Discover the differences between Xero and MYOB, comparing features, pricing, and usability to help you choose the best accounting software.

In the Australian market, two well-established giants, Xero and MYOB, often dominate the "Which accounting tool to use?" conversation.

Each provides a rich suite of tools to streamline invoicing, payroll, and reporting. But with so many overlapping features, how do you decide which best fits your needs?

In this guide, we'll examine Xero vs MYOB in depth, breaking down their unique offerings to help you decide which platform best aligns with your business goals.

And if you're looking for something a little different, we'll also introduce you to ANNA, an emerging alternative that combines business banking with financial management, making it a powerful choice for small business owners and freelancers.

By the end of this comparison, you'll have a clearer understanding of what each platform brings to the table – and which one will help your business thrive. Let's get started!

Xero: A Robust Solution for Modern Businesses

Xero is a cloud-based accounting software that simplifies financial management for small and medium-sized businesses.

With its intuitive interface, Xero makes it easy to track your business finances in real time, automate tedious tasks, and stay on top of your cash flow.

With seamless integrations with your bank accounts, advisors, and financial data, Xero offers a comprehensive suite of tools to make financial management efficient and effective.

Top Features That Set Xero Apart

1. Invoicing & Quotes

- Create and send professional invoices from any device.

- Automate payment reminders and track statuses.

- Accept payments via credit card, debit card, or direct debit.

- Generate and convert professional quotes into invoices seamlessly.

2. Banking & Reconciliation

- Link to over 21,000 banks globally for automated transaction imports.

- Match transactions automatically for streamlined bank reconciliation.

- Track and pay bills directly, gaining clear visibility into accounts payable.

3. Reporting & Analytics

- Real-time financial reports for quick insights into business performance.

- Cash flow forecasts and advanced analytics for strategic decision-making.

- Customizable accounting dashboard to track key financial metrics.

4. Document Management

- Store and manage receipts, contracts, and bills in one secure location.

- Use Hubdoc integration for automatic document capture and data extraction.

5. Expense & Purchase Management

- Capture and track business expenses and automate claims and approvals.

- Create, manage, and track purchase orders with real-time updates.

6. Payroll & Employee Management

- Automate payroll processing for small teams.

- Calculate wages, taxes, and superannuation with compliance assured.

- Manage employee leave, timesheets, and pay schedules.

7. Inventory Management

- Monitor stock levels and automate reordering.

- Populate invoices and orders directly from inventory items.

8. Project & Job Tracking

- Track project costs, timelines, and profitability in real-time.

- Plan budgets, record time, and monitor expenses for each project.

9. Multi-Currency Support

- Manage transactions in multiple currencies with real-time conversion.

- Simplify international invoicing and payments for global operations.

9. Contact Management

- Centralize customer and supplier details for easy tracking.

- Manage sales, invoices, and payment history in a single view.

10. Fixed Asset Management

- Track and manage fixed assets, including depreciation schedules.

- Collaborate with your accountant for accurate asset records.

11. Integrations

- Integrate with 1,000+ third-party apps for CRM, eCommerce, and more.

- Extend functionality with specialized tools and services.

12. Mobile Accessibility

- Manage accounting tasks on the go with the Xero mobile app.

- Capture expenses, send invoices, and view reports from your phone.

13. Sales Tax Automation

- Calculate sales tax automatically for accurate reporting.

- Prepare sales tax returns with minimal manual effort.

Who Should Use Xero?

Xero is perfect for service-based businesses, eCommerce stores, and companies with complex inventory or project management needs.

Its powerful integration capabilities make it highly adaptable for growing businesses that may want to connect to multiple systems as they scale.

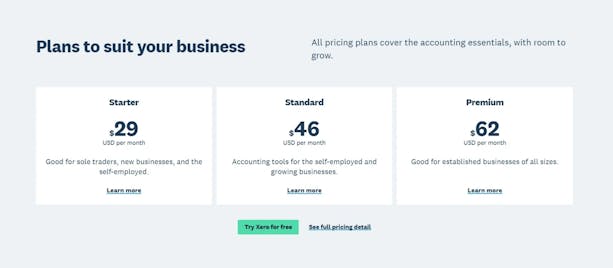

Xero Pricing

Xero offers three pricing tiers – Starter, Standard, and Premium.

The plans range from a basic option for sole traders, new businesses, and the self-employed to more advanced tiers for established businesses needing additional features like multi-currency support.

A 30-day free trial lets you explore all the features before making a decision.

Pros:

- Easy-to-use interface with a focus on simplicity.

- Real-time bank feeds and automated data entry save time.

- Strong project tracking and job management features.

- Comprehensive reporting with customizable options.

- Extensive third-party app integrations.

Cons:

- It may be expensive for very small businesses.

- Some advanced features can be overwhelming for beginners.

- Payroll features might not be robust enough for larger teams.

MYOB: An All-in-One Powerhouse for Growing Businesses

MYOB is a long-standing player in the accounting software industry, known for its comprehensive approach to business management.

MYOB provides a full suite of tools beyond traditional accounting, offering payroll, inventory, and detailed financial reporting features.

It is a good fit for businesses of all sizes, from sole traders to larger enterprises, making it a versatile solution for complex business needs.

Top Features That Make MYOB Stand Out

1. Accounting & Financial Management:

- Invoicing: Create, send, and track unlimited invoices and quotes. You can also accept payments via multiple methods like credit cards and direct debit.

- Bank Reconciliation: Automatic bank feeds from linked accounts allow real-time transaction updates, reducing manual data entry.

- Tax Management: Automates GST tracking and BAS lodgment, ensuring your business complies with ATO requirements.

2. Payroll Management:

- Payroll for Small and Large Teams: Supports automated pay runs, wage calculations, and tax withholdings.

- Single Touch Payroll (STP): Report payroll information directly to the ATO to stay compliant with Australian tax regulations.

- Employee Self-Service: Employees can access payslips, update details, and request leave online, reducing admin time.

3. Inventory & Order Management:

- Real-Time Stock Tracking: Provides accurate inventory levels, helps manage reorder points, and reduces the risk of stockouts.

- Multi-Warehouse Management: Track and transfer stock between multiple warehouses and optimize inventory across locations.

- Bill of Materials (BOM): Manage complex production workflows and costing for manufacturing operations.

4. Project & Job Tracking:

- Job Costing: Monitor costs associated with specific jobs, track time, and manage resources.

- Profitability Analysis: Provides insights into project profitability, making it ideal for industries like construction and field services.

5. Reporting & Analytics:

- Customizable Reports: Generate cash flow, profit and loss, and balance sheet reports with customizable templates.

- Advanced Analytics: Detailed forecasting and scenario planning tools help in strategic decision-making.

6. Scalability & ERP Solutions:

- MYOB Advanced (Acumatica): Tailored for larger enterprises needing comprehensive ERP functionality, such as financial management, project accounting, and multi-entity support.

- Industry-Specific Solutions: MYOB offers targeted features for industries like construction, retail, manufacturing, and non-profits.

7. Mobile Accessibility:

- Manage your finances on the go using MYOB's dedicated mobile apps. The MYOB Capture app allows for easy receipt management, and the MYOB Invoice app helps you create and manage invoices from mobile devices.

8. CRM & Integrations:

- Customer Management: Manage customer details, track communication history, and enhance client relationships.

- Integration Marketplace: Choose from a wide range of third-party apps, including CRM, eCommerce, and time-tracking tools, to extend MYOB's capabilities.

Who Should Use MYOB?

MYOB is ideal for businesses needing more advanced functionality, such as product-based businesses requiring detailed inventory management or companies anticipating rapid growth.

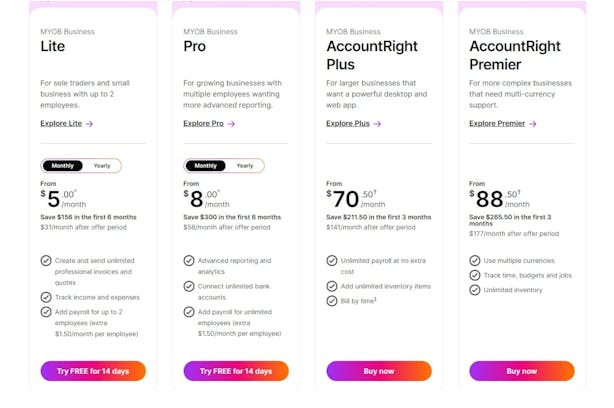

MYOB Pricing

MYOB offers a variety of pricing plans to accommodate businesses of all sizes. While its pricing is competitive for larger companies, it may be on the higher end for very small businesses or sole traders.

MYOB's pricing is structured into various tiers:

- MYOB Business Lite: Starting at $5/month, ideal for sole traders and small businesses with basic accounting needs.

- MYOB Business Pro: Starting at $8/month, includes more advanced features like multi-user access and payroll.

- MYOB AccountRight Plus: From $70.50/month, suitable for larger businesses needing more robust inventory and payroll capabilities.

- MYOB AccountRight Premier: From $88.50/month, designed for complex businesses requiring multi-currency support and advanced job tracking.

Pros:

- It can grow with your business, making it suitable for everything from small startups to large enterprises.

- Offers tailored features for specific industries, allowing businesses to optimize their workflows.

- Strong automation features reduce manual work and ensure compliance with tax and payroll regulations.

Cons:

- MYOB can be challenging for new users due to its extensive feature set.

- The higher-tier plans can be costly, making them less suitable for small businesses with basic needs.

- MYOB's custom integration capabilities may be limited compared to Xero.

ANNA: The Fresh Alternative for Hassle-Free Financial Management

Xero is a great fit if you're looking for advanced reporting, project management, and scalability. Conversely, MYOB is a better option if you need comprehensive inventory management, robust payroll, and multi-location support.

However, if you're just starting and want an all-in-one platform that covers not only accounting but also business registration, banking, and tax automation, ANNA is a strong contender.

Built specifically for small businesses, freelancers, and entrepreneurs, ANNA combines everything you need into one intuitive package, making financial management feel effortless.

Why Choose ANNA?

ANNA is designed for business owners who want simplicity without sacrificing functionality.

With its easy setup and automated tools, ANNA handles everything from company registration to tax compliance, making it perfect for those who want a one-stop solution for managing their business finances.

Top Features That Make ANNA Unique

- Hassle-Free Company Registration: Set up your business quickly and easily, with step-by-step assistance to guide you through the entire process.

- Organized Document Management: Store, organize, and retrieve receipts, invoices, and business documents all in one place, with automated transaction matching for easy bookkeeping.

- Automated Tax Calculations: ANNA handles your tax calculations, offers a personalized tax calendar, and provides clear insights into company tax obligations.

- Professional Invoicing: Create and send polished invoices quickly, with automated follow-ups to ensure you get paid on time.

- Bookkeeping Assistance: ANNA's "Bookkeeping Score " offers insights and tips for improving your financial records.

- Expert Support: Access expert advice for tax queries, compliance, and more, so you're never left guessing when it comes to financial management.

Who Should Use ANNA?

ANNA is perfect for those who seek a streamlined solution that handles multiple business functions without the steep learning curve of traditional software.

- User-friendly: ANNA is incredibly intuitive and easy to master. You can get started right away, even if you don't have an accounting background.

- All-in-One Solution: ANNA covers everything – from business setup to bookkeeping and tax automation – so you won't need multiple tools. It's one platform that handles it all.

- Built for Entrepreneurs: ANNA's design and features are tailored specifically to the needs of small business owners, freelancers, and sole traders, making it more than just accounting software – it's your financial assistant.

- Personalized Support and Guidance: ANNA doesn't just leave you to figure it out alone. With built-in expert support, ANNA provides professional advice whenever you need it.

Ready to transform the financial management of your business?

Get started with ANNA today!