Discover How to Instantly Check Your ABN Income

Discover how to instantly check your ABN income with our quick guide, helping you stay on top of your finances and manage your business effectively.

Running a business with an Australian Business Number (ABN) can be exciting, but it also has its challenges.

One of the most important aspects is tracking your ABN income. This helps you stay compliant with tax obligations and provides insights into your business performance.

In this article, we’ll explore ABN income, how to check your ABN income in minutes, its importance, and how ANNA can simplify the process.

Let’s get started!

What is ABN Income?

Let's say you're a small business owner selling handmade crafts online.

Every sale you make, whether a beautiful knitted scarf or a customized mug, contributes to your ABN income.

Essentially, ABN income refers to the revenue generated by a business or individual operating under an Australian Business Number (ABN).

This income is generated from the sale of goods or services and serves as the foundation for calculating your taxable income.

ABN Income in Practise

When you operate under an ABN, you receive full payment for your products or services without any tax deducted at the source.

This means you're responsible for managing your tax obligations, which include setting aside a portion of your income to cover your tax liability at the end of the financial year.

For instance, if you earn $30,000 through your ABN, it's recommended to save a portion of this amount to pay your taxes later.

The Importance of Tracking ABN Income

Keeping track of your ABN income is crucial for several reasons:

1. Tax Compliance

- Accurate Reporting: Properly tracking your income ensures you can accurately report your earnings to the Australian Taxation Office (ATO). This helps you avoid penalties and interest for underreporting income. Accurate reporting is essential for staying on the right side of the law.

- GST Obligations: If your ABN is registered for GST, you must report and pay GST on your sales. Accurate tracking helps you lodge your Business Activity Statements (BAS) correctly, ensuring that you meet your GST obligations.

2. Financial Management

- Cash Flow Management: Knowing your income helps you manage your cash flow efficiently. This ensures you have enough funds to cover expenses and save for future investments. It's like having a clear map to navigate your business finances.

- Budgeting: Tracking income allows you to create accurate budgets and financial forecasts, helping you plan for growth and manage resources efficiently.

3. Business Insights

- Performance Analysis: Regularly monitoring your income helps you understand your business performance, identify trends, and make informed decisions to improve profitability. It's like having a health check-up for your business.

- Client Management: Tracking who owes you money and when payments are due helps maintain good client relationships and ensures timely payments, ensuring a steady flow of income.

4. Loan and Investment Applications

- Proof of Income: Accurate income records are essential when applying for loans or seeking investment. Lenders and investors want proof of consistent income and financial stability. Having well-organized records can significantly improve your chances of securing funding.

5. Legal Requirements

- Record-Keeping: The ATO requires businesses to keep accurate records of all transactions for at least five years. Proper tracking ensures you meet these legal requirements. Keeping detailed records can save you a lot of trouble during audits or tax time.

How does the ATO Monitor ABN Income?

The Australian tax system operates on self-assessment, meaning you are responsible for calculating and reporting your income and tax obligations.

But you might wonder, how does the ATO track what income is earned on an ABN?

The ATO cross-references the income you report with other sources of information, such as:

- statements from financial institutions,

- clients, and

- government agencies.

They also use industry-specific benchmarks to compare reported income with expected ranges for different business types. This helps them identify discrepancies and ensure compliance.

Furthermore, some industries must report payments made to other businesses in a Taxable Payments Annual Report (TPAR).

This report includes:

- the ABN,

- name,

- address, and

- gross amount paid to each contractor.

The ATO uses this information to identify contractors who have not fulfilled their tax obligations.

If an ABN is not quoted on invoices or other documents, additional tax may be withheld from their payment under the PAYG withholding system.

Steps to Check Your ABN Income

Keeping track of your ABN income doesn't have to be complicated. Here's a step-by-step guide on how to do it effectively:

1. Create a myGov Account

If you don't already have a myGov account, visit the myGov website and follow the instructions to set up your account.

This will be your gateway to accessing various government services online.

2. Link Your myGov Account to the ATO

Once your myGov account is set up, link it to the Australian Taxation Office (ATO). This will allow you to access ATO online services.

Select "Services" and then "Link" next to the ATO option.

3. Sign In to myGov

Go to the myGov website and sign in with your credentials. This will give you access to your linked services.

4. Access ATO Online Services

After signing in, select "Australian Taxation Office" from the list of linked services. This will direct you to the ATO's online portal.

5. Navigate to Business Income Information

Once in the ATO online services, go to the "Business" section. Select "Business Activity Statements (BAS)" to view your income and GST information.

6. View Your ABN Income

The BAS section provides a comprehensive view of your financial activities. It includes details of your business income, including the total income reported and GST collected.

Alternative Ways to Check Your ABN Income

If you prefer other methods to check your ABN income, here are some alternatives:

👉 Dedicated Business Bank Account: Maintain a separate bank account exclusively for your business transactions. This practice helps separate your personal and business finances, making it easier to track income and expenses.

👉 Accounting Software: Use accounting software like ANNA to automate and streamline your financial tracking. These tools can help you generate reports, track expenses, and manage invoices.

👉 Expense Tracking Apps: Use apps to capture and manage your business expenses. ANNA, for instance, also allows you to take pictures of receipts and automatically categorize them.

👉 Manual Record-Keeping: If you prefer a hands-on approach, keep a detailed log of all your invoices and payments received using spreadsheets or physical records. While this method is more time-consuming, it can be effective if done meticulously.

How ANNA Can Help You Find Your ABN Income in Minutes?

ANNA is a powerful financial management tool that can help you track your ABN income quickly and easily.

Here's how you can do it using ANNA's features:

⏭️ Connect Your Accounts: Link your bank accounts to ANNA so that all your financial data is consolidated in one place.

This provides a holistic view of your income and expenses.

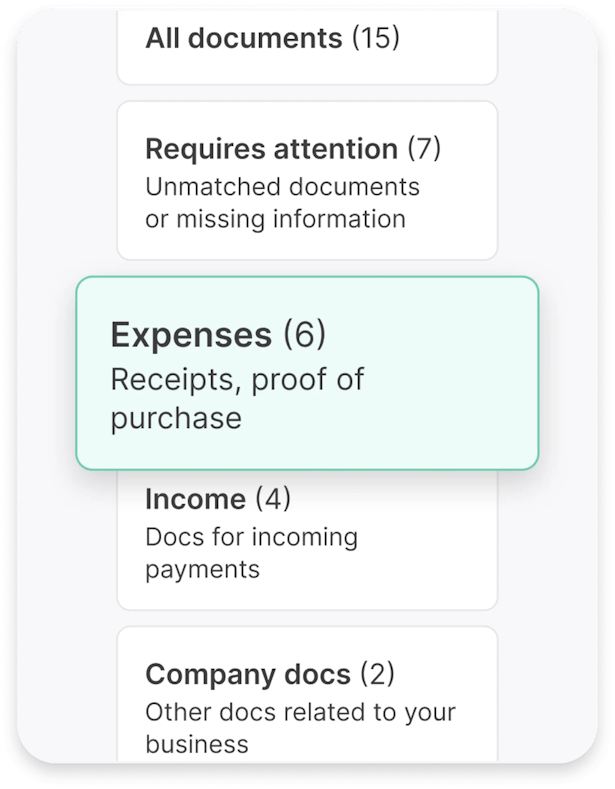

⏭️ Automated Receipt Matching: Our solution automatically matches receipts to transactions, categorizing them for optimal tax relief.

This means your income and expenses are accurately tracked and recorded.

⏭️ Efficient Bookkeeping: Store and manage all your receipts, invoices, and documents in ANNA.

This makes finding any financial record, including your ABN income, easy.

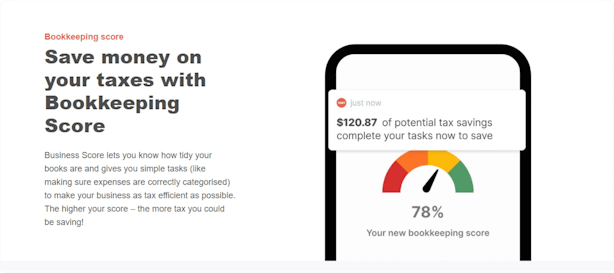

⏭️ Bookkeeping Score: Maintain tidy records with our bookkeeping score.

This feature helps you improve your record-keeping practices, ensuring all your income is accounted for.

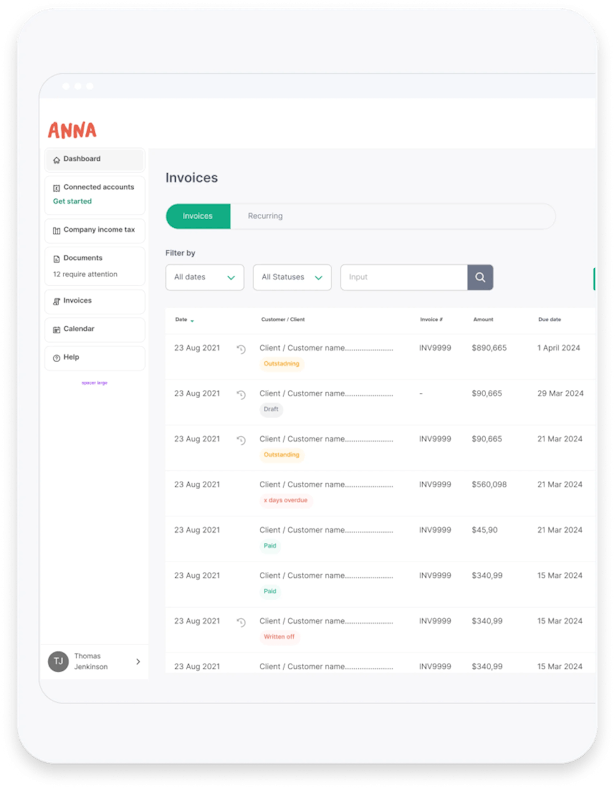

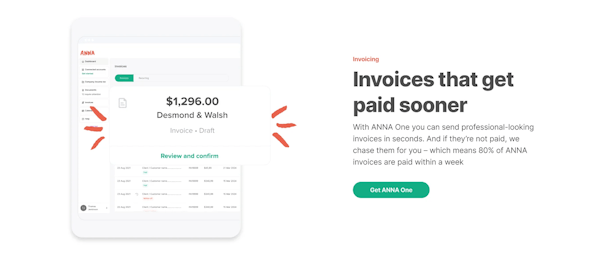

⏭️ Professional Invoices: Quickly create and send professional invoices through ANNA.

The tool tracks these invoices and follows up on unpaid ones, giving you a clear picture of your income.

⏭️ 24/7 Customer Support: If you have any questions or need assistance, our support team is available around the clock to help you locate and understand your ABN income records.

By following these steps, ANNA streamlines the process of finding your ABN income, making it accessible whenever you need it.

Other Notable Features of ANNA Solution

ANNA offers a host of other features that can significantly enhance your business operations, such as:

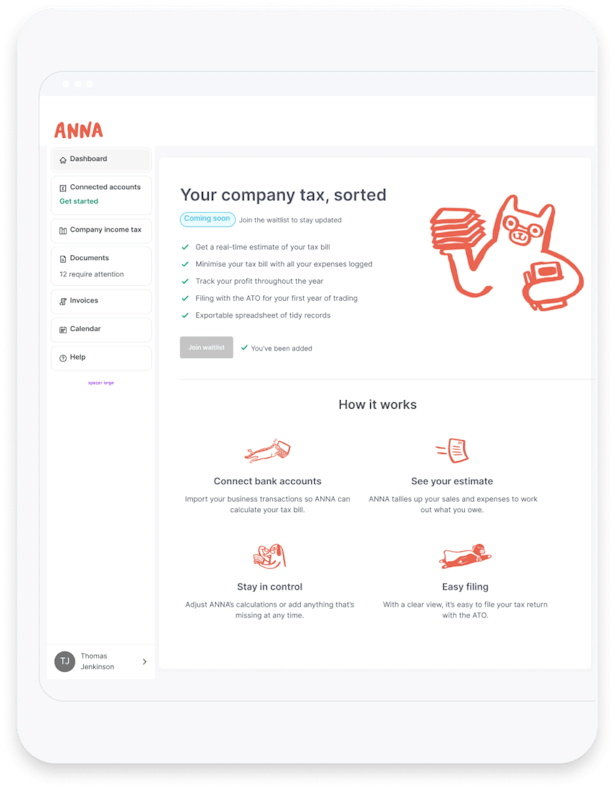

- Automatic Tax Calculations: Calculates your tax obligations based on business expenses and income, providing a clear view of upcoming tax bills.

- Personalized Tax Calendar: Ensures you never miss a tax deadline with reminders tailored to your schedule.

- Direct GST Logging: Handles GST calculations and logs them directly with the ATO, simplifying the entire process.

- Comprehensive Assistance: Offers expert help with managing BAS and GST calculations to ensure accuracy and compliance.

- Professional Guidance: Provides email support during the early stages of business setup and ongoing financial management.

- Easy Company Registration: This service assists with the registration of your Australian company, including ACN, ABN, and business name registration.

Conclusion

Managing your ABN income doesn't have to be a daunting task.

With the right tools and practices, you can ensure that your business remains compliant, financially healthy, and well-prepared for growth.

Whether you use online services like myGov and the ATO's portal, or advanced tools like ANNA, staying on top of your ABN income is essential.

So, are you ready to lighten your load and simplify your financial management?

Try ANNA today and discover how easy it can be to manage your ABN income and keep up hassle-free with all your financial obligations.

With us, you can focus on what truly matters—achieving your entrepreneurial goals.

FAQs

Why should I check my ABN income?

Checking your ABN income helps you ensure accurate reporting for tax purposes, verify eligibility for certain government benefits, and avoid potential penalties for underreporting.c

How can I check my ABN income?

You can check your ABN income through the Australian Taxation Office (ATO) website or by accessing your business's financial records via tax returns or accounting software.

What information do I need to check my ABN income?

To check your ABN income, you'll need your ABN, tax file number (TFN), and access to your financial records or tax returns. It's important to have up-to-date documentation for accurate results.

Can I check the income of other businesses using their ABN?

No, you cannot directly check the income of other businesses using their ABN. However, you can verify business details and registration status via the ABN Lookup tool.

Is there a fee to check my ABN income?

No, there is no fee to check your ABN income. Accessing income information is free through the ATO's online services, provided you have the necessary records and details.