PAYG Withholding Explained: Full Guide for Employers

Learn how PAYG withholding works for employers, including setup steps, legal obligations, and tips to stay compliant with ATO requirements.

What is the difference between PAYG and payroll? If you don't know, you're in the right place!

PAYG (Pay As You Go) withholding is one of the most misunderstood aspects of tax management in Australia.

While it may appear to be another payroll job, it is, in fact, a separate legal responsibility that requires proper reporting and registration.

In this article, we explain what PAYG withholding is, who it applies to, and how to apply it correctly – without stress.

Plus, we'll show you how ANNA Money simplifies, smartens, and automates the entire process!

What is PAYG Withholding?

PAYG Withholding (Pay As You Go Withholding) is an Australian tax system where employers withhold a portion of income tax from payments made to employees and certain contractors.

Then, they remit these amounts directly to the Australian Taxation Office (ATO) on behalf of the payees.

This system helps ensure that income tax is collected progressively throughout the year rather than in a lump sum at the end of the financial year, helping employees and contractors meet their tax obligations more easily.

What Payment Do You Need to Withhold As an Employer?

Your withholding requirements vary depending on whether your worker is an employee or an independent contractor.

You are normally required to withhold sums from payments made to employees.

You normally do not withhold money from payments made to independent contractors.

The most typical payments you withhold amounts from include:

👉 Employees

👉 Directors

👉 Businesses that do not provide their ABN

👉 Independent contractors with a voluntary agreement.

If you run a business as a sole trader or partnership and draw money from it, this is not a wage, and you are not required to withhold from these drawings.

You make provisions for your income tax liability through PAYG payments.

Payments other than income from employment may also require tax withholding, including:

👉 Expenses include investment income

👉 Dividends

👉 Interest

👉 Royalties paid to non-residents

👉 Payments to foreign residents for gaming, entertainment, sports, and construction

👉 Payments to Australian residents working overseas

👉 Super income streams and annuities

👉 Payments to beneficiaries of closely held trusts

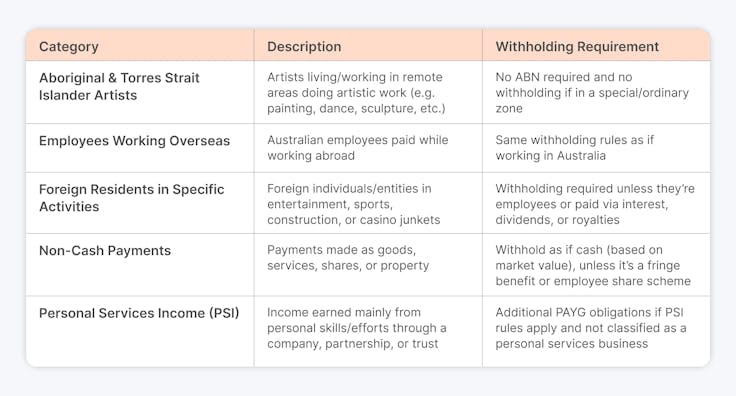

Payments With Special Rules

Special restrictions apply when determining how much tax to withhold for particular employees:

👉 Aboriginal and Torres Strait Islander artists who live or work in remote regions

If your company pays an Aboriginal or Torres Strait Islander artist for artistic work, the artist does not need to provide an Australian business number (ABN) if they work or live in an isolated area, also known as a special or ordinary zone A geographic location.

You will not be obligated to withhold tax, even though the artist hasn't quoted an ABN.

Artistic works include:

- Graphic design

- Photography

- Sculpture

- Painting and collage

- A person's performance or participation in a cultural activity, such as a musical performance, play, dance, or exhibition

👉 Employees Who Work In a Foreign Country

If you pay Australian employees who work overseas, you have the same tax duties as if they were in Australia.

Some payments for foreign services related to specific development projects, charitable activities, or government operations are excluded from taxes. You are not required to withhold sums from these payments.

👉 Foreign Residents Engage in Entertainment, Sports, Construction, and Casino Gambling Activities

Payers must withhold certain amounts from payments made to foreign resident payees who labour or participate in:

- Activities include entertainment, sports, construction, and casino junkets.

- Foreign resident payees include all foreign individuals and non-individual institutions (such as companies, partnerships, trusts, government organisations, and superannuation funds).

These specific regulations are not applicable to payments paid to foreign residents if:

- They are engaged as employees.

- Receive compensation in the form of interest, dividends, and royalties.

👉 Non-Cash Payments

If you provide a non-cash payment, such as property or services, you must still complete your withholding duties.

The withholding provisions ensure that both cash and non-monetary payments result in a similar outcome.

- If the payment represents a fringe benefit, a share, or a right under the employee share system, no PAYG withholding is required.

- The amount you are required to withhold and transmit to us is the same as if the payment were in the form of money.

- When the payment is received, you must determine the amount based on the current market value of the unpaid amount.

You have to use the appropriate tax withholding rates for your payee, depending on whether they are an employee or a contractor and if they have submitted an ABN. - You must withhold and pay ATO an amount before giving a non-cash payment, just as if the payment were in the form of money.

👉 Personal Services Income

Personal services income (PSI) is primarily determined by your personal efforts and talents.

If you run a company, partnership, or trust that does not meet the criteria for a personal services business, some of your employees' earnings may be subject to PSI.

When the PSI rules apply, your company will incur additional PAYG responsibilities for the amount owed to each individual who provided the services.

How to Register and When to Report PAYG Withholding?

You must register for pay-as-you-go (PAYG) withholding before making your first withholding-required payment.

This is necessary even if you do not withhold any cash from a payment made.

If you have an active ABN, you can register or cancel your PAYG withholding business account:

✅ Online with ATO internet services for businesses

✅ Through your registered tax agent or BAS agent

✅ Using SBR-compatible software

✅ Call the ATO line if you are an authorised business contact

💡 ProTip

Looking for an easier way?

ANNA Money's PAYG Registration tool allows you to track receipts, save for taxes, and get expert tax advice!

When To Report PAYG Withholding?

The pay as you go (PAYG) withholding cycle specifies how frequently you must report and pay the withholding amounts to ATO.

It depends on your annual withholding amount:

👉 Small withholders ($25,000 or less ) - Must pay quarterly

👉 Medium withholders ($25,000 and up to $1 million) - You have to pay monthly

👉 Large withholders (more than $1 million) - Pay electronically within six to eight days of a withholding event (e.g., staff pay)

Can You Change the Withholding Cycle?

Yes, you can.

If your annual withholding amounts change, you or your registered tax or BAS agency can request that your withholding cycle be adjusted.

You can send your request online on ATO website using the secure mail alternatives for businesses or agents:

✅ Select “communication”, “secure mail”, then “new”.

✅ Choose Pay as you go from the topic list

✅ Select the applicable subject

✅ Call ATO to discuss your specific situation

If you do not have access to ATO's online services, you can apply in writing, providing precise reasons to support the request and sending it to:

Australian Taxation Office

PO Box 3373

PENRITH NSW 2740

In addition to the fact that you can change the cycle yourself, ATO can also do that.

They may adjust your withholding cycle in response to an audit or other compliance activity.

When making a determination, they examine the following factors:

👉 The total amount you plan to withhold over the next 12 months

👉 The extent, if any, to which you make or receive withholding payments made or received by another company

👉 Any failure to comply with the withholding regulations

👉 Any other matter deemed relevant

If ATO decides to upgrade your withholding cycle, they will send you notification of the change and the date it will take effect. If you do not agree, you may object.

In Which Situation You Can’t Object?

ATO will assess your withholding payments each financial year to determine whether your withholding cycle needs to be adjusted.

If your annual withholding payments have increased, they will notify you in writing to upgrade your withholding cycle.

Your new withholding cycle is decided by your new withholding status (medium or large).

They will give you enough time to transition to the new payment cycle before your first payment is due for the new fiscal year, and you can’t object to this notification.

However, if you disagree with their decision to upgrade your cycle, you can request to remain on your current cycle, provided you believe your future year's withholding amount will be under your withholding status level.

You or your registered agent must submit your request to ATO within 21 days of receiving the letter.

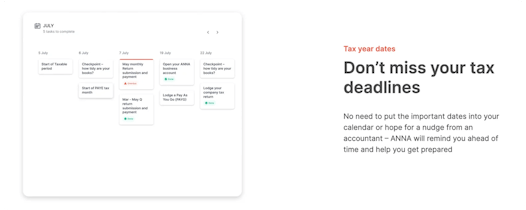

💡ProTip

In order not to miss tax deadlines that ATO closely monitors, we suggest you use ANNA Money! Why?

Well, because with this tool, you can get a personalised tax calendar and always know when it's time to pay and which tax.

When the ATO analyses your business, there will be less chance of finding any failing complaints!

How To Pay and Report PAYG Withholding To ATO?

Follow these steps to pay and report PAYG withholding to the Australian Taxation Office (ATO):

✅ Calculate the Amount to Withhold - The quickest approach to determine how much tax to withhold is to use ATO’s online tax withheld calculator or tax tables.

✅ Withhold Taxes From Payments - Deduct the calculated tax amount from each payment you make to your workers or applicable contractors and set it aside for submission to the ATO.

✅ Report and Pay Withheld Amounts - You pay the withheld tax to the ATO at the same time you file your BAS.

How To Use ATO’s Tax Withheld Calculator?

Follow these steps:

✅ Visit the ATO website and find the tax-withheld calculator

✅ Provide:

- Payees full name

- How often that person receive payments (e.g., weekly, fortnightly, monthly) and gross weekly earnings

- If that person provided TFN and status of it

- If a person claimed the tax-free threshold

- If there are Study and Training Support Loan debts or other HELP debts the payee may have

- Amount the payee claimed as Tax offsets

- Information about Medicare levy status

What To Do If You Withhold More Tax Than You Should?

If you withhold more tax than necessary and find the error quickly, you must repay the excess amount to the payee, even if you have already paid it to ATO.

If you have already paid the amount to ATO, you may offset it against another withholding amount that you are required to pay in the future for the relevant year.

Remember to keep clean business records in your accounts.

If you withhold more tax than you should and discover the error after June 30 of the year in which the withheld amount applies, do not refund the amounts to your payee; if you do, ATO will be unable to refund the money to you. To rectify this:

✅ You must provide your payee with a modified payment summary and complete and send to ATO an adjusted PAYG payment summary statement (NAT 3447).

✅ If your payee has already filed their income tax return for the current fiscal year, they must request an income tax adjustment.

✅ If you have already paid the amount to ATO and are not required to pay any additional withholding amounts for the relevant year, you must submit an updated activity statement.

Conclusion

We understand that PAYG is certainly one of the more complicated processes when you have your own business. However, it doesn't have to be that difficult.

It becomes a seamless part of your business's routine if you understand who to withhold from, when to report it, and how to handle special cases.

And when you have ANNA Money by your side? It is even easier.

From personalised tax schedules to smart receipt monitoring and expert assistance, ANNA takes the worry out of PAYG and allows you to finish more work with less effort!

What Are Additional Benefits of PAYG Registration Through ANNA Money?

Yes, you can register PAYG through ANNA Money, but what are the benefits of doing so?

Well, you will get:

⚡ All-In-One Financial View - Connect both business and personal accounts to ANNA to get a full picture of your finances.

⚡ Stress-Free Taxes Calculations - Our tool connects your receipts and transactions to help you calculate your taxes correctly.

⚡ Expert Help - Get rapid answers to your queries backed up with facts from the ATO.

In addition to registering PAYG withholding and tracking tax dates, ANNA Money can help you with many other things! See how:

⚡ Virtual Office Address - Get a virtual business address while working from anywhere you want.

⚡ Financial Management - Register your company easily, manage your funds efficiently, and stay on top of your tax reporting.

⚡ Business Account - Get a business account, start making and accepting payments, and you may start using our hassle-free business financing features immediately.

⚡ ANNA +Taxes - Calculate payroll for your limited company and eliminate the need for an accountant.

⚡ Corporate Tax - Calculate what you owe and make sure you meet all deadlines.

⚡ Pots - Get a portion of your business income set aside to cover future tax obligations.

⚡ Smart Receipt Scanner - Take a photo of a receipt, and get it linked to a transaction in your business account.

⚡ Invoicing Software - Create, send, and manage invoices effortlessly.

Make tax time stress-free, and start your PAYG journey with ANNA today!