What Can You Claim on Tax Without Receipts in Australia?

Discover what you can claim on tax without receipts in Australia and gain insights into allowable deductions to maximize your refund.

- In this article

- What is a Tax Deduction and How Does it Work in Australia?

- How Much Can You Claim on Taxes Without Receipt?

- 7 Ways to Claim on Tax Without Receipts in Australia

- Relief for Record Keeping According to ATO

- What ATO Won’t Accept as Proof for Deductions Without Receipts?

- How Can ANNA Help You Keep Your Records for Efficient Tax Claims?

- FAQ

You're probably familiar with tax returns if you're running a business in Australia.

Of course, keeping your bookkeeping in order and saving your receipts is essential if you plan to claim a portion of your expenses through these deductions.

But what if you don't have a receipt? Can you still claim it on your tax return?

Great news!

In this article, we'll look at situations where the ATO allows you to claim on tax without needing receipts.

But first, let's cover the basics!

What is a Tax Deduction and How Does it Work in Australia?

As explained by the Australian Taxation Office (ATO), a tax deduction is a cost you incur while earning income that you can use to lower your taxable income.

This means you can subtract eligible expenses from your total income, reducing the tax you must pay.

You can claim some of your expenses, which are mostly related to your income.

How Does Tax Deduction Work?

Let's quickly cover how tax deductions work in a simple way:

Think of Assessable Income as all the money you make from your job or investments.

Now, you subtract your Allowable Deductions from this amount—these are the expenses you had to pay to earn that income.

You're left with your Taxable Income, the actual amount you owe taxes on.

ATO Rules for Claiming Tax Deductions

Before we discuss what you can claim without receipts, let's quickly cover the rules for tax deductions.

To claim a work-related expense deduction, you must fulfill the following conditions:

- You paid for it but weren't reimbursed.

- It directly relates to earning your income.

- You have proof (like a receipt).

You'll claim these in your tax return under work-related expenses. You only claim the work portion if the cost is for both work and personal use.

❗ Important: You cannot claim if your employer pays or reimburses you. If there's a chance of reimbursement, the ATO might check with your employer.

How Much Can You Claim on Taxes Without Receipt?

In Australia, the maximum tax deduction you can claim for work-related expenses without a receipt is generally $300.

However, these claims must be for expenses that are directly related to earning your income, such as:

- Small tools or equipment

- Home office expenses

- Travel costs

- Car costs

For claims exceeding $300, you’ll need to have receipts or other proof of the expense. It's important to keep accurate records of all claims, as the Australian Tax Office (ATO) may require proof if they audit your tax return.

It's always a good idea to consult a tax professional to ensure you're meeting all legal requirements and getting the most out of your claims.

7 Ways to Claim on Tax Without Receipts in Australia

1. Claiming Work-Related Expenses Without Receipts

You can claim without written evidence if your total work-related expenses are up to $300.

Just be ready to show how you spent the money and calculated your claim.

Remember, this $300 limit doesn’t apply to:

- car expenses,

- meal allowances,

- award transport payments or

- travel allowance expenses.

👉 Example: If you spend $50 on a work-related phone bill, note it in your diary. Add up such expenses, and you can claim them without receipts if they’re $300 or less.

2. Claiming Laundry Expenses

Want to claim a deduction for buying, dry-cleaning, or repairing work-related clothing?

Keep receipts that are showing:

- the supplier’s name,

- amount spent,

- what you paid for, and

- the dates of payment and receipt.

If you can’t get a receipt, bank statements, invoices, or purchase orders are also acceptable if they include the required details.

You can claim without receipts if your total work-related expenses (including laundry but excluding car, travel, and overtime meal allowance expenses) are $300 or less.

If you claim $150 or less for washing, drying, and ironing (excluding dry-cleaning), you don’t need written evidence for laundry expenses.

This applies even if your work-related total expenditures exceed $300. But if your total claim is over $300, keep receipts for the other expenses.

Remember, this isn’t an automatic deduction. You must show how you determined your laundry expense total.

👉 Example: If you spend $30 on washing and drying your work uniforms, and your total laundry expenses are $150 or less, you don’t need to keep receipts for these expenses.

3. Claiming Small Expenses

Can't get a receipt for a small expense?

You can still claim a deduction if you have proof of the expense.

Small expenses are those $10 or less, and you can claim up to $200 per income year for these without receipts.

Just make sure to record the details as soon as possible after incurring the expense.

Your record should include:

- The supplier's name or business name

- The amount of the expense

- What you bought

- The date of purchase

- The date you made the record

Please ensure you record the description of the depreciating asset, the amount of decline in value, the person who made the record, and the date the record was created.

Keep these records organized so that you can readily back up your claims if necessary.

👉 Example: If you grab a $5 coffee for a work meeting and don't get a receipt, note down the café's name, the cost, what you bought, the purchase date, and the date you made the record.

4. Claiming Hard-to-Get Receipt Expenses

Sometimes, getting a receipt can be tough, but don’t worry. The ATO allows you to record these expenses instead.

These expenses can be more or less than $10, and there’s no total limit.

Make sure your records include:

- The supplier’s name or business name

- The amount of the expense

- What you bought

- The date of purchase

- The date you made the record

👉 Example: Suppose you buy a $12 meal from a food truck that doesn’t provide receipts. Note down the food truck’s name, the cost, what you bought, the purchase date, and the date you made the record.

Be cautious, though!

The ATO uses industry averages to spot suspicious claims. Over-claiming, especially without receipts, might trigger an audit where the ATO scrutinizes your tax affairs.

Keep accurate records and stay within the guidelines to ensure your claims are safe and legitimate!

5. Claiming Car Expenses Without Receipts

You don't need receipts if you're eligible to claim car expenses using the cents-per-kilometer method!

For the 2023-24 tax year, the rate is 85 cents per kilometer. This rate covers all car expenses, including:

- Decline in value

- Registration

- Insurance

- Maintenance

- Repairs

- Fuel costs

Just be prepared to demonstrate how you calculate your work use by maintaining diary records or using the myDeductions tool in the ATO app.

You can claim up to 5,000 kilometers for work-related use.

👉 Example: If you drive 3,000 kilometers for work, you can claim 3,000 x 85 cents = $2,550 on your tax return.

So, snap a photo of your car's odometer and claim those work-related kilometers!

6. Claiming Overtime Meal Allowance Without Receipts

An overtime meal allowance is an extra money your employer gives you to buy food and drinks while working overtime.

It's usually provided under an industrial agreement like an award or enterprise bargaining agreement.

This allowance covers the cost of meals you eat during overtime.

❗ Important: If your overtime meal allowance is part of your regular salary, it doesn't count as an overtime meal allowance.

👉 Example: Suppose your employer pays you an overtime meal allowance, and you buy a $20 dinner while working late. Keep the itemized receipt showing the name, amount, and date.

Record-Keeping Exceptions for Meal Allowances

You might not need to keep written evidence if:

- Your employer gives you an overtime meal allowance.

- You spend money on overtime meals, which you can deduct.

- Your claims are within the ATO's allowed limit.

For the 2023–24 income year, the reasonable amount for overtime meal expenses is $35.65 per meal.

If your expenses stay below this amount, you don't need receipts but should be able to prove you incurred the expense.

What If Your Expenses Exceed the Reasonable Amount?

If you spend more than a reasonable amount, you can either:

- Claim the total amount and keep all receipts.

- Claim only a reasonable amount and keep fewer records.

Records to Keep

Even if you qualify for the record-keeping exception, the ATO might still check your tax return and ask for documents showing:

- You worked overtime.

- You bought a meal (e.g., a credit card statement).

- Your meal allowance was paid under an industrial agreement.

- You correctly declared the meal allowance in your tax return.

Remember, the reasonable amount isn't an automatic deduction—you can only claim what you actually spent on deductible overtime meal expenses.

7. Claiming Travel Allowances Without Receipts

The good news is that you might not need receipts or a travel diary for travel allowance expenses within reasonable amounts.

Typically, detailed records are required, but exceptions apply if you receive a travel allowance and meet certain conditions.

Domestic Travel

No detailed records are required for domestic travel if:

- You receive a travel allowance from your employer.

- You can deduct reasonable travel expenses within a reasonable amount.

👉 Example: On a business trip to Sydney, if your expenses for accommodation, food, and incidentals are within reasonable amounts, you don’t need receipts or a diary.

Exceeding the limit? Keep all receipts and a travel diary if the trip lasts 6+ nights.

Overseas Travel

Keep receipts for all accommodation expenses and a travel diary if away for 6+ nights.

👉 Example: On a trip to London, receipts for meals and incidentals are not needed, but keep them for your hotel. If you stay over a week, keep a travel diary.

Airline Crew

No travel diary is needed for airline crew if:

- Your allowance covers your time as a crew member.

- Your travel is mainly outside Australia.

- Your expenses don’t exceed the allowance.

👉 Example: As a flight attendant on an international flight, no diary is needed if your expenses don’t exceed the allowance, but keep receipts for accommodation.

What are Reasonable Amounts for Travel Allowances?

Reasonable amounts are specified in TD 2023/3 for the 2023–24 income year. Only claim deductions for actual expenses incurred.

What Can You Claim on Tax?

Here’s a quick rundown:

- Tools and Tech - Deduct tools, computers, internet, stationery, and books used for work.

- Home Office - Claim expenses like stationery, energy, and office equipment when working from home.

- Work Attire - Get deductions for clothes, glasses, protective gear, and other work-related items.

- Education and Training - Deduct costs for self-education, conferences, and training (but not kids' school fees or care).

- Memberships and Fees - Claim union fees, professional memberships, working with children checks, agency fees, and commissions.

- Meals and Entertainment - Deduct meals, snacks, overtime meals, entertainment, and functions.

- Health and Fitness - Claim medical assessments, vaccinations, gym fees, cosmetics, and personal grooming.

- Gifts and Donations - Deduct gifts or donations to deductible gift recipients with proper records.

- Investments and Insurance - Claim expenses for investments, income protection insurance, personal super contributions, and foreign pensions.

- Tax Management - Deduct costs for managing your tax affairs, like lodging with a registered agent.

- Occupation-Specific Guides - Find deductions for expenses specific to your occupation or industry.

- Cars, Transport, and Travel - Claim expenses for car, transport, and travel related to your job.

Relief for Record Keeping According to ATO

Keeping every receipt can be challenging, and the ATO understands this. Here are the 3 scenarios when you might get some leeway if you can’t keep records:

1. When You Can't Get a Receipt

If you can’t get a receipt, the ATO might still allow your deduction if you have other proof of the expense.

This could include a bank or credit card statement showing the amount, date, and who you paid, along with any other documents and a note in your work diary.

👉 Example: If you spend $50 on work supplies at a market stall without receipts, a bank statement and a note in your diary about the purchase can support your claim.

2. When You Thought You Didn't Need Records

If you genuinely thought you didn’t need to keep records, the ATO might give you a break if you can show enough evidence of the expense and prove your belief was reasonable.

👉 Example: If you thought you only needed to keep records for expenses over $300 and didn’t save receipts for smaller amounts, you might not get relief.

3. When Your Records are Lost or Destroyed

If your records are lost or destroyed, you might still claim a deduction.

For example, if your records were stolen or destroyed in a natural disaster, you can use copies. If you can’t get copies, the ATO might help if you prove the loss and show you tried to protect your records.

👉 Example: If a flood destroys your tax records and you can’t get copies, you might still claim your deductions with other supporting evidence.

What ATO Won’t Accept as Proof for Deductions Without Receipts?

And finally, it is fair to mention what ATO will not accept as proof of your deductions without receipts:

🚫 Cash Payments with No Records: Claims without a tax invoice or receipt.

🚫 Items with Price Tags but No Purchase Evidence: You need a bank statement confirming the purchase.

🚫 Catalogs or Advertisements Without Purchase Proof: You need both the catalog and a bank or credit card statement showing you bought the item.

For more details, please refer to TR 97/24 Income Tax: Relief from Failing to Substantiate.

How Can ANNA Help You Keep Your Records for Efficient Tax Claims?

Managing financial records can be a hassle, but it's essential for accurate tax claims.

ANNA, a top-notch financial management tool, takes the stress out of this process.

Let's dive into how ANNA can make your record-keeping a breeze and ensure your tax claims are spot-on.

How Can ANNA Help?

ANNA offers a variety of tools designed to streamline your record-keeping and simplify tax filing:

✨ Connect Your Accounts: Link all your bank accounts to ANNA for a comprehensive view of your income and expenses.

✨Automated Receipt Matching: Using receipt apps, you can automatically match receipts to transactions and categorize them, ensuring accurate expense tracking.

✨Efficient Bookkeeping: Store and manage all receipts, invoices, and documents in one place, making it easy to find records when needed.

✨Bookkeeping Score: Helps you keep tidy records by offering tips and scoring your bookkeeping practices.

✨Professional Invoices: Quickly create and send professional invoices, with ANNA tracking payments and following up on unpaid ones.

✨24/7 Customer Support: Get round-the-clock assistance with any questions or issues related to your financial records and tax claims.

Other Notable Features for Efficient Financial Management

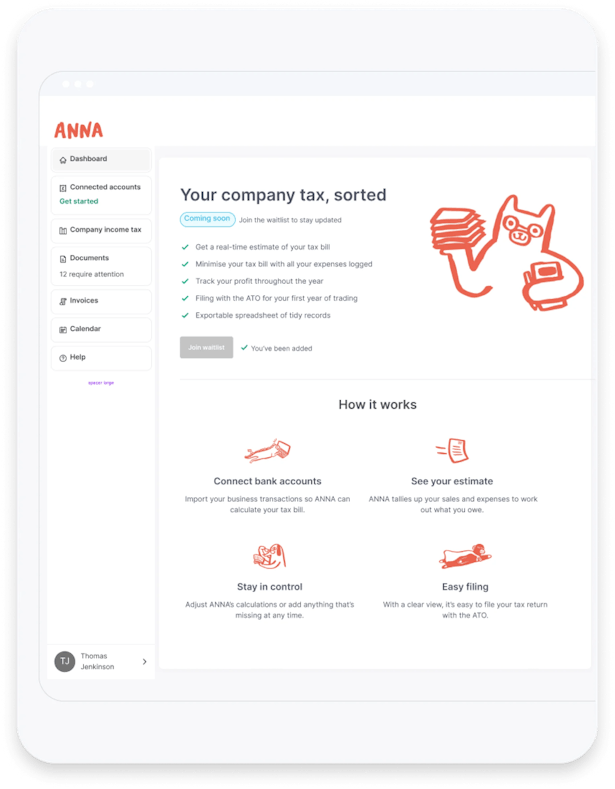

👍 Automatic Tax Calculations: Calculates tax obligations based on business expenses and income, providing a clear view of upcoming tax bills.

👍 Personalized Tax Calendar: Never miss a tax deadline with reminders tailored to your schedule.

👍 Direct GST Logging: Simplifies GST calculations and logs them directly with the ATO.

👍 Comprehensive Assistance: Expert help with BAS and GST calculations to ensure accuracy and compliance.

Using ANNA not only simplifies your record-keeping but also ensures you have all the necessary documentation for accurate and efficient tax claims.

Ready to simplify your financial management and make tax time stress-free?

Try ANNA today and experience the ease of efficient record-keeping and accurate tax claims!

FAQ

How many kilometers can you claim on tax without receipts?

You can claim kilometers on tax without receipts as long as you maintain a logbook or other evidence showing the distance traveled for business purposes.

The ATO allows claims based on the number of kilometers driven, but you must be able to substantiate the claim with relevant records such as diary entries or vehicle maintenance logs.

What if I don't have a receipt?

If you don't have a receipt, the ATO may accept other forms of evidence, such as bank statements, invoices, or a logbook, as long as they show the expense details.

It's important to maintain accurate records to substantiate your claims and ensure they're valid for tax deductions.