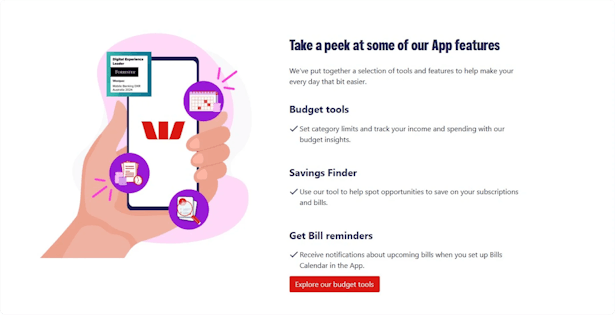

Mobile Banking App

The Westpac mobile app allows users to manage their finances conveniently from their smartphones or tablets:

- Account Management: Users can check their account balances, view transaction history, and manage multiple accounts.

- Payments: The app allows for easy payments, including bill payments through BPAY and the ability to pay anyone using bank details or PayID.

- Budgeting Tools: It offers budgeting features to help users track spending and set financial goals.

- Security: For enhanced security, the app includes biometric login options (fingerprint or facial recognition) and card management features.

- Notifications: Users receive alerts for transactions, upcoming bills, and account activity.

While the primary focus is on personal banking, the app does allow users to switch between personal and business banking profiles if they have both types of accounts.

Westpack Offerings for Small Businesses

2. NAB Overview

National Australia Bank (NAB), one of Australia’s largest financial institutions, provides various banking and financial services to individuals, businesses, and corporations.

With roots dating back to 1834 through the Commercial Banking Company of Sydney and the National Bank of Australasia established in 1858, NAB took its current form in 1981 following their merger.

Headquartered in Docklands, Melbourne, NAB serves more than 8.5 million customers across Australia, New Zealand, Asia, the UK, and the US, solidifying its presence as a leading player in the financial sector.

What NAB Has To Offer

Here’s an overview of what NAB has to offer:

1. Personal Banking Solution

NAB’s personal banking solutions meet everyday financial needs, from no-fee everyday accounts to high-interest savings options that encourage regular deposits.

For example, the NAB Classic Banking Account offers a fee-free option for daily transactions, while savings accounts like the NAB Reward Saver provide bonus interest for consistent saving habits.

On the lending side, NAB offers tailored home loans, flexible personal loans, and credit cards with features like rewards programs and introductory low fees.

For business owners, however, the focus is on NAB’s business banking solutions:

Business Banking Solutions

- Business Accounts: NAB provides accounts for businesses of all sizes, including transaction accounts and savings accounts.

- Business Loans: Options include equipment finance, trade finance, and business overdrafts to support operational needs.

- Merchant Services: Comprehensive payment solutions for businesses, including card processing and online payment gateways.

Digital Banking

- NAB Internet Banking: A secure online platform that allows customers to manage their accounts, make payments, and access financial tools from their computers or tablets.

- NAB Mobile App: A user-friendly mobile application enabling customers to perform banking tasks on the go, including checking balances, making transfers, and paying bills.

Security Features

- Fraud Protection Resources: NAB provides practical resources and alerts to help customers protect themselves against scams and fraud.

- Security Notifications: Customers receive alerts regarding suspicious activities on their accounts to enhance security.

Customer Support

- Help & Support Services: Comprehensive customer support through various channels, including online guides, customer service contacts, and in-branch assistance.

- Interpreter Services: NAB offers interpreter services for non-English speakers to ensure accessibility for all customers.

Financial Tools

- Calculators and Tools: Personal banking calculators help customers understand loan repayments, savings goals, and budgeting effectively.

- Online Resources: Access to articles and guides on managing finances effectively.

Business Credit Card Options

Types of Credit Cards

1. NAB Rewards Credit Cards

- Purpose: Suitable for earning unlimited NAB Rewards Points each month.

- Minimum Credit Limit: $6,000.

- Annual Card Fee: $195 p.a.

- Variable Purchase Rate: 20.99% p.a.

- Bonus Points: Options for significant bonus points upon meeting spending criteria (e.g., 100,000 bonus points).

2. NAB Qantas Rewards Credit Cards

- Purpose: Designed for earning Qantas Rewards Points for flights and products.

- Minimum Credit Limit: $6,000.

- Annual Card Fee: $295 p.a.

- Variable Purchase Rate: 20.99% p.a.

- Bonus Points: Options for substantial bonus Qantas Points (e.g., 70,000 or 120,000 bonus points).

3. Low Rate Credit Cards

- Purpose: Ideal for customers who may not pay off their balance in full each month.

- Minimum Credit Limit: $1,000.

- Annual Card Fee: $59 p.a.

- Variable Purchase Rate: 13.49% p.a.

- Balance Transfer Offer: 0% p.a. on balance transfers for 24 months with a 3% balance transfer fee.

4. Low Annual Fee Credit Cards

- Purpose: Suitable for those looking for a no-frills card with lower fees.

- Minimum Credit Limit: $1,000.

- Annual Card Fee: $30 p.a.

- Variable Purchase Rate: 20.99% p.a.

5. No Interest Credit Card (NAB StraightUp)

- Purpose: A credit card with no interest charges, late payment fees, or international transaction fees; just a simple monthly fee based on the chosen credit limit.

- Credit Limits Available:$1,000 with a $10 monthly fee

Key Features of NAB Credit Cards

- Digital Wallet Pay: Supports payments through smartphones and wearables using digital payment options.

- Fraud Protection: Comprehensive fraud protection and online security measures to ensure safe transactions.

- 24/7 Emergency Assistance: Customers can block lost or stolen cards via the NAB app or call customer service at any time.

- Visa Entertainment Offers: Access to special offers on shows, events, experiences, and movies through Visa Entertainment.

Eligibility Requirements

To apply for a NAB credit card, applicants must meet certain criteria:

- Be at least 18 years old and an Australian resident or citizen.

- Have a minimum annual income as specified for different card types.

- Provide identification and financial information during the application process.

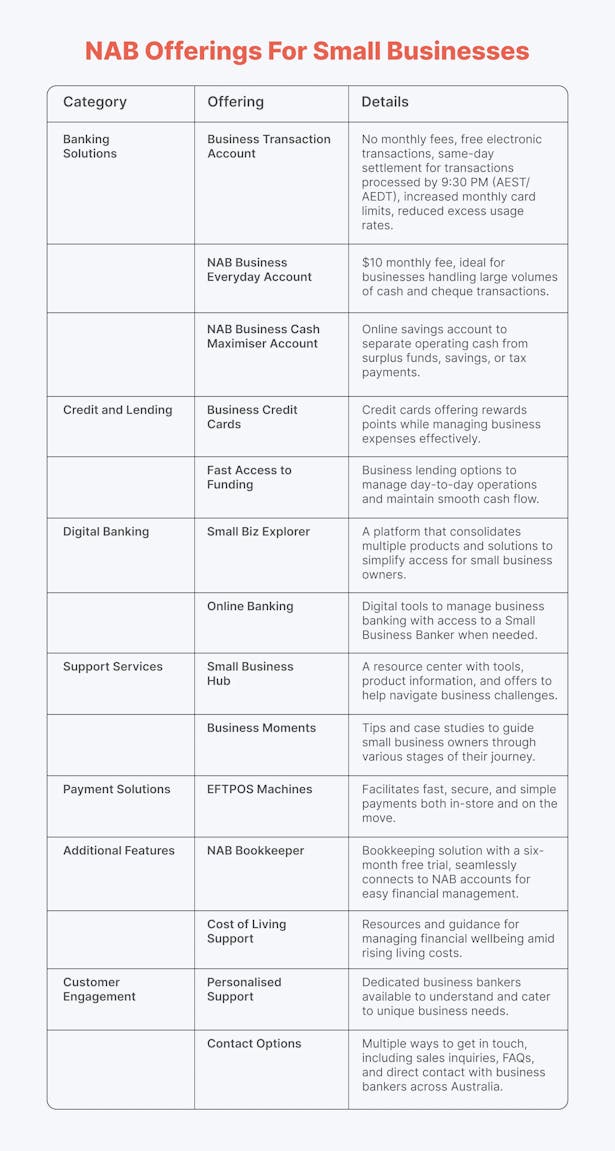

NAB Offerings for Small Businesses

Mobile Banking App

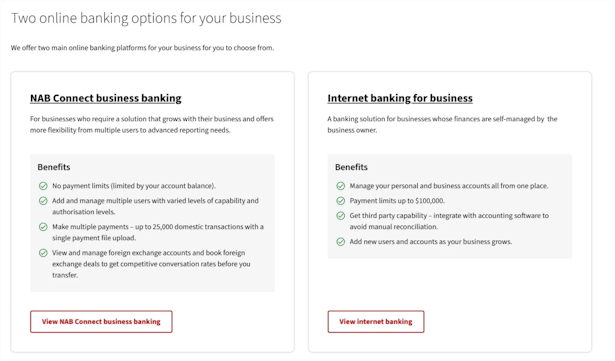

NAB offers two online banking platforms:

1. NAB Connect

It is ideal for businesses seeking a scalable solution with advanced features such as no payment limits (based on account balance), the ability to manage multiple users with varied authorisation levels, and tools for handling foreign exchange transactions.

It also allows for bulk payments, enabling up to 25,000 domestic transactions in a single file upload.

2. Internet Banking

For businesses that prefer a simpler, self-managed approach, Internet Banking for Business provides a platform to manage both personal and business accounts, with payment limits up to $100,000 and integration with accounting software for seamless reconciliation.

Comparison Table: Westpac vs NAB Offerings for Small Businesses

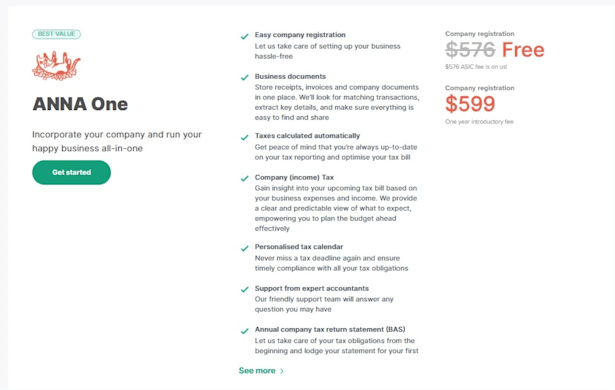

ANNA: The All-in-One Solution Redefining Business Banking and Management in Australia

When managing your business finances, ANNA is a fresh and innovative alternative to traditional banks like Westpac and NAB.

From seamless company registration to hassle-free financial management, ANNA offers a solution for modern business owners who value efficiency and peace of mind.

One of ANNA’s biggest draws is its free company registration service. Yes, you read that right – ANNA covers the ASIC registration fee, making it an unbeatable choice for new business owners.

In just three steps, you can register your Australian company, secure an ABN, and open a business bank account, all without lifting a finger.

ANNA ensures your ACN and ASIC documents are delivered directly to your inbox, streamlining a process that often feels overwhelming.

But ANNA doesn’t stop there. Once your business is up and running, ANNA One becomes your financial powerhouse. Here’s what you get:

⚡ Bookkeeping and Expense Management: Forget piles of receipts and last-minute panic at tax time. ANNA’s smart receipt scanner captures, matches, and categorises your expenses automatically, ensuring every deduction is accounted for.

The Bookkeeping Score even gives you tailored tips to optimise your tax savings, so you can keep more of what you earn.

⚡ Invoicing Made Simple: ANNA helps you create professional-looking invoices in seconds. With automated reminders for unpaid invoices, you’ll spend less time chasing clients and more time growing your business. In fact, ANNA boasts an impressive 80% invoice payment rate within a week.

⚡ Comprehensive Tax Management: Taxes don’t have to be stressful. ANNA calculates GST, sets aside funds automatically, and even files your BAS and annual company tax return. With a personalised tax calendar and AI-powered tax assistance, you’ll never miss a deadline or feel unsure about your obligations.

⚡ Virtual and Physical Credit Cards: With ANNA’s business account, you get virtual cards for instant online payments and physical debit cards for everyday transactions. Whether it’s managing employee expenses or handling customer payments, ANNA’s tools make it seamless.

⚡ Integrated Financial Insights: Connect your ANNA account to other banks and see all your finances in one place. You’ll gain valuable insights into your business’s performance while enjoying features like scheduled payments and expense tracking.

ANNA also offers perks traditional banks don’t, such as a virtual office address to protect your privacy and boost your business’s professional image.

Need help navigating the regulatory landscape? ANNA’s support team and AI-powered tax bot are always available to answer questions and guide you through the process.

For business owners who want more than a basic bank account, ANNA delivers a solution that truly takes care of it all – registration, taxes, bookkeeping, and beyond.

It’s a partner that simplifies your workload, saves you time, and ensures every detail is handled with care.

Why settle for traditional when you can choose a solution built for the future?

Sign up today and streamline your business operations right from the start.