What is a Super Fund ABN? How to Look It Up in 4 Easy Steps

Learn what a Super Fund ABN is, why it matters, and how to easily look it up to ensure accurate contributions and meet compliance requirements.

Did you know that only 51% of adults in Australia have sought advice on retirement planning?

It doesn't matter if you're an employer making regular payments, an individual managing a self-managed super fund (SMSF), or simply looking to double-check a fund's data, learning how to look up a Super Fund ABN is important.

That's why in this article, we'll walk you through what a Super Fund ABN actually means, why it matters for your business or retirement, how to search it up in just a few clicks, and what to do if something doesn't appear right.

Furthermore, we'll show you how ANNA Money may ease the administrative side of things because dealing with compliance doesn't have to be difficult.

Let’s start!

What is a Super Fund ABN?

A Super Fund ABN (Australian Business Number) is an 11-digit identifier assigned by the Australian Taxation Office (ATO) to superannuation funds. It is a vital tool for identifying individual super funds, including retail, industry, and self-managed super funds (SMSFs).

What is the purpose of a super fund ABN?

⏩ Legal Identification - The ABN ensures that super funds are legally recognised and follow Australian legislation.

⏩ Tax Compliance - It enables the ATO to monitor tax obligations, apply concessional tax rates, and detect compliance violations.

⏩ Processing Contributions - Employers use the ABN to appropriately route contributions to the Superannuation Guarantee Scheme.

⏩ Fraud Prevention - The ABN validates the authenticity of a super fund, making sure donations are made to compliant organisations.

What are the uses of Super Fund ABN?

✔️ If you are an employer, then you can determine if your contributions qualify as Super Guarantee payments.

✔️ APRA-regulated funds need it to determine whether SMSFs are eligible to receive rollovers.

✔️ Individuals can confirm the legality and compliance status of their super fund.

✔️ If you are a trustee, you can make sure their SMSF information is correct and up to date.

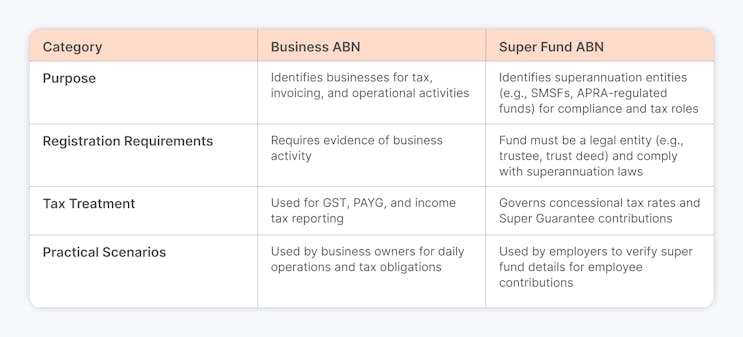

What Are the Differences Between an ABN for a Business and One for a Super Fund?

Here's a detailed breakdown of the differences between a business ABN and a super fund ABN:

Purpose:

🔶 Business ABNs identify organisations for tax, invoicing, and operational purposes.

🔷 Super Fund ABN identifies superannuation entities (such as SMSFs and APRA-regulated funds) that collect contributions, handle tax concessions, and ensure compliance.

Registration requirements:

🔶 Business ABN requires documentation of business activity.

🔷 For a super fund ABN, the fund must be established as a legal entity (e.g., trustee setup, trust deed) and comply with superannuation legislation.

Tax treatment:

🔶 Business ABN is used for GST, PAYG, and income tax reporting.

🔷 The Super Fund ABN governs concessional tax rates and Super Guarantee eligibility.

Practical scenarios:

🔶 Business owners have a business ABN for their company and a separate SMSF ABN for retirement funds.

🔷 Employers use the employee's super fund ABN (via Super Fund Lookup) to verify contributions.

How to Look Up Super Fund ABN in 4 Easy Steps

The ATO offers resources such as the Super Fund Lookup platform, which has publicly available information about all super funds with ABNs.

The Super Fund ABN Lookup tool enables you to perform multiple searches on Super Fund Lookup using your Australian Business Number (ABN).

Instead of manually entering the ABN every time you wish to verify the data of a fund, you can use the tool to enter the ABN for all funds you deal with.

From that moment on, you can access the most recent information from Super Fund Lookup by just pressing a button.

This tool is necessary for employers, employees, and trustees that manage superannuation.

How To Use Super Fund Lookup Tool?

Remember that you require Microsoft Excel 2010 or above with macros enabled, and to use the Super Fund ABN Lookup tool, you must be connected to the Internet.

Follow these steps:

✅ Step 1: Download the Tool

Download and simply accept the terms and conditions for access to the download page. If you download the tool from the Super Fund Lookup website, you must save and open it in Excel rather than within the browser. Running the tool via the browser may result in a Run Time Error.

✅ Step 2: Launch the Super Fund ABN Lookup tool

Use Excel to open the tool from its saved location. Macros must be enabled for the tool to function properly. Depending on the version of Excel and your macro security settings, you may need to activate macros when you first use the application.

✅ Step 3: Replace the Contents

To add ABNs, simply replace Column A (ABN) with your own list. The format of the ABN entered is irrelevant; the tool will recognise both an ABN with spaces (e.g. 11 335 879 843) and an ABN without spaces (e.g. 11335879843). When inserting ABNs into Column A, do not leave any empty rows because the lookup process will end at the first empty row.

✅ Step 4: Click the Start Lookup Button

Click the Start Lookup button at the top of the SuperFundLookup worksheet. The SFL Lookup dialogue box will display.

If you are connected to the internet, clicking the Lookup Fund information button sends a request to Super Fund Lookup for each ABN specified in Column A. The current data is returned and utilised to populate the spreadsheet. You can stop this procedure at any time by clicking the cancel button.

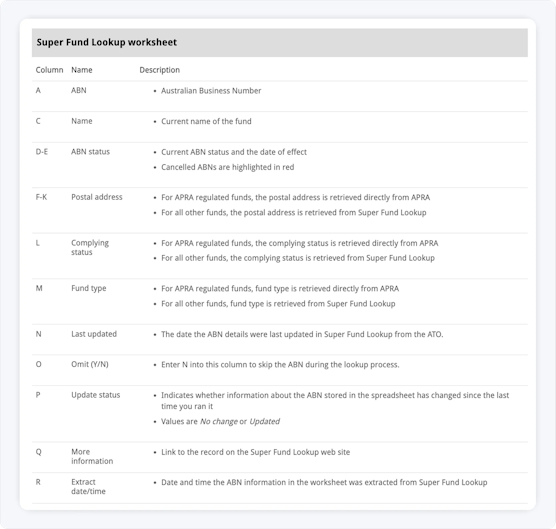

What Information Is Available on the Super Fund Lookup Tool?

Here’s the breakdown:

⏩ The Australian Business Number (ABN) of the fund.

⏩ Name of the fund.

⏩ Type of fund (for example, SMSF, retail, or industry fund).

⏩ Indicates whether the fund is in compliance with superannuation requirements, which are required for concessional tax treatment and ability to receive contributions or rollovers.

⏩ The fund's postal address.

⏩ Contact information, including location by postcode and state. This makes rollover communication and processing more efficient.

⏩ ABN status (active or cancelled).

⏩ Whether the fund has discontinued operations or been taken down from public view owing to regulatory concerns.

⏩ Indicates when the system's information was last updated.

What Happens If a Super Fund’s ABN Is Cancelled?

If a super fund's ABN is terminated, it might have serious consequences for its operations and compliance. Here are the main consequences:

❌ Fund Inoperability - Cancelled ABN can result in a super fund being inoperable. This status may restrict the fund from accepting donations or rollovers through SuperStream, which is required for electronic transactions between super funds.

❌ Rollover Restrictions - Before making a rollover to a super fund with a cancelled ABN, check with the Australian Taxation Office (ATO) to ensure compliance. This ensures that the fund remains regulated and eligible to receive rollover funds.

❌ Final Tax Return Processing - For self-managed super funds (SMSFs), the ABN is usually cancelled once the last tax return is filed and processed by the ATO during the wind-up process. If rollovers or transfers are required, these must be performed before the ABN is terminated, as SuperStream cannot function without a valid ABN.

❌ Reactivation Challenges - If an ABN is cancelled prematurely or inadvertently, trustees must approach the ATO to request reactivation.

What should I do if my super fund ABN is cancelled?

✅ Call the ATO's superannuation inquiries line at 13 10 20 to confirm the cause for the cancellation and, if necessary, request reactivation.

✅ If the cancellation occurred prematurely (for example, during a wind-up), the ATO may temporarily reinstate the ABN to enable final transactions.

✅ If you are unable to reactivate your SMSF, you may need to apply for a new ABN.

Conclusion

Managing superannuation obligations can feel like a lot, especially when you're trying to understand Super Fund ABNs.

However, if you understand how the system works and begin using tools such as the Super Fund Lookup, things become much more manageable.

On the other hand, verifying ABNs is only one part of the whole job.

There's also the matter of properly establishing your business, organising your invoices, and keeping up with day-to-day administrative tasks.

That's where Anna Money comes in. It simplifies behind-the-scenes tasks such as expense tracking, receipt automation, and record-keeping, allowing you to focus on what is most important.

If you're looking for a smarter, easier method to manage your business and stay compliant, ANNA has you covered.

Give it a try and see how much easier things can become!

ANNA Money - All-In-One Business Tool

While Super Fund Lookup helps you check ABNs, ANNA Money may help with the rest!

From streamlining your business setup and handling your invoicing to categorising spending and keeping your financial records in order, ANNA keeps everything moving smoothly.

“Easy Company” package:

🔸 Company Registration - Set up your business for $288, the $576 ASIC fee is on us!

🔸 Business Documents - Keep receipts, invoices, and company records in one location. We will check for matching transactions, extract crucial facts, and ensure that everything is easy to find and share.

“ANNA One” package:

You get everything from the first package, with free company registration, plus:

🔹 Business Account - Receive a debit card, virtual cards, Apple Pay, Google Pay, and employee expense cards. Easily check your balance and handle all of your payments

🔹 Registered Office Service - Keep your personal address off the public record with same-day automated mail scanning and handling (compliant with ASIC, ATO, and other governmental authorities).

🔹 Receipt matching - Automated receipt matching and spending classification to ensure you obtain the proper tax relief.

🔹 Personalised tax calendar - Never miss another tax date, and ensure timely compliance with all of your tax requirements.

🔹 Goods and Services Tax (GST) - Get your GST automatically calculated and reported to the ATO.

🔹 Payroll - File payroll for you and your staff.

🔹 Annual Accounts and Company Tax Return - File your annual accounts with ASIC and your company tax returns with the ATO straight through ANNA.

🔹 Support from Tax Experts - Get support from expert accountants.

Are you ready to simplify your business administration and stay compliant easily?

Sign up and try ANNA Money today!

FAQ

Do Self-Managed Super Funds Require ABN?

Yes, self-managed super funds (SMSFs) in Australia are legally required to obtain an Australian Business Number (ABN).

What Is the APRA Fund?

In Australia, an APRA fund is a superannuation fund that is governed by the Australian Prudential Regulation Authority. These funds are separate from self-managed super funds (SMSFs), which are regulated by the Australian Taxation Office.

How Do I Know If My Super Is Apra or SMSFs?

Follow the steps below to identify whether your superannuation fund is APRA-regulated (e.g., retail, industry, or public sector fund) or a self-managed super fund (SMSF):

1. Log in to myGov and link the ATO's online services.

2. Go to Super → Information to see your fund's name, ABN, and account information.

If your funds are listed:

APRA-regulated names include AustralianSuper, Rest Super, and public sector funds (for example, PSSap).

SMSF will be displayed as a "Self-Managed Super Fund" with your own ABN.