Is There GST on Bank Fees - Everything To Know

Learn if there's GST on bank fees and get all the essential information you need to understand how GST applies to your banking charges.

When it comes to managing your business, no matter where you are in the world, there's one thing you absolutely don't want to mishandle: your taxes.

This is especially true in Australia, where adhering to government regulations and ensuring compliance with GST obligations is crucial.

Here comes a common question many business owners face: Is GST applicable to bank fees?

In this article, we will address the critical aspects of this topic. We'll explore GST, BAS, and the nature of bank fees while clarifying how GST interacts with these fees.

Let's dive in and unravel these vital points!

Understanding GST: A Simple Guide

Goods and Services Tax (GST) is a value-added tax applied to most goods and services sold for domestic consumption. Consumers pay this tax, but businesses collect it and send it to the government.

The main goal of GST is to simplify the tax system by replacing many indirect taxes with a single, unified tax. This change helps reduce tax evasion and makes tax collection more transparent and efficient.

To ensure that tax is only paid on the added value at each step of production, businesses can claim a credit for the GST they pay on their purchases (called input tax) against the GST they collect from their sales (called output tax).

In the end, the consumer pays the GST because it’s included in the purchase price of goods and services.

Types of GST in Australia

In Australia, the Goods and Services Tax (GST) is divided into three primary categories:

- Taxable Sales: Most goods and services are classified as taxable sales, which means GST is applied at a standard rate of 10%. This category includes the majority of everyday items and services that consumers purchase.

- GST-Free Sales: Some goods and services are exempt from GST. This includes essential items like basic food products, healthcare services, and educational courses. These items are not subject to the 10% GST, making them more affordable for consumers.

- Input-Taxed Sales: For certain supplies, GST is not charged, and businesses involved in these sales cannot claim GST credits on related purchases. Examples of input-taxed sales include financial services and residential rental properties. This classification means that while these services and rents are exempt from GST, the businesses cannot reclaim any GST paid on expenses incurred in providing these services.

Benefits vs Downsides of GST

GST offers several benefits:

✔️ Tax Credits: Businesses can reduce tax liability by claiming GST credits on purchases.

✔️ Cash Flow Management: Quarterly GST payments allow better cash flow management.

✔️ Business Perception: GST registration can enhance your business's reputation with larger clients.

And, GST downsides include:

🚫 Administrative Burden: Quarterly BAS lodgment requires accurate and time-consuming record-keeping.

🚫 Price Increase: Adding 10% GST to your prices may make your products less competitive.

🚫 Complexity: Complying with GST regulations can be challenging, especially for small businesses.

How is BAS Lodgement Connected to GST?

Business Activity Statement (BAS) lodgement is how businesses in Australia report and pay their tax obligations to the Australian Taxation Office (ATO).

BAS is a form that businesses use to report their taxes, including:

- GST

- Pay As You Go (PAYG) withholding

- PAYG installments

- And other taxes

The main purpose of BAS is to help businesses regularly report and pay their taxes.

How Often Businesses Need to Lodge Their BAS?

This answer depends on their GST turnover. Here is a more specific breakdown:

- Monthly: For businesses with a GST turnover of $20 million or more.

- Quarterly: For most small to medium businesses.

- Annually: For businesses with a GST turnover below $75,000 (or $150,000 for not-for-profits) that choose to report annually.

Connection Between GST and BAS

BAS is how businesses report and balance their GST.

By showing the GST collected from sales and the GST paid on purchases, businesses can find out how much GST they owe or are owed.

This process keeps the GST system running smoothly, with businesses acting as go-betweens for consumers and the government.

Regular BAS lodgement helps businesses stay compliant and manage their taxes effectively.

Understanding Bank Fees and Their Connection to GST

Bank fees are charges that banks impose for various services and transactions. These fees can add up quickly and affect your overall financial health. Common bank fees include:

- Monthly maintenance fees: A regular charge for keeping an account open.

- Transaction fees: Costs for specific transactions, such as transferring money or withdrawing cash.

- Overdraft fees: Penalties for spending more money than is available in your account.

- ATM fees: Charges for using ATMs outside your bank's network.

- Credit card fees: Annual fees, late payment fees, and interest charges.

- Loan fees: Application fees and service charges for managing loans.

Where and How Bank Fees Connect to GST?

GST is a tax on most goods and services sold for domestic consumption in Australia.

However, bank fees often fall into a special category called "financial supplies," which are input-taxed.

This means that while banks do not charge GST on these fees, they also cannot claim GST credits on their expenses related to these fees. Understanding this distinction is crucial for businesses and consumers alike.

So, is there GST on Bank Fees?

The simple answer is no!

Most bank fees, including monthly account fees, ATM fees, and credit card interest, do not include GST.

Therefore, you should not add GST to these fees in your business tax returns.

However, there are exceptions.

Fees for services such as POS terminals, business insurance, and financial advice can be subject to GST.

It's important to keep detailed records of all fees and any GST charged on them to ensure accurate tax reporting.

Example: Calculating GST on Bank Fees in BAS Lodgment

When preparing your BAS lodgment, you need to account for bank fees accurately. Here’s how you can handle it:

👉 If your bank charges a $25 per month account maintenance fee, you record the $25 as an expense without adding GST.

Your BAS would reflect $0 GST for these items.

👉 For services that do include GST, such as a $50 fee for POS terminal services, you need to include the GST in your BAS.

For example, the fee might include $4.55 GST (10% of the total fee), which you need to report.

Why Are Most Bank Fees Not Subject to GST?

To understand this exemption, let's dive into the world of financial transactions.

Financial services, unlike tangible goods, are often complex and intangible.

Imagine trying to put a price tag on the convenience of an overdraft facility or the security of a savings account.

These services don't have a clear-cut value like a loaf of bread does.

The Australian government recognized this complexity and decided to simplify the taxation process by excluding most financial supplies from GST.

What Does that Mean in Practice?

The answer is simple: simplifying the tax system!

Think of it as decluttering your bakery's kitchen – removing unnecessary tools and ingredients to focus on what truly matters.

For banks and regulators, this means avoiding the headaches and complications that arise when trying to assign a value to intangible services.

This streamlined approach ensures that the financial sector operates smoothly without the added burden of GST compliance on these services.

The Broader Implications

Now, let's look at how this decision impacts everyday banking. On the surface, it seems like a win for consumers – no extra GST on bank fees means one less expense to worry about.

But there's more to the story.

Since banks cannot claim GST credits on their financial supplies, they may need to absorb these costs in other ways.

This could potentially lead to higher fees or lower interest rates on deposits. It's a delicate balance, much like adjusting your bakery's prices to cover rising ingredient costs without driving away customers.

The potential solution? Track the changes!

In essence, the exemption of most bank fees from GST is a thoughtful move to simplify a complex sector.

While it spares consumers from direct GST charges on banking services, it subtly influences the overall cost structure of these services.

As a small business owner, staying informed and vigilant helps you navigate these financial waters with confidence, ensuring your business thrives in a financially stable environment.

Or, are there other ways to keep up with financial records and meet regular obligations?

As promised, let’s meet ANNA solutions.

How to Effectively Manage Your GST Obligations With ANNA?

ANNA is a user-friendly financial management tool that helps make your business operations run smoothly. It takes care of taxes efficiently and keeps your financial records organized.

And for small businesses and sole traders looking to start a business in Australia, ANNA can even help with the registration process.

With our expert support and smart financial tools, managing your GST obligations and other financial activities becomes easy and stress-free.

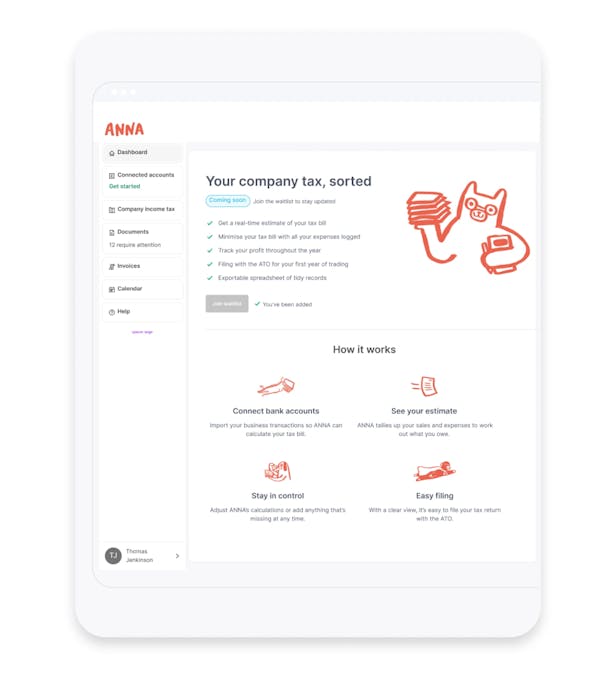

ANNA Solutions For Your Tax and GST Obligations

✨ Automatic Tax Calculations: Clear view of upcoming tax bills based on expenses and income.

✨ Personalized Tax Calendar: Highlights important dates to avoid missing deadlines.

✨ Tax Reminders: Timely notifications to ensure compliance.

✨ Direct GST Logging: Automatic GST calculation and direct logging with the ATO.

✨ Bookkeeping Score: Maintain tidy records and save on taxes.

✨ Automated Receipt Matching: Match receipts to transactions for optimal tax relief.

✨ Efficient Bookkeeping: Store and manage receipts, invoices, and documents; create and follow up on invoices.

✨ Account Linking: Connect other bank accounts to see all finances in one place.

✨ 24/7 Customer Support: Access anytime, including holidays.

✨ Professional Guidance: Email support during early stages.

✨ Comprehensive Assistance: Expert help with BAS and GST calculations for accuracy and compliance.

Additional benefits of using ANNA?

- Quickly create and send professional-looking invoices, enhancing business credibility.

- Automatically follow up on unpaid invoices, ensuring faster payments (80% of invoices are paid within a week).

- Easily extract key details from transactions and share documents for smooth financial management.

Ready to take control of your finances?

Try ANNA today and experience the ease of managing your GST obligations and more with a trusted financial partner.