4 Best Receipt Apps in Australia to Consider for 2025

Discover the best receipt apps in Australia to simplify expense tracking and find the ideal tool for managing your business receipts efficiently.

Are you tired of dealing with piles of paper receipts?

You’re not alone.

In today’s digital world, it’s natural to seek solutions that simplify your life and keep all your financial records in one place.

Besides, managing your receipts is a crucial part of financial planning, and collecting and organizing your expenses allows you to monitor your financial flow more effectively.

We’ll explore the top receipt apps in Australia so you can choose the most suitable one to address your points.

Let’s dive in!

4 Top Receipt Apps In Australia to Try Today

In the following section, we’ll review our top picks for receipt apps you can use in Australia.

Each review includes:

- A brief description,

- How to manage receipts with the app,

- Notable features,

- Top 3 FAQs,

- Customer highlights, and

- Pricing plans.

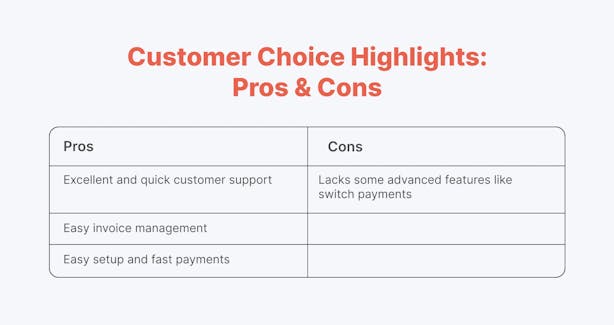

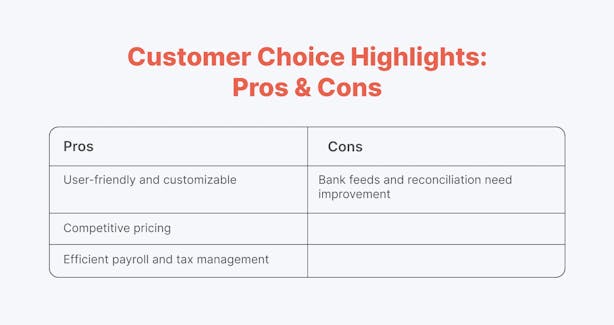

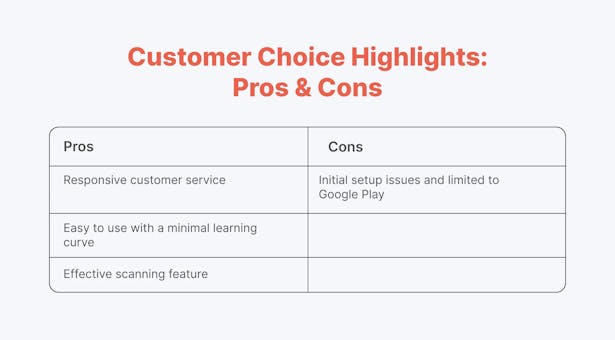

Keep in mind that all pros and cons come from Forbes Advisor, Capterra, GetApp, and Trustpilot.

Some cons may have already been resolved since they were first addressed.

1. ANNA

ANNA is an all-in-one platform for streamlining business operations, handling taxes, and maintaining organized financial records.

It provides expert support and innovative financial tools, making it an ideal choice for those looking to optimize their business management processes.

How to Manage Receipts with ANNA?

With ANNA, you can easily keep your receipts organized and your financial records up-to-date. Here's how:

1. Snap a Pic: Take a picture of your receipts using your mobile device.

2. Automatic Sorting: ANNA automatically sorts the receipts and attaches them to the correct transactions.

Other Notable Features

✨ Easy Company Registration: Set up your business effortlessly with ANNA handling all necessary registrations.

✨ Business Documents Management: Store and manage receipts, invoices, and company documents in one place. Connect other bank accounts to see all your finances in one place.

✨ Automatic Tax Calculations: Stay updated on tax reporting with clear insights into upcoming tax bills and personalized reminders.

✨ Personalized Tax Calendar: Never miss a tax deadline again, and ensure timely compliance with all your tax obligations.

✨ Annual Company Tax Return Statement (BAS): Let us handle your tax obligations from the start and lodge your statement for your first year of trading.

✨ Goods and Services Tax (GST): Automatic GST calculation and direct logging with the ATO.

✨ Invoices That Get Paid Sooner: Create professional-looking invoices in seconds, and we’ll automatically chase any unpaid invoices on your behalf.

✨ Expert Support: Access award-winning 24/7 customer support via email, even on holidays.

✨ Bookkeeping Score: Monitor and improve your bookkeeping with automated receipt matching and categorization for optimal tax relief.

✨ Receipt Matching: Automated receipt matching and categorization of expenses to get you the right tax relief.

FAQ: Our Top 3 Picks

1. What types of businesses can I register?

We currently register proprietary (private) companies limited by shares with one director and shareholder.

This company can't be a trustee of a superannuation fund.

2. Who can register a company?

Anyone over 18 in Australia with at least one director residing in Australia and a registered address in Australia.

We currently accept applications from Australian residents only.

3. What information and documents are required to register a company?

You'll need a company name, a registered office address (not a PO BOX), and director details (full name, residential address, date, and place of birth).

Directors must reside in Australia and apply for a Director ID before registration.

Customer Choice Highlights: Pros & Cons

Pricing

ANNA offers 2 premium packages, Easy Company and ANNA One, both covering a $576 ASIC fee for those who need to register their company in Australia.

2. QuickBooks

QuickBooks Australia provides online accounting software tailored for small businesses and self-employed individuals.

It simplifies financial management with features like custom invoicing, expense tracking, GST and BAS tracking, payroll management, and financial reporting.

The platform integrates with various CRM systems, inventory management tools, and payment processing platforms and offers real-time insights to help you make informed business decisions.

How to Manage Receipts with QuickBooks?

Managing receipts with QuickBooks is straightforward and efficient.

Here's a step-by-step guide:

1. Upload Your Receipts: Simply upload your receipts to QuickBooks. You can do this by taking a photo with your mobile device or scanning and uploading the file directly.

2. Automatic Extraction: Once you upload your receipts, QuickBooks automatically extracts the necessary information and creates a transaction for you to review.

3. Review and Edit: Navigate to the Receipts tab to find your uploaded receipts. You can review the extracted information, make any necessary edits, and ensure all details are accurate.

4. Add or Match Transactions: After reviewing, you can either add the receipt to an account or match it to an existing transaction.

Other Notable Features

✨ Simple Invoices: Create and send custom invoices with built-in payment options for faster payments.

✨ Automated Expenses: Connect your bank to easily sort expenses with a swipe or a click.

✨ GST & BAS Tracking: Prepare and submit your BAS, knowing exactly what you owe and when to pay it.

✨ Painless Payroll: Manage payroll, Single Touch Payroll, superannuation, and other ATO obligations in one place.

✨ Reports and Insights: Generate quick, easy reports for valuable insights and better business decisions.

✨ Cash Flow Confidence: Receive custom cash flow tips and real-time balances from connected accounts.

✨ Effortless Invoicing: Create and send professional invoices in seconds with automatic reminders.

✨ Track Income and Expenses: Connect various accounts to pull in all income and expenses automatically.

FAQ: Our Top 3 Pics

1. Can I use QuickBooks for free?

You can sign up for a free 30-day trial. Various plans are available, from Simple Start for basic needs to QuickBooks Online Advanced for more complex requirements.

2. Can QuickBooks integrate with other business applications?

Yes, QuickBooks integrates with CRM systems, inventory management tools, and payment processing platforms.

3. What kind of support is available for QuickBooks users in Australia?

Customer support and online resources, such as user guides and video tutorials, are available via phone, email, or live chat.

Local support teams in Australia are also ready to assist with any questions or issues.

Customer Choice Highlights: Pros & Cons

Pricing

QuickBooks comes with 4 pricing tiers, ranging from $2 to $77 per month.

3. Zoho Expense

Zoho Expense revolutionizes travel and expense management with streamlined booking, faster expense reporting, and effective cost control.

This tool offers simplified processes for managing travel, reporting expenses, and enforcing spending policies, making it an ideal solution for businesses looking to optimize their financial operations.

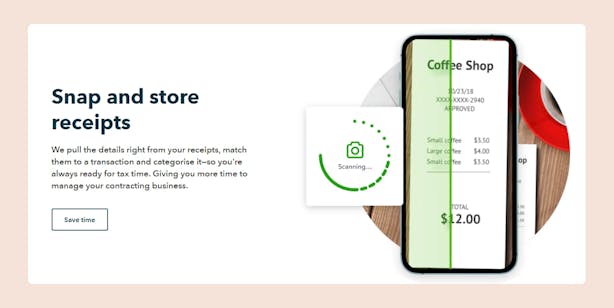

How to Manage Receipts with Zoho Expense?

Zoho offers 4 different ways to scan and store your receipts. Here is how:

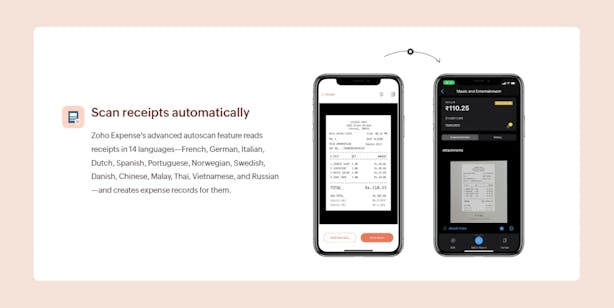

1. Use Advanced Autoscan: Zoho Expense’s advanced autoscan can read receipts in 14 languages, such as French, German, Italian, and Spanish, and automatically generate expense records.

2. Automatic Receipt Forwarding: Forward your receipts to your designated receipt forwarding address, and Zoho Expense will instantly transform them into expense entries.

3. Integrate Cloud Storage: Keep your receipts safe by storing them on the cloud.

Zoho Expense allows imports from Zoho Docs, Evernote, Google Drive, OneDrive, Dropbox, and Box, making it easy to convert receipts into expenses.

4. Bulk Receipt Import: If you have a stack of receipts from a business trip or client visit, you can upload them all at once. Zoho Expense will efficiently convert each receipt into individual expenses.

Other Notable Features

✨ Stay on Top of Account Activities: Use Zoho’s banking dashboard for precise cash flow predictions, balance mismatches, expected recurring payments, and past reconciliations.

✨ Automated Categorization: Use bank rules to filter and categorize transactions automatically.

✨ Expedited Transaction Matching: Zoho Books identifies possible and the best matches for your transactions.

✨ Streamlined Bank Reconciliation: Reconcile all your accounts in a few clicks to keep your business tax-ready.

✨ Audit & Compliance: AI-driven fraud detection helps audit expenses and maintain tax compliance with dedicated country editions.

✨ Spend Control: Set budgets, enforce policies, and configure purchase approvals to prevent unauthorized expenses.

✨ Expense Reporting: Automate the process from receipt to reimbursement, eliminating manual errors.

✨ Travel Management: Manage business travel with self-booking tools, fare lock-ins, visa requests, and flight alerts.

✨ Auto-generate Expense Reports: Automatically generate report names and numbers, group relevant expense types, and download reports as PDFs.

FAQ: Our Top 3 Picks

1. How do I receive payments online?

Zoho Books supports several payment gateways, allowing you to easily receive payments online. Integrate a payment gateway and associate it with an invoice to receive payments.

2. How do I integrate any third-party application with Zoho Books?

Zoho Books supports an open API for integration with third-party applications. To push data, use the third-party software API in Zoho Books' Webhooks and the Zoho Books API to fetch data. The API script needs to be configured as required.

3. How many branches can I create for my organization in Zoho Books?

You can create up to three branches with Zoho Books' Premium, Elite, or Ultimate plan. Add-ons are available to add more branches to your organization.

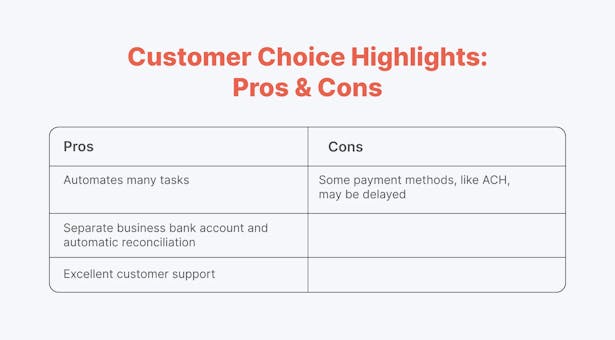

Customer Choice Highlights: Pros & Cons

Pricing

Zoho offers 1 free and 3 premium plans, starting from $5 per month per active user.

4. MMC Receipt

MMC Receipt is a robust tool designed to streamline receipt management for businesses.

By combining OCR, machine learning, and human checks it ensures accurate data extraction.

The platform supports multiple input methods and real-time updates, making expense management hassle-free and efficient.

How to Manage Receipts with MMC Receipt?

MMC Receipt is a powerful platform designed to help you manage and account for receipts, ensuring accurate and secure financial records.

Here’s how to use it:

1. Capture and Upload: Use your mobile phone camera, email, or computer scanner to capture and upload your receipts.

2. Automatic Processing: Once uploaded, MMC Receipt automatically extracts all key information and displays it in an easily manageable format, ready for processing with your linked accounting software.

3. Manage Multiple Businesses: For accountants and bookkeepers, MMC Receipt offers a single dashboard to manage the finances of multiple businesses efficiently.

Other Notable Features

✨ Receipt Capture: Easily capture receipts via app, web, or email.

✨ Real-Time Updates: See data updated in real-time with the highest accuracy.

✨ Multi-Currency Support: Capture receipts in any currency without issues.

✨ Unlimited Uploads: Upload as many receipts as needed without an upper cap.

✨ Unlimited Users: Add any number of users to a single entity.

✨ Unlimited Storage: Store as many records as needed on the cloud.

✨ Flexible File Types: Convert extracted data into any file type, including JPEG and PDF.

✨ Approval Stages: Set up multiple approval stages for data verification.

✨ Auto Push Feature: Automatically push invoices to your accounting software with custom rules.

✨ Rules Setting Feature: Organize receipts with custom categories for specific merchants and customers.

FAQ: Our Top 3 Picks

1. What technology does MMC Receipt use?

MMC Receipt uses OCR and machine learning to extract information from receipts, presenting it in an electronic, easy-to-manage format. Human checks are used for quality assurance.

2. What file types can I upload to MMC Receipt?

You can upload JPG, PNG, GIF, BMP, TIFF, PDF, DOC, DOCX, ODT, and RTF file types.

3. Who can push receipts to your connected accounting software?

Users with Administrator, Manager, or Accountant roles can push receipts to the connected accounting software.

Customer Choice Highlights: Pros & Cons

Pricing

MMC Receipt offers retail and accountant bundle pricing plans.

Monthly pricing for small businesses starts from A$25 per month per company.

Monthly pricing for accounting companies starts from A$50 per month for 10 clients.

Wrapping Up

After reviewing these top receipt apps in Australia, it’s clear that each offers unique features to help you manage expenses and streamline financial processes.

If you're still unsure which option to pick, we strongly recommend starting with ANNA.

Why?

👍 ANNA makes managing your business accounting and administration effortless By consolidating everything in one place.

👍 It enables you to connect your other bank accounts to see all your finances at a glance and never miss a tax deadline with helpful reminders.

👍With its user-friendly interface, automated receipt matching, and comprehensive support, ANNA is the top choice for small businesses and self-employed individuals.

How to Get Started?

1. Choose a Company Name.

2. Select your subscription.

3. Provide business details.

4. Get notified when your application is complete.

Eager to find out more?

Get started with ANNA today and get all the financial assistance you need in one place.

Keep Learning

26 Australian Business Statistics You Should Know

Sole Trader vs Company - What's the Difference?

GST In Australia Guide - Everything You Need to Know