The Australian Financial Year - Beginner's Guide

Learn about the Australian financial year with this beginner's guide, ensuring you understand key dates and compliance requirements for your business.

- In this article

- Understanding the Australian Financial Year

- Assessable Income: What Counts?

- Deductions: Reducing Your Taxable Income

- Superannuation: Planning for the Future

- Tax Offsets and Levies: Additional Considerations

- Strategies for Optimizing Your Tax Position

- How to Leverage Technology for More Effective Financial Management?

- Wrapping Up

Does navigating the Australian financial year and tax system seem troublesome?

It is not a surprise, but it's key to managing your money well.

Regardless of your income (salary, running a business, or investing), understanding taxes can help you make smarter financial choices.

This guide breaks down the basics of the Australian tax system, including recent changes that might affect your finances.

We'll cover everything from income tax to superannuation and share some tips on reducing your tax bill while staying within the law.

Let's dive in!

Understanding the Australian Financial Year

The Australian financial year runs from July 1 to June 30 of the following year. This period is crucial for tax reporting, financial planning, and business operations.

At this point, we're in the 2024-25 financial year, which began on July 1, 2024, and will end on June 30, 2025.

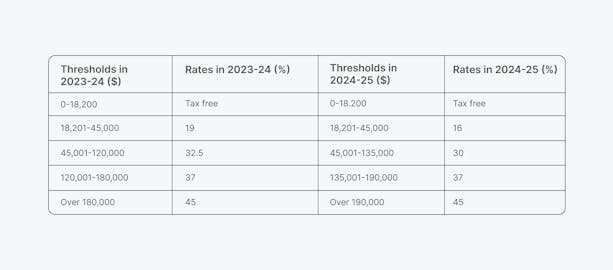

Current Tax Rates and Thresholds

For the 2024-25 financial year and beyond, the tax rates and thresholds for Australian residents are as follows:

- $0 - $18,200: 0% (tax-free threshold)

- $18,201 - $45,000: 16%

- $45,001 - $135,000: 30%

- $135,001 - $190,000: 37%

- $190,001 and over: 45%

It's important to note that these rates don't include the Medicare Levy or various tax offsets, which we'll discuss later.

Recent Tax Changes: Stage 3 Tax Cuts

The Australian tax landscape has undergone significant changes recently, with the implementation of the stage 3 tax cuts.

These changes, which took effect from July 1, 2024, aim to provide tax relief across various income brackets.

Here's what you need to know:

- The lowest rate dropped from 19% to 16%

- The 32.5% rate is now 30%

- The threshold for the 37% rate increased to $135,000.

- The top rate of 45% now applies to incomes over $190,000.

These changes have a major impact on the tax structure, potentially affecting your take-home pay and financial planning strategies.

How is Your Tax Calculated?

Many people misunderstand how tax brackets work, thinking that once their income reaches a higher bracket, all their income is taxed at that rate.

In reality, Australia uses a progressive tax system, where only the portion of income within each bracket is taxed at that rate.

Let's break it down with an example:

Imagine you earn $75,000 in the 2024-25 financial year. Here's how your tax would be calculated:

- The first $18,200 is tax-free.

- Income between $18,201 and $45,000 ($26,799) is taxed at 16%: $4,287.84

- Income between $45,001 and $75,000 ($29,999) is taxed at 30%: $8,999.70

- Total tax payable: $13,287.54 (before any offsets or the Medicare Levy)

This progressive system ensures that as your income increases, you pay more tax, but only on the additional income above each threshold.

Assessable Income: What Counts?

Understanding what constitutes assessable income is crucial for every Australian taxpayer.

It is the foundation of your tax return and directly impacts your tax liability.

And it is not just about your salary—the Australian Taxation Office (ATO) considers a wide range of income sources when determining your total taxable income:

1. Employment Income

This type of income covers salary, wages, commissions, bonuses, and even certain allowances.

For instance, if you receive car or meal allowances as part of your job, these typically need to be included in your assessable income.

2. Super Pensions and Annuities

As you transition into retirement, income from your superannuation becomes relevant.

Whether you receive regular pension payments or have taken a lump sum withdrawal, these generally need to be reported.

3. Government Payments

Many Australians receive support from the government, such as the Age Pension, JobSeeker Payment, or family tax benefits.

While some of these payments might be tax-free, they often need to be declared as they can affect tax offsets.

4. Investment Income

Investment income includes interest from savings accounts, dividends from shares, rental income from investment properties, and capital gains from selling assets.

Each of these has its own tax implications and reporting requirements.

5. Business, Partnership, and Trust Income

This category is particularly important for entrepreneurs and business owners. It includes income from sole trader activities, your share of partnership profits, or distributions from a trust. Even if you reinvest this money back into the business, it's still considered assessable income.

6. Foreign Income

In our globalized world, it's not uncommon for Australians to have income sources from overseas.

This could be from foreign investments, employment, or pensions. For tax purposes, you're generally required to declare your worldwide income as an Australian resident.

7. Certain Crowdfunding Income

Nowadays, crowdfunding has become a popular way to raise money.

Depending on the nature of the crowdfunding campaign, some of this income may be taxable, mainly if it's related to a business venture or profit-making scheme.

📍 Note: It's crucial to report all these income sources accurately to avoid issues with the ATO. Failing to declare income can lead to penalties and interest charges.

Moreover, the ATO has sophisticated data-matching capabilities to cross-reference information from various sources, including banks, employers, and government agencies.

💡 Tip: Even if tax has already been withheld from some of your income sources (like your salary), you still need to declare the full amount in your tax return.

The ATO will then calculate your total tax liability and credit you for any tax already paid.

Deductions: Reducing Your Taxable Income

Eligible deductions can be a vital strategy if you want to minimize your tax liability.

They are expenses directly related to earning your income, which the ATO allows you to subtract from your assessable income before calculating your tax.

This reduction in taxable income can lead to a lower tax bill or a larger refund.

Common deductions include:

1. Work-Related Expenses

These cover costs incurred in performing your job, such as:

- Costs for work-related travel

- Expenses for work attire

- Costs for setting up and maintaining a home office

- Expenses for work use of phone and internet

- Costs for education related to your current job

- Necessary work-related tools and equipment

2. Cost of Managing Your Tax Affairs

Includes fees paid to tax agents for preparing and lodging your tax return, as well as costs associated with tax-related travel or software.

3. Gifts and Donations

You can claim deductions for contributions to eligible organizations, known as "deductible gift recipients," as long as you haven't received any material benefit in return.

4. Investment-Related Expenses

This category includes expenses related to earning investment income, such as interest on loans used to buy shares or property, and fees paid to investment advisors.

📍 Note: Remember, while deductions can significantly reduce your taxable income, they must be legitimate and directly related to earning your income.

💡 Tip: Maintain detailed records of these expenses throughout the year.

The ATO requires you to substantiate your claims with receipts, invoices, or other documentation.

Superannuation: Planning for the Future

Superannuation, or 'super' for short, is Australia's way of helping you save for retirement. It's like a special savings account that grows over your working life.

Here's how it works:

1. Your employer puts money into your super account. In the 2024-25 financial year, they must contribute 11% of your regular earnings. This is called the superannuation guarantee.

2. You can add extra money to your super yourself. This can be smart, as it might lower your tax bill now and boost your savings for later.

3. For the 2024-25 financial year, you can add up to $30,000 to your super and claim it as a tax deduction. This amount includes what your employer puts in, too.

4. To claim this deduction, you must fill out a form from the tax office (ATO) and send it to your super fund.

5. The money you put into super is taxed at 15%. This is less than the average tax rate for many people, which means you could save on tax.

While this can save you money on tax, especially if you earn a high income, remember that you usually can't access your super until you retire.

So, make sure you have enough money for your current needs, too.

Tax Offsets and Levies: Additional Considerations

If you want to fully grasp your tax position, you should also look closely at tax offsets and levies.

These are important parts of Australia's tax system. They help balance social goals with collecting money for the government.

Their purpose?

Tax offsets can lower your tax bill, while levies might increase it. Both can make a big difference in how much tax you pay.

Here are some key information for you to consider:

1. Low Income Tax Offset (LITO)

LITO helps people who don't earn much money pay less tax. In 2024-25, if you earn up to $66,667 a year, you might get this offset.

The most you can get is $700 if you earn less than $37,500. As you earn more, the offset gets smaller until it reaches zero at $66,667.

2. Medicare Levy

This 2% levy on taxable income helps fund Australia's public health system.

While most taxpayers are subject to this levy, some low-income earners may be exempt or eligible for a reduced rate. This helps make the system fair for everyone.

3. Medicare Levy Surcharge

Aimed at encouraging individuals to take up private health insurance, this additional levy applies to high-income earners without adequate private coverage.

The surcharge ranges from 1% to 1.5% of taxable income, depending on income level.

4. Private Health Insurance Rebate

To further promote private health coverage, the government offers a rebate on insurance premiums. This rebate is income-tested, with higher earners receiving a smaller rebate or none at all.

Strategies for Optimizing Your Tax Position

Effective tax planning can significantly impact your financial well-being—from reduced tax liability to staying compliant with the ATO.

Finding the smart strategy that fits your business needs and goals is key.

However, keep in mind that what works best for one person may not be ideal for another.

Plus, consider seeking professional advice to tailor these strategies to your specific circumstances.

Let's see key approaches to consider:

- Salary Sacrificing: Redirect part of your pre-tax income into your superannuation fund. It can lower your assessable income, potentially reducing your tax bracket while boosting your retirement savings.

- Negative Gearing: For property or share investors, this strategy allows you to offset investment losses against your other income.This way, you can potentially lower your overall taxable income, but know the risks that come with it.

- Timing of Income and Expenses: Strategic timing can make a difference. Where possible, consider deferring income to the next financial year or bringing forward deductible expenses to the current year. This can help minimize your current year's taxable income.

- Maximize Deductions: Keeping meticulous records of all potential deductions throughout the year is vital. Consider using a digital app for real-time expense tracking, ensuring you don't miss out on any eligible deductions.

- Utilize Tax Offsets: Make sure you're claiming all eligible tax offsets, such as the Low Income Tax Offset. These can directly reduce your tax payable, offering significant savings.

- Review Your Health Insurance: For high-income earners, having adequate private health insurance can help avoid the Medicare Levy Surcharge, potentially saving you money while ensuring better health coverage.

How to Leverage Technology for More Effective Financial Management?

Financial technology, or "fintech," has transformed how we manage money, from mobile banking apps to advanced budgeting tools.

These digital options simplify everything:

- Track expense

- Plan for the future

- Tackle complex tasks with greater ease and accuracy

And one standout in this digital financial landscape is ANNA—a comprehensive financial management platform.

Let’s explore what makes ANNA unique and how it could change the way you approach managing your finances.

ANNA One Key Features

🔎 Seamless Account Integration: Connect all your bank accounts in one place for a comprehensive overview of your income and expenses.

🔎 Smart Receipt Management: The platform automatically matches and categorizes receipts to transactions, eliminating manual data entry.

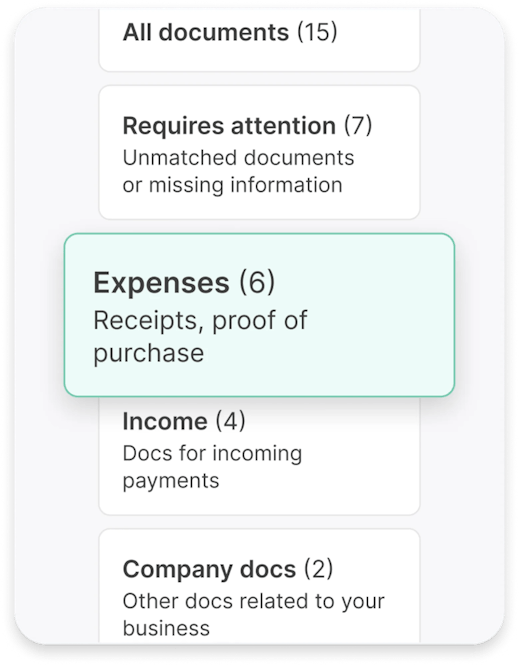

🔎 Digital Document Hub: Securely store all financial documents in one place for easy access.

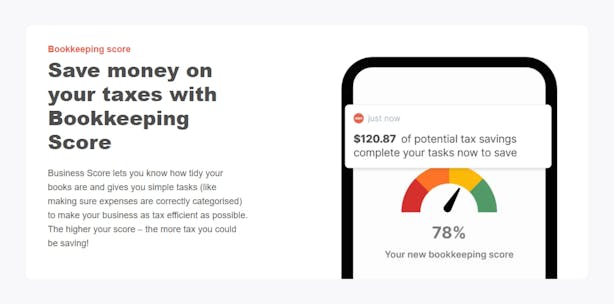

🔎 Bookkeeping Coach: Get a bookkeeping score with tips to improve financial management practices.

🔎 Professional Invoicing: Create and send invoices, track payments, and follow up on overdue accounts.

🔎 24/7 Support: The platform also offers round-the-clock customer assistance for any financial queries.

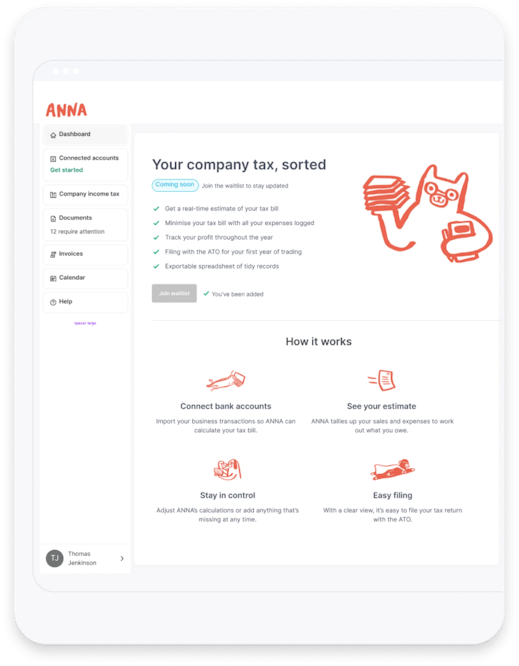

When it comes to taxes, ANNA stands out by making the process less stressful:

📈 Automatic Tax Calculations: It estimates your tax obligations based on your income and expenses, reducing the risk of unexpected bills.

📈 Tax Deadline Reminders: ANNA provides a personalized tax calendar with reminders to keep you on track.

📈 GST Simplification: It manages GST calculations and submits the information directly to the ATO for businesses.

📈 Expert Assistance: You can access professional help for complex tasks like BAS and GST calculations.

Benefits of Utilizing ANNA One

Finally, adopting a tool like ANNA isn't just about making life easier (although that's certainly a plus!). It's about transforming your entire approach to financial management.

Here's how embracing digital solutions can benefit you:

👉 Enhanced Accuracy: By automating data entry and calculations, digital tools significantly reduce the risk of human error.

👉 Time Savings: Less time spent on manual bookkeeping means more time for strategic financial planning and growing your business or personal wealth.

👉 Real-Time Insights: With up-to-the-minute financial data at your fingertips, you can make more informed decisions about your money.

👉 Improved Compliance: Staying on top of tax obligations and regulatory requirements becomes much easier with automated reminders and calculations.

👉 Strategic Focus: When routine tasks are handled automatically, you can shift your focus to big-picture financial strategies and long-term goals.

Wrapping Up

The Australian financial year isn’t just about numbers and deadlines—it’s a chance to assess your financial health, set goals, and implement strategies.

With the right tools, like ANNA, you’re well-equipped to maximize this annual cycle.

Whether you’re managing personal finances or streamlining business operations, our digital tool can help.

Why not take that first step?

Start with ANNA One today and transform your money management approach. Your bank account will thank you for it!