How to Pay Yourself as A Business Owner in Australia [2 Easy Methods]

Learn how to pay yourself as a business owner in Australia, and discover the best strategies to manage your income, taxes, and finances.

Whether you're a sole trader or run a company, determining how much to pay yourself as a business owner isn't just a simple number you can decide on.

The amount you should pay yourself depends mainly on your business structure.

For example, sole traders typically take drawings, while company owners might pay themselves a salary or dividends.

But there is more to the calculation if you want your compensation to be both appropriate and sustainable for your business.

To help you make an informed decision, we'll go over all the necessary details so you can confidently determine your pay as a business owner in Australia.

Let's start!

Understanding Your Business Structure in Australia

As we already mentioned, understanding your business structure is crucial when determining how much you should pay yourself as a business owner in Australia.

Let's explore the key aspects of different business structures in a way that's easy to grasp.

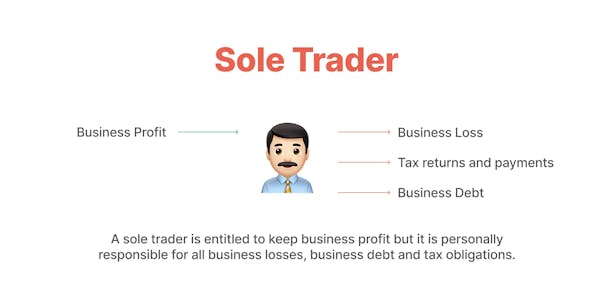

1. Sole Traders

Sole traders are individuals who run their business on their own. As a sole trader, you're the boss – you make all the decisions.

But here's the catch: your personal and business finances are intertwined.

This means if your business hits a rough patch, your personal assets could be at risk.

On the flip side, you have the freedom to take money out of the business as you see fit, though getting outside funding might be tricky.

2. Partnerships

A partnership business structure typically involves two or more people joining forces to run a business.

It's like being in a financial relationship – you share the profits and the losses.

This can be great for pooling resources, but it also means you're on the hook for your partner's actions. Each partner handles their own taxes, which can simplify things.

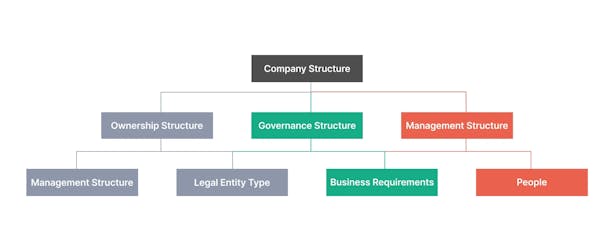

3. Companies

Companies, on the other hand, are like creating a separate person in the eyes of the law. Your business becomes its own entity, distinct from you as an individual.

This structure offers more protection for your personal assets, but it comes with more rules and paperwork.

As an owner, you can pay yourself a salary or take dividends, giving you more flexibility in how you manage your income.

Methods of Paying Yourself as a Business Owner in Australia

It is time to talk about how you can pay yourself as a business owner.

There are two main ways to do this: salary and owner's draw.

Each has its own pros and cons, so it's important to understand how they work.

Method of Paying Yourself #1: Salary

First up is a salary, which is pretty straightforward - it's like getting a regular paycheck, just like an employee would.

✔️ The upside? It's predictable and helps with budgeting.

⛔ The catch? You'll need to withhold income tax and comply with employment laws, like making superannuation contributions.

There's also this thing called the "reasonable compensation" rule.

Basically, it means you can't lowball your own salary just to dodge taxes. You need to pay yourself fairly based on industry standards and your role in the business.

Salary Example

Let's say you're the owner of a small marketing agency. You decide to pay yourself a salary of $5,000 per month. This means:

- You'll receive a consistent $5,000 in your personal account each month.

- Your business will withhold taxes from this amount.

- You'll need to make superannuation contributions based on this salary.

- At tax time, this income is reported on your personal tax return.

Method of Paying Yourself #2: Owner’s Draws

Now, let's look at the owner's draws, which is a more flexible option.

✔️ The upside? You can take money out of your business profits as you need it.

Sounds great, right? Well, it can be, but it requires more careful planning.

⛔ The catch? You don't pay taxes upfront with draws, but you'll need to set aside money for taxes at the end of the year.

It's less stable than a salary, so you really need to stay on top of your cash flow.

Owner's Draw Example

Imagine you run a freelance graphic design business. In a good month, you might take a draw of $6,000, while in a slower month, you might only draw $3,000.

Here's how it works:

- You transfer $6,000 or $3,000 from your business account to your personal account as needed.

- No taxes are withheld at the time of transfer.

- You'll need to set aside a portion (say, 30%) of each draw for taxes.

- At the end of the year, you'll pay taxes on the total amount you've drawn.

These examples show how salary provides stability but less flexibility, while draws offer more freedom but require more careful tax planning.

So, Which One Should You Choose?

The answer depends on:

- your business structure,

- your financial goals, and

- what works best for your personal situation.

Some owners even use a combination of both methods. The key is to understand your options and choose what fits your needs best.

Tax Considerations

Next, we will break down the key tax considerations for business owners, focusing on how you pay yourself and handle superannuation.

This stuff can be a bit complex, but it's crucial to get it right.

1. Tax Alignment

Consider tax alignment as ensuring your business's financial systems play nicely with tax rules. It's all about setting up your systems to capture the right data for tax reporting.

This isn't just about checking boxes—proper tax alignment can enhance planning and provide defense during audits.

💡 Pro Tip

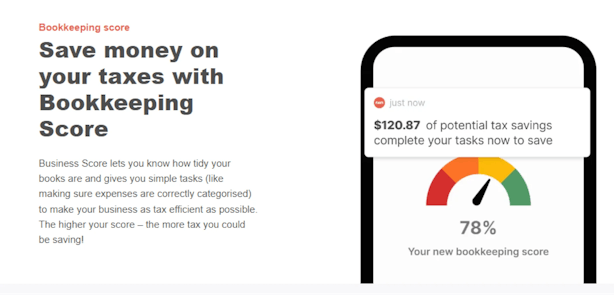

Take advantage of ANNA's automatic categorization feature to simplify your tax alignment. Customize categories to match your tax reporting needs—for example, create separate categories for different GST rates or tax-deductible expenses.

This way, when ANNA categorizes your transactions, you're also organizing them for tax purposes.

When tax time comes, you'll have well-organized data, making reporting easier and potentially uncovering additional deductions you might have missed.

2. Indirect Taxes

Managing indirect taxes like GST can be challenging.

The rules can vary depending on your business activities and the products or services you sell, making it far from straightforward.

With many exceptions to consider, it's essential to set up systems that accurately calculate these taxes.

Automating this process can help minimize errors and save you a lot of hassle.

💡 Pro Tip

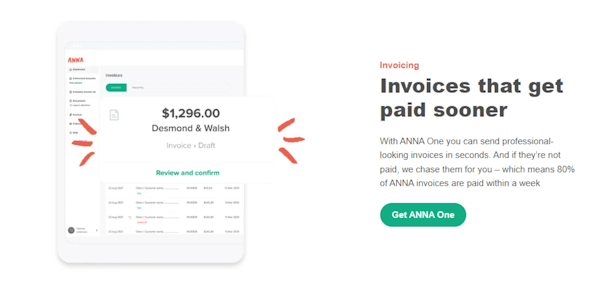

Maximize ANNA's automated invoicing system to manage indirect taxes like GST efficiently.

Set up invoice templates that automatically apply the correct GST rate based on the product or service category.

For instance, create separate templates for standard-rated items, GST-free exports, and any special categories relevant to your business.

This ensures you're always charging the correct GST amount, and ANNA will track everything for you.

When it's time to file your Business Activity Statement (BAS), you'll have accurate GST figures at your fingertips, saving you hours of manual work and minimizing errors.

3. Superannuation

Superannuation is a big one for Australian business owners. If you have employees, you need to pay into their super funds.

This means:

- offering them a choice of fund,

- making payments at least quarterly, and

- using SuperStream for electronic payments.

Keep good records and make sure you're giving employees the right forms.

💡 Pro Tip

Leverage ANNA's document storage feature by creating a dedicated "Superannuation" folder.

Store all your super-related documents here, including employee super fund choice forms, contribution statements, and receipts for your personal super contributions.

When you make super payments, simply snap a photo of the payment confirmation and upload it to this folder.

ANNA will automatically extract key details like dates and amounts, making it easy to track your super obligations.

This organized approach not only helps you stay compliant but also simplifies record-keeping for potential audits.

4. Self-Employed Super

Here's an interesting bit: if you're a sole trader or in a partnership, you don't have to pay super for yourself.

But don’t neglect your retirement savings! Consider making personal super contributions to strengthen your financial future.

💡 Pro Tip

Make the most of ANNA's automation to manage your self-employed super contributions.

Set up a recurring payment plan that automatically transfers a fixed amount to your personal super fund each month.

For example, you can set up ANNA to contribute $500 monthly to your super account, ensuring consistent contributions and simplifying your tax deduction claims.

This approach can help reduce your taxable income while keeping your retirement savings on track.

Getting these tax and super considerations right means setting up your business for long-term success and ensuring you're taking care of yourself and your employees for the future.

Balancing Business and Personal Finances

Balancing your business and personal finances is crucial for long-term success as a business owner. Let's break this down into practical steps.

Budgeting is The Key

You need to create a budget that covers both your business and personal expenses.

The trick is to keep these separate - use different bank accounts for your business and personal funds.

This makes it much easier to track where your money is going and helps at tax time too.

Here's a simple example:

👉 Let's say your business brings in $10,000 a month.

You might allocate $6,000 for business expenses, $3,000 for your personal needs, and $1,000 for savings or reinvestment.

By sticking to this plan, you ensure your business has what it needs to operate while also taking care of your personal financial needs.

Avoid Overextending Yourself

Don't fall into the trap of using business funds for unnecessary personal expenses.

👉 For instance, if your business is having a good month, resist the urge to splurge on a luxury item for yourself.

Instead, consider reinvesting in your business or boosting your emergency fund.

Consulting experts Can Be a Game-Changer

An accountant or financial advisor can provide invaluable guidance. They can help you decide how much to pay yourself, plan for taxes, and develop strategies for growth.

👉 For example, an accountant might advise you to increase your super contributions during a particularly profitable year to reduce your tax burden.

Remember, the goal is to find a balance that allows your business to thrive while also ensuring your personal financial security.

It's not always easy, but with careful planning and expert advice, you can achieve a healthy balance between your business and personal finances.

Wrapping Up

Navigating the complexities of paying yourself as a business owner in Australia doesn't have to be a daunting task.

ANNA's comprehensive financial management solution emerges as an essential tool in this process, offering a seamless blend of technology and expertise tailored to the unique needs of Australian business owners.

Key benefits of ANNA for managing your business finances:

✔️ Simplified company registration for hassle-free business setup.

✔️ Smart document storage for easy receipt and invoice management.

✔️ Automated tax calculations to stay on top of your tax obligations.

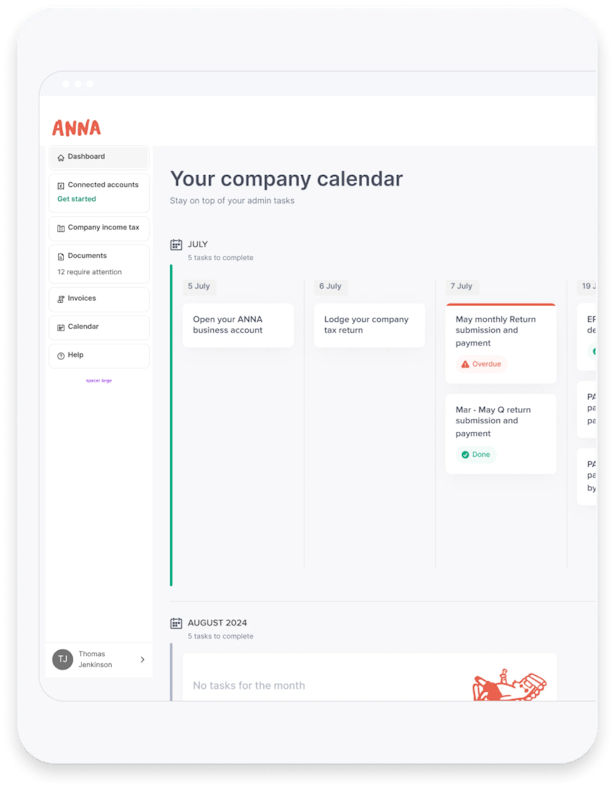

✔️ Personalized tax calendar to never miss important deadlines.

✔️ Real-time financial insights for informed decision-making.

✔️ Expert accountant support for personalized guidance.

By leveraging ANNA's features, you can confidently manage your business finances, ensure compliance with Australian tax regulations, and make informed decisions about your compensation.

This allows you to focus solely on growing your business.

Ready to take control of your business finances and simplify paying yourself?

Sign up for ANNA today and experience the difference smart financial management can make for your business.