Discover the steps to easily find your PayG payment summary with our quick and efficient guide to accessing your tax information.

Are you trying to figure out your PAYG payment summaries and where to find them?

You've come to the right place.

This guide will cover everything you need about PAYG payment summaries, including their key components and purpose.

We'll also discuss when and how employers process these summaries and provide step-by-step instructions on how to access them efficiently.

By the end of this article, you'll be familiar with the different types of PAYG payment summaries and have solutions to help you manage your finances more effectively in the future.

Let's dive in!

What are PAYG Payment Summaries?

PAYG (Pay As You Go) payment summaries are essential documents provided by employers to their employees, workers, and other payees at the end of each financial year.

These summaries detail the total payments made to the employee and the amounts withheld for tax purposes.

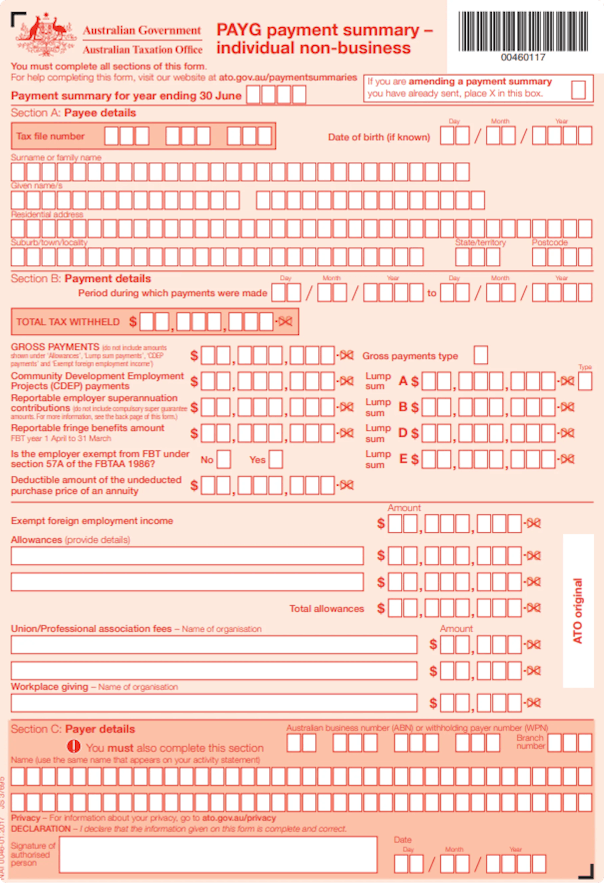

Key components of PAYG Payment Summary include:

- Gross Payments: Total salary, wages, allowances, and other payments made to the employee.

- Tax Withheld: Total amount of tax withheld from the employee’s earnings.

- Reportable Fringe Benefits: Value of any fringe benefits provided to the employee.

- Superannuation Contributions: Employer contributions to the employee’s superannuation fund.

Here is what the PAYG payment summary - individual non-business form looks like:

❗ Note: It's crucial to provide payment summaries to all your employees, even if no tax was withheld.

Purpose of PAYG Payment Summaries

Understanding the importance of PAYG payment summaries helps maintain transparency and compliance in financial reporting.

Furthermore, it ensures a smooth tax reporting process for both employers and employees.

Here is how:

- Tax Reporting: Assists employees in reporting their income and tax withheld to the Australian Taxation Office (ATO) when filing their tax returns.

- Transparency: Offers employees a clear record of their earnings and tax deductions.

- Compliance: Ensures employers fulfill their legal obligations to report employee earnings and tax withholdings.

When and How Employers Provide PAYG Payment Summaries?

Employers must furnish PAYG (Pay As You Go) payment summaries to their employees to detail total payments made and tax withheld during the financial year. Here's a comprehensive overview of the timing and methods for providing these summaries:

When Employers Provide PAYG Payment Summaries?

👉 End of Financial Year: Employers must issue PAYG payment summaries to employees by 14 July each year. This deadline ensures employees have the necessary information to complete their tax returns on time.

👉 Employment Termination Payments (ETP): If an employee receives an employment termination payment, employers must provide the PAYG payment summary within 14 days of payment. This prompt issuance allows employees to manage their tax affairs without delay.

How Employers Provide PAYG Payment Summaries?

1. Electronic Payment Summaries

Employers can issue electronic PAYG payment summaries through secure online portals or email. Employees can access these summaries via their myGov account linked to the Australian Taxation Office (ATO) if the employer uses Single Touch Payroll (STP) reporting.

This method is efficient and ensures immediate access to necessary tax information.

2. Paper Payment Summaries

While less common due to the convenience of electronic methods, employers can still provide paper PAYG payment summaries. These are either mailed or handed directly to employees, catering to those who prefer physical documents.

How to Find Your PAYG Payment Summary?

1. Accessing Your PAYG Payment Summary through myGov

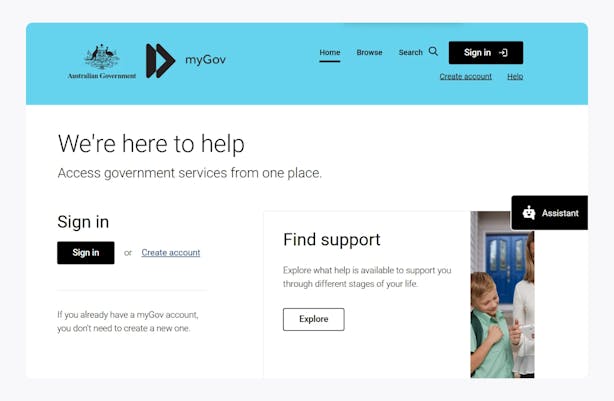

To access your PAYG payment summary, follow these simple steps using your myGov account. This guide will help you create an account, link it to the Australian Taxation Office (ATO), and view your income statement.

Step 1: Create a myGov Account

- Visit the myGov Website: Open your browser and go to the myGov website.

- Set Up Your Account: Click on “Create an account” and follow the prompts. You will need to provide some personal information to set up your account.

Step 2: Link to the ATO

- Log In to myGov: Enter your credentials to log in to your myGov account.

- Select ATO Services: Select "Services" from the main menu once logged in.

- Choose the ATO: Select "Australian Taxation Office" from the list of available services.

- Verify Your Identity: To complete the linking process, provide your personal details, such as your Tax File Number (TFN) and date of birth.

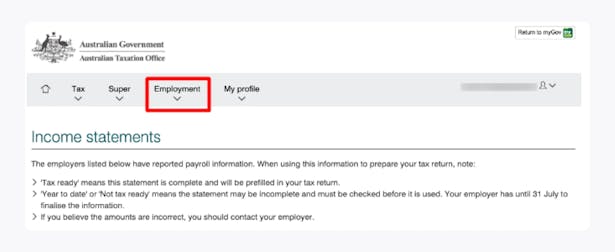

Step 3: Access Your Income Statement

- Go to ATO Online Services: After linking, navigate to the ATO online services through your myGov account.

- View Your Income Statement: Go to the "Employment" section in the ATO section. Here, you can view your income statement, which includes your PAYG payment summary.

Step 4: Request a Copy

- Call the ATO: If you prefer not to use myGov, you can request a copy of your income statement by calling the ATO at 13 28 61.

2. Obtaining Your PAYG Payment Summary Directly from Your Employer

If you prefer to receive your PAYG payment summary directly from your employer, follow these simple steps.

- Check Your Email: Some employers may send the PAYG payment summary electronically. Look for an email from your employer.

- Check Your Mail: If your employer provides paper summaries, check your postal mail for the document.

- Request Your Summary: If you haven’t received your PAYG payment summary, reach out to your employer directly to request it. They can provide the summary either electronically or in paper form based on your preference.

Types of PAYG Payment Summaries

There are several types of PAYG payment summaries, each tailored to different types of payments and employment situations. Here are the main types:

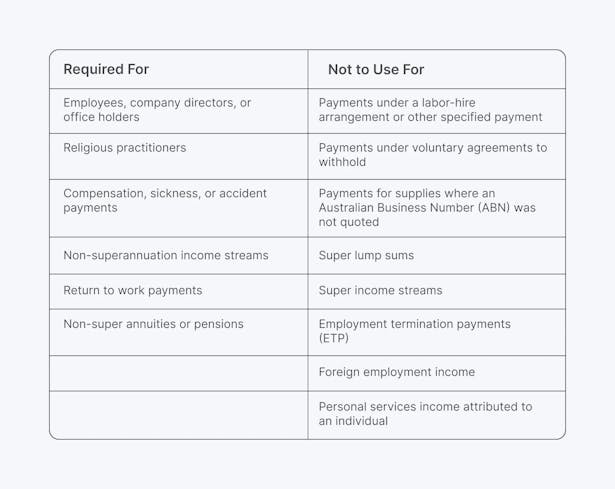

1. PAYG Payment Summary – Individual Non-Business (NAT 0046)

👉 Purpose: For payments to employees, company directors, office holders, and religious practitioners.

👉 Includes: Salaries, wages, allowances, and other non-business income.

👉 Example: An employee working full-time at a retail store receiving a salary and allowances.

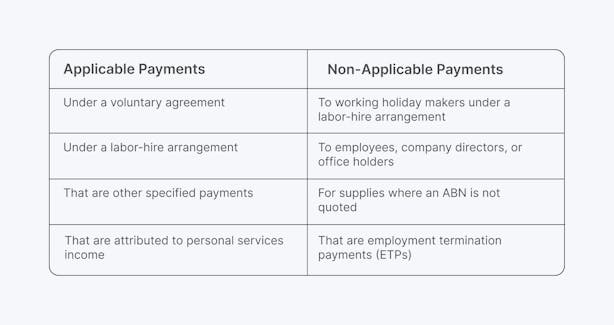

2. PAYG Payment Summary – Business and Personal Services Income (NAT 72545)

👉 Purpose: For payments to individuals for services provided under a contract.

👉 Includes: Income from business activities and personal services.

👉 Example: A freelance graphic designer contracted to create marketing materials for a company.

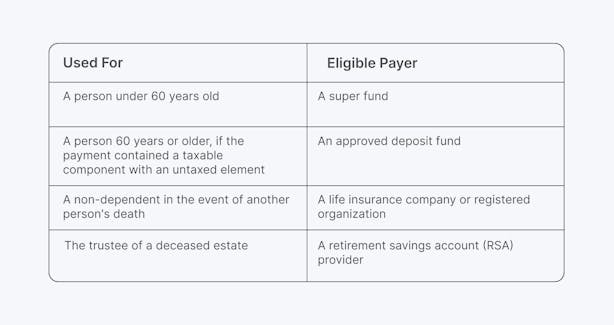

3. PAYG Payment Summary – Superannuation Lump Sum (NAT 70947)

👉 Purpose: For superannuation lump sum payments.

👉 Includes: Payments from superannuation funds, approved deposit funds, and retirement savings accounts.

👉 Example: A retiree withdrawing a lump sum from their superannuation fund.

❗ Note: Employers should avoid using this form for super lump sum payments to individuals with a terminal medical condition.

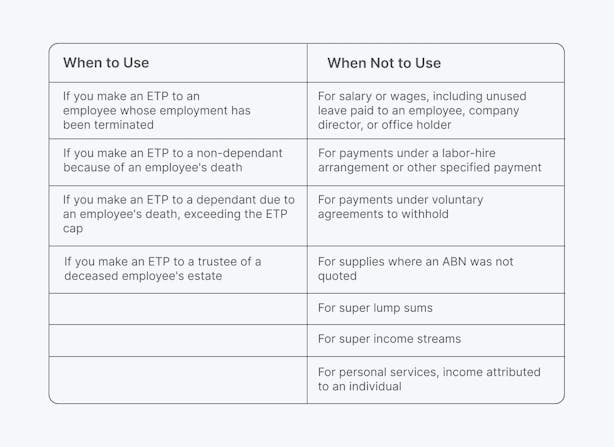

4. PAYG Payment Summary – Employment Termination Payment (ETP) (NAT 70868)

👉 Purpose: For payments made upon termination of employment.

👉 Includes: Redundancy payments, unused leave, and other termination-related payments.

👉 Example: An employee receiving a redundancy package, including payment for unused annual leave.

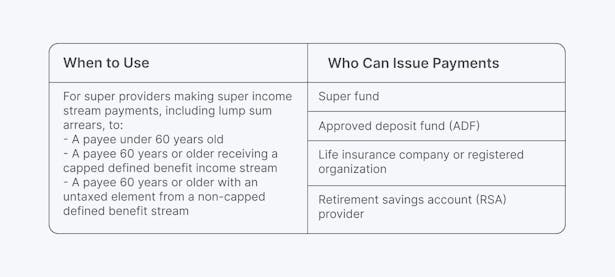

5. PAYG Payment Summary – Superannuation Income Stream (NAT 70987)

👉 Purpose: For regular superannuation income stream payments.

👉 Includes: Pensions and annuities from superannuation funds.

👉 Example: A retiree receiving monthly pension payments from their superannuation fund.

❗ Note: Employers should not use this payment summary if they are a non-super entity. Instead, they should use the PAYG payment summary—individual non-business (NAT 0046).

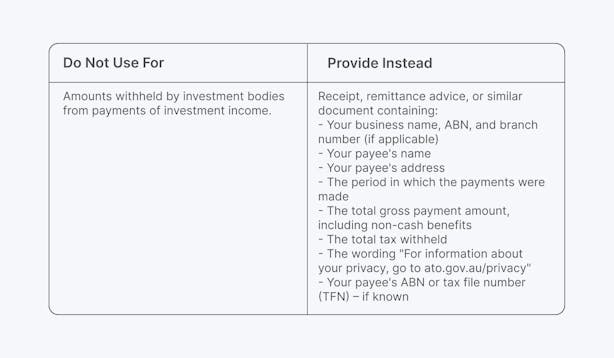

6. PAYG Payment Summary – Withholding Where ABN Not Quoted (NAT 3283)

👉 Purpose: For payments where the payee did not provide an Australian Business Number (ABN).

👉 Includes: Payments for goods and services where no ABN was quoted.

👉 Example: A business paying a supplier for goods without an ABN, resulting in tax withholding.

❗ Note: Employers must ensure all the required information is included in the document they provide to their payee.

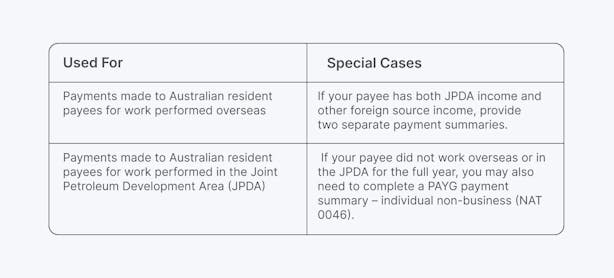

7. PAYG Payment Summary – Foreign Employment (NAT 73297)

👉 Purpose: For payments to employees working overseas.

👉 Includes: Income earned from foreign employment.

👉 Example: An Australian employee working in the UK for an extended period and receiving income from their employer.

❗ Note: Foreign earnings not qualifying for exemption are considered assessable income and subject to PAYG withholding requirements.

👉 Exception: Employers do not need to provide a PAYG payment summary—foreign employment income (NAT 73297) if they reported and finalized the amounts through Single Touch Payroll (STP).

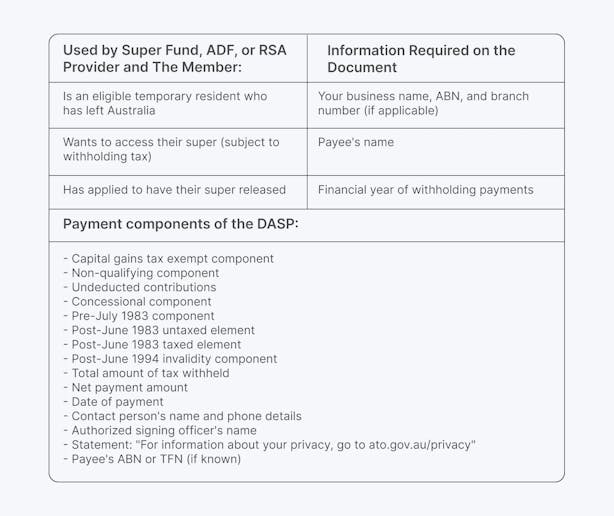

8. PAYG Payment Summary – Departing Australia Superannuation Payment (DASP)

👉 Purpose: For superannuation payments to individuals leaving Australia permanently.

👉 Includes: Superannuation benefits paid to departing temporary residents.

👉 Example: A temporary resident returning to their home country and withdrawing their superannuation.

❗ Note: No official form is provided for this type of PAYG payment summary. However, employers can issue a 'free-format' payment summary, such as a receipt, remittance advice, or similar documents.

Simplify Financial Records Management with ANNA Solutions

ANNA is an advanced financial solution designed to streamline every aspect of your business operations, from company registration to managing financial records.

With us, you can seamlessly register your Australian company and open a business bank account in one streamlined process.

ANNA supports every aspect of business incorporation, including registering a company number (ACN), getting an ABN, and registering a business name.

Plus, the registration cost with ASIC is covered, so it won't cost you a penny.

ANNA Features

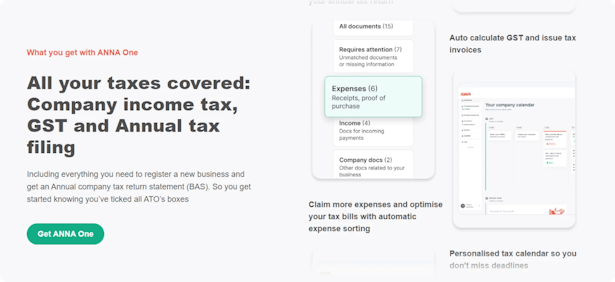

Here is how ANNA solutions can simplify the management of your financial records:

✨ 24/7 Customer Support: Access ANNA’s award-winning support team anytime for assistance in locating and understanding your PAYG payment summary.

✨ Efficient Bookkeeping: Store and manage receipts, invoices, and documents in one place, making it easier to find and retrieve your PAYG payment summary when needed.

✨ Automated Receipt Matching: Automatically match and categorize transactions, helping you keep track of all necessary documents related to PAYG payments.

✨ Comprehensive Assistance: Expert help with managing your Business Activity Statement (BAS) and GST calculations, ensuring all related documents are easily accessible.

Beyond managing PAYG summaries, ANNA offers numerous benefits:

👍 Professional Invoices: Create and send professional-looking invoices quickly, with automated follow-ups on unpaid ones.

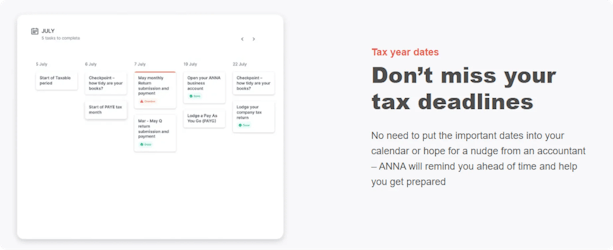

👍 Automatic Tax Calculations: Get peace of mind with automatic GST calculation and direct logging with ATO, plus a personalized tax calendar to ensure timely compliance.

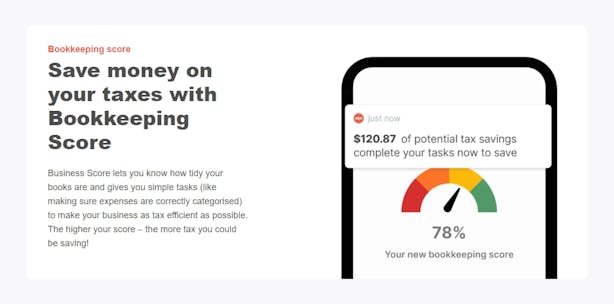

👍 Bookkeeping Score: Stay on top of your bookkeeping with tips and automated receipt matching, ensuring your records are always tidy and tax-efficient.

In essence, ANNA not only helps you find and manage your PAYG payment summaries but also provides a comprehensive solution for all your financial management needs

Ready to simplify your financial records management?

Try ANNA today and experience the ease and efficiency it brings to your business operations.