7 Best Australian Banks for Business Accounts In 2025

Discover the best Australian banks for business accounts. Compare business banking options, fees, and benefits to choose the right solution.

Business bank accounts are specialized financial tools designed to meet the unique needs of any business in Australia.

They offer features that go beyond personal banking services, tailored to handle daily transactions, manage savings, and support financial planning.

With all this in mind, selecting the right bank account is crucial for any business owner.

It's not just about finding a place to store your company's funds—it's about choosing a financial partner to support your business's growth and day-to-day operations.

To assist you in selecting the most suitable option, we've compiled a list of leading Australian banks offering business bank account services.

Let's explore them!

Understanding Business Bank Accounts

Business bank accounts often come with tools to streamline bookkeeping, facilitate payments, and foster business growth.

When choosing a business bank account, consider these key factors:

- Account fees

- Transaction limits

- Interest rates

- Range of services offered

- Online and mobile banking capabilities

- Alignment with your specific business needs

Benefits of Using Business Bank Accounts

One of the main benefits of opening a dedicated business bank account is the clear separation between personal and business finances.

This separation offers several advantages:

👉 Simplified accounting: Keeping business transactions separate makes it easier to track income, expenses, and cash flow.

👉 Easier tax preparation: A distinct business account simplifies the process of compiling financial records and calculating tax liabilities.

👉 Clearer financial insights: A dedicated account provides better visibility into your company's financial health.

👉 Asset protection: Separating personal and business finances can offer some protection for personal assets in certain legal situations.

👉 Enhanced credibility: A professional business account can improve your company's image with customers, suppliers, and potential investors.

Now, let's explore eight of Australia's top banks offering business accounts, each with its unique features and benefits to help you find the best match for your enterprise.

7 Best Banks for Business Accounts

1. ANNA: Innovating Business Banking

ANNA is at the forefront of modern financial solutions for small businesses, freelancers, and entrepreneurs in Australia.

This platform integrates essential financial services with administrative tasks, creating a comprehensive ecosystem for business management.

ANNA offers a transparent pricing model with fixed monthly fees. The platform provides two main packages:

Both packages include business registration services, with varying levels of additional features to cater to different business needs.

Key Features

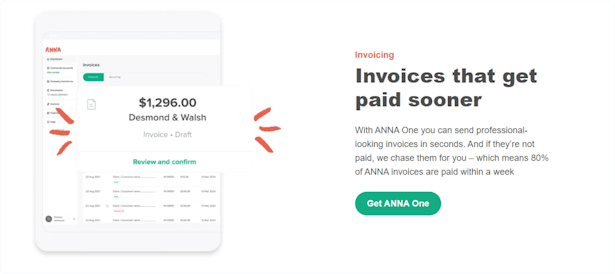

- Automated Invoicing: ANNA simplifies billing by allowing users to create and send professional invoices easily. The system includes automatic reminders for unpaid invoices, helping maintain consistent cash flow.

- Expense Management: The platform categorizes expenses automatically and matches them with receipts, significantly reducing time spent on bookkeeping.

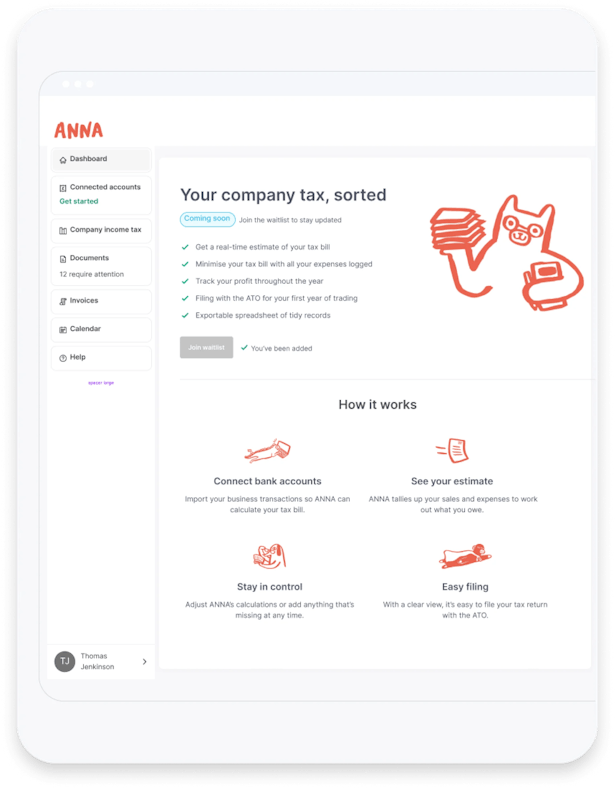

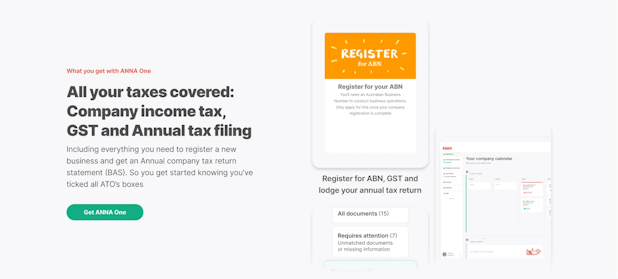

- GST and Tax Calculations: ANNA automatically calculates and logs GST, providing users with a clear overview of their tax obligations. This feature is particularly valuable for small businesses without dedicated accounting staff.

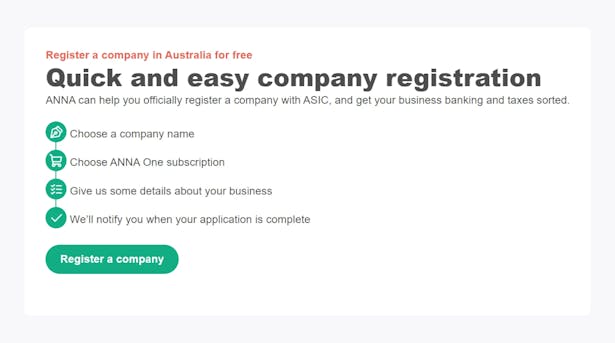

- Company Registration Assistance: ANNA offers support for registering new companies in Australia, including help with obtaining an ABN and registering a business name. This streamlined approach simplifies the process of setting up a new business.

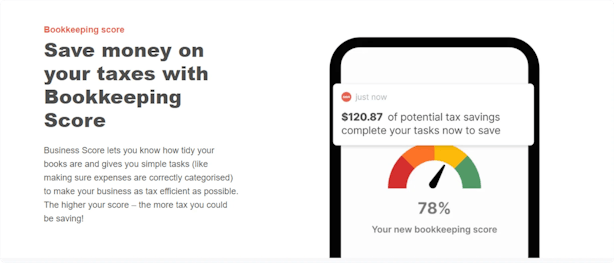

- Bookkeeping Insights: The platform provides tips and insights to help businesses maintain accurate and compliant financial records, promoting good financial health.

- Tax Reminders: ANNA helps businesses stay on top of important tax deadlines by providing automated reminders, helping to avoid penalties and maintain compliance.

Ideal For

ANNA Money is well-suited for small businesses, freelancers, and entrepreneurs looking for an all-in-one platform to simplify their financial tasks and administrative duties.

Its automated features and integrated approach make it an excellent choice for those who want to focus on growing their business rather than getting bogged down in financial administration.

2. Macquarie: Comprehensive Financial Services

Macquarie Bank is a leader in providing comprehensive financial services, including a range of business accounts tailored to meet the diverse needs of Australian enterprises.

Their offerings cater to businesses of all sizes, from small startups to large corporations.

Key Features

- Multiple Account Options: Macquarie offers various account types, including the Business Transaction Account for daily operations, the Business Savings Account for high-interest earnings, and Term Deposit accounts for secure investments.

- Competitive Interest Rates: The Business Savings Account offers attractive interest rates, with 4.65% p.a. applied to balances up to $1,000,000, and a stepped rate of 3.35% p.a. for balances over $1,000,000.

- Fee-Free Banking: Many of Macquarie's business accounts, including the Business Transaction Account, come with no monthly fees and free transactions.

- High Transaction Limits: With the Macquarie Authenticator App, businesses can make Pay Anyone payments up to $100,000 daily, while PayID transactions are limited to $10,000 daily.

- Integrated Financial Tools: Macquarie provides a suite of tools designed to enhance cash flow management and financial planning.

Ideal For

Macquarie's business accounts are well-suited for businesses seeking a reliable and flexible banking partner with a focus on tailored financial solutions.

Their combination of high-interest savings options and fee-free transaction accounts makes them particularly attractive for businesses looking to maximize their financial efficiency.

3. Suncorp Bank: Trusted Australian Financial Institution

Suncorp Bank offers a range of business banking solutions designed to cater to businesses of all sizes. Their product lineup includes accounts for daily transactions, savings, and specialized needs.

Key Features

- Business Premium Transaction Account: This account offers 0.01% p.a. interest on all balances, providing a straightforward solution for daily transactions with the benefit of earning interest.

- Business Saver Account: A flexible online savings account with a standard interest rate of 2.25% p.a. variable, allowing businesses to earn interest while maintaining easy access to funds.

- flexiRates: This feature allows businesses to maximize interest by setting aside savings in either the Business Premium Account or Business Saver Account, offering a fixed rate of 4.70% p.a. for 12 months.

- Term Deposits: For businesses looking for guaranteed returns, Suncorp offers term deposits with a fixed rate of 5.05% p.a. for 9 months on balances ranging from $100,000 to $999,999.

- 24/7 Access: Suncorp provides round-the-clock access to accounts through multiple banking platforms, ensuring businesses can manage their finances at any time.

Ideal For

Suncorp Bank is ideal for Australian businesses seeking flexible, fee-free banking with specialized options.

Their range of accounts and competitive interest rates make them suitable for businesses looking to balance daily transaction needs with long-term savings goals.

4. Heritage Bank: Community-Focused Banking

Heritage Bank, a member-owned financial institution, emphasizes flexibility and community-focused banking in its business offerings. They provide a range of accounts designed to meet various business needs.

Key Features

- Business Cheque Transaction Account: A low-cost account for small to medium-sized businesses, ideal for managing day-to-day transactions.

- Club Cheque Transaction Account: An everyday transaction account with no monthly or transaction fees, specifically designed for non-profit and charitable organizations.

- Specialized Accounts: Heritage Bank offers tailored accounts for specific needs, such as Body Corporate Accounts, Self Managed Super Fund Accounts, and Farm Management Deposits.

- Term Deposits: Businesses can lock in savings with term deposits ranging from 1 month to 5 years, ensuring predictable returns.

- Flexible Access: Heritage Bank provides both online and in-branch account management options, catering to diverse business preferences.

Ideal For

Heritage Bank is particularly suitable for small to medium-sized businesses seeking personalized, community-oriented banking solutions.

Their range of specialized accounts makes them an attractive option for businesses with specific financial management needs.

5. NAB: Comprehensive Business Banking Solutions

National Australia Bank (NAB) is one of Australia's largest financial institutions, offering a robust suite of business banking solutions suitable for enterprises of all sizes.

Key Features

- NAB Business Everyday Account: Designed for daily transactions, this account offers options for no monthly fees on selected plans.

- NAB Business Cash Maximiser: A high-interest savings account for businesses looking to maximize their returns.

- Comprehensive Financial Tools: NAB provides a range of tools to support business growth and cash flow management.

- Online and Mobile Banking: Businesses can manage their finances through NAB's digital platforms, offering convenience and flexibility.

Updates on Account Fees

Starting September 30, 2024, NAB will implement a new fee structure for various business accounts. Key changes include:

- New fees for cash and cheque transactions

- Removal of the Internet Banking Multiple Funds Transfer fee

- Adjustments to the number of free eligible transactions for the NAB Business Everyday Account with the $10 monthly fee option

- A $3 fee for each banker-assisted deposit, withdrawal, or cheque transaction after exceeding the monthly free transaction limit

Ideal For

NAB's business accounts are well-suited for businesses seeking a full-service banking solution with flexible options for both transactions and savings.

Their comprehensive range of services makes them a good fit for businesses of various sizes and industries.

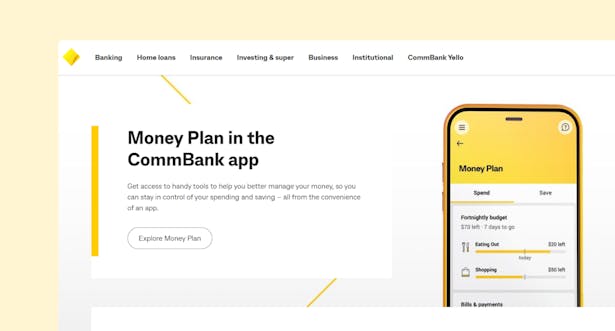

6. CommBank: Leading Financial Institution

Commonwealth Bank of Australia (CommBank) is renowned for its comprehensive business banking solutions, catering to a wide range of business needs.

Key Features

- Business Transaction Account: Offers options for $0 or $10 monthly fees, with unlimited electronic transactions and a Business Visa Debit Card linkable to Apple Pay.

- Business Online Saver: A savings account offering up to 1.25% p.a. variable interest, with no minimum deposit or withdrawal requirements.

- Capital Growth Account: A business notice deposit account providing up to 3.25% p.a. interest with flexible notice periods.

- Specialized Accounts: CommBank offers accounts tailored for specific industries, such as Statutory Trust Accounts for legal and real estate professionals.

- Integrated Financial Tools: The bank provides tools for invoicing and financial management, supporting efficient business operations.

Ideal For

CommBank's business accounts are suitable for businesses of all sizes seeking flexible and comprehensive banking solutions.

Their range of specialized accounts and integrated financial tools make them particularly attractive for businesses looking for a one-stop banking solution.

7. AMP Bank: Specialized Solutions for SMEs

AMP Bank focuses on providing specialized banking solutions tailored for small to medium-sized businesses, emphasizing simplicity and efficiency in their offerings.

Key Features

- AMP Cash Manager: Offers tiered interest rates up to 4.80% p.a. for balances between $10,000 and $5 million, with no monthly fees and digital wallet payment capabilities.

- AMP Access Account: A transaction account with no monthly fees, offering easy access, a debit card, and BPAY facilities.

- AMP Business Saver Account: Provides up to 4.80% p.a. interest with a bonus rate for six months, linkable to a transaction account.

- AMP Term Deposit: Offers competitive rates up to 5.20% p.a., with a $5,000 minimum deposit and terms ranging from three months to five years.

Ideal For

AMP Bank is particularly well-suited for small businesses seeking straightforward, reliable banking solutions.

Their combination of competitive interest rates and easy online management makes them an attractive option for businesses looking to simplify their financial operations.

Conclusion: Why ANNA Stands Out as the Top Choice?

While all the banks mentioned offer valuable services for businesses, ANNA emerges as the standout choice for several compelling reasons:

👉 Integrated Solution

ANNA goes beyond traditional banking by combining essential financial services with administrative tasks.

This comprehensive approach saves businesses time and reduces the complexity of managing multiple systems.

👉 Automation Focus

ANNA's automated features for invoicing, expense tracking, and tax calculations are particularly beneficial for small businesses and freelancers who need to focus on their core operations rather than administrative tasks.

👉 Modern Business Approach

With its digital-first approach, ANNA caters to the needs of modern, agile businesses that require flexibility and real-time financial management.

👉 Proactive Financial Management

Features like the Bookkeeping Score and tax reminders demonstrate ANNA's commitment to helping businesses maintain financial health and compliance.

👉 Business Setup Assistance

ANNA's support with company registration and ABN acquisition simplifies the process of starting a business, making it an excellent choice for entrepreneurs and startups.

👉 Transparent Pricing

ANNA's straightforward pricing model, with fixed monthly fees and clear package options, allows businesses to budget effectively for their banking needs.

👉 Specialized Focus

While many traditional banks cater to businesses of all sizes, ANNA's specialized focus on small businesses and freelancers ensures that its services are tailored to this often underserved segment.

In conclusion, while each bank offers unique advantages, ANNA's innovative approach to business banking sets it apart.

Ready for an easy start?

Get started with ANNA today to supercharge your business growth and simplify your financial operations with confidence!