9 Best Free Business Bank Accounts for Aussies in 2025

Discover the best free business bank accounts for Aussies to simplify your banking and find the perfect solution for managing your business finances.

As an Australian business owner, choosing the right bank account is crucial for managing your finances efficiently and cost-effectively.

In this guide, we'll explore the top free business bank accounts available in Australia, helping you make an informed decision that aligns with your business needs.

Let’s start!

Why Choose a Free Business Bank Account?

Before diving into the options, let's understand why a free business account can be beneficial:

✔️ Cost savings: Eliminating monthly fees can significantly reduce your operating expenses.

✔️ Better cash flow management: More money stays in your business, improving your overall financial health.

✔️ Simplified accounting: Many free accounts offer integrations with popular accounting software, streamlining your bookkeeping processes.

What to Look for in a Free Business Bank Account?

When selecting your business bank account, consider these key factors:

- Unlimited Free Transactions: Look for accounts that offer unlimited electronic transactions, including online banking, mobile app transfers, and EFTPOS payments.

- No Hidden Fees: Check for any hidden costs related to ATM withdrawals, international transfers, or other services you might need.

- Integration with Accounting Tools: Accounts that sync with your accounting software can save you time and reduce bookkeeping headaches.

- Business Debit Card: A fee-free debit card that works with digital wallets can make managing daily expenses much more accessible.

- Overdraft Facility: An optional overdraft can be a lifesaver for managing temporary cash flow issues.

- Strong Online and Mobile Banking: User-friendly platforms help manage your account on the go.

- Security Features: Look for robust security measures like fraud detection, two-factor authentication, and transaction alerts.

Now, let's explore the top 9 free business bank accounts in Australia for 2024:

9 Best Free Business Bank Accounts in Australia

1. CommBank Business Transaction Account

CommBank offers a versatile business transaction account with two fee options: $0 or $10 monthly. This account provides unlimited electronic transactions, making it ideal for businesses that handle a large volume of digital payments.

You can also link a Business Visa Debit Card to Apple Pay for seamless transactions.

Additional features include customized alerts to keep you in control and eligibility for StepPay, a buy now, pay later option.

Key Takeaways

👉 Monthly Fee: $0 or $10

👉 Key Features: Unlimited electronic transactions, Business Visa Debit Card, Apple Pay integration, StepPay eligibility.

2. Revolut Business Account

Revolut’s business account is ideal for companies with international dealings, offering borderless accounts and no-fee international transfers within certain limits.

The Basic plan is free and includes essential features like currency exchange at interbank rates, virtual and plastic company cards, and expense management tools.

Revolut also supports integrations with popular apps, providing a comprehensive solution for modern businesses.

Key Takeaways

👉 Monthly Fee: £0 (Basic plan)

👉 Key Features: No-fee international transfers, multi-currency accounts, virtual and plastic cards, 24/7 support.

3. Westpac Business One Transaction Account

Westpac’s Business One Transaction Account comes with a $0 monthly fee for businesses that primarily bank online. It offers unlimited free electronic transactions and a Business Debit Mastercard.

For businesses with more complex needs, there’s an optional overdraft facility and extensive mobile banking features, including direct debit cancellation and contactless payment options.

Key Takeaways

👉 Monthly Fee: $0

👉 Key Features: Unlimited electronic transactions, Business Debit Mastercard, overdraft facility, direct debit management.

4. Heritage Bank Business Cheque Account

Heritage Bank offers a straightforward, no-monthly-fee business cheque account designed for small to medium-sized businesses.

This account provides essential transaction features without the frills, making it a practical choice for those looking for a low-cost option.

Heritage Bank also supports a variety of business structures, including trusts, SMSFs, and partnerships.

Key Takeaways

👉 Monthly Fee: $0

👉 Key Features: No monthly account fees, support for various business structures, personal service.

5. Wise Business Account

Wise is well-known for its transparent pricing and international focus. The Wise Business Account allows you to hold and exchange over 40 currencies with no monthly fees.

It’s particularly suitable for businesses that deal with cross-border transactions, offering low fees for currency exchange and money transfers.

The account also supports receiving payments in multiple currencies at no additional cost.

Key Takeaways

👉 Monthly Fee: $0

👉 Key Features: Hold and exchange 40+ currencies, no hidden fees, low-cost international transfers, multi-currency accounts.

6. ANZ Business Essentials

ANZ’s Business Essentials account is a great option for businesses seeking simplicity and reliability.

With no monthly account service fees and unlimited ANZ ATM and electronic transactions, this account is designed to streamline your business banking.

The account also includes ANZ Falcon® protection, a robust anti-fraud technology, and easy integration with accounting software to simplify tax time.

Key Takeaways

👉 Monthly Fee: $0

👉 Key Features: Unlimited ATM and electronic transactions, ANZ Falcon® protection, accounting software integration.

7. NAB Business Everyday Account ($0 Monthly Fee)

NAB’s Business Everyday Account offers a fee-free option perfect for businesses that mostly operate online.

This account provides unlimited electronic and ATM transactions with the added benefit of seamless accounting integration.

It also comes with a feature-packed NAB Business Visa Debit Card, making it a comprehensive solution for everyday business banking needs.

Key Takeaways

👉 Monthly Fee: $0

👉 Key Features: Unlimited electronic and ATM transactions, accounting software integration, NAB Business Visa Debit Card.

8. Hume Bank Business Account

Hume Bank’s Business Account offers no account keeping fees and a straightforward approach to business banking.

It integrates seamlessly with accounting software like MYOB and Xero, and offers additional features like payroll processing and an optional overdraft.

This account is ideal for businesses seeking simplicity and low costs.

Key Takeaways

👉 Monthly Fee: $0

👉 Key Features: No account keeping fees, accounting software integration, optional overdraft, payroll processing.

9. Mercury Business Account

Mercury offers a no-frills business banking experience with no monthly fees or account minimums.

The account is ideal for startups and tech-savvy businesses, providing free checking and savings accounts, team management features, and third-party integrations.

Mercury also offers advanced financial features at a premium, making it a scalable solution for growing businesses.

Key Takeaways

👉 Monthly Fee: $0

👉 Key Features: No account minimums, free checking and savings, team management, API access.

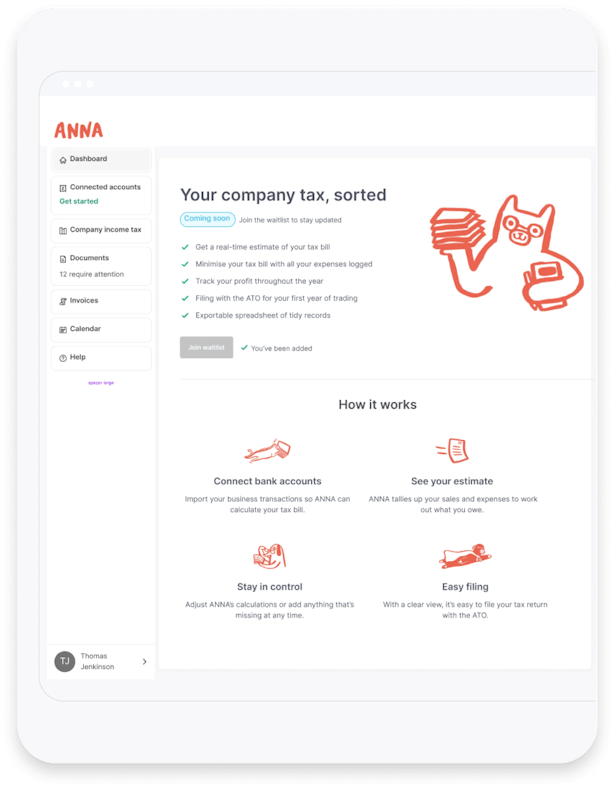

Starting a Business? Simplify It with ANNA One

If you're just starting out, consider ANNA One as an all-in-one solution. While not a traditional bank, we offer:

- Free company registration

- Business bank account setup

- Automated tax management and bookkeeping

- Expert support for financial and legal requirements

This can be an excellent option for entrepreneurs looking to simplify the process of setting up and managing a new business.

Company Registration Made Easy

ANNA One streamlines the process of registering your business in Australia.

With us, you can quickly register your Australian Company Number (ACN) and receive all necessary ASIC documents directly in your inbox.

We’ll also help you secure an Australian Business Number (ABN) and register a business name, ensuring your business is legally recognized and ready to operate.

Seamless Business Banking and Tax Management

Once your business is registered, ANNA One automatically sets up a business bank account that integrates with our comprehensive tax and accounting tools.

This means you can manage all your business finances in one place, with features like:

- Automated Tax Management: ANNA calculates your taxes, including GST and company tax, and helps you stay compliant with a personalized tax calendar.

- Effortless Invoicing and Bookkeeping: Create professional invoices in seconds, and let ANNA chase unpaid invoices and match receipts automatically.

Expert Support at Every Step

At ANNA, we don't just provide you with tools—we offer expert support to help you navigate your business’s financial and legal requirements.

Whether it’s answering questions or helping you lodge your first BAS, our support team is there to guide you.

Start your business with ANNA One today—let us handle your registration, banking, and tax needs, so you can focus on what matters most: growing your venture.