Learn why you might owe money to the ATO, and understand the reasons, potential benefits, and key considerations for managing your tax obligations.

Ever opened a letter from the ATO and found out you owe them money? It's not a great feeling, right?

But don't worry, you're not alone.

Lots of people find themselves in this boat for all sorts of reasons. Maybe you didn't pay enough tax during the year, or perhaps you forgot to report some income.

It could even be that you claimed a deduction you weren't quite entitled to.

Whatever the reason, owing money to the ATO can be a bit of a headache.

But understanding why it's happened is the first step to sorting it out and making sure it doesn't happen again.

Let's dive in!

When and How Does the ATO Inform You of Owed Money?

After you've submitted your tax return, the Australian Taxation Office (ATO) doesn't leave you hanging. They have a systematic way of letting you know about your tax situation, including if you owe them money.

Here's what you need to know:

The Notice of Assessment (NOA)

The Notice of Assessment (NOA) is the ATO's primary method of communication about your tax status. You'll receive this after lodging your income tax return.

It's your official heads-up about whether you owe money or are due a refund.

What's in the Notice?

If you owe money, the NOA will clearly state:

- The amount you need to pay

- The due date for your payment

- Your payment reference number (crucial for linking your payment to your account)

Timing

The ATO typically issues the NOA soon after processing your tax return. If you're owed a refund, it can take up to 50 business days for the ATO to issue it.

How You'll Receive It?

Look for a copy in your mailbox. If you've set up online services, check your ATO online account.

"Owed by ATO" vs. "Owe to ATO"

If your tax return shows "owed by ATO," good news! You've overpaid and are due a refund.

If it shows you "owe to ATO," you'll need to make a payment.

📍 Remember, the NOA is an official document. If you're ever unsure about owing money to the ATO, always verify through your myGov account or by contacting the ATO directly.

Don't fall for scams claiming you owe money without official ATO documentation.

Unexpected ATO Tax Bill? 9 Common Reasons Explained

Before we discuss the "why," it is vital to emphasize that receiving a tax bill doesn't necessarily mean you've done anything wrong.

It often can result from changes in your financial situation or adjustments to tax policies.

And, if you're unsure about your tax bill, you can always consult a tax professional or contact the ATO directly for clarification.

1. Changes in Tax Offsets

Tax offsets can change from year to year based on government policies. When a tax offset you previously received is no longer available, it can result in a higher tax bill.

📍 Example: Let's say that the low and middle-income tax offset ended on 30 June 2022. John, who earned $80,000 in both 2021-22 and 2022-23, received a higher tax bill in the latter year due to this change.

2. Insufficient Tax Withholding

If not enough tax is withheld from your income throughout the year, you may end up owing money to the ATO. This can happen due to changes in your income or incorrect claiming of the tax-free threshold.

📍 Example: You got a promotion mid-year, moving you into a higher tax bracket. Your employer didn't immediately adjust your tax withholding, resulting in a tax bill.

3. Changes in Income or Study Loans

An increase in your income can affect your study or training support loan repayments. If you haven't informed your employer about your loan, they may not withhold enough to cover your repayment liability.

📍 Example: Your income increased from $50,000 to $60,000, pushing you into a higher HELP debt repayment rate and increasing your tax liability.

4. Business and Investment Income

Income from running a business, partnerships, trusts, or investments can lead to tax bills if you haven't paid enough tax throughout the year. This is common for those new to self-employment or investing.

📍 Example: You started a side business selling handmade crafts online but didn't set aside money for tax payments, leading to a tax bill at the end of the year.

5. Sharing Economy Activities

Income from sharing economy activities like ride-sharing or renting out assets is taxable. If you haven't accounted for this in your tax planning, it can result in a tax bill.

📍 Example: You started driving for a ride-share company part-time but didn't report this additional income or pay quarterly taxes, resulting in a tax bill.

6. Medicare Levy Changes

Changes to your income or family status can affect your Medicare levy or Medicare levy surcharge obligations. This can lead to unexpected tax liabilities.

📍 Example: Your income increased, pushing you over the Medicare Levy Surcharge threshold. Without private health insurance, you faced an additional tax liability.

7. Private Health Insurance

The amount of private health insurance rebate you receive can change based on your income. If you've claimed too much rebate, you may need to repay the difference.

📍 Example: You claimed the full private health insurance rebate upfront, but your actual income was higher than estimated, requiring you to repay part of the rebate.

8. Superannuation

Exceeding the concessional contributions cap for your superannuation can result in additional tax. This can happen if you're not keeping track of all contributions, including those made by your employer.

📍 Example: Your employer made super contributions, and you also made personal contributions. The total exceeded the cap, resulting in additional tax.

9. Data Discrepancies

The ATO uses data matching to compare your tax return with information from other sources. If discrepancies are found, it may lead to a reassessment and a tax bill.

📍 Example: You forgot to report interest earned from a savings account. The ATO's data matching picked this up, leading to a reassessment and tax bill.

Dealing with ATO Debt: Your Action Plan

Receiving a tax bill from the Australian Taxation Office (ATO) can be stressful, but there are clear steps you can take to manage the situation.

1. Pay the bill by the due date specified on your Notice of Assessment (NOA).

Still, if you find yourself unable to meet this deadline, it's crucial to act quickly while your debt is still manageable.

2. Check if you are eligible for a payment plan.

The ATO understands that financial circumstances can vary, and they offer options to help. You may be eligible to set up your own payment plan tailored to your specific situation.

If you're unsure about why you've received a tax bill or are struggling to pay, the ATO can provide clarification and guidance on your next steps.

How to Avoid an Unexpected ATO Tax Bill

Prevention is often the best strategy when it comes to tax bills. For most employees, tax payments are automatically deducted throughout the year through Pay As You Go (PAYG) withholding.

This system helps ensure you meet your annual tax obligations.

However, if you earn income that doesn't have tax withheld, or not enough tax withheld, there are proactive steps you can take.

1. Increase the Tax Withheld From Your Payments

You can request one or more of your payers to increase the amount they withhold, ensuring you're not left with a large bill at the end of the financial year.

Depending on your circumstances, you may need either an upward or downward variation in your withholding rate.

💡 Pro Tip

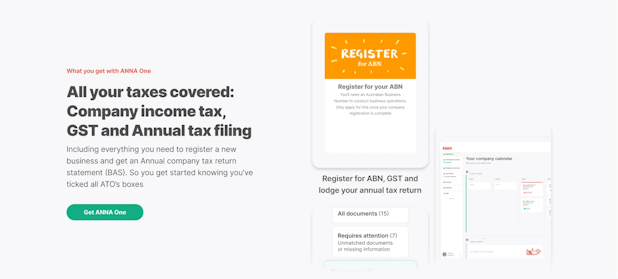

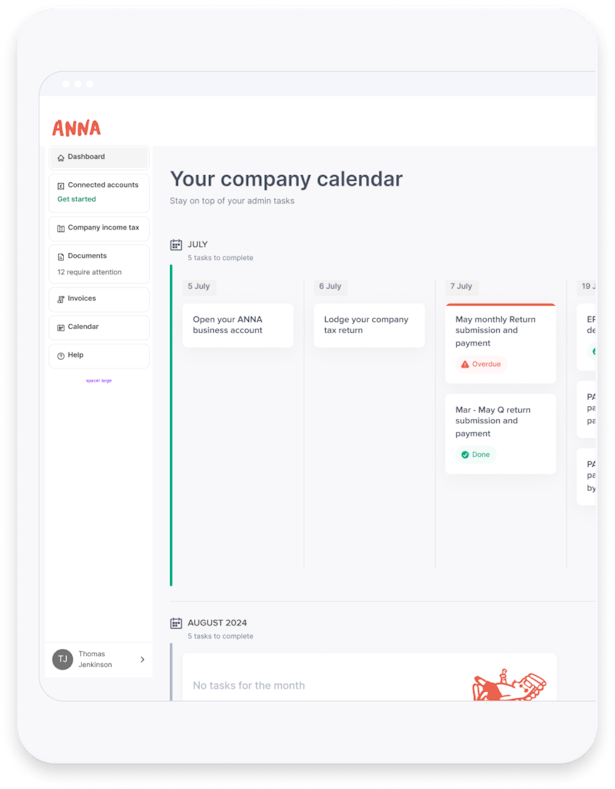

Consider using a comprehensive solution like ANNA One to streamline your tax management. It offers features such as automatic tax calculations and a personalized tax calendar.

This can help you stay on top of your tax obligations throughout the year, reducing the likelihood of unexpected tax bills.

The system provides company tax insights, giving you clear visibility of upcoming tax obligations based on your income and expenses.

Additionally, it handles GST calculations and reports directly to the Australian Taxation Office (ATO), further simplifying your tax management process.

2. Enter the Pay As You Go (PAYG) Installments System

PAYG installment system is particularly useful if you're new to running a business or if you anticipate earning business or investment income above certain thresholds.

By making regular tax payments throughout the year, you can avoid a large tax bill at the end of the financial year.

You can arrange this through ATO online services.

💡 Pro Tip

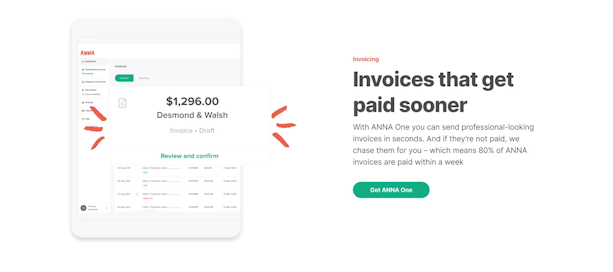

If you're using ANNA One solution, take advantage of its Business Setup and Management features. This package offers an all-inclusive solution that covers everything from business registration to professional invoicing.

ANNA One can be especially helpful when you're new to the business and entering the PAYG installments system.

The ANNA's automatic tax calculation feature can help you accurately determine your PAYG installment amounts, ensuring you're paying the right amount throughout the year.

3. Make Tax Prepayments

You have the flexibility to make prepayments at any time and as frequently as you like, helping you manage your tax more effectively.

The ATO will keep these prepaid amounts and apply them to your future tax obligations, reducing your end-of-year tax bill.

However, if you need the money back, you or your registered tax agent can request a refund of these prepayments.

To help you plan, the ATO provides an income tax calculator.

This tool can help you estimate how much tax you're likely to owe, allowing you to plan how much money to set aside or pay through PAYG installments or prepayments in future income years.

💡 Pro Tip

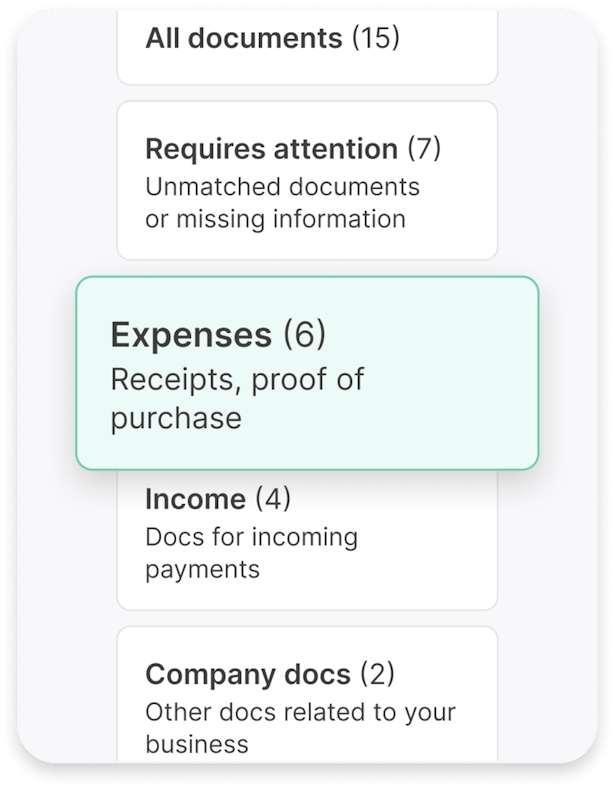

ANNA One's financial organization features can significantly assist with tax prepayments.

The system's document storage capability centralizes all your financial documents, with automated matching and easy sharing.

This means you can easily track your prepayments and ensure they're correctly applied to your tax obligations.

Additionally, ANNA One's Personalized tax calendar can remind you when it might be beneficial to make prepayments, based on your business's cash flow and projected tax liability.

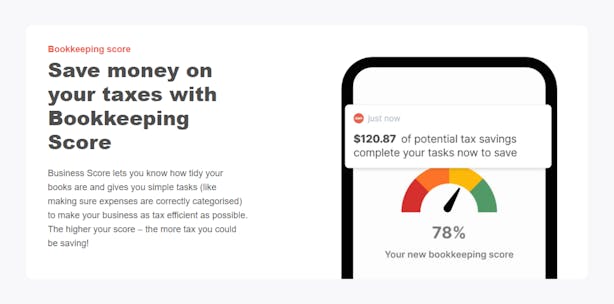

The Bookkeeping score feature can also help you maintain healthy financial records, making it easier to determine when and how much to prepay.

Conclusion

Proper tax planning is crucial for avoiding unexpected bills and managing your finances effectively.

Throughout this guide, we've explored various strategies to help you stay on top of your tax obligations, from increasing tax withholding to making prepayments and utilizing the PAYG installments system.

Remember, if you're ever unsure about your tax situation, it's always best to consult with a tax professional or contact the ATO directly for guidance. They can provide strategic advice based on your specific circumstances.

For those seeking a comprehensive solution for their financial management not to get in a situation to owe money to the ATO, the ANNA One stands out as an excellent choice.

With its array of features covering everything from business setup to tax calculations and personalized insights, ANNA One offers a robust platform to simplify your financial operations and ensure tax compliance.

By leveraging its tools and implementing sound tax planning strategies, you can take control of your finances and minimize tax-related stress.

Ready to revolutionize your approach to tax management and financial organization?

Explore ANNA One today to see how it can transform your business operations and take the first step towards hassle-free tax compliance.