Explore the differences between Xero and QuickBooks, comparing features, pricing, and usability to help you choose the best accounting software.

In the quest for the ideal accounting software, small business owners often find themselves comparing Xero and QuickBooks Online – two of the frontrunners in cloud-based accounting solutions.

In this guide, we will compare the specifics of each platform, helping you decide which software might be the best fit for your business needs.

Overview of Xero and QuickBooks Online

Both Xero and QuickBooks Online are designed to enhance the financial management of small to medium-sized businesses, providing a clear view of accounting operations, maximising tax deductions, and enabling efficient project and time tracking.

They cater to a similar market, including small businesses, agencies, retail stores, and startups. However, larger enterprises with complex needs might find them less accommodating.

Xero:

Founded in 2006 in New Zealand, Xero has made a name for itself with a sleek, user-friendly interface that belies powerful under-the-hood capabilities.

Known for its tagline "Beautiful business," Xero is especially popular among startups due to its clean usability and strong average reviews.

QuickBooks Online:

QuickBooks Online is a product of Intuit and is the cloud-based version of QuickBooks.

It dominates the US market with an estimated 80% share, favoured particularly by accountants for its comprehensive feature set and ease of use.

QBO is designed to simplify many repetitive tasks and is highly regarded for helping users manage their business finances more efficiently.

Key Differences Between Xero and QuickBooks Online

- User Interface: Both platforms offer intuitive dashboards with a quick overview of key business metrics. QuickBooks boasts a simple, customisable layout, while Xero offers a minimalist vibe aligned with its overall design ethos.

- Ease of Use: Xero and QuickBooks are both user-friendly and offer extensive banking integrations. However, Xero has improved significantly, matching QuickBooks in terms of ease of setup and bank syncing.

- Customer Support: Both platforms could improve in this area, but they generally receive positive reviews for their user support.

Xero Features

Xero's comprehensive suite of features is designed to streamline and enhance the accounting processes for small businesses, accountants, and bookkeepers.

Here's an overview of the key features that Xero offers to empower business growth and financial management:

- Comprehensive Online Accounting: Manage invoicing, payments, reporting, and analytics all in one platform, with robust support for bank connections to over 21,000 institutions for automated feeds and easy reconciliation.

- Efficient Payment and Invoicing System: Accept payments via multiple methods, including credit, debit, and direct debits. Automate and manage invoices easily, allowing for on-the-go billing and reminder setups from any device.

- Expense and Purchase Order Management: Streamline expense submission, management, and reimbursement. Create, manage, and track digital purchase orders seamlessly.

- Integrated Payroll and HR Functions: Simplify payroll processes, manage pay runs, and generate detailed payroll reports, complemented by tools for managing fixed assets and sales tax calculations.

- Project and Inventory Tracking: Utilise detailed tools for project budgeting, cost tracking, and client invoicing. Manage inventory levels and integrate stock information into business operations.

- Advanced Reporting and Analytics: Leverage powerful reporting capabilities for real-time financial tracking and analysis with advanced analytics tools to forecast cash flow and assess business metrics.

- App and Service Integrations: Enhance functionality with a wide range of app integrations, facilitating tailored solutions for diverse business needs.

- Client and Document Management: Keep detailed contact management records, store and share documents securely online, and automate data capture with Hubdoc integration.

- Mobile and Remote Accessibility: Access financial data, manage operations, and send quotes through the Xero Accounting App, ensuring productivity from anywhere.

Quickbooks features

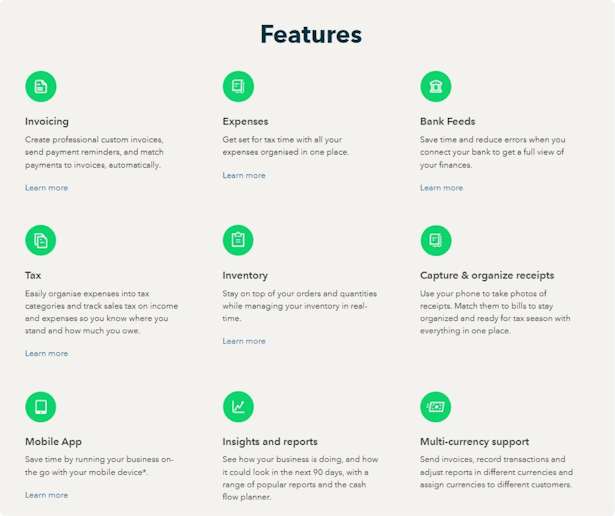

QuickBooks Online (QBO) also offers various features to simplify and enhance the financial management processes for businesses of all sizes.

Here’s a detailed look at the key functionalities that QuickBooks provides:

- Invoicing: QuickBooks allows users to create professional, customisable invoices. It also offers features to send payment reminders and automatically match payments to invoices, streamlining the accounts receivable process.

- Expenses: Organise all your expenses in one place to simplify tax preparation. QuickBooks categorise expenses, making it easier to manage deductions and financial reports.

- Bank Feeds: Connect your bank accounts to QuickBooks to automatically import and categorise transactions. This integration saves time and reduces errors, giving you a complete view of your finances.

- Tax Management: QuickBooks helps organise expenses into tax categories and tracks sales tax on both income and expenses. This feature simplifies the process of understanding tax liabilities and preparing for tax filings.

- Inventory Management: Manage your stock with real-time tracking of orders and inventory levels. This feature helps maintain accurate stock counts and optimise inventory handling.

- Receipt Capture and Organisation: Use the mobile app to take photos of receipts and match them to expenses, keeping your financial records organised and tax-ready.

- Mobile App: Run your business on the go using the QuickBooks mobile app. This tool allows for managing finances from your mobile device, enhancing flexibility and efficiency.

- Insights and Reporting: Gain insights into your business performance with a variety of reports. QuickBooks also offers a cash flow planner to forecast your financial status over the next 90 days, aiding in more informed decision-making.

- Multi-Currency Support: Handle transactions in multiple currencies, send invoices, record payments, and adjust financial reports in different currencies. Assign specific currencies to different customers to streamline global operations.

- Software Migration: If you’re switching from another accounting software like Xero, Excel, Sage, Wave, or FreshBooks, QuickBooks offers tools and support to transition smoothly to QuickBooks Online.

Xero vs Quickbooks – Feature Comparison

1. Invoicing:

Both Xero and QuickBooks provide reliable invoicing features.

Xero allows for easy invoice creation and previews, while QuickBooks offers more direct client detail editing within invoices.

2. Expenses and Bills:

Both have excellent mobile apps for managing receipts and expenses on the go.

QuickBooks incorporates expense tracking in all plans, which could be more cost-effective for small businesses than Xero’s plan-specific features.

3. Reporting:

QuickBooks generally offers more detailed and customisable reporting tools compared to Xero. However, Xero provides unique reports like the Cash Flow Statement and Business Snapshot, offering valuable insights into financial health.

4. Integrations:

Both platforms support a wide array of integrations with other business tools, including CRMs, email marketing tools, and more specialised accounting functionalities like inventory management.

Scalability and Suitability

While both are suited for small to mid-sized businesses, Xero is particularly favoured by growing startups due to its scalability and comprehensive features that support business expansion. QuickBooks, on the other hand, is preferred for businesses that prioritise advanced reporting and budgeting features.

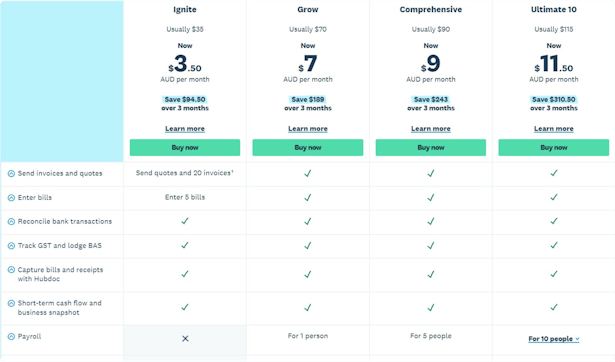

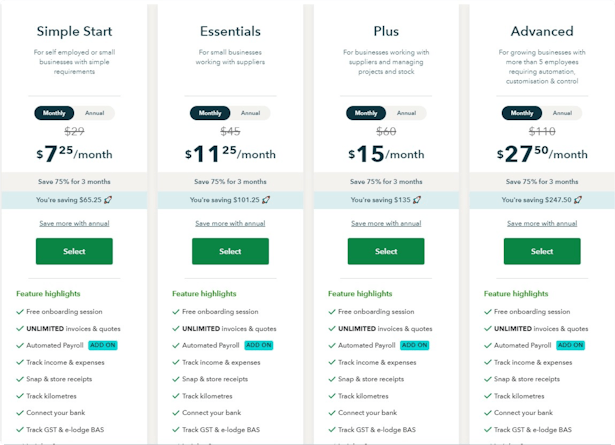

Pricing Overview

Xero offers four pricing tiers ranging from $35 to $115 per month.

QuickBooks Online starts at $29 per month, with its basic plan offering more features than Xero's cheapest option. The more comprehensive plans range up to $110 per month, offering advanced functionalities like batch invoicing and custom reporting.

When to Choose Each Platform

- QuickBooks Online is better suited for businesses that need robust reporting capabilities, prefer software with a strong US market presence, and seek great value for the cost, especially at lower price points.

- Xero might be the better choice for startups and businesses outside of North America, thanks to its ease of use, modern interface, and scalability. It's particularly strong in markets like Europe and New Zealand.

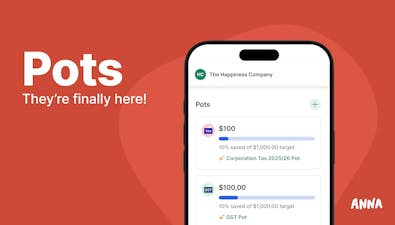

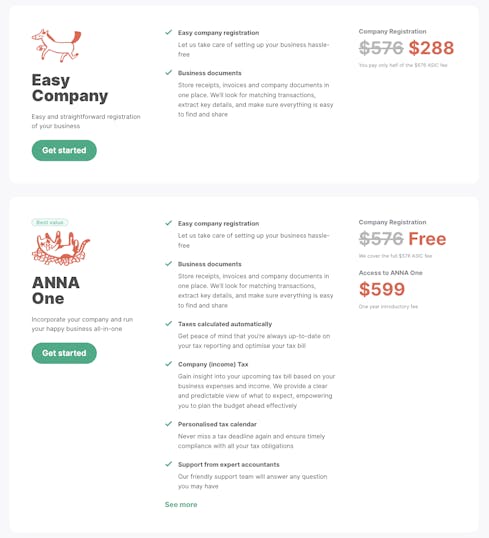

ANNA: The Complete Business Companion for Australian Entrepreneurs

ANNA isn't merely an accounting platform – it's a full-fledged business toolkit crafted for the unique needs of Australian entrepreneurs and small business owners.

With ANNA One, the complexities of launching, managing, and expanding a business are streamlined into a user-friendly solution that transcends traditional accounting functionalities.

How ANNA Works:

ANNA simplifies the foundational tasks required to legally establish and run a business in Australia. From acquiring an Australian Company Number (ACN) and Australian Business Number (ABN) to business name registration, ANNA handles it all, allowing you to focus on what you do best – running your business.

Post-setup, ANNA’s integrated system facilitates the automation of invoicing, bookkeeping, GST management, and BAS (Business Activity Statement) submissions, eliminating the burden of tedious administrative tasks.

Key Features:

- Company Registration: Swiftly register your company and receive your ACN and essential ASIC documents directly in your inbox.

- ABN and Business Name Registration: Easily set up your ABN for both companies and sole traders, and secure your business name to commence legal trading.

- Tax Management: Automate GST computations, keep track of important tax dates with a personalised calendar, and handle BAS filings with ease.

- Bookkeeping & Invoicing: Benefit from professional invoice templates, automatic payment reminders, and real-time bookkeeping to ensure financial accuracy and compliance.

- Document Storage: Safely store all critical business documents for convenient access and optimal organisation.

- Virtual Office Address: Maintain the privacy of your personal address and forget about waiting for important mail – ANNA scans your business mail and sends it directly to your inbox the same day.

- Expert Support: Receive assistance from a friendly support team and seasoned accountants for any business inquiries or challenges.

If ANNA One meets your business needs, take action today – sign up to streamline your business operations and manage your finances with unmatched ease.