Do You Need an ABN to Sell on Etsy Australia? [7 Tips to Know]

Learn whether you need an ABN to sell on Etsy, including legal requirements, benefits, and key considerations for Australian sellers.

Etsy is a popular platform for creative entrepreneurs to showcase and sell their handmade, vintage, or custom goods.

With millions of active buyers around the world and a dedicated audience seeking unique, artisanal products, Etsy provides an attractive opportunity for Australian makers.

However, as soon as you consider turning your hobby into a business (or if you’re looking to supplement your main income by selling on Etsy), you may wonder about the need for an Australian Business Number (ABN).

The answer is – it depends, so let’s go into detail below.

Why Etsy?

Etsy is a worldwide community of craftsmen and craftswomen, artisans, digital creators, vintage curators, and passionate hobbyists-turned-entrepreneurs.

Founded in 2005, Etsy quickly distinguished itself from other eCommerce platforms by focusing on handmade, unique, and one-of-a-kind items.

By the end of the 2010s, Etsy boasted tens of millions of buyers around the globe.

Its user-friendly interface and niche focus on creative goods make it an ideal space for small-scale sellers.

Rather than building your own eCommerce website (and worrying about attracting traffic), you can tap into Etsy’s established audience of shoppers actively looking for handmade or vintage treasures.

But does this mean you can simply open a shop, list items, and start selling without any formal paperwork?

That depends on a key decision: are you running a hobby or a business?

Understanding this distinction is fundamental when it comes to Australian tax obligations and whether or not you need an ABN.

What Is an ABN and Who Needs One?

Essentially, an ABN is used to:

- Identify your business to the government and the public

- Track your business’s tax obligations (such as Goods and Services Tax or GST)

- Allow you to register for the Pay As You Go (PAYG) withholding system

- Facilitate your interactions with other businesses and government agencies

According to the ATO, you’re required to have an ABN if you are “carrying on an enterprise” in Australia.

In other words, if you conduct activities in a business-like manner, such as developing a business plan, keeping financial records, marketing to customers, expecting to turn a profit, etc., you’re likely considered a business.

If, however, you’re simply pursuing your craft on a small scale, with irregular sales and no profit motive, your activity may be classified as a hobby.

Since a hobby is not considered an enterprise, hobbyists typically do not need an ABN.

Do You Need an ABN to Sell on Etsy?

The short answer: it depends on how you’re selling, how much you earn, and whether your activity is considered a hobby or a business.

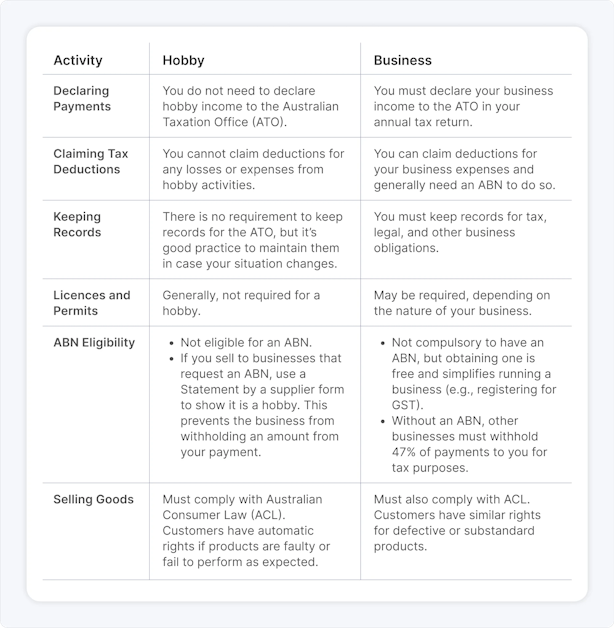

Hobby vs. Business: Key Differences

🟠 Purpose and Scale

- Hobby: You make and sell goods irregularly or casually, typically without a solid plan to grow or make significant profits.

- Business: You have clear goals, strategies for expansion, consistent production, and a plan to generate profit.

🟠 Record-Keeping and Financial Management

- Hobby: You may keep minimal records; sales might be sporadic, and you are not actively trying to develop your craft into a full-time, profit-driven operation.

- Business: You maintain financial and administrative records, including expenses, income statements, and marketing strategies.

🟠 Revenue Threshold

- While there is no single revenue figure that automatically defines your activity as a business or hobby, the ATO does require you to have an ABN if your yearly turnover exceeds AUD $75,000. At that point, you’ll need to register for GST and lodge Business Activity Statements (BAS).

- If you’re only earning a few hundred or a few thousand dollars a year from your Etsy shop, that might still be considered a hobby, especially if you’re not intentionally scaling to make a profit. However, if you’re selling regularly, marketing your store, and operating like a business, you should consider obtaining an ABN even if you’re below the $75,000 threshold.

According to ABR, here are the most important distinctions between the two: 👇

How to Apply for an ABN

You can apply for an ABN online through the Australian Business Register website.

To receive one, you must:

- Be carrying on an enterprise in Australia

- Provide your Tax File Number (TFN)

- Show that your goods or services are connected with Australia

- Provide evidence of business-like activities (such as having a business structure or plan)

If your application meets these criteria, you will be issued an ABN, typically within a short period.

Or, you can go through ANNA’s fast and straightforward process, done in just a few minutes.

Benefits of Having an ABN

Even if your earnings are modest at the start, there are several advantages to having an ABN as an Etsy seller:

🟠 Tax Credits and Deductions

If you’re registered for GST (which is mandatory once you earn over AUD $75,000 a year), you may claim back GST credits on business expenses. This can significantly lower your overall costs.

Having an ABN also streamlines the process of claiming deductions for costs related to running your Etsy shop, such as materials, shipping supplies, and certain business services.

🟠 Smoother Transactions with Other Businesses

Wholesalers, suppliers, and service providers often prefer dealing with ABN-holding clients because it simplifies invoicing and tax requirements. An ABN shows you’re running a legitimate business.

🟠 Flexibility in Hiring and Growth

If you decide to hire employees or contractors, you will need an ABN (and possibly register for PAYG withholding).

Having an ABN establishes the legal foundation to expand your operations without scrambling for official registration down the line.

🟠 Professional Credibility

Displaying an ABN on invoices or within your Etsy profile (where applicable) can make you appear more professional and trustworthy to potential buyers or suppliers.

🟠 Future-Proofing Your Etsy Business

If your store grows faster than expected, having an ABN from the outset avoids complications with the ATO. You won’t need to rush to register if your sales suddenly surge and you cross a tax threshold.

7 Tips to Know When Deciding on an ABN for Etsy

If you’re on the fence about whether you need an ABN for your Etsy shop, these tips can help guide your decision:

1. Evaluate Your Sales Goals

Are you content with making a few sales a month, or do you have bigger ambitions? If you’re actively trying to scale your shop, an ABN is a wise investment in your future business.

2. Conduct a Profitability Check

Estimate your costs, potential sales volume, and pricing to see if you’ll reach or exceed the $75,000 annual turnover threshold sooner than you think. If you’re anywhere close, it’s better to be proactive.

3. Keep Accurate Records

Whether you define your Etsy venture as a hobby or business, maintain clear records of income, expenses, and inventories. You can use spreadsheets or accounting software like ANNA to make tracking easier. Good record-keeping can help you prove your status if the ATO inquires.

4. Consider the Hobby Test

Ask yourself: Am I advertising and marketing? Do I have a business plan and goals? Do I treat my craft like a job or just for personal satisfaction? If you answer “yes” to business-like activities, obtaining an ABN is prudent.

5. Check Your Time Commitment

If you spend a significant amount of time creating and selling goods (e.g., daily or weekly production schedules), you’re likely operating more like a business than a casual hobbyist.

6. Consult a Tax Professional

When in doubt, seek professional advice. An accountant or tax agent can offer personalised guidance based on your individual circumstances. They can also help you apply for an ABN and explain how to manage your tax obligations correctly.

7. Take Advantage of Business Registrations

If you do get an ABN, explore registering for other systems that can help streamline your operations, such as PAYG withholding (if you hire staff) or GST. They might not all apply immediately, but knowing your options can help you scale in the future.

What Happens If You Don’t Get an ABN (But Should)?

If you’re deemed by the ATO to be running a business and you haven’t registered for an ABN or the required tax obligations (like GST), you might face:

- Penalties and Fines: The ATO may impose fines on businesses that fail to register appropriately or lodge their taxes.

- Backdated Obligations: If the ATO decides you should have been paying GST all along, you may have to pay it retroactively but potentially including penalties and interest.

- Administrative Hurdles: Not having an ABN can complicate your ability to claim input tax credits, hire staff, or collaborate with other businesses.

Key Takeaways

- Not every Etsy seller needs an ABN, especially if it’s purely a hobby.

- If your revenue exceeds $75,000 in a financial year, you must register for GST and thus need an ABN.

- Having an ABN ensures future-proofing and gives you professional credibility, even if you’re not at the GST threshold just yet.

How Can ANNA Help With Your Etsy Store?

If you’re ready to turn your creative side hustle or your fast-growing Etsy shop into a structured business, ANNA is here to make life easier.

From free eCommerce business registration to managing finances and filing taxes, ANNA’s all-in-one platform covers every step.

🟠 Seamless Business Account Setup

Once your business is registered, you automatically receive an ANNA business account – no more juggling personal accounts for business transactions.

Debit cards and virtual cards are included, plus integrations with Apple Pay and Google Pay to keep payments flexible.

🟠 Straightforward Tax and Accounting

ANNA automatically calculates GST, prepares statements (like BAS), and handles your company income tax, all in one place.

Keep track of invoices, receipts, and expenses effortlessly, with ANNA matching each expense to the correct transaction.

🟠 Personalised Tax Calendar and Reminders

Never miss an important filing deadline; ANNA sends timely reminders for all your tax obligations.

You can rest easy knowing your compliance is handled, leaving you free to focus on creating and selling.

🟠 Expert Support on Tap

ANNA’s friendly support team is there to answer any questions – be it about setting up your business structure or navigating tax returns.

Get professional insights when needed, without the hassle of booking face-to-face appointments.

Sign up today and say goodbye to administrative headaches and focus on growing your business – whether it’s on Etsy, your own site, or any other platform.

!['How To Start A Real Estate Business In Australia [2025]' article image](https://images.prismic.io/annamoneyblog/aDYkdydWJ-7kSmbS_CoverLarge.webp?auto=compress&w=400&h=225)

!['How To Start A Jewellery Business In Australia [2025]' article image](https://images.prismic.io/annamoneyblog/aDYlWidWJ-7kSmb3_CoverLarge.webp?auto=compress&w=400&h=225)