Explore MYOB alternatives for Australian businesses, offering tax, accounting, and management solutions to streamline operations and support growth.

Nowadays, Australian businesses have more choices than ever for their accounting software.

While MYOB remains popular, many companies are exploring alternatives that offer enhanced features, competitive pricing, or improved user experiences.

This guide highlights the leading MYOB alternatives gaining popularity among the Aussies.

In this article, we'll help you discover tools that can streamline your financial management and boost your company's efficiency.

Before we dive in, let's take a quick look at the MYOB’s offerings.

Myob Overview

MYOB is a comprehensive accounting software platform designed to simplify and streamline business operations for small to medium-sized enterprises (SMEs).

It offers a range of tools to manage everything from invoicing and payroll to expense tracking and compliance.

With MYOB, businesses can efficiently handle their financial processes, ensuring accuracy and saving time.

How Does It Work?

MYOB integrates various business management functions into one platform, allowing users to handle accounting, invoicing, payroll, and more through a user-friendly, cloud-based interface.

It’s accessible on both desktop and mobile devices, ensuring you can manage your business from anywhere.

Features

- Invoicing - Create and send professional invoices and quotes with ease.

- Expense Management - Track and manage expenses, automate payment reminders, and keep cash flow steady.

- Tax & GST Compliance - Generate GST reports and ensure compliance with ATO regulations.

- Payroll - Automate payroll processes, including superannuation, tax, and leave management.

- Inventory Management - Keep track of inventory levels and manage stock efficiently.

- Financial Reporting - Access real-time insights and detailed financial reports to make informed business decisions.

- Job Tracking - Monitor job progress and costs to stay on budget.

- CRM Integration - Manage customer relationships directly within the platform.

Best For

MYOB is perfect for small to medium-sized businesses seeking a simple, scalable solution to manage accounting, payroll, and compliance efficiently.

Pricing

MYOB pricing starts from $5/month to $88.50/month, depending on the plan and business size, offering flexibility for different needs and budgets.

Key Takeaways

MYOB is a reliable and versatile platform that caters to the needs of growing businesses.

With its extensive feature set, easy integration, and flexible pricing plans, MYOB helps businesses streamline their operations and make informed financial decisions, all while staying compliant and improving cash flow.

5 Best Myob Alternatives to Check Out in 2025

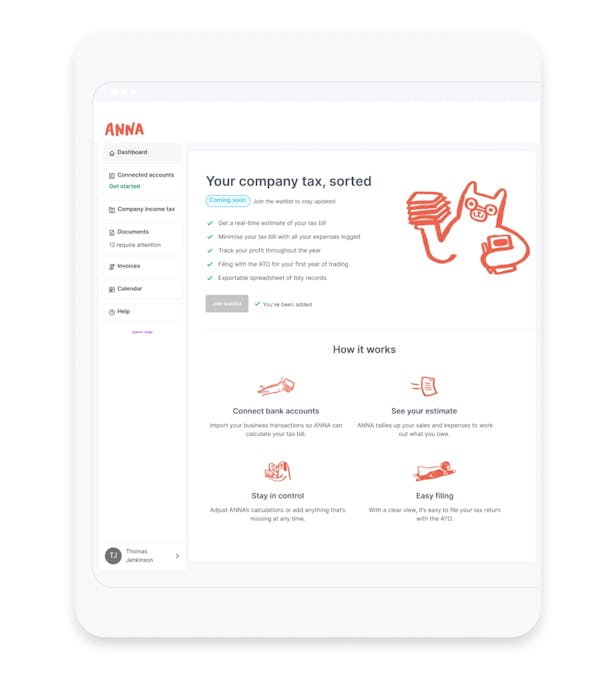

1. ANNA

ANNA is a comprehensive business solution designed to simplify the process of starting, running, and growing a business in Australia.

From company registration to managing taxes and bookkeeping, ANNA provides everything you need to set up and manage your business, allowing you to focus on growth and success.

How Does It Work?

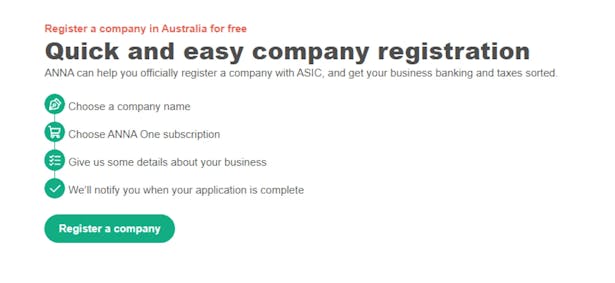

ANNA offers a seamless process for registering your company and setting up a business account in just a few steps.

It handles all aspects of business incorporation, including obtaining an Australian Company Number (ACN), Australian Business Number (ABN), and registering a business name.

Once registered, ANNA One automates your bookkeeping, invoicing, GST, and tax management, ensuring compliance and efficiency.

Features

- Company Registration - Effortless registration with an ACN and necessary ASIC documents delivered to your inbox.

- ABN Registration - Easily obtain an Australian Business Number, whether you’re a company or sole trader.

- Business Name Registration - Register your trading name to operate legally.

- Tax Management - Automatic GST calculation, personalized tax calendars, and BAS lodgement.

- Bookkeeping & Invoicing - Professional invoices with automatic follow-ups and receipt matching for accurate bookkeeping.

- Document Storage - Securely store and manage receipts, invoices, and company documents.

- Expert Support - Access to a friendly support team and expert accountants to assist with any queries.

Best For

ANNA One is ideal for entrepreneurs and small businesses in Australia looking to simplify the process of company registration, bookkeeping, and tax management with a single, integrated solution.

Pricing

ANNA One offers 2 budget-friendly packages for company registration, both covering the ASIC fees, making it an accessible option for new businesses.

Key Takeaways

With ANNA One, starting and managing a business in Australia becomes a straightforward and stress-free experience.

From seamless company registration to comprehensive tax management and expert support, ANNA One equips you with the tools and confidence needed to focus on growing your business.

2. Xero

Xero is a versatile accounting software platform designed to simplify financial management for small businesses, accountants, and bookkeepers.

With a wide range of features, Xero empowers users to streamline their operations, manage finances, and focus on growing their business.

How Does It Work?

Xero connects your business to over 21,000 financial institutions globally, offering seamless bank integration, online invoicing, expense management, and more.

Its cloud-based platform ensures that you can manage your finances from anywhere, whether on desktop or mobile.

Features

- Online Invoicing - Create and send invoices, automate reminders, and track payments from any device.

- Bank Connections - Connect to over 21,000 global institutions for automatic bank feeds and reconciliation.

- Expense Management - Submit and manage expenses easily with tools designed to streamline reimbursements.

- Payroll - Run payroll for a small number of employees and generate reports effortlessly.

- Inventory Management - Track stock levels and manage inventory directly from Xero.

- Multi-Currency Accounting - Manage transactions in multiple currencies with ease.

- Reporting and Analytics - Generate accurate financial reports and track business performance with real-time data.

- Project Tracking - Plan, budget, and track projects to ensure they stay on schedule and within budget.

- App Integrations - Extend Xero’s capabilities by integrating with apps tailored to your business needs.

Best For

Xero is ideal for small businesses, freelancers, and accountants who need an intuitive, scalable solution for managing finances and automating accounting tasks.

Pricing

Xero offers pricing plans starting at $14.50 USD per month for the Starter plan, with more advanced options available for growing businesses.

All plans include essential accounting features with the flexibility to upgrade as your business expands.

Key Takeaways

Xero provides a comprehensive suite of accounting tools that cater to the unique needs of small businesses and accountants.

With its robust features, seamless integrations, and user-friendly interface, Xero helps businesses efficiently manage their finances, freeing up time to focus on success.

3. QuickBooks

QuickBooks is a cloud-based accounting software that provides small businesses with real-time access to their financial data from any device, anytime and anywhere.

By automating repetitive accounting tasks and integrating with popular apps, QuickBooks streamlines business operations, allowing entrepreneurs to focus on growth.

How Does It Work?

QuickBooks connects to your bank accounts and automates tasks like invoicing, expense tracking, and financial reporting.

Accessible from any internet-connected device, QuickBooks ensures your business finances are always up-to-date, secure, and easily manageable on the go.

Features

- Income & Expense Tracking - Monitor your cash flow, track GST/VAT, and manage bills efficiently.

- Online Invoicing - Create and send custom invoices, set up recurring invoices, and automate payment reminders.

- Bank Integration - Sync with your bank for seamless transaction categorization and reconciliation.

- Inventory Management - Track inventory levels and receive low-stock alerts to manage supplies.

- Multi-Currency Support - Handle transactions in multiple currencies for global operations.

- Custom Reporting - Generate detailed financial reports with just one click.

- App Integrations - Connect with a wide range of eCommerce, CRM, and expense management apps.

Best For

QuickBooks is ideal for small businesses, freelancers, and accountants looking for a flexible, scalable solution to manage their finances and automate accounting tasks.

Pricing

QuickBooks offers plans ranging from €5.40 to €22.80 per month, with options to pay annually for additional savings.

Plans cater to various business needs, from basic accounting to advanced financial management.

Key Takeaways

QuickBooks provides a robust and user-friendly platform that simplifies accounting for small businesses.

Its extensive features, real-time data access, and secure cloud environment make it an essential tool for efficiently managing your finances.

4. Bildu

Billdu is a highly rated invoicing app designed for small businesses, offering an intuitive platform for creating and managing invoices on both web and mobile devices.

In addition to invoicing, Billdu provides tools for online booking, e-commerce, and customer relationship management, making it a versatile solution for businesses of all sizes.

How Does It Work?

Billdu streamlines the invoicing process with its easy-to-use app, allowing users to create professional invoices, send them to clients, and track payments seamlessly.

The app also integrates with popular platforms like PayPal, Stripe, and Xero, ensuring a smooth payment experience.

Users can manage their business on the go, turning features on and off as their business grows.

Features

- Invoice Maker - Create and send professional invoices quickly and easily.

- Online Booking - Manage appointments and bookings directly through the app.

- E-commerce Integration - Set up an online store and handle sales efficiently.

- Mobile Invoicing - Access invoicing features on iPhone, iPad, or Android devices.

- Invoicing Security - Ensure your data is secure with Billdu’s robust security measures.

- Business Management - Tools for managing customer relationships, tracking expenses, and accepting online payments.

Best For

Billdu is ideal for small businesses across various industries, from creatives and retailers to craftsmen and service providers, who need a flexible invoicing and business management solution that grows with their needs.

Pricing

Billdu offers a free 30-day trial with no credit card required, allowing businesses to explore its features before committing to a paid plan.

Pricing is designed to be affordable and scalable, catering to businesses as they grow.

Key Takeaways

Billdu is a comprehensive business management tool that supports small businesses in streamlining their operations while staying organized.

5. FreshBooks

FreshBooks is an intuitive accounting software designed to simplify financial management for freelancers, self-employed professionals, and small businesses.

Through an easy-to-use interface available on both web and mobile platforms, users can create professional invoices, accept online payments, and track their financial health in real time.

How Does It Work?

FreshBooks automates key accounting tasks, from invoicing and expense tracking to time management and reporting.

Users can create professional invoices, accept online payments, and track their financial health in real-time through an easy-to-use interface available on both web and mobile platforms.

Features

- Invoicing - Create customizable invoices, set up recurring billing, and automate payment reminders.

- Payments - Accept payments via credit card, bank transfers, and more, with support for Advanced Payments like recurring billing.

- Expense Tracking - Scan receipts, import bank transactions, and categorize expenses automatically.

- Accounting & Reports - Double-entry accounting tools with robust financial reports for accurate bookkeeping.

- Client Management - Manage client communications, proposals, estimates, and projects efficiently.

- Team Management - Tools for payroll and team collaboration, with options to add team members to your account.

- Mobile Apps - Access FreshBooks features on the go with iOS and Android apps.

Best For

FreshBooks is ideal for freelancers, small business owners, and teams who need a user-friendly accounting solution that scales with their business.

It’s particularly well-suited for those who require robust invoicing and payment features alongside comprehensive expense and project management tools.

Pricing

FreshBooks offers flexible pricing plans ranging from $7.60 to $24.00 USD per month, depending on your business needs.

Each plan includes essential features, with options to add team members and advanced payments for an additional fee.

Key Takeaways

FreshBooks combines simplicity with powerful features, making it a suitable choice for small businesses and freelancers looking to streamline their accounting processes.

With its intuitive design, automation capabilities, and mobile accessibility, FreshBooks helps users save time and focus on their business.

The Best Myob Alternative For You?

Choosing the right accounting software is crucial for effective business financial management.

While MYOB has several alternatives, ANNA stands out as the top choice for new businesses. Here's why:

✔️ Easy Company Registration: ANNA offers free company registration, simplifying the startup process.

✔️ All-in-One Financial Tools: Manage bookkeeping, invoicing, GST, and taxes on a single platform, eliminating the need for multiple software solutions.

✔️ User-Friendly Design: ANNA's intuitive interface is accessible even to those with limited accounting experience.

✔️ Flexible Features: Adapt the software to your needs by activating or deactivating features as your business grows.

✔️ Expert Assistance: Access professional guidance and support to ensure your business remains compliant and on track.

Ready for an easy start?

Get started with ANNA today and equip your business with the tools and support you need to grow confidently.