How to Find My ACN Number? [2025 Guide]

Learn how to find your ACN easily through online resources, official documents, and company records to streamline your business operations today.

Are you starting a business in Australia?

There are several key elements you must obtain to operate legally, and one of them is your ACN number.

In this article, we’ll explain how to find your ACN number and provide additional information that can be useful when starting your business in Australia.

Let's get started!

Top 3 Things You Must Obtain When Starting Your Business in Australia

Starting a business in Australia involves several key steps. Here are the three most important things you need to obtain:

1. Australian Business Number (ABN)

An Australian Business Number (ABN) is a unique 11-digit number that identifies your business to the government and community.

It’s essential for tax purposes and is required if your business has a turnover of $75,000 or more to register for Goods and Services Tax (GST).

Obtaining an ABN is the first step to getting your business recognized legally and operationally in Australia.

2. Business Name Registration

If you plan to trade under a name other than your own, you must register your business name with the Australian Securities and Investments Commission (ASIC).

This registration protects your brand and ensures no one else can use the same name. Registering your business name is crucial for building a distinct identity and establishing trust with your customers.

3. Tax File Number (TFN)

A Tax File Number (TFN) is necessary for managing your business taxes. If you’re a sole trader, you can use your personal TFN.

However, if you operate as a partnership, company, or trust, you’ll need a separate TFN for your business.

Having the correct TFN helps streamline your tax reporting and compliance processes.

What About the ACN?

Now that we’ve covered the basics, you might be wondering about the Australian Company Number (ACN).

In the next section, we’ll explain what an ACN is, how it differs from an ABN, and how to register an ACN number.

You’ll learn the purpose, format, and usage of each number, and find out how to obtain them.

Understanding these key identifiers will help ensure your business is set up correctly from the start.

What is an ACN Number?

An ACN (Australian Company Number) is a unique nine-digit identifier issued by the Australian Securities & Investments Commission (ASIC) to every registered company in Australia.

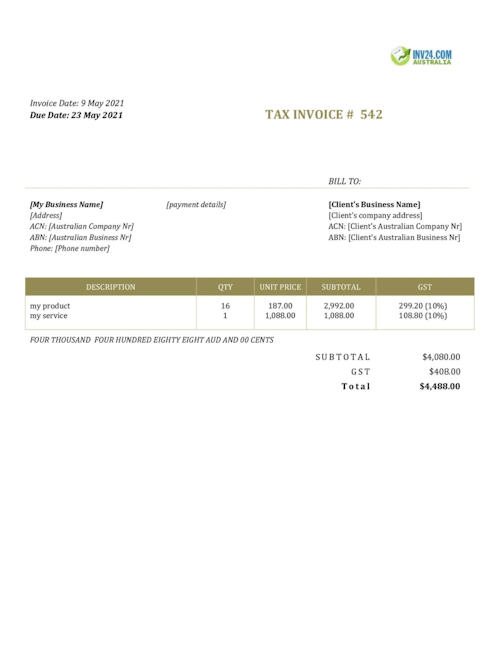

This number ensures legal compliance and is required on various company documents, such as invoices, receipts, and official notices.

The ACN helps identify and verify companies, making it easier to manage business operations and regulatory requirements.

How to Apply for an ACN Number?

You don’t need to apply separately for an ACN.

When you register a company with ASIC, you are automatically issued an Australian Company Number as part of the registration process.

The Difference Between ABN and ACN

Understanding the differences between an ABN (Australian Business Number) and an ACN (Australian Company Number) is crucial for proper business setup.

ABN (Australian Business Number)

- Purpose: Identifies businesses for tax and other business purposes.

- Issued By: Australian Business Register (ABR).

- Format: An 11-digit number.

- Who Needs It: All businesses operating in Australia, including sole traders, partnerships, companies, and trusts.

- Usage: Required for GST registration, invoicing, and dealings with other businesses and government agencies.

ACN (Australian Company Number)

- Purpose: Specifically identifies registered companies.

- Issued By: Australian Securities & Investments Commission (ASIC).

- Format: A unique 9-digit number.

- Who Needs It: Only companies registered under the Corporations Act 2001, including proprietary companies (Pty Ltd), public companies, and other types of companies.

- Usage: Must be displayed on company documents, such as invoices, receipts, and official notices.

In summary:

👉 Companies need both an ACN and an ABN.

👉 Sole traders, partnerships, and trusts only need an ABN.

How to Find Your ACN Number?

Finding your ACN (Australian Company Number) is straightforward using these methods:

1. Registration Documents

To find your ACN number, you can check your company’s registration documents.

When you registered your business with the Australian Securities & Investments Commission (ASIC), you received a Certificate of Registration that includes your ACN.

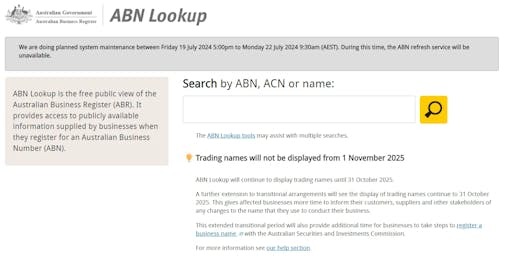

2. ASIC Website

Visit the ASIC website and use their ABN lookup. You can search by your company’s name or your ACN/ABN/ARBN/ARSN.

This is a quick and reliable way to find your ACN.

3. Company Correspondence

Look at any official company documents, such as invoices, receipts, or letters, where your ACN should be displayed.

These documents routinely include your ACN for identification purposes.

What If You Lost Your ACN Number?

If you’ve misplaced your ACN certificate, don’t worry! You can still retrieve your ACN using the following methods:

1. ASIC Website

Use ASIC’s search tool.

You can search by your company’s name or other identifiers like your ABN. This is the easiest way to find your ACN without the original certificate.

2. Company Documents

Check any official company documents such as invoices, receipts, or letters where your ACN should be displayed.

Your ACN is typically included on these documents.

3. Contact ASIC

If you need a replacement certificate, you can contact ASIC directly for assistance. They can provide you with a new copy of your Certificate of Registration.

You can contact them using the following methods:

👉 Submit an online enquiry form.

👉 Reach their Customer Contact Center:

- Within Australia: 1300 300 630: within Australia

- Outside Australia: + 61 3 5177 5407

👉 Write to ASIC using the following information:

- Australian Securities and Investments Commission

- GPO Box 9827

- Melbourne VIC 3001

👉 If you need an interpreter, contact TIS at 131 450, and they will connect you with ASIC at 1300 300 630.

Alternatively, you can visit the TIS website for assistance. They offer interpreting services in over 150 languages.

When to Use Your ACN Number?

Using your ACN (Australian Company Number) correctly is crucial for maintaining legal compliance and ensuring that your company is easily identifiable in all business dealings.

Here are the key situations where you should use your ACN:

- Official Company Documents: Include your ACN on all official documents such as invoices, receipts, letters, and statements. This ensures that your business is clearly identified in all formal communications.

- Contracts and Agreements: Display your ACN on any legal contracts or agreements your company enters into. This is essential for legal clarity and accountability.

- Company Website: Ensure your ACN is visible on your company’s website, especially on the contact or about pages. This provides transparency and builds trust with your customers and partners.

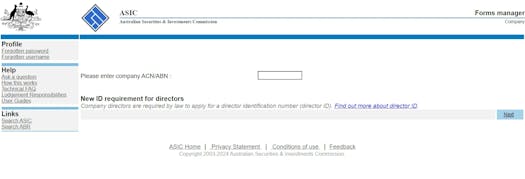

- Regulatory Filings: Use your ACN when filing documents with the Australian Securities & Investments Commission (ASIC) or other regulatory bodies. This helps in the accurate processing and record-keeping of your company's regulatory compliance.

- Business Correspondence: Include your ACN in business correspondence, such as emails and letters. This helps ensure the clear identification of your company in all communications.

How to Update Your ACN Information?

Updating your company details with the Australian Securities & Investments Commission (ASIC) is straightforward.

Here’s how you can do it online:

1. Register for Online Access: If you haven’t already, register for ASIC’s online services using your company’s corporate key.

2. Log In: Go to the ASIC online portal and log in with your company’s ACN or ABN, username, and password.

3. Start a New Form: Select ‘Start new form’ and choose 'Change to company details.’

4. Update Details: You can update various details such as company addresses, officeholders, share structure, and more.

5. Submit Changes: Once you’ve made the necessary updates, submit the form. Your changes will be processed within one business day.

Common Changes You Can Make

- Change Company Addresses: Update your registered office, principal place of business, or other addresses.

- Appoint/Cease Officeholders: Add or remove directors, secretaries, or other officeholders.

- Change Share Structure: Update information about shares and shareholders.

- Other Changes: Update company name, type, financial year, and more.

📍 Important Notes

👉 Timeliness: Submit changes within 28 days of the change occurring to avoid late fees.

👉 Suppressed Addresses: If you have a suppressed residential address, use Form 379 to update it.

By keeping your company details up-to-date with ASIC, you ensure compliance and avoid any potential penalties.

Wrapping Up

Registering your company not only boosts brand recognition and credibility but also offers several important benefits:

✔️ With a registered company, your personal assets are protected from business debts and losses, thanks to limited liability.

✔️ You may also enjoy potential tax benefits, such as lower business tax rates and deductions.

✔️ Moreover, having an ACN enhances your brand's credibility and makes it easier to form partnerships and attract investors.

Besides, investors often prefer registered companies, seeing them as more secure and legitimate investment opportunities.

And there is good news for all of you considering starting your own business in Australia—someone else can do it for you, hustle-free.

And for those interested in how that can be achieved, let me introduce you to the ANNA solution.

About ANNA

ANNA is your ultimate partner for starting and running a business in Australia.

Designed to simplify business operations, ANNA provides packages that cover everything from company registration to efficient tax management.

ANNA offers ideal solutions for those looking to streamline their business operations, handle taxes efficiently, and maintain organized financial records while benefiting from expert support and innovative financial tools.

Plus, the added benefit of having the registration process covered makes it a highly time and cost-effective choice.

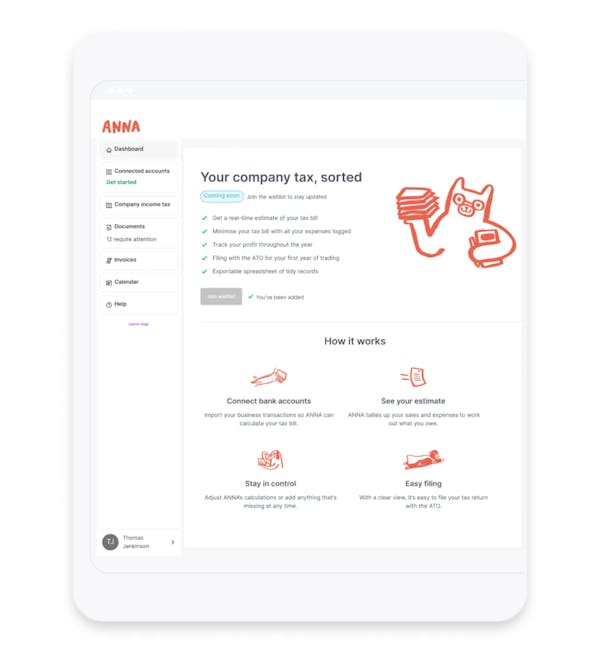

What ANNA Solutions Offer?

✨ ANNA handles all necessary registrations, making it simple to get your business up and running without any stress.

✨ Store and manage receipts, invoices, and company documents in one place.

✨ View all your finances in one place by linking other bank accounts to ANNA One.

✨ Automatically match transactions, extract key details, and easily share documents.

✨ Stay up-to-date with tax reporting and optimize your tax bill.

✨ Gain insights into upcoming tax bills based on business expenses and income.

✨ Ensure timely compliance with a personalized tax calendar.

✨ Never miss another tax deadline with timely reminders.

✨ Manage annual company tax return statements (BAS) and GST calculations with ease.

✨ Direct logging with the Australian Taxation Office (ATO).

✨ Create professional-looking invoices quickly and efficiently.

✨ Ensure prompt payment with automated follow-up on unpaid invoices.

✨ ANNA’s customer support team is available around the clock, even on holidays.

Benefits of Getting Started With ANNA Packages

👍 80% of ANNA invoices are paid within a week, thanks to proactive follow-up.

👍 Track your bookkeeping with tips for maintaining tidy records.

👍 Save money on taxes by keeping your books organized.

👍 ANNA automatically matches and categorizes receipts for optimal tax relief.

Ready to take the next step in securing your business's future?

Start your business journey with ANNA and experience a hassle-free, efficient way to manage your business operations in Australia.

Keep Learning

How Much Does it Cost To Register a Company in Australia?

How Can a Foreigner Register a Business in Australia?

How Long Does It Take To Register a Company in Australia?