Discover Xero alternatives in Australia, comparing features and pricing to help you choose the best accounting software for your business needs.

- In this article

- 1. ANNA – Everything You Need to Grow Happy Business

- 2. Sage Business Cloud Accounting: A Scalable Solution for Growing Businesses

- 3. Kashoo: Simple, Straightforward Accounting for Small Businesses and Freelancers

- 4. Zoho Books: A Versatile and Affordable Solution for Small Businesses

- Finding the Right Xero Alternative

Xero has cemented its position as a leading accounting solution for small to medium-sized enterprises (SMEs) in Australia, thanks to its comprehensive feature set and ease of use. However, it’s not the only option in the market.

Many businesses, particularly those with smaller budgets, are exploring other solutions that might be a better fit for their specific requirements.

This guide will walk through four notable (but less known) Xero alternatives: ANNA, Sage Business Cloud Accounting, Kashoo, and Zoho Books.

Each platform offers distinct advantages, different pricing plans, and various levels of functionality tailored to specific business types.

1. ANNA – Everything You Need to Grow Happy Business

ANNA is not just an accounting tool; it’s a comprehensive business solution designed specifically for Australian entrepreneurs and small business owners.

With its streamlined approach, ANNA One simplifies the complex process of setting up, managing, and growing a business.

It goes beyond traditional accounting software with unique features like seamless business registration services, automated bookkeeping and invoicing, and even personalized tax support.

How It Works:

ANNA takes all the groundwork needed to establish and operate a business legally in Australia. It handles everything from obtaining an Australian Company Number (ACN) and Australian Business Number (ABN) to registering a business name.

After the initial setup, ANNA’s integrated platform helps automate invoicing, bookkeeping, GST management, and BAS (Business Activity Statement) lodgement, saving business owners from countless hours of manual admin.

Key Features:

- Company Registration: Register your company and get your ACN and other ASIC documents sent directly to your inbox in a matter of hours.

- ABN and Business Name Registration: Set up your ABN, whether you’re a company or a sole trader, and secure your business name to start trading legally.

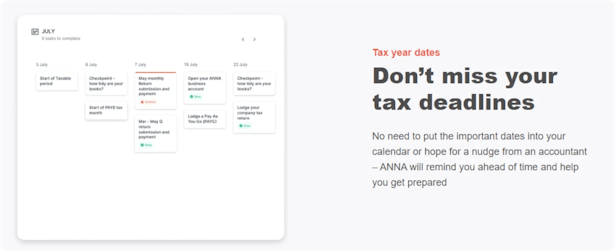

- Tax Management: Automate GST calculations, track key tax dates with a personalized tax calendar, and manage BAS submissions effortlessly.

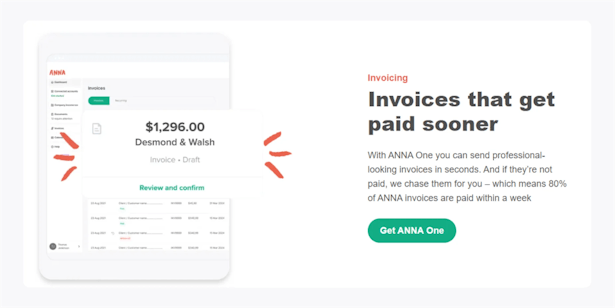

- Bookkeeping & Invoicing: ANNA provides professional invoicing templates, automatic follow-ups, and real-time bookkeeping, ensuring accuracy and compliance.

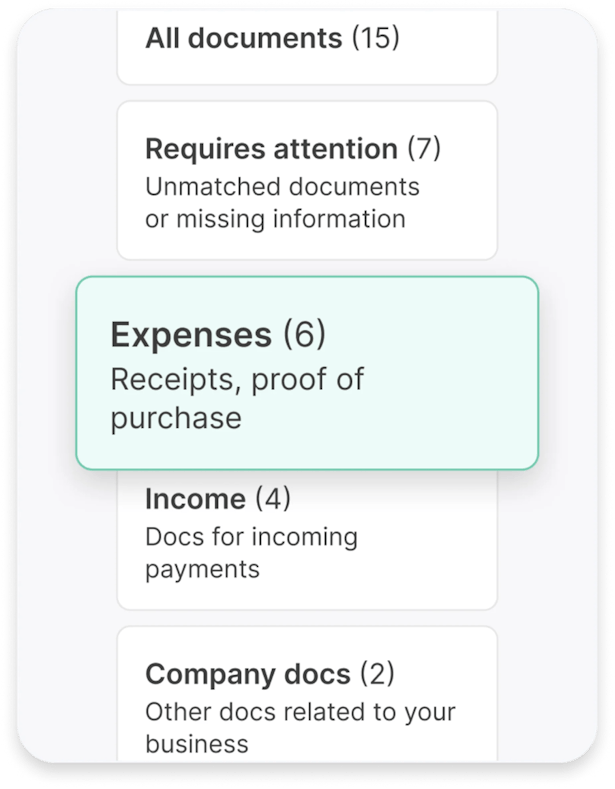

- Document Storage: Securely store all your receipts, invoices, and important business documents for easy access and better organization.

- Virtual Office Address: Keep your personal address private and scam-free.

- Expert Support: Get guidance from a friendly support team and experienced accountants to resolve queries and navigate any business challenges.

Pricing:

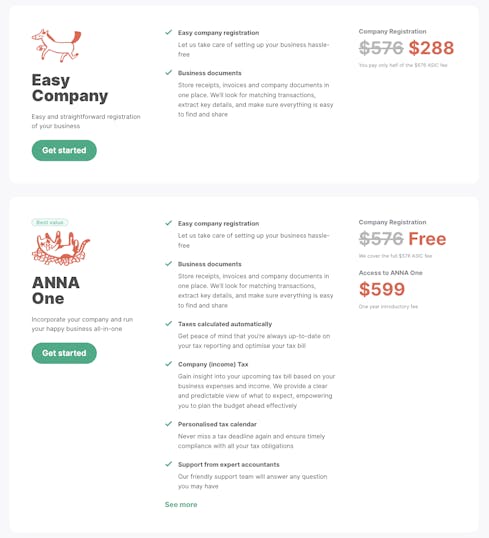

ANNA offers two budget-friendly packages for company registration, both covering ASIC fees, making it an affordable solution for new businesses to get started on the right foot.

Ideal For:

ANNA is perfect for start-up founders, entrepreneurs, and small business owners in Australia looking to simplify the process of business registration, bookkeeping, and tax management in a single integrated solution.

2. Sage Business Cloud Accounting: A Scalable Solution for Growing Businesses

Sage Business Cloud Accounting is a comprehensive cloud-based platform built for small to medium-sized businesses that need a reliable tool to manage their finances.

Known for its solid set of features and scalability, Sage is an excellent choice for companies that expect to grow and need a solution that can grow with them.

Key Features

- True Cloud Solution: Sage Intacct is built entirely in the cloud, providing users with accessibility from anywhere and ensuring automatic updates without the need for manual installations.

- Multi-Dimensional Reporting: Users can generate hundreds of real-time reports and dashboards that allow for in-depth analysis across various dimensions, helping organizations make data-driven decisions.

- Multi-Entity Consolidation: This feature enables businesses with multiple entities to consolidate their financials easily, simplifying the reporting process and ensuring compliance across all operations.

- Integration Capabilities: Sage Intacct can seamlessly connect with other business tools such as Salesforce, enhancing data flow and reducing manual data entry efforts.

- General Ledger Outlier Detection: This tool helps identify anomalies in financial data, improving accuracy and reducing the risk of errors.

- Interactive Reporting Tools: Users can create customized reports that cater to specific business needs, enhancing visibility into financial performance.

- Industry-Specific Solutions: Sage Intacct is adaptable to various industries, allowing businesses to tailor the software according to their unique requirements.

- Compliance and Security: The platform is AICPA preferred and HIPAA compliant (with an advanced audit trail), ensuring that sensitive financial data is protected.

Pricing:

The price is available upon request.

Ideal For:

Sage Business Cloud Accounting is ideal for small to medium-sized enterprises that need a scalable solution with robust cash flow management tools.

It stands out as a powerful alternative to Xero due to its extensive features tailored for complex financial environments, robust reporting capabilities, and flexibility in integration with other business systems.

3. Kashoo: Simple, Straightforward Accounting for Small Businesses and Freelancers

Kashoo is an intuitive accounting software for small business owners and freelancers.

With a focus on simplicity, it’s designed for those who prefer a straightforward, no-frills approach to bookkeeping without sacrificing essential features.

Key Features:

- User-Friendly Interface: Kashoo’s interface is simple and clean, making it easy to navigate for users with minimal accounting experience.

- Invoicing: Create and send invoices quickly to maintain professional relationships with clients.

- Expense Tracking: Automatically imports expenses from bank accounts, reducing the need for manual data entry.

- Real-Time Reporting: Generate up-to-date financial reports for better decision-making.

- Multi-Currency Support: Supports businesses dealing with international clients and vendors by facilitating transactions in multiple currencies.

While Kashoo is a Canadian-based accounting software, it is designed for global use and offers functionalities that cater to the needs of Australian businesses.

Its support for multi-currency transactions, real-time reporting, and expense tracking makes it versatile for business owners outside North America.

Key Considerations for Using Kashoo in Australia:

- Currency and Localization: Kashoo supports multi-currency functionality, allowing you to handle transactions in Australian dollars (AUD) and any other foreign currencies you might deal with. However, it’s essential to ensure that all settings are configured correctly for your local currency and accounting standards.

- GST Compliance: Although Kashoo does not have built-in Australian-specific tax compliance features like automatic GST calculations or BAS (Business Activity Statement) lodgement, you can still manually set up GST tax codes to track GST on your invoices and expenses. This means you’ll have to perform some additional tasks to ensure accurate GST reporting.

- Bank Integrations: Kashoo supports bank feeds from various financial institutions worldwide. It’s advisable to check with Kashoo’s support or their website to confirm whether your specific Australian bank is compatible for automated bank feed connections.

- Invoicing and Reporting: Kashoo allows you to customize invoices with Australian standards, and you can adjust your reporting formats as needed. This flexibility ensures that your invoices and financial reports meet Australian business requirements.

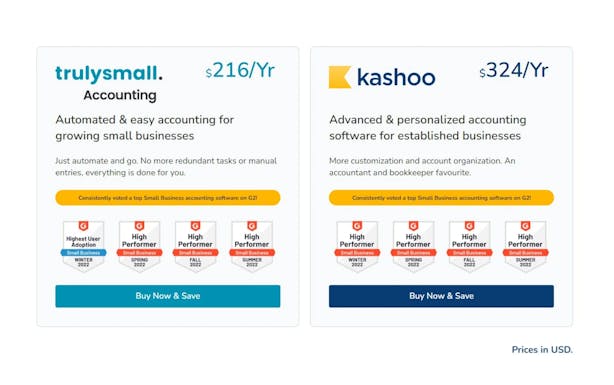

Pricing:

Kashoo offers two pricing plans:

- TrulySmall Accounting - $216/year (USD), ideal for small businesses needing basic automated accounting.

- Kashoo Advanced - $324/year (USD), suited for established businesses requiring more customization and advanced features.

Ideal For:

Kashoo is best suited for those looking for a straightforward and cost-effective accounting tool that covers essential features without overwhelming complexity.

4. Zoho Books: A Versatile and Affordable Solution for Small Businesses

Zoho Books is part of the broader Zoho suite of business applications, making it a perfect fit for companies already using other Zoho tools.

Its comprehensive accounting features, combined with deep integrations with Zoho CRM, inventory, and other applications, provide a unified platform for managing various aspects of a business.

Key Features:

- Automated Workflows: Zoho Books streamlines recurring tasks like invoicing and expense tracking, saving time and reducing the risk of human error.

- Multi-Currency Support: Facilitates international transactions for businesses operating across borders.

- Customizable Reports: Generate detailed financial reports to gain deeper insights into business performance.

- Client Portal: Enhances client communication by allowing customers to view invoices, make payments, and access statements through a secure portal.

- Integration with Zoho Ecosystem: Seamlessly connects with other Zoho apps like Zoho CRM, making it easier to manage sales, inventory, and more.

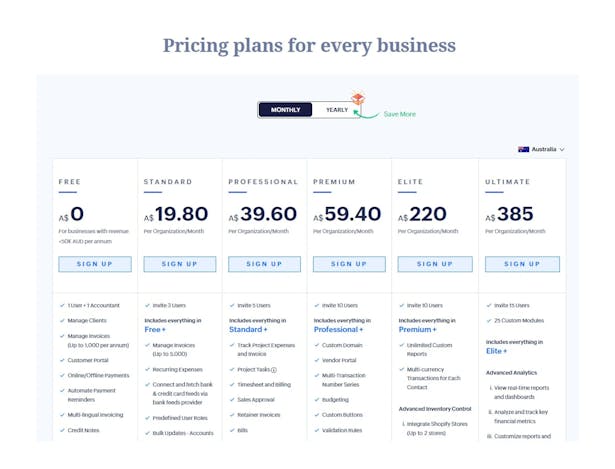

Pricing:

Zoho Books offers Free and 5 pricing plans, from Standard at AUD 19.80 to Ultimate for AUD 385 per month.

Ideal For:

Zoho Books is a great choice for small businesses looking for a comprehensive accounting tool that integrates with other business systems. It’s particularly beneficial for those who are already using or considering the Zoho suite.

Finding the Right Xero Alternative

While Xero remains a popular choice in Australia, exploring alternatives can reveal options that might align more closely with your business needs.

Key Considerations:

- Business Size and Growth: Some solutions, like Sage, are designed for scalability, making them a good fit for more demanding businesses. Others, like Kashoo, are tailored to freelancers and small service-based businesses.

- Feature Requirements: Determine which features are essential for your business, such as project management, GST and expense tracking, or multi-currency support.

- Budget Constraints: Evaluate the pricing plans to see which option provides the best value for your investment.

However, ANNA, with its holistic business management approach, leads the pack by offering a comprehensive toolset for starting and growing a business in Australia.

Ultimately, choosing the right solution will depend on your unique business requirements and priorities.

If ANNA One aligns with your needs, take the next step today – sign up now to simplify your business operations and manage your accounting with ease.