What is a Partnership Business Structure - Guide

Learn about the partnership business structure, including setup steps, legal requirements, and considerations for building a successful partnership.

- In this article

- What is a Partnership Business Structure?

- 3 Types of Partnerships in Australia

- Key Characteristics of Partnerships

- Advantages of Forming a Partnership

- Potential Drawbacks of Partnerships

- Legal Framework Governing Partnerships in Australia

- How To Set Up a Partnership

- Additional Considerations for Partnerships

- Is a Partnership Right for You?

- How Can ANNA Help?

If you're thinking about joining forces with someone to start a business, a partnership might be the right fit. It's one of the simpler ways to get going, especially if you and your future partners share the same goals.

This business structure lets you share responsibilities, resources, and profits, which makes them a popular choice in Australia.

Let's break down what partnerships involve, the different types available, and the benefits and potential challenges that come along with this business structure.

What is a Partnership Business Structure?

A partnership is simply two or more people (or businesses) joining to run a venture and share its rewards. Unlike a company, partnerships aren't separate legal entities; instead, each partner is personally responsible for the business.

This setup gives you more control but can also increase personal risk.

Example: Say Alice and Liam decide to start a coffee shop together. They both invest some money, agree to share the workload, and split the profits. They're equally responsible if the business takes off or if it encounters financial trouble.

3 Types of Partnerships in Australia

Did you know that a partnership business structure is often preferred for professional services, such as law and accounting firms because it offers simplicity and allows for shared management responsibilities?

Let’s take a look at 3 main types of partnerships:

1. General Partnership (GP):

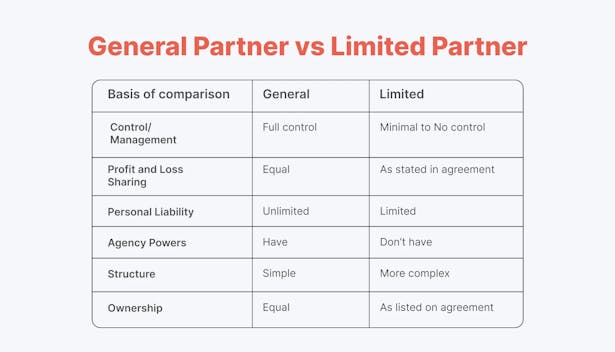

In a General Partnership, everyone has an equal say in managing the business and shares equal responsibility for its debts. If something goes wrong, all partners are personally on the hook for any debts.

Example: Imagine a small law firm with two partners, Sarah and Priya. They both handle clients and share the workload equally. But if the firm faces a lawsuit, both Sarah and Priya are equally liable for any debts or damages, even if one partner was more responsible for the issue.

2. Limited Partnership (LP):

Limited Partnerships are a bit more complex. They have both general partners (who manage the business and have unlimited liability) and limited partners (who only invest money and aren't involved in daily operations).

Limited partners' liability is capped at the amount they invest, making it a good option if you have silent investors who don't want management responsibilities.

Example: Picture a real estate investment project. Emma and Max are the general partners running day-to-day operations, while their friend, James, is a limited partner who simply invested money. James won't be liable beyond his investment if the project faces financial trouble. Still, he also has no say in management.

3. Incorporated Limited Partnership (ILP):

Incorporated Limited Partnerships are used for high-risk ventures, like tech startups or venture capital projects. Here, all partners except one have limited liability, protecting most partners from losing more than they've invested.

However, at least one partner must have unlimited liability, taking on more personal risk.

Four types of ILPs exist, each with specific criteria for registration:

- Venture Capital Limited Partnership (VCLP): Invests directly in companies.

- Early-Stage Venture Capital Limited Partnership (ESVCLP): Targets eligible entities with assets under $50 million prior to investment.

- Australian Venture Capital Fund of Funds (AFOF): Invests indirectly through a VCLP or ESVCLP, or directly, subject to certain requirements.

- Venture Capital Management Partnership (VCMP): Solely manages the other types of ILPs.

Example: A biotech startup aiming to develop new medicines may use an ILP. One general partner takes on more risk to lead the project, while other investors have their risk limited to their investment, making this structure popular for high-stakes projects.

Key Characteristics of Partnerships

Here are some core elements that define partnerships in Australia:

- Formation: Partnerships are easy and affordable to set up. Though not legally required, it's wise to have a partnership agreement to clarify responsibilities, profit-sharing, and ways to resolve disputes.

- Taxation: Partnerships don't pay taxes as separate entities. Instead, each partner reports their share of the business income on their tax returns. However, the partnership must file an annual tax return with the Australian Taxation Office (ATO) to report total income and expenses.

- Registration: Every partnership needs an Australian Business Number (ABN) and a Tax File Number (TFN). If annual revenue exceeds $75,000, the business also has to register for Goods and Services Tax (GST).

- Liability: This is the big one – each partner has joint liability, meaning anyone can be held fully responsible for the business's debts if others can't pay.

Advantages of Forming a Partnership

There's a reason partnerships are so popular. They offer a flexible and straightforward way to do business with a team mentality. Here are some key benefits:

✔️ Cost-Effective Setup:

Compared to companies, partnerships are relatively inexpensive to start. This setup appeals to people just getting a business off the ground.

✔️ Less Red Tape:

Partnerships don't face the same heavy reporting and compliance requirements as corporations, making them easier to run from a regulatory standpoint.

✔️ Combined Resources:

Pooling skills and resources can be a huge advantage. If one partner is a pro at finance and the other excels at marketing, they can focus on their strengths, ultimately benefiting the business.

For example, In a restaurant partnership, one person might manage the kitchen while another handles customer relations and finances, allowing each to focus on their strengths.

✔️ Privacy:

Partnerships don't need to publicly disclose financials in the same way companies do, which is a plus if you prefer privacy.

Potential Drawbacks of Partnerships

While partnerships offer flexibility and simplicity, they come with some significant considerations:

❌ Unlimited Liability:

Unlike companies, partnerships lack limited liability protection. If the business raises debts, each partner's assets might be at risk.

For example, if a landscaping partnership goes into debt because of equipment purchases, each partner could be liable, even if one partner didn't make the decision to buy the equipment.

❌ Potential for Disputes:

Partnerships can experience conflict, especially over management decisions or profit distribution. Having a solid partnership agreement helps, but disagreements can still arise.

❌ Limited Growth:

Partnerships typically have a cap of 20 partners, so if you're planning to scale significantly, this might not be the best structure.

❌ Challenges in Transfer or Termination:

Changing ownership in a partnership isn't as simple as selling shares in a company. Often, all partners must agree, making adjustments tricky.

Legal Framework Governing Partnerships in Australia

Each state and territory has specific laws governing partnerships:

📌 To avoid misunderstandings or penalties, it’s best to consult a lawyer or advisor to understand the rules in your area.

How To Set Up a Partnership

To get started, follow these essential steps:

1. Pick a Structure: Decide whether a General, Limited, or Incorporated Limited Partnership works best for your business needs.

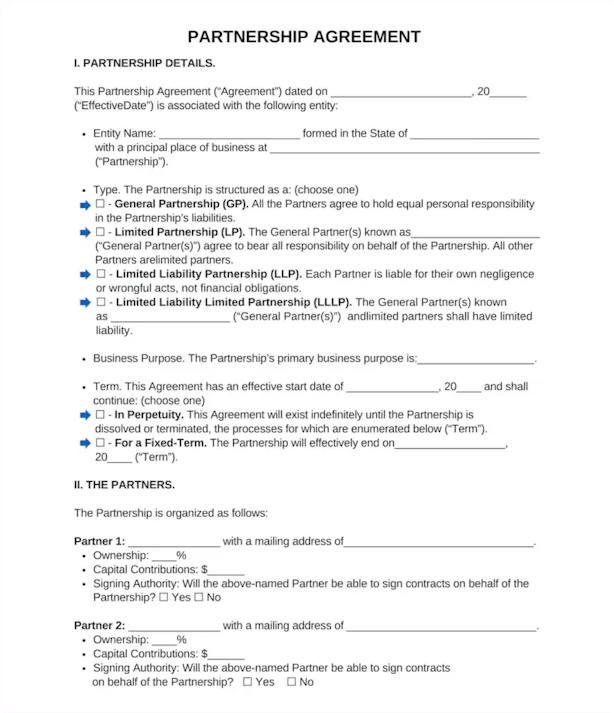

2. Draft a Partnership Agreement: Although not legally required, this document helps prevent future disagreements by outlining rights, responsibilities, profit distribution, and how to handle disputes.

3. Register Your Business Name: If you're using a name other than your personal name, register it with the Australian Securities and Investments Commission (ASIC).

4. Apply for ABN and TFN: Essential for tax and legal purposes.

5. Register for GST: If your business brings in more than $75,000 annually, you'll need to register for GST with the ATO.

Additional Considerations for Partnerships

- Profit Distribution: Profits are divided according to the partnership agreement. Each partner includes their share on their personal tax returns.

- Superannuation Obligations: Since partners aren't technically employees, they're responsible for arranging their own superannuation.

- Employment Responsibilities: Partnerships hiring staff must handle payroll tax and superannuation contributions for eligible employees.

Is a Partnership Right for You?

A partnership business structure works well for people who want to combine strengths and work collaboratively. It allows shared resources and decisions but also means sharing risks and responsibilities.

Just make sure everyone involved understands the risks and responsibilities, and don't skip that partnership agreement – it's an essential step to protect your business and relationships.

How Can ANNA Help?

Considering a partnership can be an excellent way to pool resources and expertise for a shared vision. If you're ready to streamline the management side, ANNA offers tools designed to simplify business operations and financial tasks, making it easier for you and your partners to focus on growth.

Here's how ANNA can support your business:

⚡ Streamlined Financial Management: ANNA's platform helps manage everything from invoicing to tax filing, ensuring efficient and accurate financial tasks so that you can spend more time on strategy.

⚡ Effortless Expense Tracking and Receipt Management: Organise all business receipts and invoices with ANNA's system, automatically categorising and tracking expenses, saving you time and reducing hassle.

⚡ Automated Invoicing and Payment Reminders: Generate professional invoices in seconds, and let ANNA handle reminders, ensuring timely payments without the need to follow up manually.

⚡ Simplified Tax Reporting: Stay on top of tax obligations with ANNA's tax insights. Understand upcoming tax payments and optimise based on your income and expenses, taking the guesswork out of tax season.

⚡ Efficient Employee Expense Management: Equip your team with credit or virtual cards and payment options like Apple Pay and Google Pay. ANNA's tools make tracking and managing employee expenses easy and transparent.

With ANNA, you and your partners can focus on growing the business, confident that your financial management is accurate and under control.

Ready to take the next step in business management?Start with ANNA and experience a streamlined approach to handling your finances.