ACN Number - Everything You Need to Know About

Learn about the ACN number, what it is, how to find it, and its importance for Australian businesses. Get comprehensive information on ACN numbers.

Wondering what an ACN Number is and why it's so important for businesses?

This article is for you!

Here, you'll find everything you need to know about:

- How to get an ACN number?

- How to use your ACN?

- Where does your ACN need to appear?

- Exceptions for ACN on documents?

- And more.

Ready to grasp the essentials and make sure your business is in compliance?

Keep reading to learn all about ACN number and why it matters.

How to Obtain an ACN Number for Your Company?

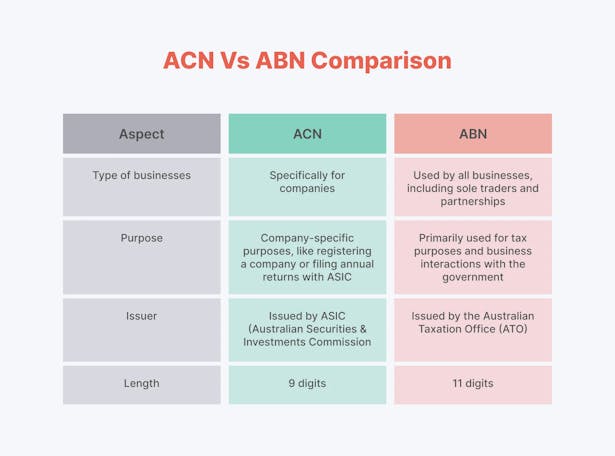

An Australian Company Number (ACN) is a unique identifier issued to every company registered in Australia.

An ACN is a nine-digit number where the last digit is a check digit, calculated using a modified modulus 10 method.

This number helps streamline business operations and ensure regulatory compliance. Without it, companies can face legal and operational challenges.

Here’s a quick overview of how to register a company in Australia:

- Decide on a Company Structure: Determine if a company structure fits your business needs.

- Choose a Company Name: Ensure the name is unique and meets legal requirements.

- Select Governance Rules: Choose between using replaceable rules or creating a company constitution.

- Understand Officeholder Duties: Be aware of the legal responsibilities of directors and secretaries.

- Obtain Written Consents: Secure consent from all directors, secretaries, and members.

- Register Your Company: Register online via the Business Registration Service or through a private service provider.

Company Name Guidelines

A company can choose its own name or be identified by its Australian Company Number (ACN).

1. Naming Rules

Certain rules apply to the names companies can use.

The public must be able to determine if a company is public or proprietary and if the shareholders have limited or unlimited liability.

2. Proprietary Limited Companies

Proprietary limited companies must include the words "proprietary" and "limited" or their abbreviations at the end of their name. For example:

- Proprietary Limited

- Proprietary Ltd

- Proprietary Ltd.

- Pty Limited

- Pty Limited.

- Pty Ltd

- Pty. Ltd.

3. Proprietary Unlimited Companies

Proprietary unlimited companies only need the word "proprietary" at the end of their name.

Common Seal Guidelines

A company may choose to have a common seal and use it to execute documents according to its constitution. However, having a common seal is not mandatory.

1. Requirements for a Common Seal

If a company decides to use a common seal, it must include:

- The company’s name.

- The expression 'Australian Company Number' and the company’s ACN, or

- If using an ABN instead of an ACN, the company’s name, the expression 'Australian Business Number,' and the company’s ABN.

2. Additional Information

The Australian Securities and Investments Commission (ASIC) does not issue common seals.

A company can make contracts and execute documents without using a seal.

ACN Structure and Appearance

Imagine navigating the intricate world of business documentation without a clear identifier for each company.

This scenario highlights the importance of the Australian Company Number (ACN) and its proper usage.

Whether your company stands alone or appears alongside others on a document, displaying the ACN correctly is essential. If you're unsure how to find your ACN number, it’s usually provided during registration or accessible through ASIC's search tools.

1. Structure and Labeling

When multiple companies are mentioned in a document, such as a letterhead, each company's ACN must be displayed next to its name.

- The ACN should always be clear, easily readable, and clearly associated with the respective company.

- You can label the ACN as 'Australian Company Number', 'ACN', or 'A.C.N.'

- For companies that use an Australian Business Number (ABN), the ABN can replace the ACN on documents. Ensure that the ABN includes the nine-digit ACN and is used wherever the ACN would typically appear.

2. Format and Placement

To ensure clarity and legibility, guidelines dictate the correct format and placement of the ACN.

- The ACN should follow the company’s name on seals and the first mention of the company's name in documents.

- It must be legible to the ordinary reader, with an 8-point Times Roman or better typeface recommended.

- Leading zeros in the ACN do not affect its value and can be formatted as needed.

3. General ACN Guidelines

The company's full name and ACN (or its abbreviations) should be clearly displayed on certain documents.

If the ACN is part of the company’s name, it doesn't need to be repeated and should appear immediately after the company's full name.

Examples

- "Anonymous Pty Ltd ACN 111 111 111"

- "Anonymous Pty Ltd A.C.N. 111 111 111"

- "Anonymous Pty Ltd Australian Company Number 111 111 111"

- "Anonymous Pty Ltd Aust Co No 111 111 111"

- "Anonymous Proprietary Limited ACN 111 111 111"

By adhering to these structured approaches, businesses can ensure their documents meet regulatory standards, present a professional image, and avoid legal pitfalls.

Proper use of the ACN not only facilitates smooth business operations but also reinforces trust and transparency with clients and regulatory bodies.

Where the ACN Must Appear?

Knowing where to display your Australian Company Number (ACN) is crucial for regulatory compliance.

This section details the specific documents and instruments requiring the ACN, ensuring you understand the legal requirements.

1. Specific Requirements

A company's ACN must be included on all 'public documents' and 'eligible negotiable instruments.' This includes:

- All documents lodged with ASIC.

- Statements of account, including invoices.

- Receipts (non-machine-produced).

- Orders for goods and services.

- Business letterheads.

- Official company notices.

- Cheques, promissory notes, and bills of exchange.

- Written advertisements making a specific offer.

To simplify, the ACN is required on:

- Every public document signed, issued, or published by the company.

- Every eligible negotiable instrument signed or issued by the company.

- The company’s common seal and other seals.

2. Definition of Public Document

To help your business understand where ACN requirements apply, let’s define what constitutes a public document.

👉 Definition: A public document is any document signed, issued, or published by the company intended to be lodged or required by law.

Public documents include:

- Business letters

- Statements of account

- Invoices

- Receipts

- Orders for goods or services

- Official notices

👉 Importance: Identifying all required documents ensures full compliance with legal standards, preventing potential fines and legal issues.

3. Electronic Documents

In today's digital age, knowing the requirements for electronic documents is equally essential for compliance.

Electronic documents and other non-legible forms are considered documents but are not required to display the ACN or company name unless they are public documents in written form.

4. Advertisements and Other Specific Documents

Advertisements are public documents only if they fit into specific categories, such as an order for goods or services or an official notice.

Electronic transmissions like EDI (Electronic Data Interchange) are not required to display the ACN as they are not typically issued in a legible form.

Where the ACN Is Not Required?

This section details the specific situations and items where the ACN is not required, providing clarity on exceptions to the general rules.

Understanding exemptions helps businesses avoid unnecessary inclusion of the ACN, focusing on compliance where it truly matters.

So, let’s clarify when you DON’T need ACN number:

- Packaging, labels, business cards, and "with compliments" slips.

- Machine-produced receipts (like cash register receipts), though they must include the company’s full name.

- Transport documents like tickets, waybills, or bills of lading.

- Credit card vouchers and electronically generated receipts.

1. Abbreviations

Understanding the acceptable abbreviations for the ACN and company name ensures clear and consistent usage.

It also maintains consistency and compliance in all business documents.

👉 Allowed Abbreviations:

- "Aust." for Australian

- "Co." for Company

- "No." for Number

- "A.C.N." for Australian Company Number

The company can also use abbreviations for its name, such as "Pty." for Proprietary and "Ltd." for Limited

2. Penalties

Awareness of penalties reinforces the need for compliance, helping businesses avoid fines and legal issues.

👉 Consequences:

Non-compliance with the ACN requirements can result in penalties, including fines. However, failure to comply does not invalidate the document.

By following these simplified guidelines, companies can ensure they meet legal requirements for displaying their ACN and full name on necessary documents.

But did you know that there are solutions available to help with the registration of your business?

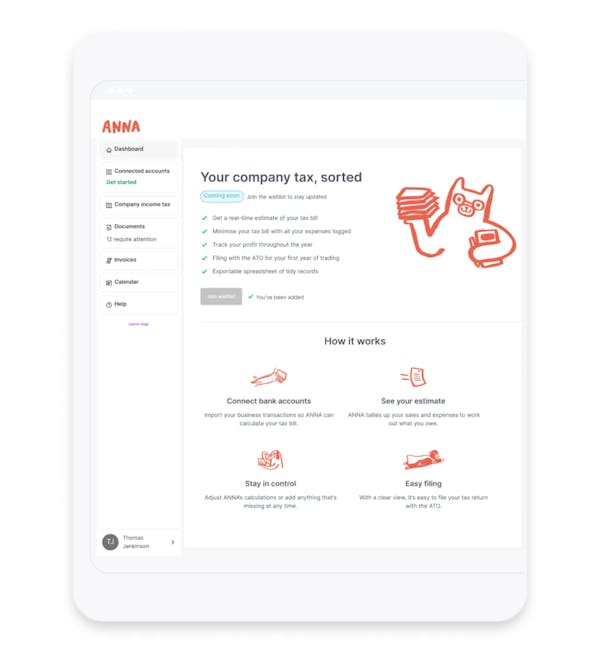

We introduce you to ANNA, a comprehensive solution designed to simplify the business registration process while also providing efficient tax and accounting solutions.

What is ANNA?

Let’s face it.

Registering your business and obtaining an ACN number is just the tip of the iceberg when it comes to your business operations.

The real challenge begins with what comes next.

How do you effectively manage receipts, invoices, and business documents while keeping up with taxes and monthly obligations?

ANNA offers a comprehensive solution to streamline your business operations by providing the following capabilities:

✔️ Hassle-Free Setup:

- ANNA handles all necessary registrations, ensuring your business is set up without any hassle.

✔️ Document Management:

- Store and manage receipts, invoices, and company documents in one place.

- Automated transaction matching, extraction of key details, and easy sharing of documents.

✔️ Tax Management:

- Stay up-to-date with tax reporting and optimize your tax bill.

- Gain clear insights into upcoming tax bills based on business expenses and income.

- Manage annual company tax return statements (BAS) and GST calculations.

- Automatic GST calculation and direct logging with the ATO.

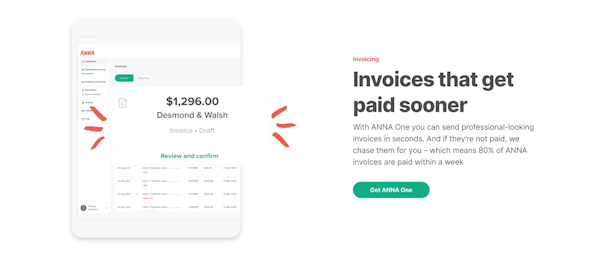

✔️ Professional Invoicing:

- Create professional-looking invoices quickly.

- Automated follow-up on unpaid invoices to ensure prompt payment.

- Ensure prompt payment of invoices: 80% of ANNA invoices are paid within a week thanks to automated follow-ups.

✔️ Bookkeeping and Financial Insights:

- Monitor your bookkeeping with tips on maintaining tidy records.

- Automated receipt matching and categorization for optimal tax relief.

✔️ Support:

- Access a friendly support team for any queries.

- Early-stage support is available via email to assist with any questions or issues.

In simple words, ANNA simplifies the complex tasks of business management, allowing you to focus on what you do best: growing your business.

The best part?

If you sign up for one of ANNA's two packages, we’ll take care of your business registration.

Sounds tempting?

Explore ANNA today and make business registration and management effortless.