How Much Tax Should You Pay for a Second Job in Australia?

Find out how much tax you should pay for a second job in Australia with this guide, covering key details, tips, and best practices for compliance.

- In this article

- What is Considered a Second Job in Australia?

- Understanding Tax Brackets in Australia

- What Is Tax-Free Threshold with Multiple Jobs

- Why Do Some People Pay More Tax with a Second Job?

- How to Handle Tax Withholding on Your Second Job

- What If You Earn Less Than $18,200 Combined?

- Can You Have a Second Job as a Business Owner?

- Planning Ahead: Managing Tax on Multiple Jobs

- Is Working Two Jobs Worth It?

- How Can ANNA Help Business Owners Manage Tax When Taking a Second Job?

Many Australians believe that taking on a second job will push them into a higher tax bracket, leaving them worse off than before. It’s an idea that has caused a lot of confusion, and like many myths, it sounds believable at first glance.

But does earning more really mean you pay double the tax? Not exactly.

While it’s true that higher earnings mean paying more tax overall, your second job doesn’t magically increase the tax rate on your income – it just changes how tax is calculated across your jobs.

In this article, we’ll break down how taxes work when you take on a second job, clear up the misconceptions, and help you understand what to expect when payday rolls around.

What is Considered a Second Job in Australia?

With rising living costs, many Australians are turning to second jobs for extra income. A second job is any work taken on in addition to a primary role and can include:

- Part-Time Employment: Flexible roles like retail, hospitality, or admin work that fit around a main job.

- Freelance and Contract Work: Specialised tasks such as graphic design, writing, or consulting done on a project basis.

- Gig Economy Jobs: On-demand work via platforms like Uber, DoorDash, or Airtasker for deliveries, ridesharing, or tasks.

- Tutoring and Teaching: Offering private lessons or teaching online in subjects like maths, science, or languages.

- Creative Pursuits: Monetising hobbies, such as selling handmade goods, art, or performing music.

- Household Services: Providing cleaning, gardening, or pet care services during spare hours.

- Community and Personal Care: Casual roles in aged care, personal care, or community services.

Key Statistics on Second Jobs in Australia

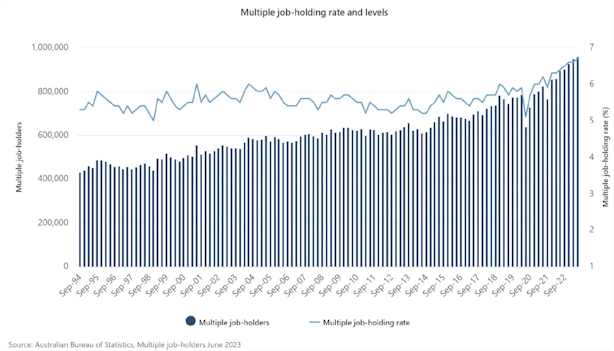

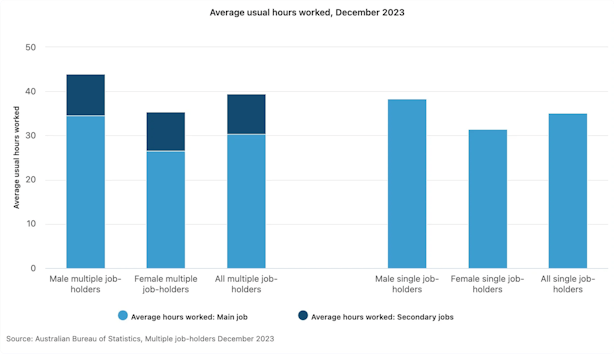

Second jobs are on the rise as Australians seek additional income to cope with economic pressures like inflation and slow wage growth. Here are some key findings:

⚡ As of September 2024, approximately 986,400 Australians (about 6.6% of the workforce) hold multiple jobs. This reflects a steady increase over recent years.

⚡ The Australian Bureau of Statistics (ABS) reports that:

- 7.7% of employed women hold multiple jobs

- 5.8% of employed men are multiple job-holders

⚡ Nearly 46% of Australians have indicated they are considering taking up a second job in the next year. Rising living costs are the primary driver of this trend.

⚡ Younger Australians, particularly those aged 20-24, are more likely to hold multiple jobs, with 8.7% engaged in additional work.

Understanding Tax Brackets in Australia

Australia uses a progressive tax system, which means the more you earn, the higher your tax rate. Here’s a breakdown of the current tax brackets:

Note: These rates do not include the Medicare levy of 2%, which is applied to most taxpayers.

What About Tax on a Second Job?

When you have a second job, the income from both jobs is combined to calculate your total taxable income. This total determines which tax bracket you fall into and how much tax you need to pay.

For example:

- If you earn $50,000 from your main job and $10,000 from your second job, your total taxable income is $60,000.

- This places you in the $45,001 – $120,000 bracket, where you pay the base tax of $5,092 plus 32.5 cents for every $1 earned over $45,000.

What Is Tax-Free Threshold with Multiple Jobs

The tax-free threshold in Australia is the first $18,200 of your annual income that isn’t taxed.

While this seems straightforward when you have one job, things get a bit more nuanced when you’re juggling two or more jobs at once.

If you’re earning income from multiple sources, you need to decide which job will claim the tax-free threshold, and this decision can impact how much tax is withheld from your pay.

Here’s what you need to know:

- Your primary job: Claim the tax-free threshold here. This ensures your main source of income benefits from the $18,200 tax-free portion.

- Your secondary job: Don’t claim the tax-free threshold. Instead, tax will be withheld at a higher rate, which helps cover your total income tax liability for the year.

Why does this matter?

If you incorrectly claim the threshold on both jobs, your employers won’t withhold enough tax.

When the ATO calculates your total income at the end of the year, you could end up with a tax bill to cover the shortfall.

Why Do Some People Pay More Tax with a Second Job?

The belief that a second job “costs more in tax” often comes from a misunderstanding of how the tax system works. To clear this up, let’s look at a different example involving a higher tax bracket.

Example:

James earns $100,000 per year from his first job. He decides to take on a second job, earning an additional $30,000 annually.

- First job income: $100,000

- Second job income: $30,000

- Total income: $130,000

James’s total income now pushes him into the $120,001–$180,000 tax bracket, where every dollar earned over $120,000 is taxed at 37 cents.

Here’s how it works:

1. On the first $120,000 of his income, James pays the tax as follows:

- Base tax: $29,467

- Plus 32.5 cents for every dollar over $45,000 (standard calculation for this bracket).

2. On the extra $10,000 above $120,000 (from his second job), James pays:

- 37 cents per dollar = $3,700 in tax.

💡 The Key Takeaway

James’s second job didn’t cause a higher tax rate; it’s his total income of $130,000 that pushed the additional earnings into the next tax bracket.

If James had earned the same $130,000 from just one job, the tax calculation would have been identical.

The second job itself isn’t taxed at a higher rate – it’s the combined income that determines which portion of earnings gets taxed at higher rates.

This example shows that while your overall tax increases as you earn more, the tax system applies the same rules to all your income, regardless of how many jobs you have.

How to Handle Tax Withholding on Your Second Job

To avoid surprises at tax time, you need to ensure your employers are withholding the right amount of tax. Here’s how to do that:

1. Choose the right job for the tax-free threshold

- Claim the threshold on the highest-paying job.

- Don’t claim it on any additional jobs because they’ll withhold tax at a higher rate automatically.

2. Ask for extra tax to be withheld

If you’re earning a significant amount from your second job, you can request your employer to withhold extra tax to cover any potential shortfall.

This is especially helpful if you’ve experienced a tax bill in previous years.

3. Submit a Withholding Declaration

If your income situation changes (e.g., you start earning more or less), complete a Withholding Declaration form. This notifies your employer to adjust your tax withholding.

What If You Earn Less Than $18,200 Combined?

If you’re confident your total annual income from all jobs combined will be under $18,200, you can claim the tax-free threshold on both jobs. This ensures no tax is withheld during the year, which keeps more money in your pocket.

However, if your income unexpectedly increases and surpasses $18,200, you’ll need to act quickly. Provide a Withholding Declaration to one of your employers to stop claiming the threshold and avoid a tax debt.

Example:

Jack works two casual jobs, earning $10,000 from his first job and $6,000 from his second. Since his total income is $16,000, he claims the tax-free threshold on both jobs.

Midway through the year, Jack takes on more shifts, increasing his income to $20,000.

He submits a Withholding Declaration to his second employer, ensuring the correct tax is withheld for the rest of the year.

Too Much Tax? You’ll Get a Refund

If you’ve played it safe and paid more tax than necessary, for example, by not claiming the tax-free threshold on your second job, you won’t lose out.

At tax time, the ATO calculates your total tax liability and refunds any excess tax withheld.

Example:

Lisa earns $12,000 from her first job and $8,000 from her second.

She doesn’t claim the tax-free threshold on her second job, so her employer withholds $1,520 in tax over the year.

At tax time, her total income of $20,000 means she owes $342 in tax. Since Lisa has already paid $1,520, she receives a refund of $1,178.

Too Little Tax? Prepare for a Bill

The opposite can also happen. If you claim the tax-free threshold on multiple jobs when your income exceeds $18,200, your employers may under-withhold tax.

In this case, you’ll owe the difference at tax time.

To prevent this:

- Monitor your combined income throughout the year.

- Adjust your withholding early if you’re earning more than expected.

Can You Have a Second Job as a Business Owner?

Yes, in Australia, you can be a business owner and have a second job simultaneously.

Many individuals choose to operate a business while maintaining employment for various reasons, including financial security and the desire to pursue entrepreneurial interests.

Here’s an overview of the considerations and implications involved:

- No legal restrictions: There are no specific laws in Australia that prohibit individuals from being employed while also running their own business. Many entrepreneurs start their businesses while still working full-time or part-time jobs.

- Employment contracts: It is crucial to review your employment contract for any clauses related to secondary employment or conflicts of interest. Some employers may have policies that restrict employees from engaging in similar business activities that could compete with their interests. To maintain transparency and avoid misunderstandings, companies can also implement an employee engagement solution to foster open communication, clarify policies, and ensure employees feel supported in balancing their professional goals with organizational expectations.

- Conflict of interest: If your business operates in the same industry as your employer, you must ensure that there is no conflict of interest. This could involve disclosing your business activities to your employer.

Tax implications

- Combined income: Both your salary from your job and profits from your business will be considered part of your total taxable income.

- Tax-free threshold: When you have multiple income sources, you can only claim the tax-free threshold (currently $18,200) on one income stream. This typically should be claimed on the higher-paying job to minimise tax deductions from your paychecks.

- Deductions for business expenses: As a business owner, you can claim deductions for legitimate business expenses, which can help reduce your overall taxable income. This includes costs related to supplies, marketing, and operational expenses.

- Quarterly tax payments: If you're self-employed, you may need to make quarterly tax payments to the Australian Taxation Office (ATO) based on your expected income from both your job and business.

Planning Ahead: Managing Tax on Multiple Jobs

Here are a few tips to stay on top of your taxes when you have more than one job:

Is Working Two Jobs Worth It?

Ultimately, it comes down to what matters to you:

- Do you need extra money? If so, a second job can be a great way to boost your income.

- Work-life balance: It might not be worth the extra stress if you feel burnt out or stretched thin.

Your tax increases because you earn more, not because you have two jobs. All that matters at tax time is your total income, regardless of how many jobs you worked to earn it.

The key to avoiding stress is managing your tax-free threshold correctly, staying aware of your total earnings, and ensuring enough tax is withheld throughout the year.

How Can ANNA Help Business Owners Manage Tax When Taking a Second Job?

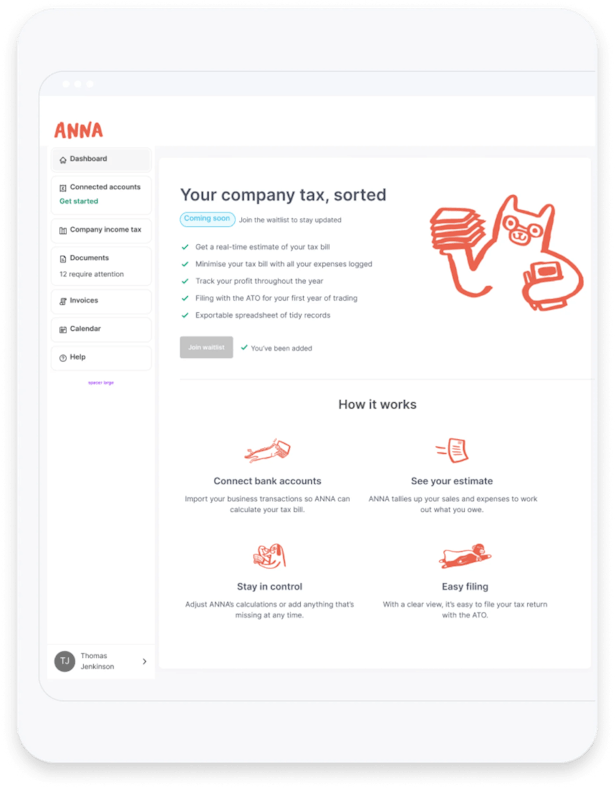

Managing your tax obligations can quickly become overwhelming if you’re a business owner juggling a second job. Here’s how ANNA can help:

1. Centralised Document Management for Clarity

When balancing income from your business and a second job, you’re likely managing multiple receipts, invoices, and documents. ANNA makes this simple by storing all your business documents, including receipts and invoices, in one place.

How it helps:

ANNA’s system automatically matches receipts with transactions, extracts key details, and categorises expenses. This reduces the stress of manually tracking your income sources and ensures everything is tidy and easy to access.

For example, if you’re earning wages from a second job while managing business expenses, ANNA will help organise these records so you can claim accurate deductions at tax time.

2. Automatic Tax Calculation and Forecasting

Understanding how much tax you’ll owe can be tricky when you’re juggling multiple income streams. ANNA’s automatic tax calculations take the guesswork out of the process.

- Income tax insight: ANNA gives you a clear breakdown of your expected company income tax based on your business’s income and expenses. This makes it easier to plan your budget and forecast your tax bill accurately.

- GST simplification: If you’re running a business registered for GST, ANNA calculates GST automatically and logs it directly with the ATO. This ensures compliance without adding more to your already busy schedule.

If you earn $60,000 in total — $30,000 from your business and $30,000 from your second job – ANNA helps you understand how tax is applied to both income streams and ensures GST is correctly reported for your business activities.

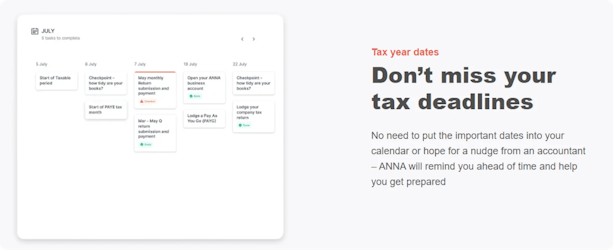

3. Personalised Tax Calendar for Timely Compliance

Missing a tax deadline can lead to penalties and unnecessary stress, especially when managing both a second job and a business. ANNA provides a personalised tax calendar that tracks your tax obligations, from BAS to income tax deadlines.

How it helps:

ANNA sends reminders to ensure you never miss a payment or reporting date, keeping you compliant with the ATO.

If your second job means you’re earning more and moving into a higher tax bracket, staying ahead of deadlines ensures you avoid last-minute scrambles and costly mistakes.

4. Annual Tax Returns and Expert Support

Filing your annual company tax return or BAS can feel overwhelming when you’re balancing multiple income sources. With ANNA:

- Your tax statements (like the BAS) are lodged on your behalf, giving you peace of mind.

- Expert accountants are available to answer any questions you might have, from income reporting to tax offsets.

If you’re unsure whether to claim the tax-free threshold on your second job or how business expenses affect your overall taxable income, ANNA’s friendly support team can guide you through the process.

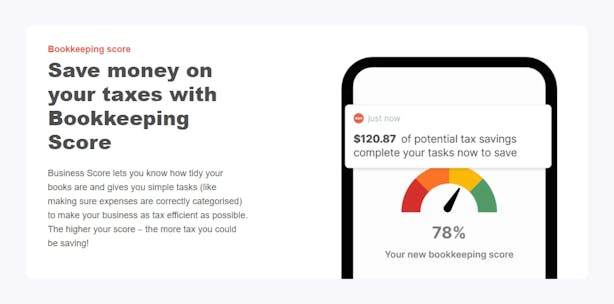

5. Efficient Bookkeeping and Tax Relief

Good bookkeeping is essential for claiming accurate deductions and ensuring you’re paying only the tax you owe. ANNA offers:

- A Bookkeeping Score to help you stay organised and tidy up your records.

- Receipt Matching to categorise expenses automatically, making sure you claim every deduction you’re entitled to.

How it helps:

When your total income – business and wages – is combined, deductions can reduce your taxable income and offset some of the higher tax rates applied to your earnings. ANNA ensures nothing slips through the cracks.

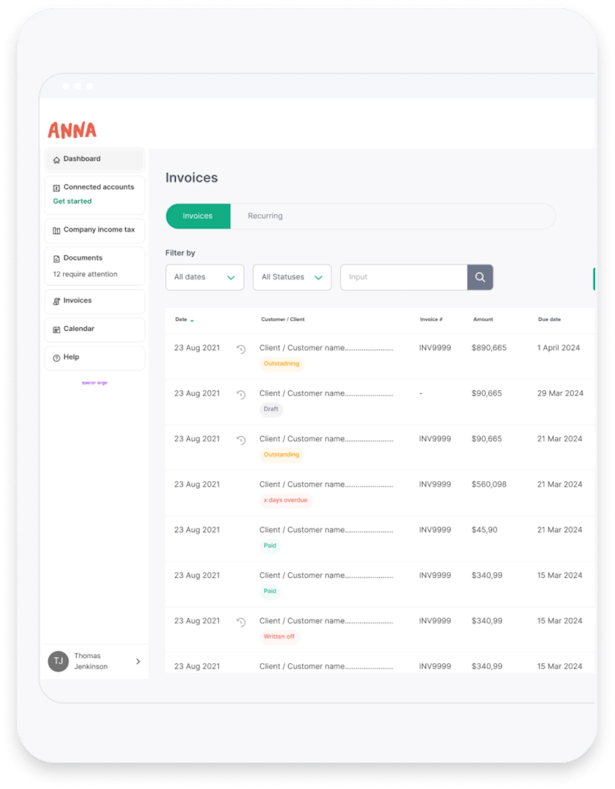

6. Faster, More Professional Invoicing

If your business income relies on client payments, unpaid invoices can disrupt your cash flow and create financial stress. ANNA enables you to:

- Create professional invoices in seconds.

- Automatically chase overdue invoices on your behalf, ensuring you get paid sooner.

With ANNA, managing multiple income streams doesn’t have to be complicated. It’s all about clarity, efficiency, and peace of mind.

Ready to simplify your tax and stay in control?

Sign up for ANNA today and take the stress out of managing your business and second job income. From automatic tax calculations to expert support, ANNA has you covered every step of the way!