Explore how much tax you should pay on ABN and understand tax obligations, rates, and deductions for sole traders and small businesses in Australia.

Starting a business in Australia comes with many responsibilities, including understanding and paying your taxes.

If you have an ABN (Australian Business Number), it's crucial to know which taxes apply to you and how much you should pay.

This knowledge helps you stay compliant and avoid potential penalties.

Let’s dive into the key taxes you need to consider as an ABN holder.

ABN (Australian Business Number)

👉 What it is: A unique 11-digit identifier for businesses.

👉 Purpose: Required for invoicing, registering for GST, and conducting business legally.

👉 Who needs it: All businesses operating in Australia.

How to Determine Whether Your Business Requires an ABN?

When starting a business in Australia, one of the first steps is to determine if you need an Australian Business Number (ABN).

This unique 11-digit number identifies your business to the government and the community.

Let’s see if your business needs an ABN number.

1. Carrying on an Enterprise

You need an ABN if you are conducting or starting a business in Australia.

This includes running a business or renting out property as an ongoing enterprise.

Indicators that you are running a business, according to the Australian Taxation Office (ATO), include:

- Intending to make a profit or repeatedly selling goods or services

- Advertising or making your presence known to potential customers

- Having significant commercial activity similar to other businesses in your industry

2. GST Registration

If your business has a turnover of $75,000 or more per year, you must register for the Goods and Services Tax (GST).

To register for GST, you need an ABN. This threshold also applies if you expect your business turnover to reach $75,000 within the first year.

3. Business Name Registration

If you trade under a name different from your own, you must register that business name. To do so, you need an ABN.

This requirement applies to all business structures, including sole traders, partnerships, and companies.

TFN (Tax File Number)

👉 What it is: A unique identifier issued by the Australian Taxation Office (ATO) for individuals and businesses.

👉 Purpose: Used for managing tax and superannuation records.

👉 Who needs it: All individuals earning income in Australia and businesses for tax purposes.

Difference Between ABNs and TFNs

A TFN (Tax File Number) is required for anyone working in Australia, while an ABN (Australian Business Number) is exclusively for businesses.

Your TFN is permanent, but if you start a partnership business, both partners need separate TFNs.

When you begin working, your TFN allows your employer to deduct tax from your income through the PAYG (Pay As You Go) system.

Sole traders can use their existing TFN for tax purposes. However, partnerships and companies need their own TFNs.

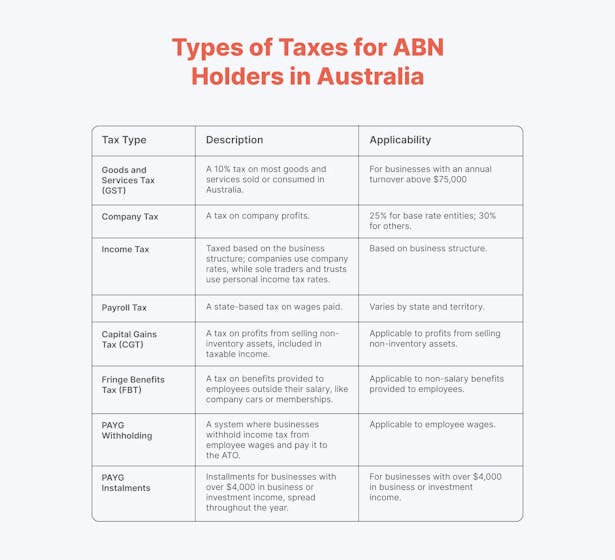

Types of Taxes for ABN Holders in Australia

Now that we have figured out what ABN and TFN numbers are, it is time to help you understand the different types of taxes for businesses in Australia.

This step is crucial for compliance and financial planning.

Here are key taxes that ABN holders need to be aware of:

How Taxation Works in Australia?

Understanding taxation in Australia can be straightforward, especially when you know how both the ABN and TFN systems operate.

ABN and Taxation

When you have an ABN, tax is not deducted at the source.

Instead, you receive full payment for your products or services. It's crucial to set aside a portion of this income to cover your tax liability at the end of the financial year.

👉 For example, if you earn $10,000 through your ABN, you should save part of this amount to pay taxes later.

Unlike TFN income, where taxes are deducted before you receive your pay, ABN income requires you to manage your own tax payments.

Tax-Free Threshold in Australia

Australia offers a tax-free threshold (TFA) of $18,200.

This means you can earn up to this amount in a financial year without paying any tax, whether your income is from an ABN or TFN.

Working with Both ABN and TFN

Confusion often arises when individuals earn income from both ABN and TFN jobs. Here's a simplified example to illustrate how the tax system works:

John works both an ABN job and a TFN job. For the full tax year, he earns:

- ABN income: $15,000

- TFN income: $15,000 (with $5,000 tax already withheld)

- John's combined income is $30,000.

Since he qualifies for the full TFA of $18,200, his taxable income reduces to $11,800 ($30,000 - $18,200).

According to the ATO tax tables, he owes 19% tax on $11,800, which amounts to $2,242.

However, $5,000 has already been withheld from his TFN income.

This means that John has overpaid his taxes.

As a result, he will receive a refund of $2,758 ($5,000 - $2,242).

Reducing Tax Liability

It's important to note that work-related expenses can reduce your tax liability. Expenses like work-related courses, protective gear, and tools are deductible.

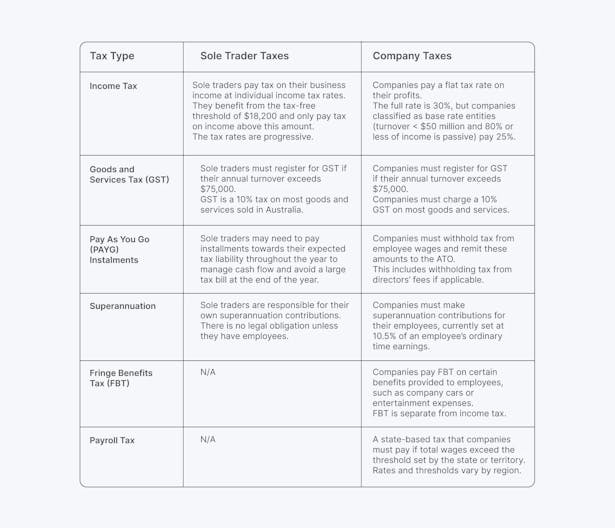

Understanding Tax Differences Between a Sole Trader and a Company

When you start a business in Australia, it is important to choose the right structure.

It is crucial, as it impacts your tax obligations, legal responsibilities, and how you manage finances.

Let’s explore the differences between being a sole trader and running a company, focusing on taxes and financial reporting.

👉 Sole Trader – A sole trader is an individual running a business, personally responsible for all aspects of the business, including debts and losses.

This structure is simple to set up and manage, making it ideal for small businesses or those just starting out.

👉 Company – A company is a separate legal entity from its owners (shareholders).

This structure limits personal liability and can be more complex and costly to establish and maintain, suitable for larger businesses or those seeking investment.

Taxes Sole Traders and Companies Have to Pay

Understanding the specific taxes that sole traders and companies must pay is essential for effective financial planning and compliance.

Each business structure has distinct tax obligations and benefits, and choosing the right structure depends on various factors, including:

- the size of the business,

- growth expectations, and

- the level of administrative complexity you are willing to manage.

Here’s a breakdown of the main taxes applicable to each structure:

Let’s review other essential elements considering sole traders and companies when it comes to taxes.

Tax Returns

👉 Sole Traders: Lodge an individual tax return annually, including business income in the personal income section. This simplifies the process but requires careful tracking of business expenses and income.

👉 Companies: Must lodge a separate company tax return annually. This return details all income, expenses, and any deductions applicable to the company, following stricter regulatory requirements.

Record Keeping

👉 Sole Traders: Generally have less paperwork, needing to keep records for five years. They must notify government agencies of any business changes within 28 days.

👉 Companies: Face more rigorous record-keeping requirements, needing to keep financial records for at least seven years to comply with the Corporations Act 2001.

They must also comply with annual reviews by the Australian Securities and Investments Commission (ASIC).

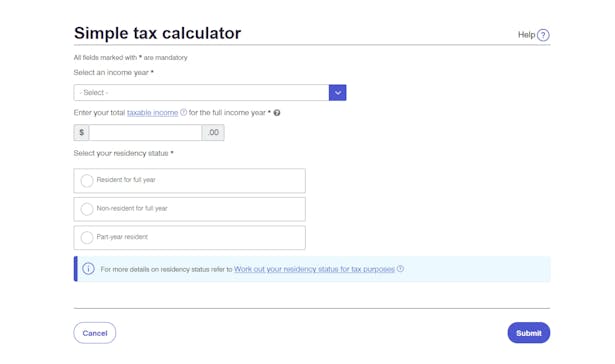

How to Calculate Taxes for Your Business?

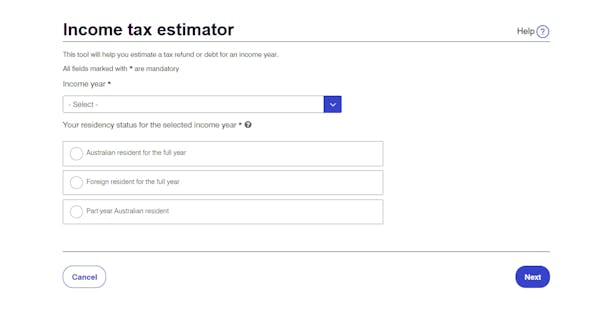

Calculating taxes for your business can seem daunting, but the ATO Simple Tax Calculator makes it easier.

This tool helps you estimate the gross tax on your taxable income for the income years from 2013–14 to 2022–23.

Using the ATO Simple Tax Calculator

- Access the Calculator: You can find the ATO Simple Tax Calculator on the ATO website. It takes between 2 and 10 minutes to complete.

- Input Your Details: Enter your taxable income for the full income year and your residency status.

- Understand the Results: The calculator provides an estimate of your gross tax, which is the tax on your taxable income before any tax offsets. Use these results for guidance only.

Which Tax Rates Apply?

👉 Individual Income Tax Rates: These rates depend on the income year and your residency status for tax purposes.

Foreign residents are taxed at a higher rate and do not receive a tax-free threshold. Part-year residents may be entitled to a partial tax-free threshold.

For better understanding, let’s review tax rates for residents and foreign residents.

- Resident tax rates:

- Foreign resident tax rates:

👉 Working Holiday Makers: If you hold a 417 Working Holiday or 462 Work and Holiday visa, use the Income Tax Estimator Calculator for accurate tax calculations based on your specific circumstances.

Limitations of the Calculator

The ATO Simple Tax Calculator does not cover:

- Medicare levy and surcharge

- Tax obligations for working holiday makers

- First Home Super Saver (FHSS) scheme

- Study and training support loans (e.g., HELP, TSL, VET Student Loan)

Additional Resources

👉 Income Tax Estimator: For a detailed calculation, use the Income Tax Estimator available on the ATO website.

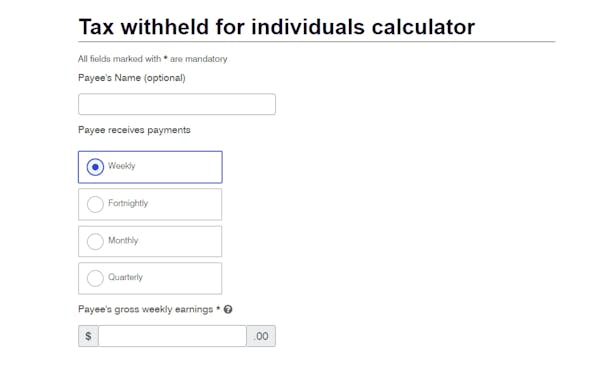

👉 Tax Withheld Calculator: To determine how much tax to withhold from employee payments, use the Tax Withheld Calculator.

By using these tools, you can better understand your tax obligations and ensure accurate tax calculations for your business.

How to Manage Your Taxes With ANNA?

Managing taxes efficiently is crucial for your business's success.

Beyond maintaining positive cash flow, it requires a deep understanding of your tax obligations. And it can be tedious if you decide to do it on your own.

However, many companies turn to professional assistance to register their business, manage bookkeeping, handle finances, and pay taxes.

One such service that can help is ANNA.

What is ANNA?

ANNA is a financial services company that helps small businesses register and manage their operations easily.

It offers comprehensive support through two main packages: Easy Company and ANNA One. Each package caters to different needs, making it easier to choose the right solution for your business.

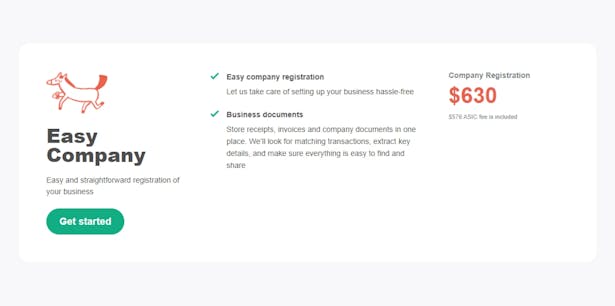

Easy Company Package

⭐ Easy Business Setup: ANNA handles the entire process of setting up your business, making it easy and stress-free.

⭐ Business Documents Management: Organize and store receipts, invoices, and company records in one place.

ANNA's system matches transactions and extracts key details for easy access and sharing.

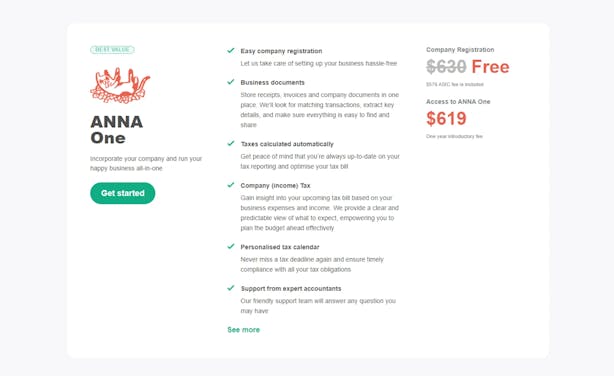

ANNA One Package

⭐ Comprehensive Business Management: Ideal for those looking to streamline operations, handle taxes efficiently, and maintain organized financial records.

⭐ Easy Company Registration: Hassle-free setup with all necessary registrations handled by ANNA.

⭐ Automated Financial Tools: Manage receipts, invoices, and company documents, automatically calculate taxes, and maintain a personalized tax calendar for compliance.

⭐ Expert Support: Access to a support team for any queries, help with annual tax returns, and automatic GST calculations and logging with the ATO.

⭐ Efficient Invoicing: Create professional invoices and follow up on unpaid invoices automatically.

Using ANNA simplifies the process of managing your business taxes, whether you're just starting out or looking to streamline existing operations.

Choose the Easy Company package for a straightforward business setup, or opt for ANNA One for a comprehensive solution that includes financial tools and expert support.

Ready to simplify your business management?

Sign up for ANNA One today and take control of your business finances effortlessly!