From Active to Archive: Your Ultimate ABN Cancellation Handbook

Learn how to transition your ABN from active to archived status with our step-by-step cancellation guide for a smooth and compliant process.

- In this article

- What Do You Need to Know Before Canceling Your ABN?

- Online ABN Cancellation: The Quickest Method

- Alternative Ways to Cancel Your ABN

- Understanding the Impact of ABN Cancellation

- When It's Time to Say Goodbye to Your ABN?

- 🎁 Preparing to Exit Your Business: A Comprehensive Checklist

- Conclusion

Ready to cancel your ABN?

Before you take this significant step, it's crucial to understand the process and its implications.

In this guide, we'll walk you through the key considerations, steps for cancellation, and the impact it may have on your business.

We'll also help you recognize when it's time to cancel your ABN and provide a comprehensive exit checklist to ensure a smooth transition.

Whether you're closing shop, changing your business structure, or taking a break, this guide will equip you with the knowledge you need to navigate ABN cancellation confidently.

Let’s dive in!

What Do You Need to Know Before Canceling Your ABN?

Before canceling your ABN, it's essential to properly wrap up your business affairs. Here's what you need to know and do:

1. Review Your Obligations

Before canceling your ABN, conduct a comprehensive review of your business obligations.

👉 Check for outstanding:

- Lodgments

- Reports

- Payments to government agencies

👉 Ensure compliance with:

- Tax obligations

- Superannuation commitments

- Industry-specific requirements

- Regulatory matters

Thorough review helps avoid potential issues and penalties, streamlining the ABN cancellation process.

2. Submit Final Documents

As you prepare to cancel your ABN, file all necessary final documents.

👉 Submit last Business Activity Statement (BAS):

👉 Lodge final Income Tax Return:

- Cover period up to business cessation

- Include capital gains/losses from asset sales

Meticulous completion ensures tax law compliance and creates a clear financial record of your business closure.

3. Clear Outstanding Debts

Before canceling your ABN, settle all outstanding financial obligations.

👉 Pay remaining taxes:

- Income tax

- GST

- Other business-related taxes

👉 Update employee superannuation:

- Ensure all contributions are paid

👉 Settle supplier bills

👉 Address government grants/loans:

- Check and fulfill repayment obligations

Clearing these debts ensures a clean business exit and avoids future complications.

4. Inform Relevant Parties

Clear communication is key when canceling your ABN.

👉 Employees:

- Notify about closure

- Specify final working day

- Explain entitlements

👉 Suppliers:

- Inform about business cessation

- Cancel future orders

👉 Customers:

- Communicate closure

- Address ongoing contracts

- Explain transition plans

👉 Regulatory bodies:

- Alert if in a regulated industry

Proactive communication ensures a smooth transition and maintains professional relationships during the closure process.

5. Record Keeping

Proper record-keeping is crucial when canceling your ABN.

👉 Organize and store:

- Financial statements

- Tax invoices

- Employee records

- Sale/closure documents

👉 Retention period:

- Keep records for at least 5 years after final tax return

👉 Storage:

- Ensure secure and accessible storage

Maintaining proper records helps smooth the ABN cancellation process and prevents potential future issues with tax authorities.

Online ABN Cancellation: The Quickest Method

Canceling your ABN online is the fastest and most efficient method.

Here's how to do it:

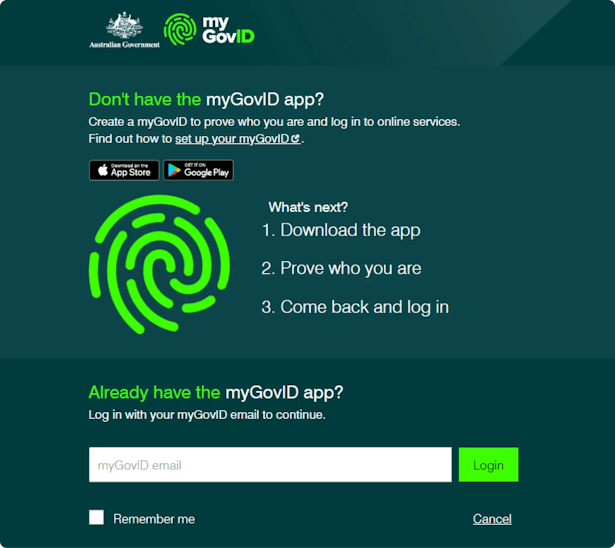

1. Set up myGovID: If you haven't already, download the myGovID app and set up your digital identity.

2. Link to RAM: Use the Relationship Authorisation Manager (RAM) to link your myGovID to your ABN.

3. Log in to ABR: Visit the Australian Business Register website and log in using your myGovID.

4. Navigate to cancellation: Find your account dashboard's 'Cancel ABN' option.

5. Confirm details: Review your business details and confirm your intention to cancel.

6. Submit request: Complete the cancellation process by submitting your request.

Alternative Ways to Cancel Your ABN

If online cancellation isn't an option for you, don't worry - there are other methods available:

👉 Phone cancellation:

- Call the Australian Business Register on 13 92 26 (Monday to Friday, 8 am to 6 pm).

- Have your ABN and personal identification details ready.

- Follow the operator's instructions to verify your identity and cancel your ABN.

👉 Mail cancellation:

- Download and complete the Application to Cancel Registration form (NAT 2955).

- Mail the form to the address provided on the form.

👉 Agent cancellation:

- Contact your registered tax agent or BAS agent.

- Provide them with written authorization to cancel your ABN on your behalf.

For example, if you're not comfortable with online processes, you might prefer to call the ABR directly.

Or, if you're closing a larger business with complex tax affairs, you might ask your accountant to handle the cancellation process.

Understanding the Impact of ABN Cancellation

Canceling your ABN has broader implications than you might initially realize:

- GST registration: Your GST registration will be automatically canceled. This means you can no longer charge GST on your goods or services.

- Other tax registrations: Registrations for luxury car tax, wine equalization tax, and fuel tax credits will also be canceled.

- Business name: If you have a registered business name, you'll need to cancel it separately through ASIC.

- Government contracts: Any contracts or grants with government agencies may be affected.

For instance, if you run a winery, canceling your ABN would mean you can no longer claim wine equalization tax credits. Or if you're a courier service, you'd lose access to fuel tax credits.

When It's Time to Say Goodbye to Your ABN?

Recognizing when to cancel your ABN is crucial for maintaining proper business practices. Here are the scenarios where canceling your ABN becomes necessary:

👉 Business Closure: If you've decided to permanently close your business, it's time to cancel your ABN.

For example, if you're retiring and shutting down your long-running bakery, canceling your ABN is a necessary step in the closure process.

👉 Business Sale: When you've sold your business, you should cancel your ABN as the new owner will need to apply for their own.

For instance, if you've sold your successful landscaping company, canceling your ABN should be one of your final actions as the previous owner.

👉 Ceasing Operations in Australia: If your business is no longer operating in or connected to Australia, you should cancel your ABN.

This might apply if you're an international consultant who no longer serves Australian clients or if you're moving your entire operation overseas.

👉 Change in Business Structure: When you're restructuring your business, such as transitioning from a sole trader to a company or partnership, you'll need to cancel your old ABN and apply for a new one.

This ensures your ABN accurately reflects your current business structure.

👉 Lack of Business Activity: If you haven't been active in business lately, the ABR might flag your ABN for cancellation.

If you've submitted your final tax return and have no plans to resume business activities, it's probably time to proactively cancel your ABN.

Remember, keeping an unused ABN active can lead to complications, such as continued tax reporting obligations or potential penalties for non-compliance.

It's your responsibility to cancel your ABN when your business circumstances change.

If you're unsure whether you should cancel your ABN, consider consulting with a tax professional or contacting the Australian Business Register directly for guidance.

7 Surprising Ways Your ABN Can Be Canceled Automatically

1. Final Tax Return Filing

The ABR may automatically cancel your ABN when you lodge your final tax return. This occurs when you've officially notified the ATO that you've ceased business operations.

2. Lack of Business Activity

Your ABN can be canceled if you haven't reported business income for an extended period.

Failure to submit Business Activity Statements (BAS) can also trigger an automatic cancellation.

3. ABN Renewal Failure

Neglecting to renew your ABN when required can result in its automatic cancellation. The ABR may terminate your ABN if you don't respond to renewal notices.

4. Company Deregistration

If ASIC informs the ABR that your company has been deregistered, your ABN will be canceled. This applies to businesses operating through a company structure.

5. Cessation of Trading

The ABR can cancel your ABN if they detect that you've stopped trading. This may occur even if you haven't formally notified them of your business closure.

6. Visa Expiration

Your ABN can be canceled automatically if your Australian visa expires. This is because your right to operate a business in Australia is tied to your visa status.

7. Identity Fraud

ABR may cancel your ABN if your ID information (this includes Tax File Number) has been compromised.

This is a protective measure taken when identity fraud is suspected or confirmed.

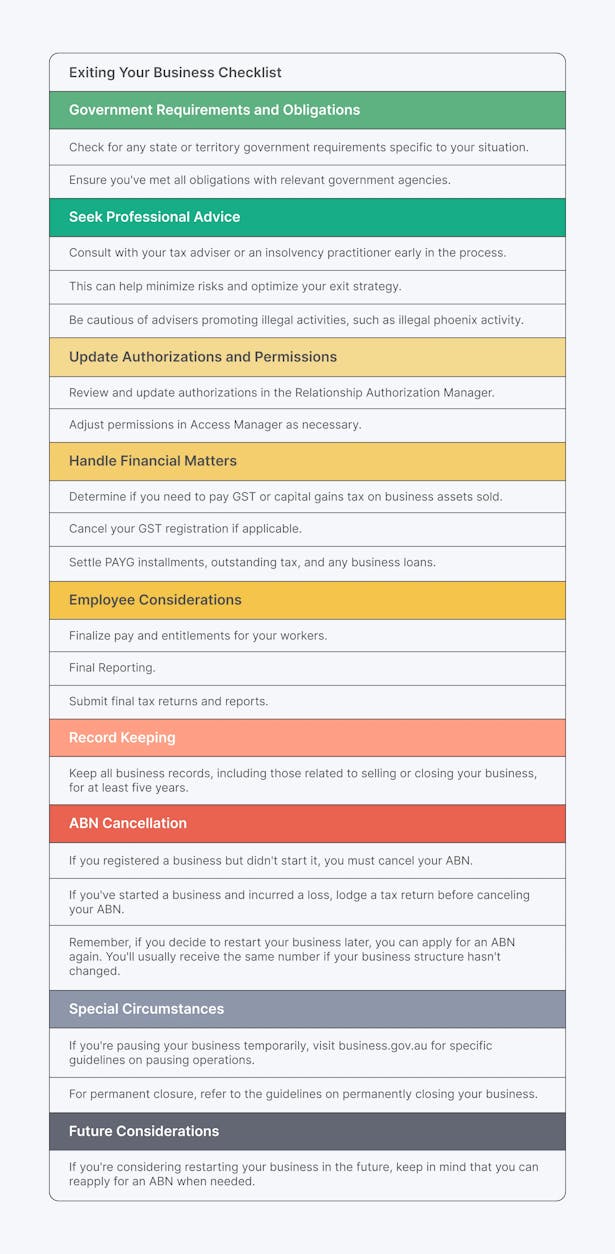

🎁 Preparing to Exit Your Business: A Comprehensive Checklist

When you're changing, pausing, closing, selling, or winding up your business, follow these steps to ensure a smooth transition:

Conclusion

Canceling your ABN is a significant step that requires careful planning and execution.

By following the steps outlined in this guide, you can ensure a smooth and compliant business closure.

Remember, proper preparation not only simplifies the cancellation process but also helps you avoid potential legal and financial complications in the future.

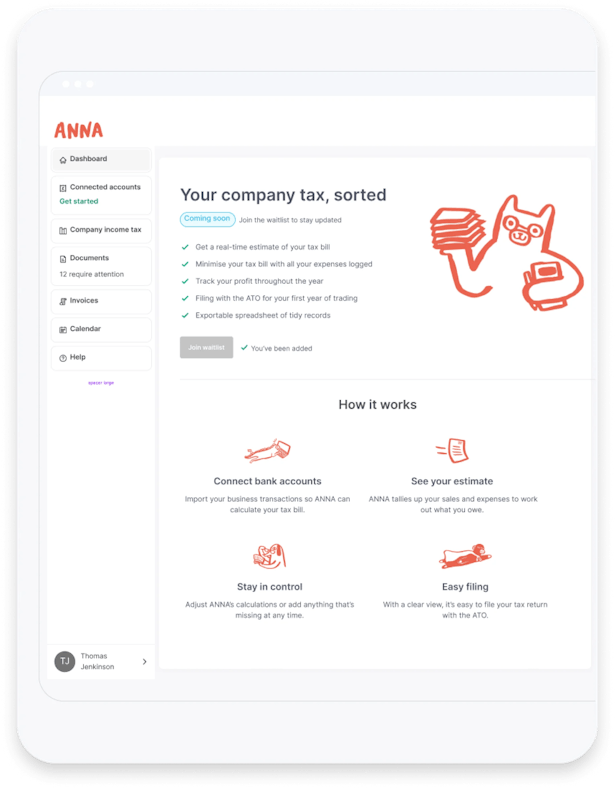

For those still unsure about ABN cancellation or considering starting a new business venture, there's a solution that can simplify financial management.

ANNA offers a comprehensive accounting and bookkeeping solution for small businesses and sole traders. It helps you easily manage your finances and obligations.

ANNA provides:

✨ Easy company registration

✨ Business documents management

✨ Automatic tax calculations

✨ Personalized tax calendar

✨ Expert accountant support

✨ Bookkeeping score to track your financial health

Whether you're closing your current business or starting a new one, ANNA can help streamline your financial processes, ensuring compliance and saving you time and stress.

Ready to simplify your business finances?

Give ANNA a try and experience the difference for yourself.