Discover the best accounting apps for sole traders to simplify your finances and find the perfect tool for managing your business accounts.

Are you a sole trader struggling to keep your finances in order?

Managing your own business can be overwhelming, especially when it comes to accounting.

The right accounting app can make all the difference, helping you stay organized, save time, and ensure compliance with tax obligations.

This article will explore the 5 best accounting apps designed specifically for sole traders.

These apps offer features that simplify bookkeeping, invoicing, expense tracking, and tax preparation, allowing you to focus on what you do best – running your business.

Ready to transform your accounting processes?

Let’s dive in!

What are Accounting Apps for Sole Traders?

Accounting apps for sole traders are software solutions designed to help individual business owners manage their finances efficiently.

They typically offer features like:

- Invoicing

- Expense tracking

- Tax preparation

- Financial reporting

Benefits of Utilizing Accounting Apps for Sole Trades

Sole traders often find it challenging to manage their finances effectively while juggling various business tasks.

Without proper tools, they risk errors, missed deadlines, and financial stress that can impact business growth and stability.

By utilizing accounting apps, sole traders can alleviate these challenges with the following advantages:

✔️ Centralized Financial Data: Keeps all your financial information in one place, reducing the risk of lost receipts and missed expenses.

✔️ Automated Expense Tracking: Automatically tracks expenses, ensuring all deductible expenses are accounted for and potentially reducing your tax bill.

✔️ Minimized Human Error: Automating data entry and calculations reduces mistakes common with manual bookkeeping.

✔️ Cash Flow Forecasting: Helps forecast your cash flow, enabling better planning and informed financial decisions.

✔️ Tax Obligation Management: Ensures you stay compliant with tax laws and regulations by keeping you on top of your tax obligations.

These benefits can save sole traders significant time and money while allowing stable growth and fewer administrative tasks.

Top 5 Accounting Apps for Sole Traders to Consider For Your Business

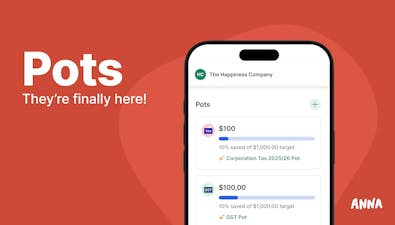

1. ANNA

ANNA is a comprehensive business account and tax management tool designed to simplify starting, running, and growing a business in Australia.

Tailored for business owners and sole traders, ANNA Money focuses on company registration, bookkeeping, invoicing, and tax management, offering a streamlined solution for your financial needs.

Feature Highlights

- Free Company Registration — ANNA Money covers the ASIC registration cost, making it free to register your company.

- Business Account — Open a business bank account seamlessly integrated with your company registration.

- Tax Management — Automatic tax calculations provide a clear view of your tax bill and ensure compliance with obligations.

- Document Storage — Store receipts, invoices, and company documents in one place, with key details extracted for easy access and sharing.

- Expert Support — Access to support from expert accountants for any questions you may have.

- Automated Bookkeeping — Automated receipt matching and categorization for optimal tax relief.

- Professional Invoicing — Create professional invoices quickly, with automated follow-ups on unpaid invoices to ensure prompt payment.

- GST Management — Automatic GST calculation and direct logging with the ATO.

- Tax Insights — Gain clear insights into upcoming tax bills based on business expenses and income.

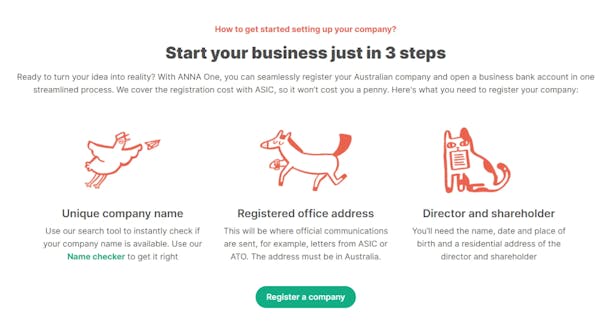

Who Can Register a Company?

Anyone over the age of 18, with at least one director residing in Australia, can register a company.

ANNA currently registers proprietary companies limited by shares with one director and shareholder.

Required Information and Documents

✔️ Company Name

✔️ Registered Office Address — Must be a physical address in Australia.

✔️ Director Details — Full name, residential address, date and place of birth.

Once you receive the confirmation email of your successful company registration, you’re ready to start trading.

Pricing

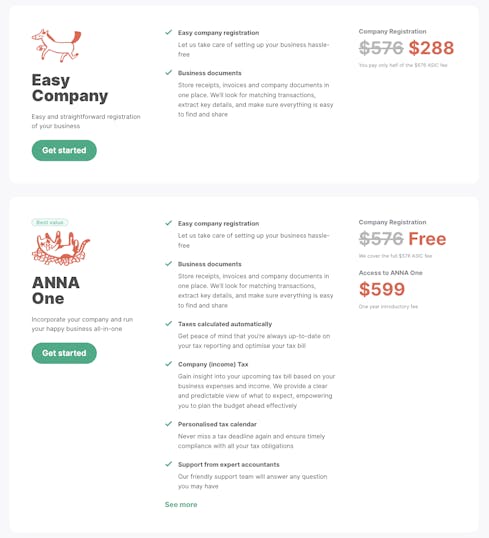

ANNA offers 2 premium packages:

👉 Company Registration — $288 (includes $576 ASIC fee).

👉 Access to ANNA One — $599. ANNA covers the ASIC fee for customers who purchase the ANNA One package, registering your company free of charge and covering the government fee.

2. Rounded

Rounded is an online platform tailored for freelancers and sole traders in Australia, designed to simplify invoicing, accounting, and tax preparation.

With a suite of user-friendly tools, Rounded makes the administrative side of freelancing more efficient, allowing you to focus on growing your business.

Here’s an overview of what Rounded offers:

Feature Highlights

- Invoicing — Create and send professional invoices quickly, directly from the platform.

- Expense Tracking — Digitally track expenses and connect bank feeds for seamless financial management.

- Tax Preparation — Organize financial data for GST, BAS, and estimated taxes, ensuring you’re ready for tax time.

- Time Tracking — Integrated time tracker to ensure accurate billing for all your hours.

- Client Management — Keep client details organized and accessible, with easy import options from Gmail.

- Mobile App — Manage your business on the go with iOS and Android apps, allowing you to send invoices, track time, and manage expenses from anywhere.

Who is Rounded For?

Rounded is ideal for Australian sole traders, freelancers, and small business owners who need a streamlined solution for managing their finances and administrative tasks.

It is particularly useful for those setting up and managing an LLC, as it simplifies accounting and invoicing tasks.

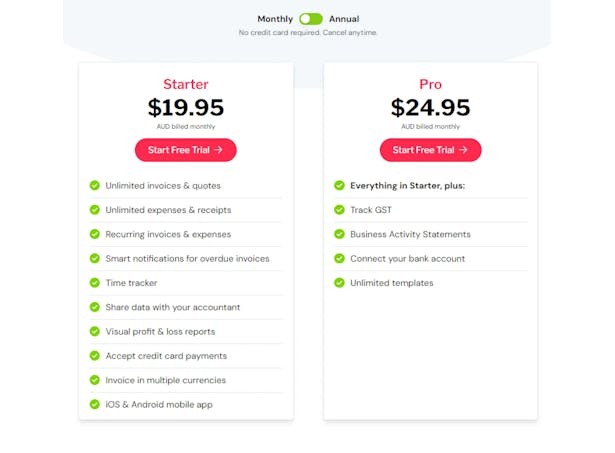

Pricing

Rounded comes with 2 premium tiers. It also offers a 14-day free trial, allowing you to explore its features without any initial commitment.

3. Myob

Myob is a comprehensive business software platform designed to support small to medium businesses in Australia.

Offering a range of features, Myob serves as an all-in-one solution for managing accounting, payroll, and more, helping businesses streamline their operations and ensure compliance with tax obligations.

Feature Highlights

- Cashflow Management — Get a clear view of your finances to prepare for future needs.

- Online Invoicing — Create and send professional invoices, with the ability to receive online payments.

- Expense Tracking — Track business expenses by connecting bank accounts or using the mobile app to snap receipts.

- Tax Management — Organize financial data for Business Activity Statements (BAS) and end-of-year tax returns.

- Flexible Payment Options — Manage the sales process from quote to invoice and offer various payment options.

- Online Payments — Accept payments online directly from your invoices.

- Inventory Management — Track stock levels and streamline reordering processes.

- Multi-Currency Accounting — Handle transactions in over 150 currencies with live exchange rates.

- Mobile Accessibility — Access business information on both desktop and mobile devices, with apps for iOS and Android.

Who is Myob For?

Myob is ideal for small to medium-sized businesses in Australia, including LLCs, sole traders, and larger enterprises.

The platform’s flexibility and range of features make it suitable for various business needs, from basic accounting to comprehensive financial management.

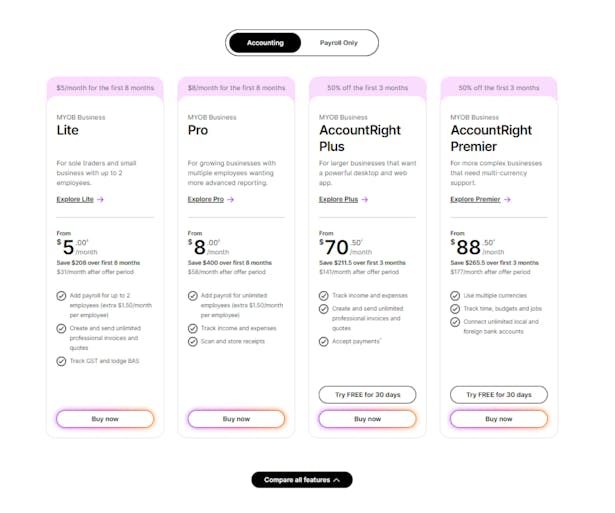

Pricing

Myob offers 4 different pricing plans tailored to various business sizes and needs.

It also offers a 30-day free trial for AccountRight Plus and AccountRight Premier plans.

4. Intuit Quickbooks

Intuit QuickBooks is a robust online accounting software that assists businesses in Australia with comprehensive financial management.

Ideal for small to medium-sized businesses and sole traders, this platform simplifies financial tasks and ensures compliance with tax obligations, offering a variety of features tailored to different business needs.

Feature Highlights

- Cash Flow Management — Access real-time balances and receive custom cash flow tips.

- Automated Invoicing — Send custom invoices and set up recurring billing with automated reminders.

- Expense Tracking — Automatically track income and expenses by connecting your bank account.

- GST & BAS — Track GST and prepare your BAS directly within the platform.

- Receipt Capture — Snap and store receipts for easy expense tracking and tax preparation.

- Industry-Specific Solutions — Cater to various industries with relevant tools for bookkeeping and financial management.

- App Integration — Connect with over 500 business apps like Shopify and PayPal.

- Support — Access unlimited support and free guided setup to get started smoothly.

- Multi-Device Access — Manage your business from anywhere using the QuickBooks mobile app on iOS and Android.

Who is QuickBooks For?

Intuit QuickBooks is ideal for small to medium-sized businesses in Australia, including LLCs, sole traders, and freelancers.

The platform’s flexibility and range of features make it suitable for various business needs, from basic accounting to comprehensive financial management.

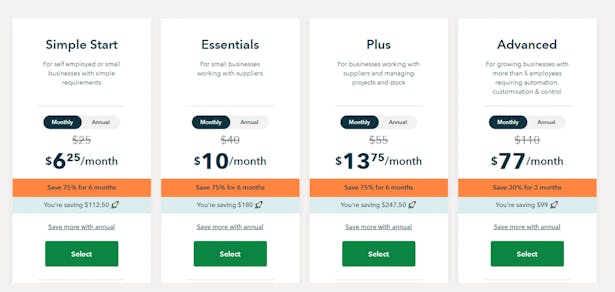

Pricing

Intuit QuickBooks offers 4 different pricing plans tailored to various business sizes and needs, providing scalable solutions whether you’re a sole trader or managing a larger business.

5. Xero

Xero is a cloud-based accounting software platform tailored to meet the needs of small businesses and sole traders in Australia.

With a range of features designed to streamline financial tasks, Xero ensures efficient business management and compliance.

Here’s an overview of what Xero offers:

Feature Highlights

- Cash Flow Management — View simple, customizable reports to stay in control of your bills and invoices.

- Smart Online Invoicing — Customize and send online invoices with automatic reminders to ease payment collection.

- Bank Connectivity — Maintain tidy bookkeeping records and simplify compliance with direct bank feeds.

- End of Financial Year Resources — Access resources to simplify the tax time process.

- Claim Expenses — Manage spending efficiently and handle expense claims with ease.

- Accept Payments — Offer multiple payment options on your invoices to increase timely payments.

- Track Projects — Plan, budget, and invoice for projects using Xero’s job tracking tools.

- Inventory — Monitor stock levels and manage inventory with Xero’s inventory tools.

- Multi-Currency Accounting — Handle transactions in over 160 currencies with live exchange rates.

- Purchase Orders — Create and manage digital purchase orders with ease.

- App Integration — Connect Xero to a wide range of apps and financial services for easier business operations.

Who is Xero For?

Xero is ideal for small to medium-sized businesses in Australia, including LLCs, sole traders, and freelancers.

The platform’s flexibility and range of features make it suitable for various business needs, from basic accounting to comprehensive financial management.

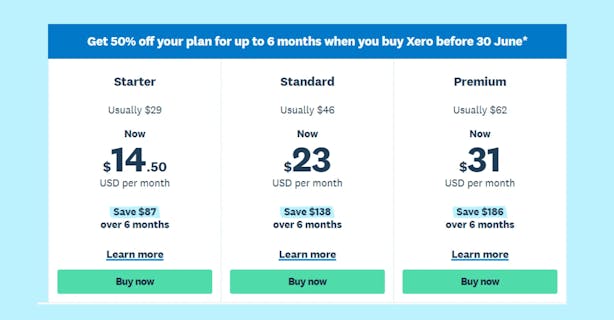

Pricing

Xero offers 3 premium plans, including a starter package, to accommodate different business needs.

This flexibility ensures that businesses of all sizes can find a plan that fits their requirements.

Which Accounting App for Sole Traders is the Right Choice for You?

Choosing the right accounting app is crucial for sole traders who want to streamline their financial management.

Each tool we've discussed offers unique features to help you manage your finances more efficiently:

👉 Intuit QuickBooks: Known for its comprehensive accounting features and ease of use.

👉 Xero: Offers robust financial management tools and seamless bank connectivity.

👉 MYOB: Provides an all-in-one accounting, payroll, and inventory management solution.

👉 Rounded: Explicitly tailored for freelancers and sole traders, focusing on simplicity and essential features.

👉 ANNA: Stands out as the best solution for sole traders with its user-friendly interface and comprehensive support.

Why is ANNA the Best Solution for Sole Traders?

ANNA excels in providing a tailored experience for sole traders, offering a combination of features that make it the top choice.

Top 5 benefits of ANNA One:

✔️ Hassle-Free Setup: ANNA handles the registration and setup process, allowing you to focus on your business.

✔️ Automated Invoicing and Payments: Create and send professional invoices with automated follow-ups to ensure prompt payments.

✔️ Expense Tracking: Effortlessly manage your expenses with automated receipt matching and categorization.

✔️ Tax Management: Stay compliant with automatic GST calculations and direct logging with the ATO.

✔️ Expert Support: Access a friendly support team and expert accountants to assist with any queries.

Ready to simplify your accounting and focus on growing your business?

Register with ANNA One today and experience the benefits firsthand!