How to Pay and Lodge Your Business Activity Statement

Learn how to pay your business activity statement, and understand the process, benefits, and key considerations for managing your tax obligations effectively.

- In this article

- What is a Business Activity Statement (BAS)?

- Lodging and Paying Your Business Activity Statement (BAS): Step-by-Step Process

- Payment Options for Your Business Activity Statement (BAS)

- Troubleshooting Missing Payments for Your Business Activity Statement (BAS)

- Conclusion: Simplifying BAS Payments with ANNA

In Australia, you must meet several requirements to operate your business legally and avoid legal trouble.

One of these obligations is filing and paying your taxes on time. BAS is essential to maintaining compliance and avoiding fines for your company.

In this article, we'll explore everything you need to know about paying your BAS, including how to lodge it and which payment methods are available.

Let’s begin!

What is a Business Activity Statement (BAS)?

A Business Activity Statement, or BAS, is a key financial report that most businesses registered for GST must use in Australia.

However, this financial form isn’t just for one type of tax.

Businesses use it to report multiple financial obligations in one place, showing the Australian Taxation Office (ATO) how much money they’ve made and what taxes they owe.

Here is the list of taxes a BAS can include:

1. Goods and Services Tax (GST)

2. Pay As You GoPay As You Go (PAYG) installments

3. PAYG withholding tax

4. Other taxes as applicable to the business

By correctly and timely lodging and paying your BAS, you will stay compliant with tax laws and ensure proper tax collection.

Who Needs to Lodge a BAS?

Any business that is registered for GST is required to lodge a BAS. It is important to understand that this requirement applies regardless of:

- The business structure (sole trader, partnership, company, or trust)

- The size of the business

How to Receive a BAS?

When you register your business for an Australian Business Number (ABN) and GST, you're automatically in the ATO's system.

This means you don't have to worry about remembering when to report your financial information.

The ATO keeps track of your reporting schedule and sends you a Business Activity Statement (BAS) when it's time for you to lodge.

Importance of BAS

As a business owner, filling the Business Activity Statement (BAS) helps you to:

1. Stay compliant with tax laws.

2. Keep track of your tax obligations.

3. Manage your money better by understanding tax liabilities.

4. Maintain detailed and accurate records of your business activities.

Lodging and Paying Your Business Activity Statement (BAS): Step-by-Step Process

As a business owner, lodging and paying your Business Activity Statement (BAS) on time is crucial for keeping your business in good standing with the ATO.

By selecting the right lodgment method, sticking to your reporting schedule, and meeting deadlines, you'll ensure your business fulfills its BAS obligations efficiently.

One convenient way to manage your tax obligations is to pay BAS online, which simplifies the process and helps you avoid penalties.

This helps you:

- Avoid costly penalties and interest charges.

- Maintain a positive relationship with the ATO.

- Keep your business finances organized.

Lodgment Options

You have several options for lodging your BAS:

1. Online Lodgment: This is the preferred method for most businesses because it offers:

- Convenience - you can lodge whenever it suits you.

- Potential extended deadline - you might get an extra 2 weeks to lodge and pay.

- Faster refunds through electronic processing.

- Fewer errors thanks to system checks.

- Ability to review before final submission.

You can lodge your BAS online through myGov (for individuals and sole traders), online services for business, or SBR-enabled software.

2. Using a Tax or BAS Agent: These professionals can lodge on your behalf and manage your BAS while still allowing you access through online services.

3. Mail Lodgment: While less common, you can still lodge by mail using the pre-addressed envelope in your BAS package or sending it to the ATO's address:

- Australian Taxation Office

- Locked Bag 1936

- ALBURY NSW 1936

4. 'Nil' BAS: If you have nothing to report for a period, you still need to lodge a 'nil' BAS online or by phone.

Payment Options for Your Business Activity Statement (BAS)

When it comes to paying your Business Activity Statement (BAS), the Australian Taxation Office (ATO) offers several payment options to suit different business needs. Here they are:

Primary Payment Methods

1. BPAY

This is a quick and secure way to pay electronically. Here's what you need to know:

- The Biller Code is always 75556

- You'll use your unique Payment Reference Number (PRN) as the reference

- You can access BPAY through your online banking

Keep in mind that payments can take up to 4 business days to process, so plan accordingly.

2. Credit Card Through Online Services

If you prefer to use a credit card, you can do so via the ATO's online services:

- If you're an individual or sole trader, you'll access this through your myGov account

- For companies and other business entities, use the Online services for business

- Be aware that card payment fees will apply when you use this method

Both methods offer convenience, but they have different processing times and potential costs.

BPAY might take longer to process but doesn't incur extra fees, while credit card payments are faster but come with additional charges.

Other Payment Options

In addition to BPAY and credit card payments, you have several other options for paying your BAS:

3. Electronic Transfer

You can transfer funds directly to the ATO's account:

- Use the Reserve Bank of Australia

- BSB: 093 003

- Account number: 316385

- Account name: ATO direct credit account

- Always use your PRN as the reference

4. Direct Debit

You can set up automatic payments from your Australian bank account. Do this via online services or by calling 13 11 42.

📍 Note: Only the cardholder can set up direct debit using a card.

5. Government EasyPay

Government Easy pay service allows you to pay online or by phone (1300 898 089).

6. In-person at Australia Post

You can pay your BAS at the post office using cash, EFTPOS, or cheque. Remember to bring your ATO barcode when using this method.

7. Mail

While not preferred, you can mail a cheque or money order:

- Make it payable to 'Deputy Commissioner of Taxation'

- Mark as 'Not Negotiable'

- Include a payment slip or your details

- Mail to the ATO's Albury address

8. International Payments

If you're paying from overseas, use SWIFT transfer in Australian dollars or consider using agreed international money remitters

Important Considerations

👉 First thing you need to remember is that your Payment Reference Number (PRN) is crucial for all paying methods. It ensures your payment is correctly allocated.

You can find your PRN through online services, ATO notices, or by contacting the ATO.

👉 A second consideration is payment processing time.

The most electronic payments can take up to 4 business days to show up in your ATO account.

And, if you mailed a payment, you'll need to factor in how long it takes for the post to deliver it, plus another 4 business days for processing.

Choose the method that's most convenient for you to pay your Business Activity Statement (BAS), but always ensure you allow enough time for processing to meet the due date.

Troubleshooting Missing Payments for Your Business Activity Statement (BAS)

If you've made a payment for your Business Activity Statement (BAS) but can't see it reflected in your account, don't panic. In this section we’ll guide you on what to do next, based on the payment method you used.

1. BPAY Payments

If your BPAY payment isn’t showing, you should make sure that you used the right biller code (75556) and PRN.

1. If you accidentally used the wrong biller code, contact your financial institution right away.

2. In case you used a different PRN, contact the ATO with these details:

- Payment amount

- Date of payment

- Receipt number

- The PRN you used

- Bank account details (BSB and account number)

2. Credit or Debit Card Payments

If you think you might have accidentally paid another government agency (it happens!), get in touch with your bank or card provider immediately.

They can usually help reverse the payment.

And, if you're sure you paid the ATO, either through myGov or by phone, you'll need to contact them directly. Again, have all your payment details ready (same as for the BPAY payments).

3. Electronic Transfer

First, double-check those bank details you used. It's easy to mix up a number when you're typing in BSBs and account numbers. If you spot a mistake, call your bank.

If the details are spot on but your payment is still invisible, it's time to give the ATO a call.

Before you do, gather up all the info about your payment - how much you paid, when you paid it, any receipt numbers, the PRN you used, and your own bank details.

The more info you can give them, the faster they can track down your missing money.

4. Cheque Payments

Cheque payments take time. Give it a few days for postal delivery, then add another 4 business days for the ATO to process it.

If it still doesn't show up, it's time to take action.

In case your bank hasn't cashed the cheque yet, you can ask them to stop it. Then you can make other arrangements to pay - maybe try one of those electronic methods next time?

But if the cheque has been cashed and you still can't see it in your ATO account, you'll need to contact them. Have all the cheque details ready - the amount, when it was cashed, your bank details, the cheque number, and who signed it.

5. In-person Payments at Australia Post

When paying your BAS with in-person payments at Australia post, the process is similar to the cheque payment process. Give the ATO a bit of time to process it.

If it still doesn’t show up, contact them with all the details - how much you paid, when you paid, which post office you used, the reference number on your receipt, and how you paid (cash, cheque, or card).

Key Takeaways for Missing Payments

Remember, no matter how you've paid your BAS, the ATO can help.

They deal with this stuff every day and they're pretty good at tracking down wayward payments!

And to avoid issues with future payments, here are the key points to take under consideration:

1. Always double-check payment details before confirming.

2. Keep all payment receipts and confirmation numbers.

3. Allow sufficient time for processing before the due date.

4. Consider using electronic payment methods for faster processing.

Conclusion: Simplifying BAS Payments with ANNA

While the Australian Taxation Office (ATO) offers various methods to pay your Business Activity Statement (BAS), managing your tax obligations can still be a complex and time-consuming process.

This is where innovative solutions like ANNA can make a significant difference in how you handle your BAS payments and overall business finances.

ANNA One: Key Features

ANNA offers a comprehensive suite of features designed to streamline your business operations and tax management:

1. Automated Tax Calculations

ANNA automatically calculates your taxes, including GST, ensuring you're always up-to-date on your tax reporting.

This feature can help optimize your tax bill and reduce the risk of errors in your BAS.

2. Personalized Tax Calendar

Never miss a BAS deadline again with ANNA's personalized tax calendar. This feature ensures timely compliance with all your tax obligations.

3. Automatic GST Calculation and Lodgment

ANNA calculates your GST automatically and can lodge it directly with the ATO, simplifying one of the key components of your BAS.

4. Expert Support

ANNA provides support from expert accountants who can answer any questions you may have about your BAS or other tax matters.

5. Annual Company Tax Return Statement

ANNA can take care of your tax obligations from the start, including lodging your statement for your first year of trading.

6. Document Management

Store all your receipts, invoices, and company documents in one place. ANNA matches transactions, extracts key details, and makes everything easy to find and share, which is crucial for accurate BAS reporting.

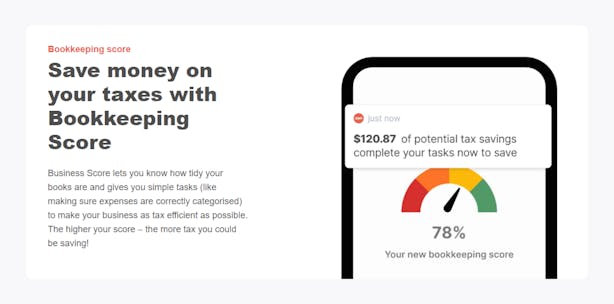

7. Bookkeeping Score

Stay on top of your bookkeeping with ANNA's Bookkeeping Score feature, which provides easy tips on keeping your books tidy. This can be invaluable when preparing your BAS.

8. Receipt Matching

ANNA offers automated receipt matching and categorization of expenses, ensuring you get the right tax relief and accurate reporting on your BAS.

While you'll still need to use one of the ATO's approved payment methods to actually pay your BAS, ANNA can make every other aspect of the process smoother and more efficient.

From calculating your tax obligations to organizing your financial documents, ANNA provides a comprehensive solution that can transform how you manage your BAS and other tax responsibilities.

Ready to get started?

Sign up for ANNA One today and experience hassle-free, fully automated taxes and record-keeping.