How To Set Up a Payment Plan With the ATO

Discover the steps to easily set up a payment plan with the ATO using our quick and efficient guide to manage your tax obligations.

Are you struggling to pay your tax bills in full and on time?

If so, you might be eligible for a payment plan, especially if financial difficulties are holding you back.

A payment plan is a helpful tool for anyone facing financial challenges.

It provides a structured way to meet your tax obligations without incurring hefty penalties or interest charges.

By staying proactive, you can manage your finances more effectively and keep your tax record clean.

So, if you are eager to find out how to set up a payment plan with the ATO to stay proactive while paying down your debt swiftly, you are in the right place.

Today, we’ll cover all the essential information, from what a payment plan is, who can set it up, and how to do it on your own.

Let’s start!

What is a Payment Plan?

A payment plan breaks down your tax bill into smaller, manageable installments.

You can pay these installments weekly, fortnightly, or monthly over a fixed period.

This approach makes it easier to handle your tax obligations without the stress of a lump sum payment.

How Does Payment Plan With ATO Work?

When you set up a payment plan, you agree to pay a specific amount regularly until your balance is clear.

For instance, many businesses use payment plans to stay compliant while managing cash flow more effectively.

It's important to note that tax debts on a payment plan continue to accrue general interest charges (GIC), which compound daily.

However, by paying off your debt as quickly as possible, you can minimize the total GIC you'll pay.

This strategy not only keeps you on track but also saves you money in the long run.

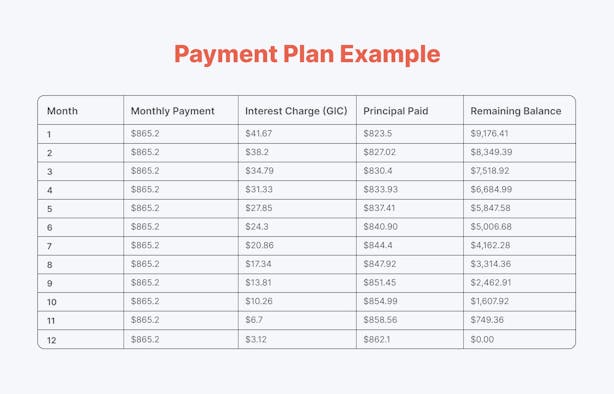

Payment Plan Example

Here’s an example of a payment plan for a tax debt in Australia.

Let’s assume a total tax debt of $10,000 with an interest rate of 5% per annum, paid off in monthly installments over 12 months.

For a payment plan, we need to have the following categories:

▶️ Monthly Payment: The fixed amount paid each month.

▶️ Interest Charge (GIC): The general interest charge applied to the remaining balance each month.

▶️ Principal Paid: The portion of the monthly payment that goes towards reducing the principal debt.

▶️ Remaining Balance: The remaining tax debt after each monthly payment.

This table is a simplified example to illustrate how a payment plan might look.

Actual payment plans will vary based on the specific interest rates, total debt amount, and repayment terms agreed upon with the ATO.

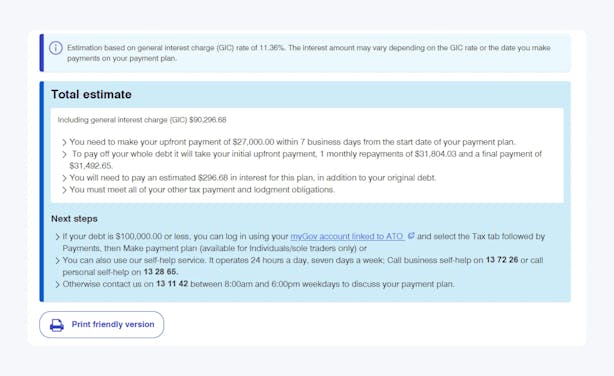

How Can the Payment Plan Estimator Help You Manage Tax Debt?

If you are struggling with tax debt and wondering how to manage it effectively, you might find the payment plan estimator very helpful.

It is a valuable tool to help you work out how quickly you can pay off your tax debt and how much interest you'll be charged.

The longer you take to pay off your debt, the more interest you'll accumulate.

What Does the Payment Plan Estimator Offer?

The payment plan estimator gives you a rough idea of how you can manage your tax debt. However, it doesn't guarantee eligibility for an automated payment plan online.

You might need to contact the ATO to provide more detailed information about your circumstances, such as:

- Income and expenses breakdown

- Assets

- Bank balances, creditors, and debtors details

- Note that this estimator cannot be used for super guarantee charge debts.

Below, you can find guidelines on how to use ATO’s payment plan estimator.

Payment Plan Estimator in Practice

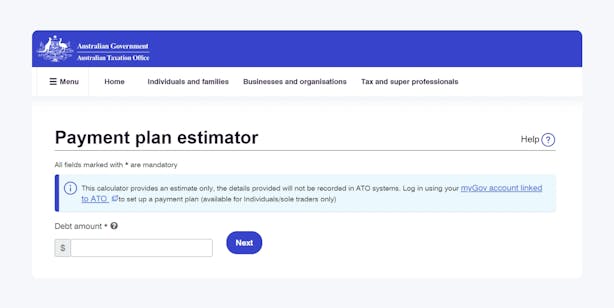

You can find a payment plan estimator on ATO’s page with other calculators and tools.

The first thing you need to do is to enter your debt amount and then click “Next.”

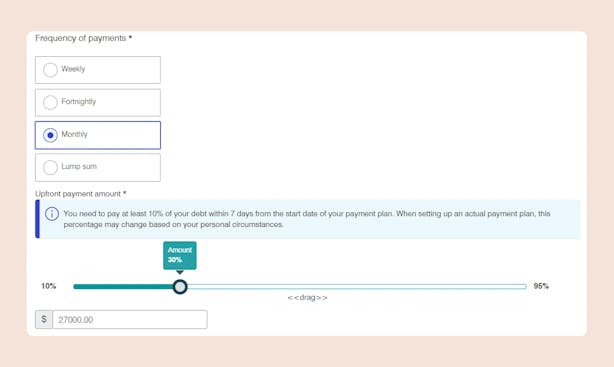

Once the page options extend, you will now find new options to set before the calculation.

The first one is to set the frequency of payments.

Here you can choose between weekly, fortnightly, monthly, or lump sum.

You’ll also need to set the upfront payment amount that you are obligated to pay within 7 days from the start date of your payment plan. The minimum amount is 10% of your debt.

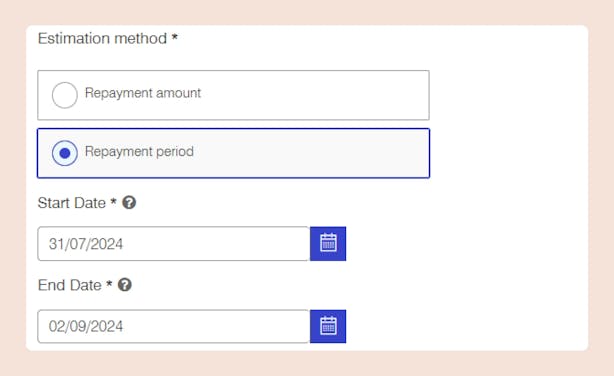

And finally, before the payment plan estimation, you’ll need to provide the estimation method you prefer.

Here you can choose between repayment amount and repayment period. Once you make your selection, you can hit “Show results.”

The tool will provide you with an estimation based on the general interest charge rate, which may vary when you set up an actual payment plan.

Once you’ve worked out a suitable payment scenario based on your circumstances, use it as a guide to set up a ATO payment plan and address your tax obligations.

And now, let’s see how to actually set up a payment plan with ATO.

How Can You Effectively Set Up a Payment Plan with the ATO in 3 Steps?

1. Check If You Are Qualified for a Payment Plan

To qualify for a payment plan, the ATO may require you to demonstrate that your business can repay the debt.

Here’s what they may look for:

- Gross Margins: The difference between revenue and cost of goods sold.

- Current Debt Arrangements: Any existing debt and repayment plans.

- Assets and Liabilities: The overall financial health of your business.

- Cashflow: Your business’s ability to generate cash to pay its obligations.

- Availability of Funding: Access to additional financial resources.

❗ Note: Ensure all your small business's tax returns are current and lodge all financials for the current financial year, regardless of the tax debt's specific year.

Why is this relevant?

By meeting these criteria, you can increase your chances of qualifying for a payment plan and effectively managing your tax debt.

2. Understand the Conditions for Setting Up a Payment Plan

To successfully set up a payment plan with the ATO, keep these key conditions in mind:

- Reduction of Tax Debt: All tax credits and refunds will reduce your tax debt but won’t replace the required installment payment.

- Accrual of General Interest Charges (GIC): General interest charges will continue to accrue until the debt is fully paid.

- Voluntary Payments: You can make additional voluntary payments or pay off the debt at any time.

- Compliance with Lodging Requirements: You must lodge your activity statements and tax returns and pay any associated liabilities on time.

3. Set Up a Payment Plan Using These 4 Methods

Here are 4 ways to set up a payment plan with ATO:

1. MyGov Account

If you are a sole trader or your tax debt is under $100,000, you can apply for a payment plan online via your MyGov account.

All you need is to ensure your MyGov account is linked to the Tax Portal.

Learn how to create and link your accounts here.

2. Call the ATO

Option #2, which involves using the ATO's automated phone service, is another way to set up your payment plan.

This is mainly for you if your tax debt exceeds $100,000.

In this case, ATO may also require you to make a one-off upfront payment to qualify for the payment plan.

Prepare your tax file number (TFN) and Australian business number (ABN) to set up your payment plan.

👉 ATO Contact Number: 13 11 42

3. Hire a Registered Tax Agent

Hiring a registered tax agent can simplify setting up a payment plan with the ATO.

Your accountant can handle the application on your behalf through the Tax Agent Portal, ensuring accuracy and compliance.

Besides, this way, you can benefit from their expertise and guidance.

A tax agent can navigate the complexities of tax debt management more effectively and maintain clear, proactive communication with the ATO.

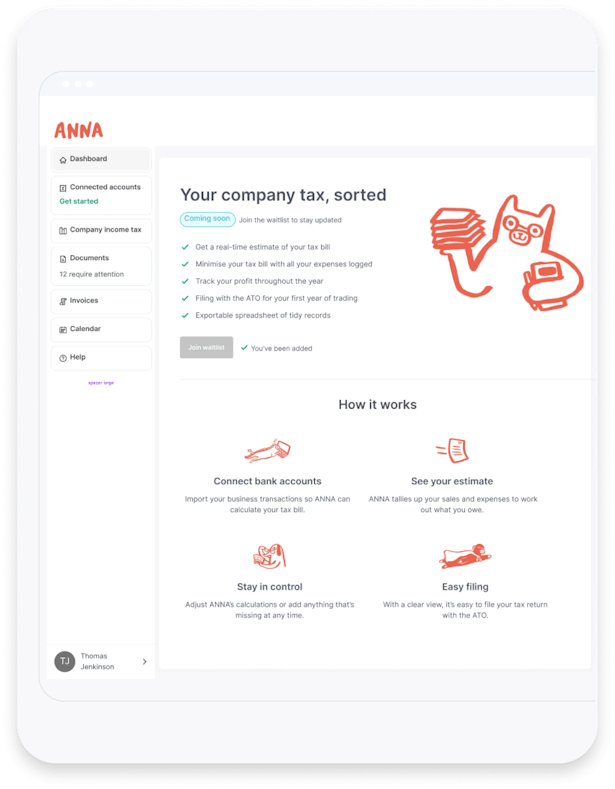

4. Utilize Business Accounting Software

Finally, by utilizing accounting software, you can streamline your financial management and ensure the accuracy of your records.

These tools can automate invoicing, track expenses, and generate financial reports, saving you time and reducing errors.

With the right tool, you can set up a payment plan by scheduling your payments and keeping up with your obligations without stressing about missing any dues.

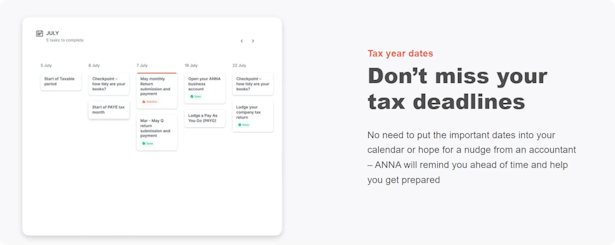

For instance, ANNA enables you to set reminders while also allowing you to monitor all your tax obligations from a personalized calendar.

With accounting software, you can easily monitor cash flow, manage tax obligations, and ensure compliance with all regulatory requirements, providing peace of mind.

Wrapping Up

Setting up a payment plan with the ATO is just the tip of the iceberg on your financial journey. It’s crucial to have a plan that you can stick to, or it’s worthless.

Once you master the continuity of the process, managing your tax debt will be a piece of cake.

Besides, no one wants to mess with the government on unpaid taxes and obligations—that’s a mistake that can cost you dearly.

So why risk making errors like missing due dates or incorrect calculations when you can rely on a tool like ANNA to handle it for you?

Using ANNA can make managing your finances and negotiating with the ATO much easier.

Our platform streamlines financial management and enhances your ability to set up and manage a payment plan effectively.

Here's how ANNA can assist:

✨ Consolidated Financial View: By linking your bank accounts, ANNA provides a holistic view of your finances, making it easier to assess your repayment capacity.

✨ Automated Receipt Matching: ANNA automatically matches receipts to transactions, ensuring precise tracking of your expenses.

✨ Comprehensive Bookkeeping: Store and manage all receipts, invoices, and financial documents in one place, simplifying the review and presentation of your financial status to the ATO.

✨ Personalized Tax Calendar: Keeps track of important tax deadlines and reminders, ensuring you never miss a payment.

✨ Direct GST Logging: Handles GST calculations and logs them directly with the ATO, maintaining compliance.

✨ Professional Invoicing: Quickly create and send invoices, with automatic follow-ups on unpaid ones to ensure timely payments.

And much more.

Ready to streamline your financial management and set up a payment plan with ease?

Start using ANNA today and take control of your tax obligations.

FAQ

What If I Can't Pay an Installment?

If you're unable to pay an installment:

- Use online services to adjust your installment, including the amount, due date, or cancel the payment plan.

- Reach out your registered tax or BAS agent to make modifications on your behalf.

- Call the ATO at 13 11 42 during operating hours to discuss your circumstances. The ATO may vary the payment plan to suit your situation.

How Can I Monitoring My Payment Plan

To check the status of your payment plan, you can access ATO online services.

👉 For individuals or sole traders:

- Access the 'Tax' menu in ATO online services (when you've linked your myGov account to the ATO)

- Select 'Payment'

- Then 'Payment plans'

👉 For businesses: Access the 'Accounts and Payments' menu in Online services for business.

What If I’ve Missed a Scheduled Installment?

If you miss a scheduled payment or fail to meet another tax obligation by the due date, please contact the ATO as soon as possible.

You may still have time to pay before your payment plan defaults.

👉 ATO Contact Number: 13 11 42

What Happens If I Don't Pay an Installment?

Depending on your compliance history, if you don't pay an installment, the ATO may:

- Send you a reminder letter.

- Modify the payment plan.

End your payment plan.